Living Trust Taxes

Description

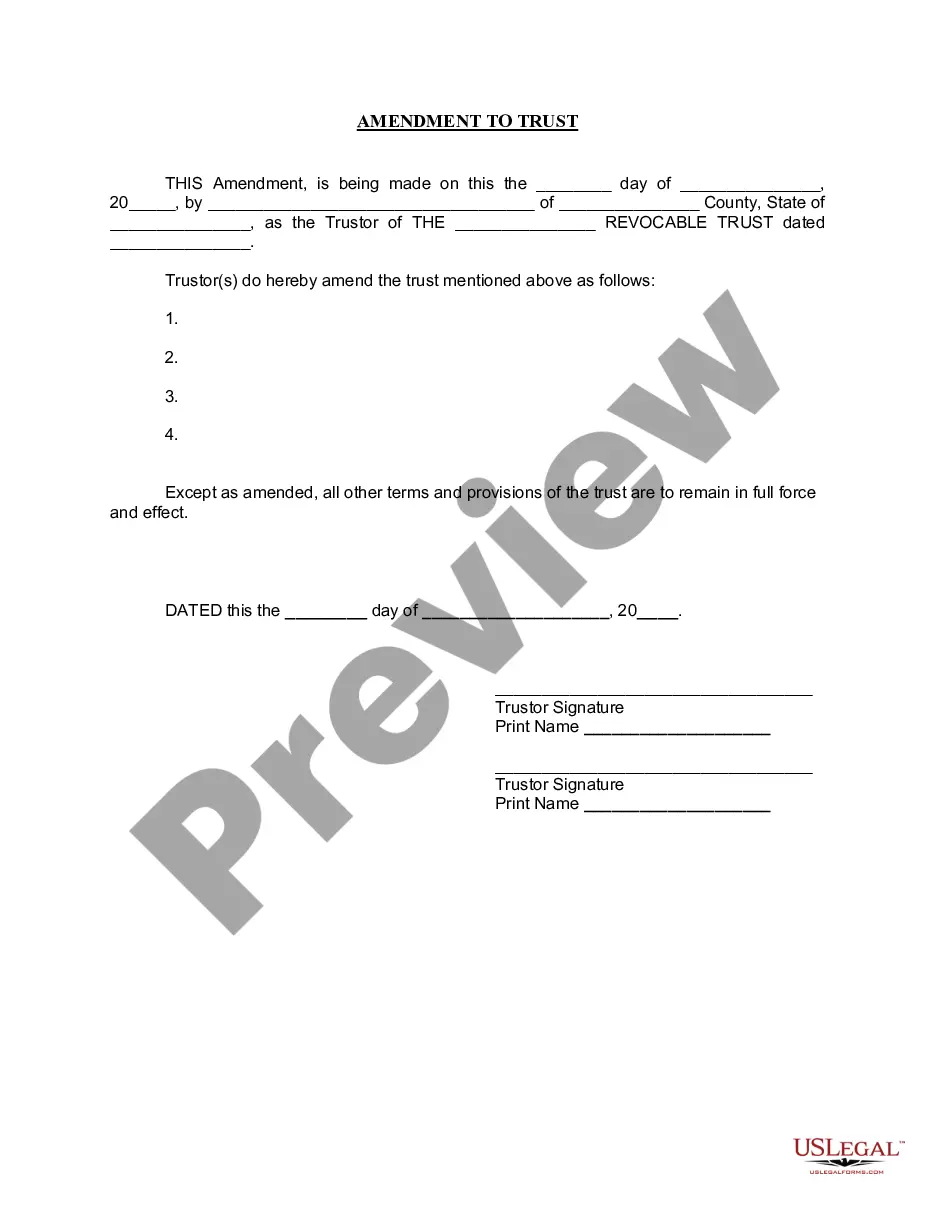

How to fill out Connecticut Amendment To Living Trust?

- Log in to your US Legal Forms account. If you haven't created an account yet, register for one to access the full library.

- Search for the living trust tax form. Use the search bar to locate the specific template that corresponds with your local regulations.

- Review the form details. Ensure that the selected document meets your requirements and has the correct jurisdictional compliance.

- Select your subscription plan. Click on the 'Buy Now' button and choose a plan that fits your legal needs.

- Complete your payment. Enter your credit card information or opt for PayPal to finalize your subscription.

- Download your form. Save the completed template directly to your device for easy access and continued editing, if necessary.

By following these steps, you can ensure that accessing living trust taxes is straightforward and stress-free.

Start your journey today by visiting US Legal Forms and take advantage of their extensive library and expert assistance!

Form popularity

FAQ

Trust taxes are filed separately under specific circumstances, primarily when the trust is irrevocable. In such cases, the trust itself becomes a taxable entity and must file its own tax return. It's important to explore how living trust taxes apply to your specific situation to ensure compliance and efficiency.

A trust reports taxes by filing Form 1041, which is specifically designed for estates and trusts. This form details all income, deductions, and distributions during the taxation year. Depending on the type of trust, the approach to living trust taxes may vary, so understanding the trust's structure is crucial.

In some situations, trusts do need to file separate tax returns, especially when they are irrevocable. If the grantor passes away, the trust must file a return to report any income generated. Living trust taxes can become more complex after the grantor’s death, often necessitating additional tax planning.

Yes, if a living trust earns income, it may receive a 1099 form depending on the type of income generated. This form reports income such as interest or dividends. The living trust taxes will require that this income be accurately reported by the trustee on the appropriate tax forms.

Generally, a living trust does not file a separate tax return during the grantor's lifetime. The income generated by the trust is reported on the grantor's personal tax return. However, if the trust becomes irrevocable or the grantor passes away, it may need to file a separate return for living trust taxes.

Recently, the IRS has updated its guidelines on living trust taxes, emphasizing transparency and compliance. Trusts must ensure proper reporting of income generated within the trust. This change aims to prevent tax evasion and ensure that all income, whether inside or outside a trust, is accounted for.

A living trust does not typically file its own tax return unless it is a complex trust. A revocable living trust usually reports income on the grantor's personal tax return. Understanding how living trust taxes work can streamline your overall tax strategy and simplify compliance.

Yes, if a living trust earns income, it may receive a 1099 form reporting that income. This form provides necessary details about various income sources, which facilitates accurate reporting of living trust taxes. Understanding the 1099 process can help in managing your tax obligations effectively.

Failing to file a trust tax return can lead to penalties and interest on owed taxes. This noncompliance may also trigger an audit from the IRS, leading to potential legal complications. It's important to address living trust taxes proactively to avoid these issues.

A living trust itself does not count as income. However, the income it generates from assets, such as interest or dividends, is subject to taxation. For living trust taxes purposes, focused attention on the income generated by the trust is essential for proper financial management.