Subcontractors For Amazon

Description

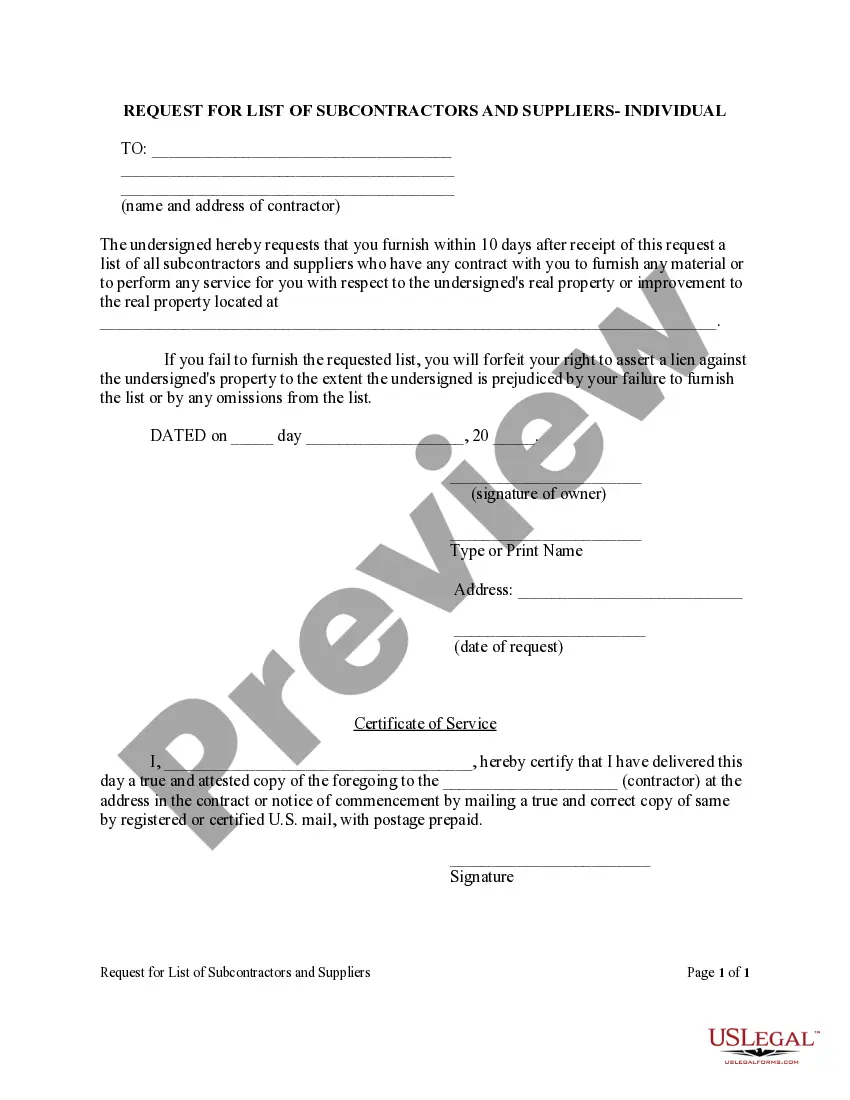

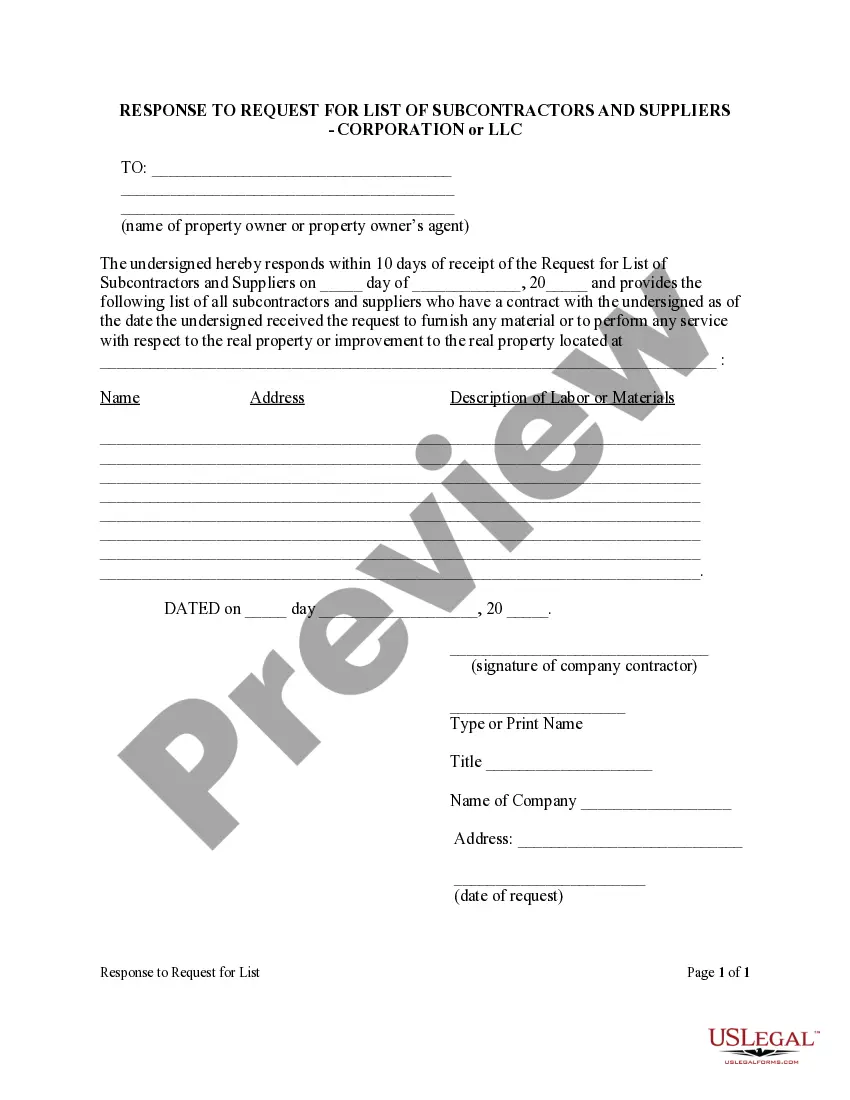

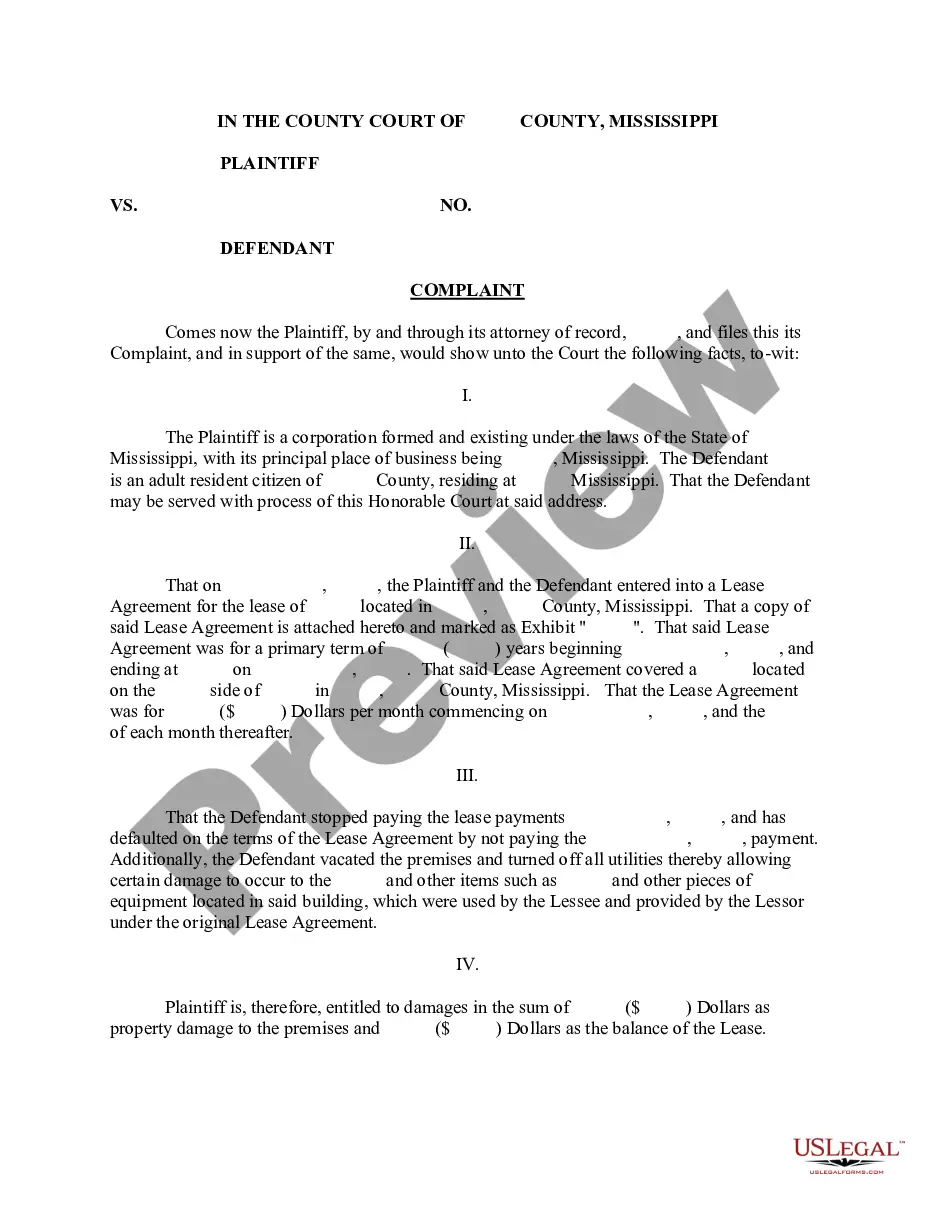

How to fill out Florida Response To Request For List Of Subcontractors And Suppliers - Individual?

- If you're an existing user, log in to your account and ensure your subscription is active. Download the required form template directly.

- For first-time visitors, browse the Preview mode and form descriptions to ensure you select the right document that aligns with your local jurisdiction.

- Should you find discrepancies, use the Search tab to find a more suitable form that meets your requirements.

- Once you've identified the right template, click the Buy Now button and select your preferred subscription plan, creating an account for full access.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Finally, download the completed form to your device and access it anytime from the My Forms section in your profile.

US Legal Forms empowers users with a robust collection of over 85,000 legal forms, far exceeding competitors, and provides access to premium experts for document completion.

Take advantage of an efficient legal document process by visiting US Legal Forms today!

Form popularity

FAQ

Yes, you can work with Amazon using your own van. As a subcontractor for Amazon, you have the flexibility to operate your own vehicle, which can help you maintain independence and brand identity. However, ensure that your van meets Amazon's requirements for delivery standards. Additionally, US Legal Forms provides resources and guidance to help you navigate the legal aspects of becoming a subcontractor for Amazon, streamlining your onboarding process.

