Payment To Construction

Description

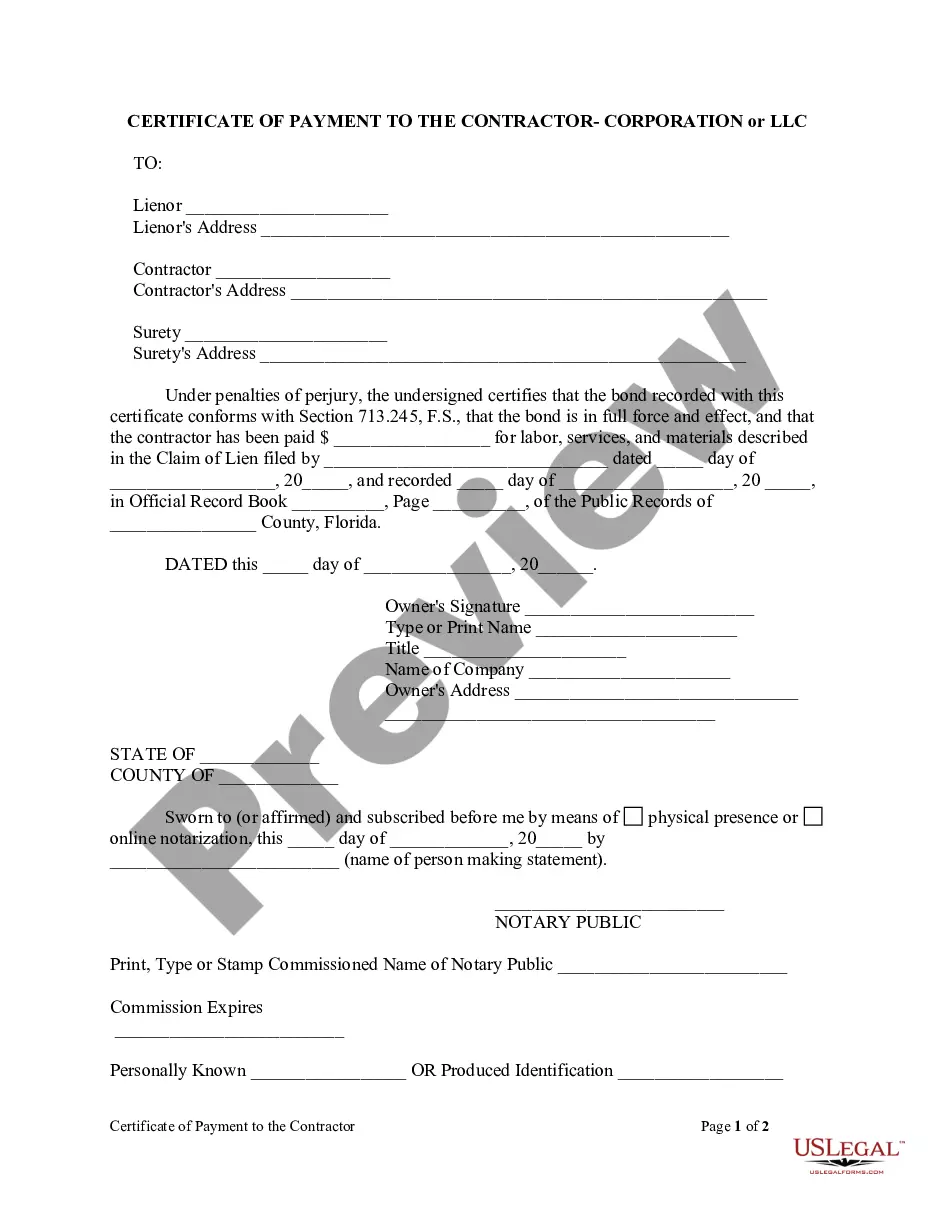

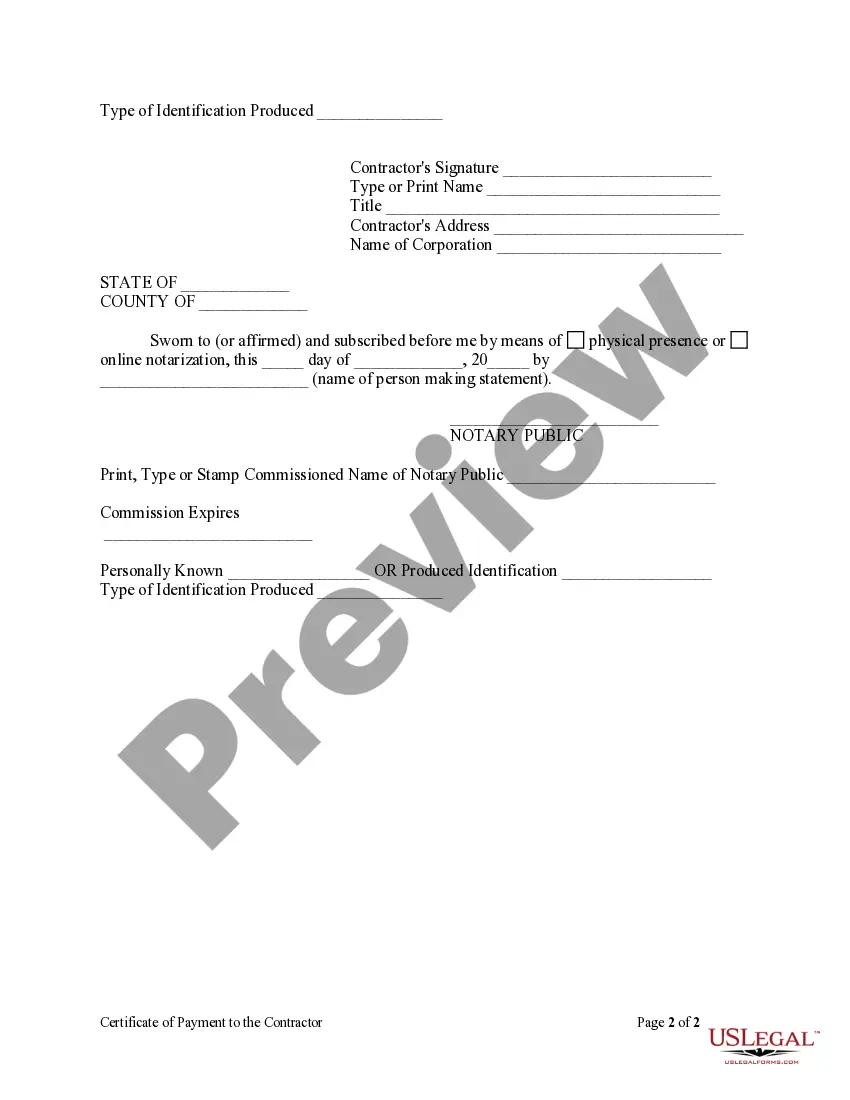

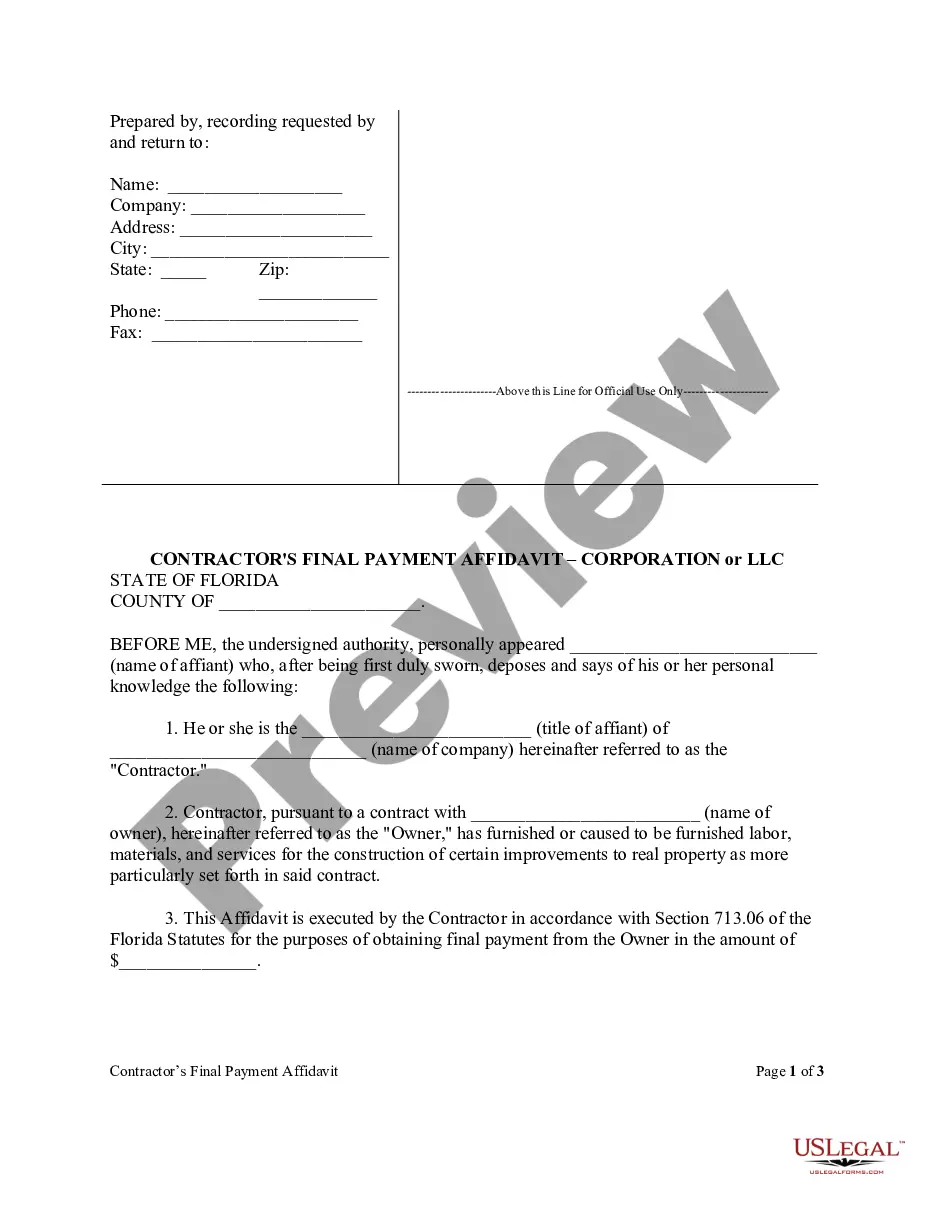

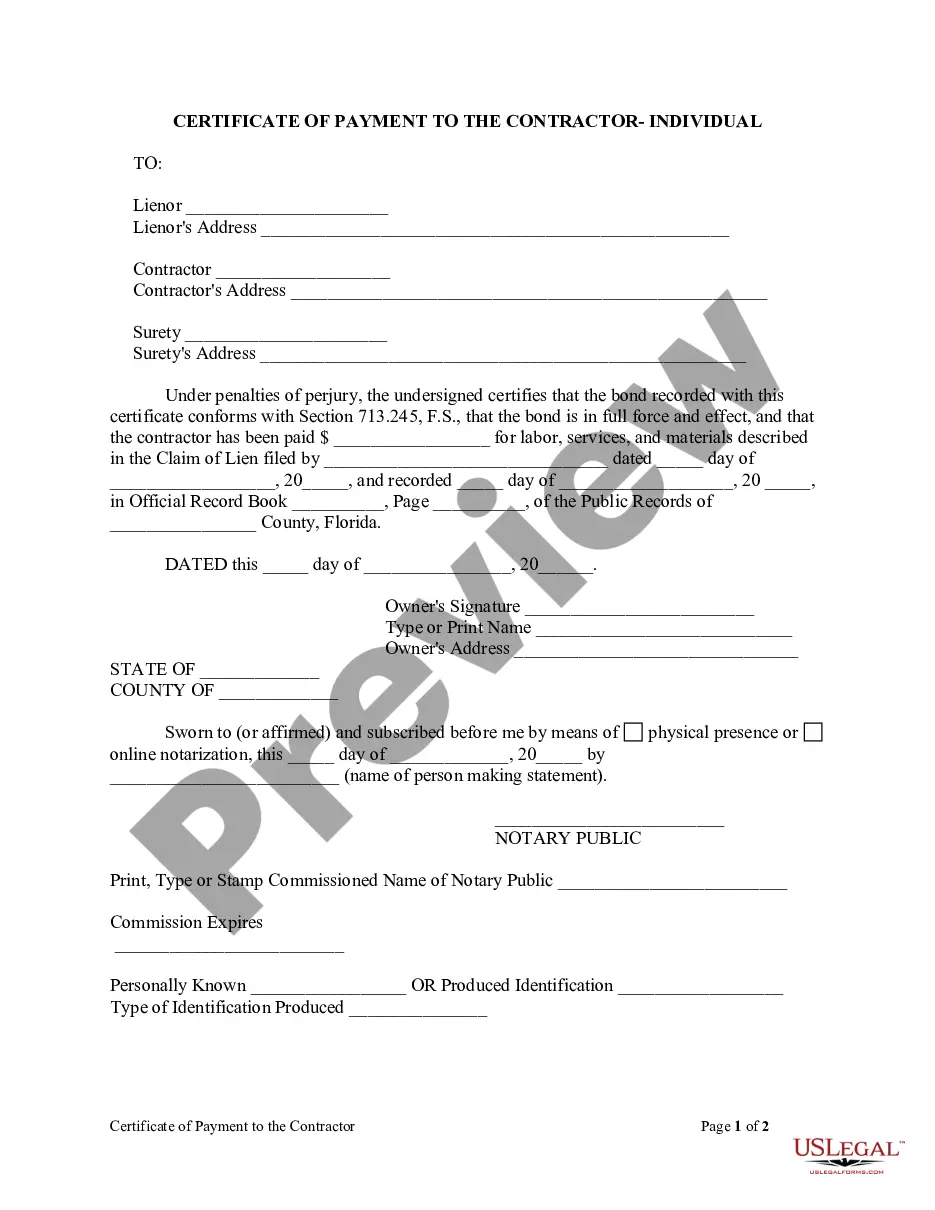

How to fill out Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation Or LLC?

When you are required to complete Payment To Construction that aligns with your local state's laws and regulations, there can be numerous alternatives to choose from.

There is no necessity to review every form to confirm it meets all the legal requirements if you are a US Legal Forms member.

It is a trustworthy source that can assist you in acquiring a reusable and current template on any topic.

Navigating through the suggested page and verifying it for alignment with your needs becomes intuitive with US Legal Forms.

- US Legal Forms is the largest online directory featuring a compilation of over 85k ready-to-use documents for business and personal legal matters.

- All templates are verified to adhere to each state's regulations.

- Thus, when downloading Payment To Construction from our platform, you can be assured that you have a legitimate and updated document.

- Acquiring the required sample from our site is quite simple.

- If you already possess an account, simply Log In to the system, ensure your subscription is active, and save the selected file.

