Lien Assignment Form

Description

Form popularity

FAQ

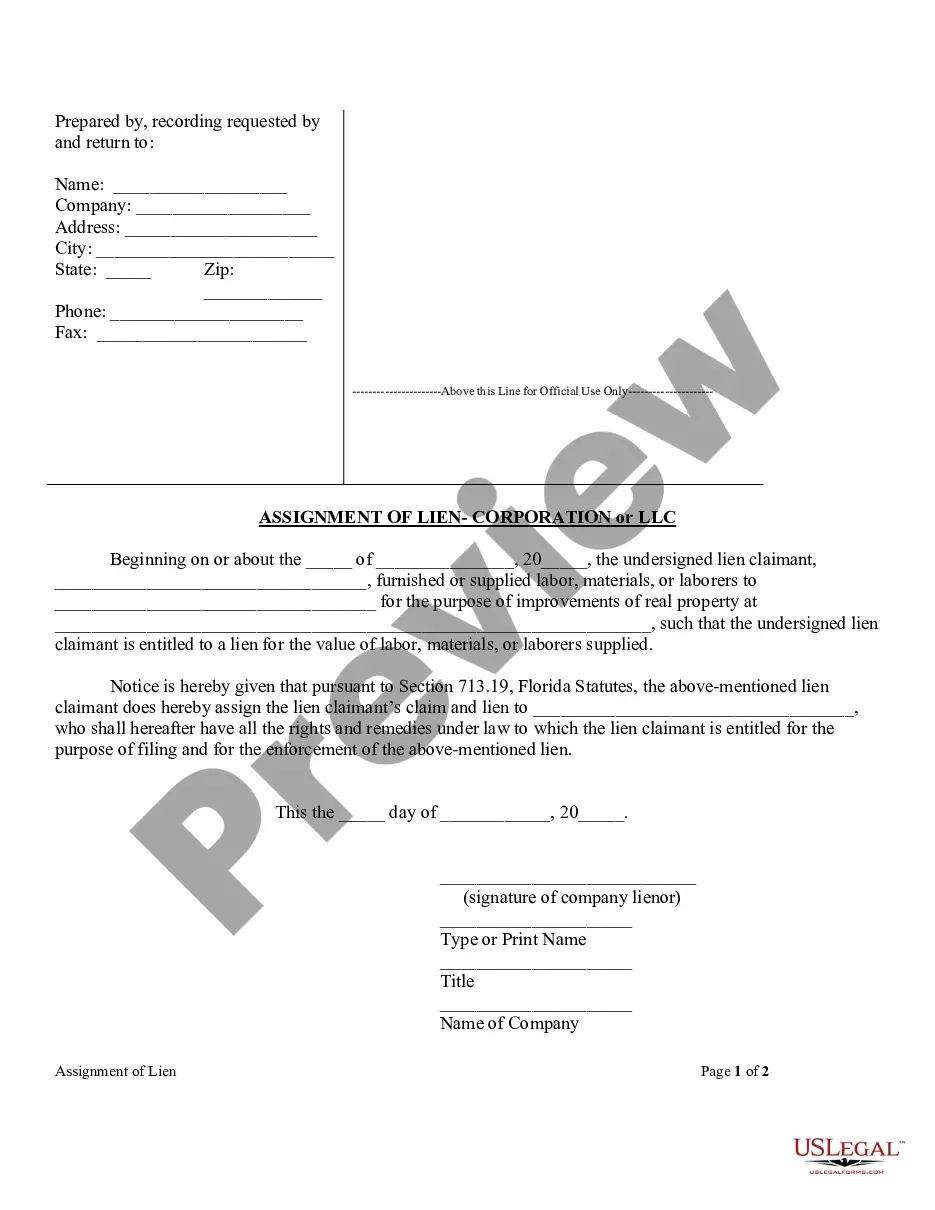

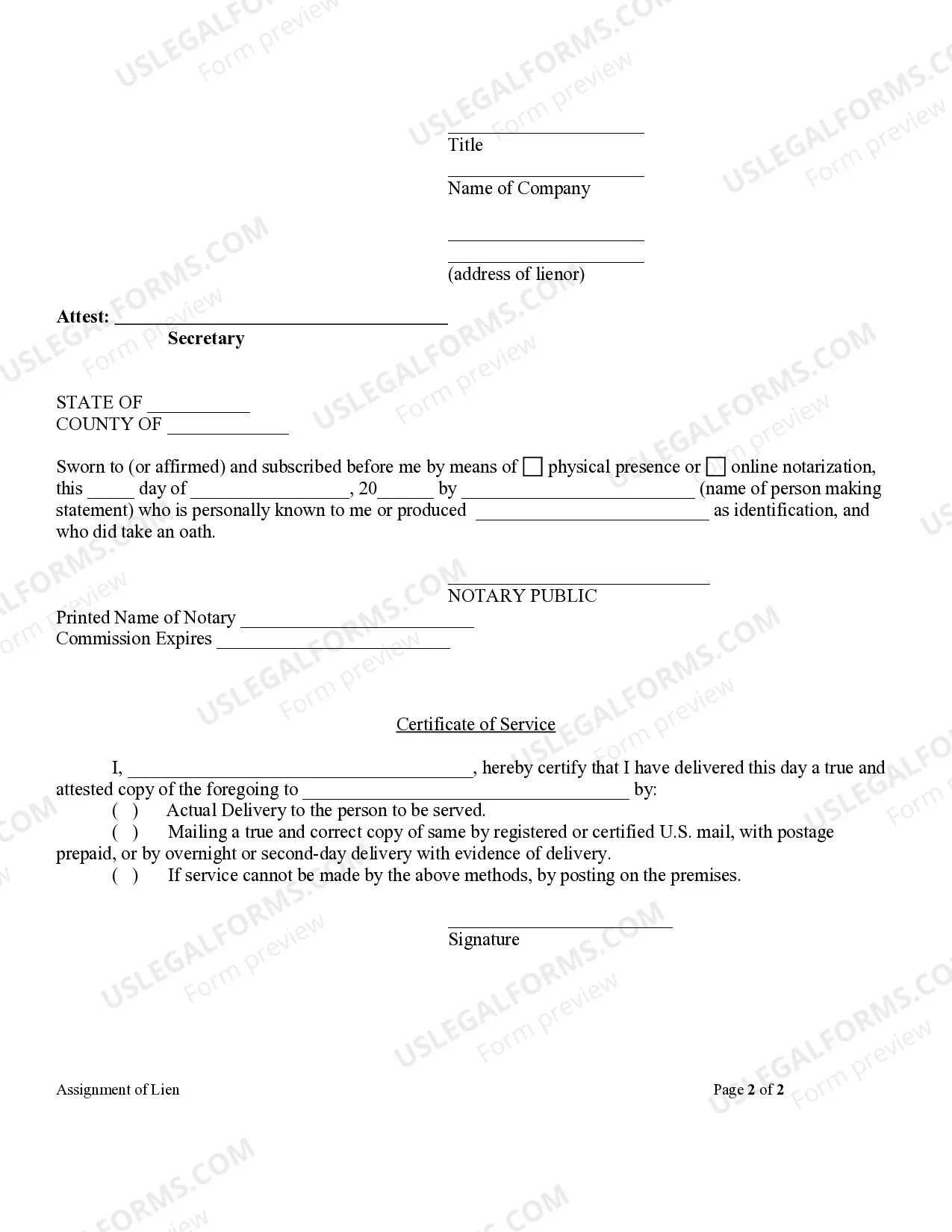

A lien provides a creditor with a legal claim over a debtor's property until the debt is repaid, while an assignment pertains to the transfer of ownership or rights from one party to another. While both concepts interact in the realm of finance, their purposes differ significantly. A lien assignment form bridges these concepts by allowing the transfer of lien rights, ensuring clarity in financial transactions.

A lien is a legal right or interest that a lender has in a borrower's property, granted until the debt obligation is satisfied. It acts as a security interest that protects the lender's investment. Understanding the concept of a lien is crucial when dealing with assets, especially when creating a lien assignment form.

A lien assignment is the process of transferring the rights and benefits of a lien from one party to another. This formality ensures that the assignee can claim the asset if the related debt is not satisfied. Using a lien assignment form helps clarify these rights and minimizes potential disputes.

A lien is a legal claim against an asset that serves as collateral for a debt. An assignment involves transferring rights or interests from one party to another. In the context of a lien assignment form, you can formally assign the rights of a lien to another party, allowing for effective management of property and obligations.

You can obtain a lien release form from various sources including legal document providers, such as US Legal Forms. They offer easy access to template forms that you can customize to your specific needs. By using US Legal Forms, you ensure compliance with local regulations and save time in your legal processes.