Yes, Amazon Flex is classified as an independent contractor position. As a subcontractor for Amazon, you are responsible for delivering packages while enjoying the independence that comes with not being an employee. This allows you to create your own schedule and work according to your preferences. If you're considering this path, platforms like US Legal Forms can help you navigate your responsibilities.

Yes, Amazon frequently uses subcontracting to manage its delivery operations. By leveraging subcontractors for Amazon, the company can handle its vast logistics network more efficiently. This approach enables Amazon to expand its service capacity while working with a diverse set of independent contractors. As a subcontractor, you play a crucial role in helping Amazon meet customer demands.

No, Amazon Flex does not classify drivers as employees of Amazon. Instead, Flex drivers operate as independent contractors. This status offers you the opportunity to work as a subcontractor for Amazon, allowing more freedom in how you run your delivery service. Keep in mind that this means you won't receive benefits typically associated with employment.

Yes, you can work for Amazon using your own truck. When you become a subcontractor for Amazon, you have the freedom to use your own vehicle for deliveries. However, it is important to ensure that your vehicle meets Amazon's requirements in terms of size and condition. This flexibility can help you maximize your earning potential while enjoying the autonomy of being your own boss.

Amazon Flex drivers are classified as independent contractors, not employees. This means that you operate your own business while delivering packages for Amazon. As a subcontractor for Amazon, you have the flexibility to set your own hours and manage your workload. This arrangement allows you to enjoy benefits like choosing when and how much to work.

