Form Corporation Llc For Non Residents

Description

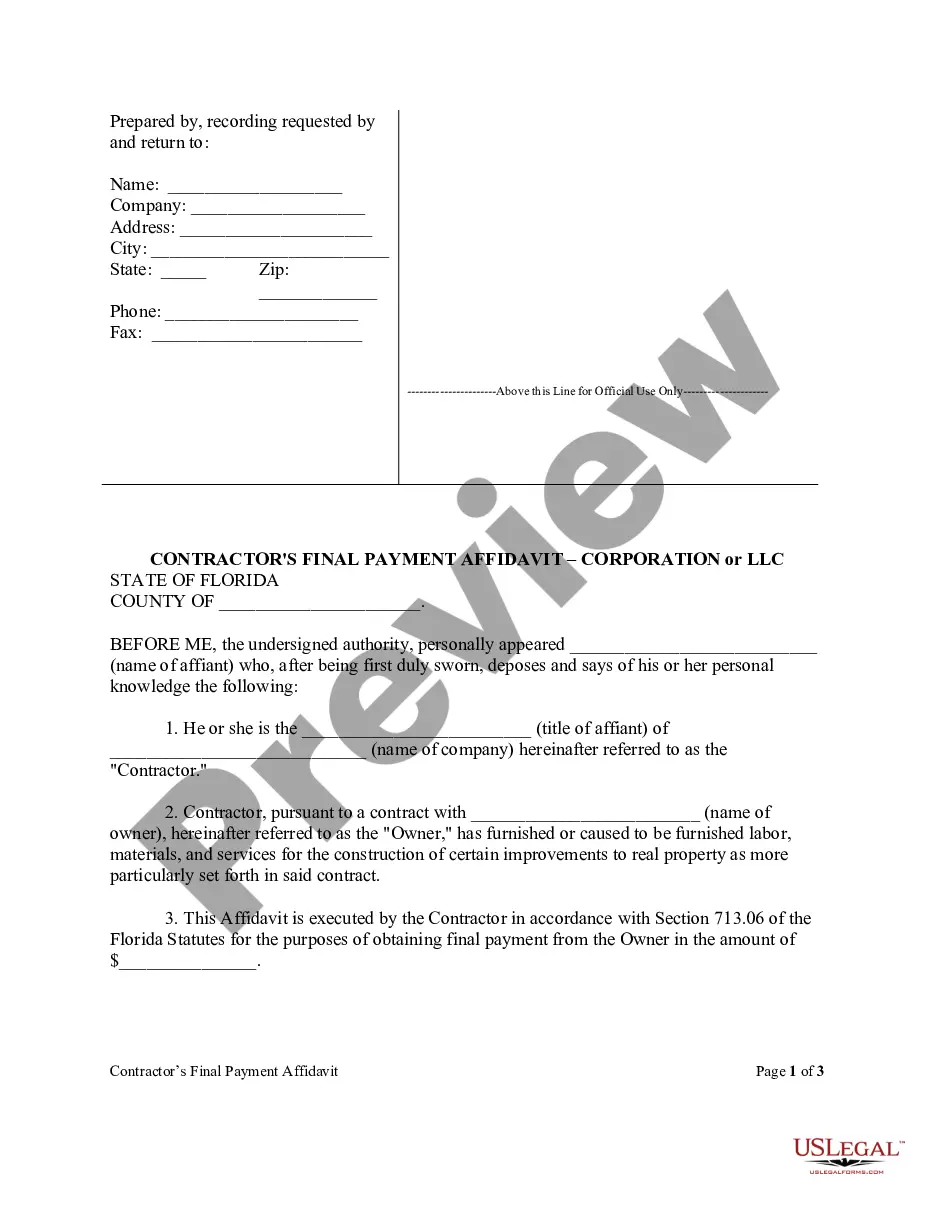

How to fill out Florida Contractor's Final Affidavit Form - Construction - Mechanic Liens - Corporation?

