Living Trist

Description

How to fill out Colorado Living Trust Property Record?

- Log in to your US Legal Forms account if you're an existing user. Check your subscription status to ensure it is active.

- For first-time users, browse the extensive library. Use the Preview mode to assess forms and confirm they meet your jurisdiction's requirements.

- Utilize the Search bar for any specific templates you need, ensuring that your selection is appropriate for your situation.

- Select the document you need and click 'Buy Now.' Choose your preferred subscription plan and create an account to access additional tools.

- Complete your purchase with your credit card or PayPal account to finalize your subscription.

- After the transaction, download your legal form directly to your device and access it anytime through the 'My Forms' section.

In conclusion, utilizing US Legal Forms sets you on the right path towards efficient and accurate legal documentation. With over 85,000 forms available and support from premium experts, you can trust that your legal needs are met seamlessly.

Start your journey with US Legal Forms today and unlock the potential of living trist with dependable legal solutions.

Form popularity

FAQ

Choosing the right person to set up a living trust is crucial for its success. Ideally, a qualified estate planning attorney can provide expert advice on the process and ensure compliance with legal standards. Additionally, your chosen individual should understand your goals and family dynamics. US Legal Forms offers resources that can guide you in selecting the best professional for your needs.

The best way to set up a living trust involves a few essential steps. First, identify the assets you want to include in your trust and decide who will serve as the trustee. Next, draft the trust document, ensuring it complies with state laws. You can use US Legal Forms to help you create a comprehensive living trust tailored to your needs and goals.

In California, a living trust generally does not need to be filed with the court. A living trust allows you to manage your assets during your lifetime and simplifies the transfer of your estate upon your death. However, if there are legal disputes or the trust becomes irrevocable, court involvement may come into play. For a smoother process, consider using a reliable platform like US Legal Forms to ensure you meet all necessary legal requirements.

One significant mistake parents often make when setting up a trust fund is not clearly defining the beneficiaries and their needs. This oversight can lead to confusion and potential disputes down the line. Furthermore, failing to regularly review and update the trust can result in it not reflecting your current intentions. To avoid these pitfalls, consider using USLegalForms for guidance and to ensure your living trust is set up correctly and efficiently.

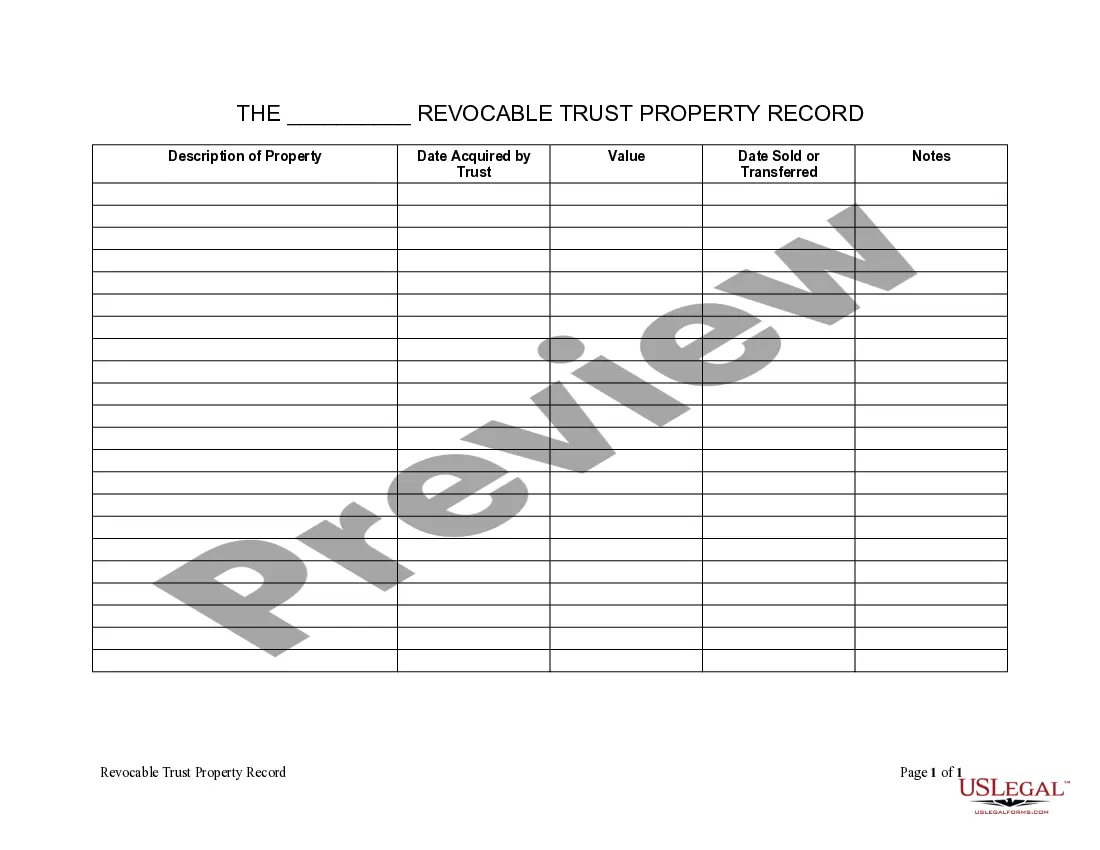

Filling a living trust requires several key steps. First, you should gather essential documents such as property deeds, financial statements, and beneficiary information. Next, use a reliable platform like USLegalForms to simplify the process. Finally, ensure you properly sign and notarize the document to make your living trust legally binding.

While there are many benefits to placing your house in a living trust, some disadvantages do exist. Establishing a trust may involve upfront costs and ongoing management fees. Additionally, if not properly set up, a trust can complicate your estate plan. Always consult with legal professionals to weigh these factors and make an informed decision.

Yes, you can place your house in a living trust in Pennsylvania. This can protect your property from probate and give you the flexibility to manage it during your lifetime. Establishing a living trust can be straightforward, but it is important to ensure that all paperwork is filled out correctly. You might want to consider platforms like US Legal Forms to simplify the process of creating your trust.

The main purpose of a living trust is to manage your assets during your lifetime and facilitate their distribution after your death without going through probate. This private arrangement keeps your estate matters away from public eyes and can help reduce the costs associated with probate. It also allows you to maintain control over your assets even if you become incapacitated. Trusts can be powerful tools in estate planning.

In Pennsylvania, a living trust does not inherently avoid inheritance tax, as the assets in the trust are still considered part of your estate. However, establishing a living trust can simplify the distribution of your assets upon your death. This can lead to quicker transfers and potentially less tax liability due to streamlined processes. Engaging with professionals can help you navigate these complexities effectively.

Deciding whether to gift a house or to place it in a living trust depends on your goals. A living trust can provide more control over your home, allowing you to dictate how and when your assets are distributed after your passing. On the other hand, gifting a house might have tax implications you need to consider. Therefore, it's wise to consult with a legal professional to evaluate what suits your situation best.