- In the future, you can access the My documents section in your profile and retrieve the Payment To Construction at any time.

- If it's your initial interaction with our website, please follow the instructions below.

Form popularity

FAQ

When you make a payment to construction, you need to consider whether that payment exceeds $600 in a calendar year. If so, it's generally required to issue a 1099 form to the construction company, which helps the IRS track income. This requirement ensures compliance with tax regulations and is essential for both parties' record-keeping. By using platforms like USLegalForms, you can easily manage your payment documentation and ensure you follow the IRS guidelines accurately.

Payment methods in construction can vary widely but often include checks, bank transfers, and digital payment platforms. Many contractors now prefer using electronic transfers for quicker and safer transactions. Additionally, agreements can incorporate payment methods that suit both client and contractor preferences. Utilizing reliable platforms, like uslegalforms, can streamline the payment process to construction and ensure compliance with state regulations.

Payment terms in construction typically specify when and how payments are made throughout a project. Commonly, these terms include payment schedules that align with project milestones or phases. It is essential to clearly outline these terms in contracts to avoid misunderstandings. By establishing clear payment terms to construction, both parties can feel secure about their financial obligations.

In a short payment letter, get straight to the point. Mention who you are, the amount owed, and any pertinent details in just a few sentences. Maintain a polite tone while expressing urgency for payment. A succinct message can effectively convey the need for payment to construction without unnecessary elaboration.

To write a payment letter to a contractor, begin with a cordial introduction followed by the purpose of the letter. Clearly mention the amount due and refer to any previous agreements or invoices. Close with a polite request for prompt payment, reinforcing the importance of fulfilling payment to construction obligations.

Structuring a contractor payment requires outlining the project scope and defining payment terms in your agreement. Specify milestones or completion phases tied to payments. Ensure both parties agree to the schedule to avoid misunderstandings. An organized payment structure can streamline the payment to construction process.

When writing a letter about payment, start with a formal greeting and specify the purpose. Clearly state the due amount, the services provided, and any relevant dates. Keep the tone courteous, and express your hope for prompt resolution. This clarity aids in encouraging timely payment to construction.

Writing a strong demand letter for payment involves stating the reasons for the demand succinctly. Outline the agreement and the specific amount owed, while reinforcing the timeline for payment. Be firm but respectful in your language to encourage compliance. Using uslegalforms can guide you in crafting a legally sound demand letter that emphasizes the necessity of payment to construction.

To write a request letter for payment, clearly state the project details and the amount owed. Be direct and concise, using a polite tone. Include a request for prompt payment and remind the recipient of any due dates. This approach helps ensure the communication remains professional while emphasizing the importance of payment to construction.

The payment to construction can include various methods such as direct bank transfers, checks, and digital payment platforms. Each of these methods has its own benefits, offering flexibility and security for both contractors and clients. It is important to establish clear terms before beginning a project, ensuring that all parties agree on the payment method. By using US Legal Forms, you can easily document these agreements and streamline your payment process for a smooth construction experience.