- Log in to your US Legal Forms account if you're an existing user, and ensure your subscription is active. If needed, renew it per your payment plan.

- For first-time users, start by checking the Preview mode and description of the needed form. Make sure it fits your jurisdiction's requirements.

- If the selected template doesn’t match your needs, utilize the Search tab to find a suitable alternative.

- Purchase the document by clicking the Buy Now button and selecting your desired subscription plan. You'll need to create an account for access.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Download the form to your device and access it any time through the My Forms section in your account.

US Legal Forms empowers individuals and legal professionals to efficiently execute essential documents with confidence. Their robust library offers a variety of forms, more than many competitors, ensuring you have what you need at your fingertips.

In conclusion, forming a corporation LLC for non-residents is a manageable task with the right resources. Start your journey today with US Legal Forms and experience ease in legal document management!

Form popularity

FAQ

The best state for forming an LLC as a non-resident often depends on specific business needs. Generally, Delaware and Wyoming are favored due to their business-friendly regulations and lower fees. Consider factors like tax implications and privacy laws when making your choice. To explore your options, US Legal Forms can offer insights and help you form corporation LLC for non-residents in the most suitable state.

Non-US residents can register an LLC in the US by first selecting the state where they want to operate. After that, they must appoint a registered agent who resides in that state. Filing the Articles of Organization and acquiring an Employer Identification Number (EIN) are essential steps. Using platforms like US Legal Forms can guide you through the process to form corporation LLC for non-residents seamlessly.

Registering a business in a state where you are not a resident involves several steps. First, choose a business structure, such as an LLC or corporation, and ensure you understand the state laws. Afterward, file the necessary formation documents and obtain any required licenses. Services like US Legal Forms provide resources to smoothly register your business and help you form corporation LLC for non-residents efficiently.

To form an LLC in a state where you do not reside, begin by selecting the state of incorporation. Next, choose a registered agent who can handle your business correspondence in that state. You will need to file the Articles of Organization and comply with state-specific regulations. Utilizing platforms like US Legal Forms can simplify this process, especially when you seek to form corporation LLC for non-residents.

To set up an LLC as a non-resident, begin by choosing a state that permits LLC formation for foreign individuals. You must choose a unique name for your LLC that complies with state regulations. Next, appoint a registered agent who will handle official correspondence on behalf of your LLC. Finally, submit the required formation documents along with any necessary fees, ensuring you follow all local rules to successfully form corporation LLC for non residents.

To set up a US company as a non-resident, start by choosing the right business structure, such as an LLC or corporation. You’ll need to select a state for registration, obtain a registered agent, and file the necessary formation documents. While forming a corporation LLC for non-residents can seem daunting, using platforms like uslegalforms simplifies the process and guides you through each step.

Some of the best banks for LLC non-residents include HSBC, Citibank, and Wells Fargo due to their international services. These banks typically have experience dealing with non-resident business owners, making it easier to establish banking relationships. They offer various account types, beneficial for managing business funds effectively. When you form a corporation LLC for non-residents, consider these banks for a smoother experience.

When forming a corporation LLC for non-residents, a business checking account is typically the best option. This type of account allows you to clearly separate personal and business finances, which simplifies bookkeeping. Look for accounts with low fees, easy online access, and reliable customer service. Selecting the right bank is vital to managing your LLC’s financial health.

The best state to open an LLC for non-residents often includes Delaware and Wyoming due to their business-friendly environments. These states allow non-residents to easily form corporations while offering tax advantages and privacy. Consider what features matter most for your business. Gathering information specific to your circumstances will help you choose the right state.

Yes, you can successfully open an LLC even if you do not live in the US. Many entrepreneurs choose to form a corporation LLC for non-residents to take advantage of the US market. You will need a registered agent who has a physical address in the state where you register your LLC. Consulting with professionals or platforms like uslegalforms can simplify the process.