The earnings for Amazon route owners can vary significantly based on various factors, including route location and efficiency. On average, owners can earn substantial profits, especially as subcontractors for Amazon often enjoy stable demand for their services. It's essential to consider both operating costs and delivery metrics when estimating income. If you're thinking about becoming a route owner, resources available through US Legal Forms can provide helpful insights and support.

Yes, as a driver for Amazon Flex, you do need to file taxes. All income earned through Amazon Flex is considered self-employment income, which you must report. It's important to maintain accurate records of your earnings and any expenses, as this can impact your tax obligations. Many subcontractors for Amazon utilize platforms like US Legal Forms to help navigate tax filings efficiently.

The earnings of an Amazon delivery contractor can vary based on several factors such as location and hours worked. On average, subcontractors for Amazon may earn between $18 to $25 per hour, depending on demand and the number of deliveries completed. Moreover, many factors impact overall income, including incentives and bonuses offered by Amazon. For those interested in becoming subcontractors for Amazon, understanding the potential income can help in making informed decisions.

Yes, Amazon Flex can be considered a type of subcontractor for Amazon. It allows independent drivers to deliver packages using their own vehicles, offering flexible scheduling options. This model empowers individuals to act as subcontractors for Amazon, providing a vital service while enjoying the freedom of being their own boss. Additionally, this approach benefits Amazon by expanding its delivery network quickly and efficiently.