Connecticut Employee File Withholding Allowance

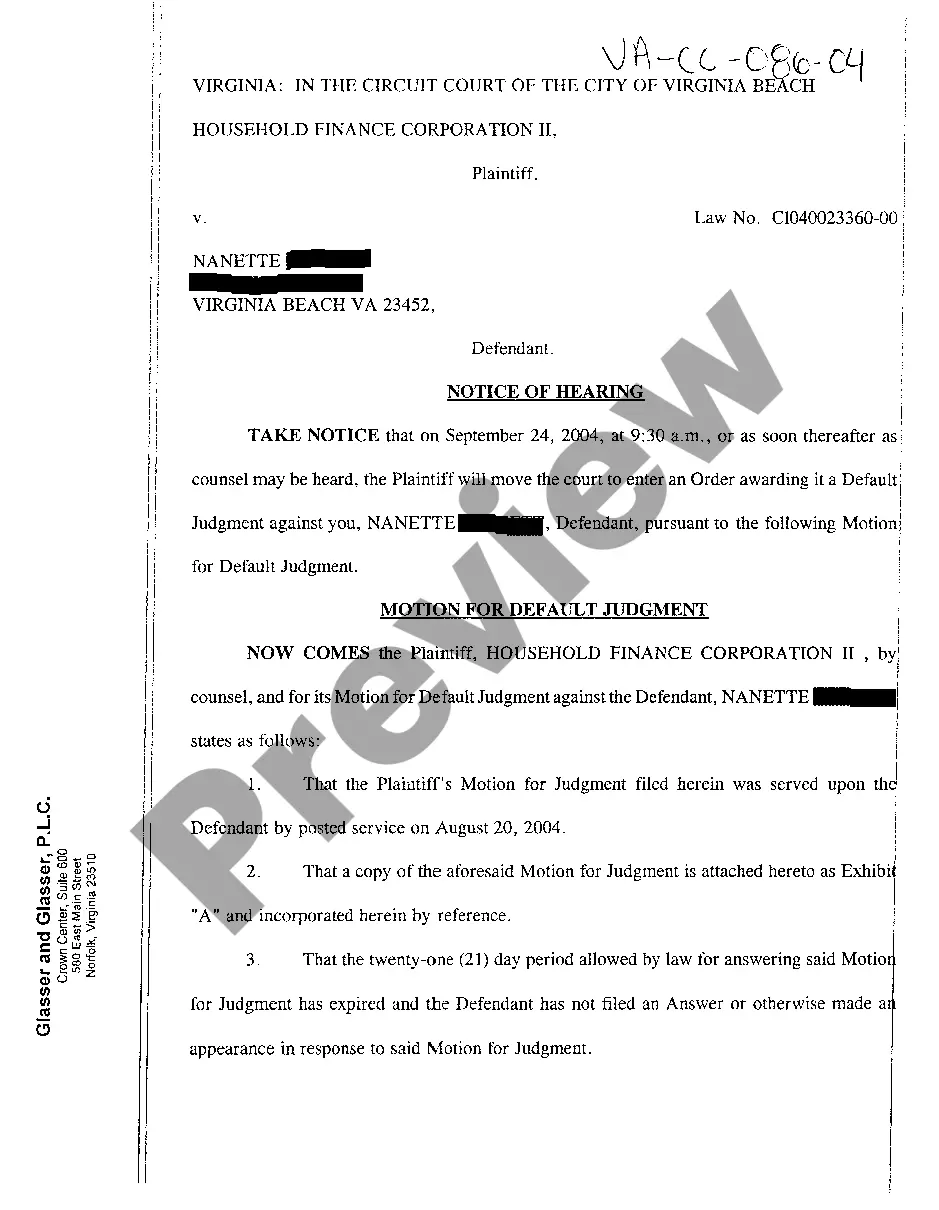

Description

How to fill out Connecticut Employment Employee Personnel File Package?

Utilizing legal forms that adhere to federal and local regulations is essential, and the internet provides numerous alternatives to choose from.

However, why squander time searching for the appropriately formatted Connecticut Employee File Withholding Allowance template online when the US Legal Forms digital library already has such forms compiled in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 fillable templates crafted by attorneys for various professional and personal situations. They are user-friendly to navigate with all documents categorized by state and intended use. Our specialists stay abreast of legislative updates, so you can always trust that your form is current and compliant when procuring a Connecticut Employee File Withholding Allowance from our platform.

Click Buy Now once you've found the appropriate form and select a subscription package. Create an account or Log In and make a payment via PayPal or credit card. Choose the correct format for your Connecticut Employee File Withholding Allowance and download it. All forms you discover through US Legal Forms are reusable. To re-download and fill out previously acquired documents, access the My documents section in your profile. Take advantage of the most comprehensive and user-friendly legal documentation service!

- Acquiring a Connecticut Employee File Withholding Allowance is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, sign in and store the document sample you require in the desired format.

- If you are new to our site, follow the steps outlined below.

- Examine the template using the Preview function or through the text description to verify it fulfills your requirements.

- If necessary, find another sample using the search utility at the top of the page.

Form popularity

FAQ

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

You can claim anywhere between 0 and 3 allowances on the W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

Employer Instructions For any employee who does not complete Form CT-W4, you are required to withhold at the highest marginal rate of 6.99% without allowance for exemption. You are required to keep Form CT?W4 in your files for each employee.

You must begin withholding at the highest marginal rate of 6.99%, from each employee who claimed exempt status from Connecticut income tax withholding in the prior year and who did not provide a new Form CT-W4 on or before February 15 of the current year. See Employees Claiming Exemption on Page 10.