A notice of intent is a written notice that communicates to a party about an upcoming legal action, such as the intent to file a lien. This notice is essential for transparency and allows the other party the chance to rectify any issues before further action is taken. It’s crucial for contractors and service providers to follow proper procedures to ensure enforceability. For a clearer understanding and correct format, a lien assignment form can be very helpful.

In California, a lien typically lasts for a period of five years from the date it was recorded. However, this duration can be extended under certain circumstances, especially if the lienholder takes legal action to enforce it. Property owners should regularly check for any recorded liens to stay informed. Utilizing a lien assignment form may be beneficial for managing or disputing existing liens.

A lien on a house in California is a legal claim against the property to secure payment for a debt. This means that if the debt remains unpaid, the lienholder can potentially force a sale of the property to recover the owed amount. It’s important to be aware of any existing liens before purchasing a property. A lien assignment form can help streamline the process of understanding or transferring a lien.

A notice of intent to lien is a formal declaration that a contractor or service provider intends to place a lien on a property for unpaid services. This notice serves as a warning to the property owner, allowing them an opportunity to settle any outstanding debts. It's crucial to address this notice promptly to avoid complications. To ensure proper understanding, you can refer to a lien assignment form.

In California, a lien typically cannot be placed on your house without a valid contract. Limitations exist to safeguard property owners. Generally, service providers or contractors must have a written agreement to enforce a lien. If you believe a lien exists without proper documentation, consider utilizing a lien assignment form for clarity.