Fiduciary Probate Certificate Format India

Description

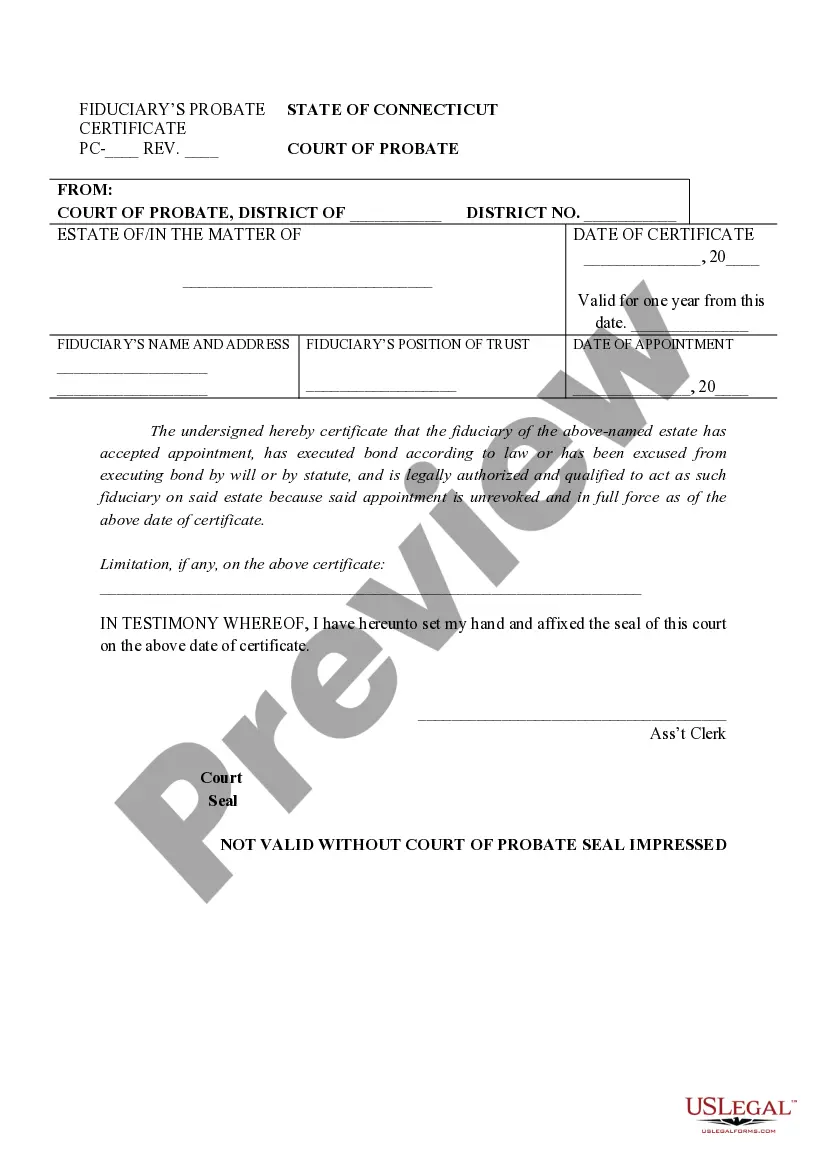

How to fill out Connecticut Fiduciary's Probate Certificate?

Handling legal papers and processes can be a lengthy addition to your entire day.

Fiduciary Probate Certificate Format India and similar documents typically necessitate a search for them and figuring out the most effective way to fill them out.

Therefore, whether you are managing financial, legal, or personal issues, having a comprehensive and efficient online directory of forms readily available will be of great assistance.

US Legal Forms is the premier online resource for legal templates, providing over 85,000 state-specific forms and countless resources to help you complete your documents effortlessly.

Is this your first time using US Legal Forms? Create and establish a free account in just a few minutes to access the form collection and Fiduciary Probate Certificate Format India. Then, follow these steps to complete your form: Ensure you've found the correct form by utilizing the Preview function and reviewing the form details. Select Buy Now when ready, and choose the subscription plan that suits you best. Click Download, then fill out, sign, and print the form.

- Explore the collection of relevant documents available to you with just a single click.

- US Legal Forms supplies state- and county-specific documents available for download at any time.

- Safeguard your document management tasks by utilizing a high-quality service that enables you to prepare any form within minutes without extra or hidden fees.

- Simply sign in to your account, locate the Fiduciary Probate Certificate Format India, and obtain it instantly from the My documents section.

- You can also retrieve forms that you have downloaded previously.

Form popularity

FAQ

How to apply for probate of a will? The executor of the will is required to file a petition and the original will to the court for grant of probate. ... The executor will have to pay the applicable court fees depending upon the value of the assets. The petition must be filed before a competent court.

Probate in simpler terms is a copy of the will that is certified by the seal of the court. Only the executor nominated in the Will can apply for probate. Whereas Letter of Administration is needed at times when a person dies without a Will or the absence of an executor.

In most cases, probate is mandatory in India, meaning that unless someone specifically waives the right to have their estate probated, the court will be required to carry out the process. This is different from waiver of discharge, which is a legal maneuver used to avoid probate altogether.

It is not always necessary to get a probate order for a will. If there is no dispute between the legal heirs as to the contents of a will they may choose to forgo a probate. It is therefore not necessary for a registered will to have a probate, though one may be applied for.

Every state sets the priority ing to which claims must be paid. The estate's beneficiaries only get paid once all the creditor claims have been satisfied. Usually, estate administration fees, funeral expenses, support payments, and taxes have priority over other claims.