File Judgment Lien With Secretary Of State

Description

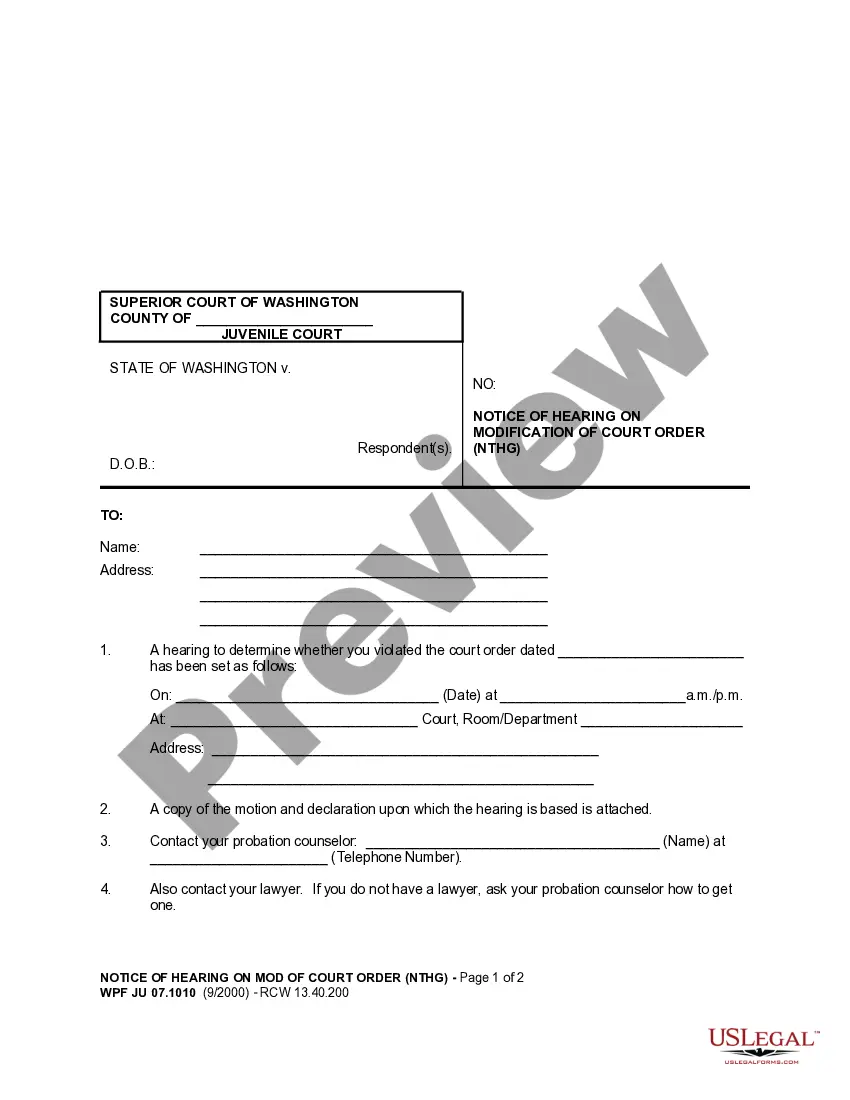

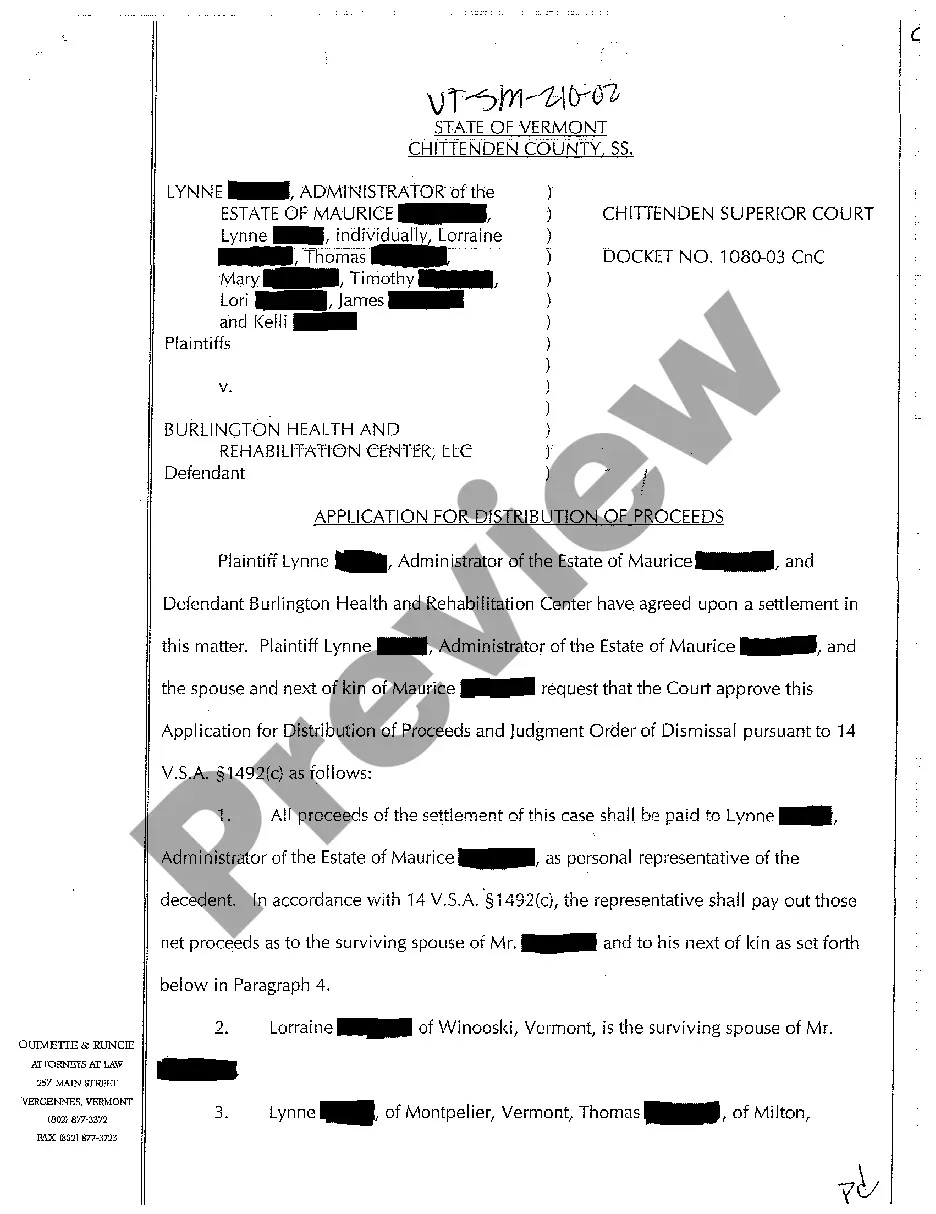

How to fill out Colorado Affidavit Of Service Of Notice Of Intent To File Lien Statement?

- Log in to your US Legal Forms account if you are a returning user. If you are new, create an account to get started.

- Browse through the curated form templates related to judgment liens. Utilize the preview mode to confirm the form meets your requirements and aligns with local jurisdiction rules.

- If necessary, search for alternative templates using the search feature to find the correct document.

- Select the form you intend to use and click the 'Buy Now' button. Choose a subscription plan that suits your needs.

- Complete the purchase process by entering your payment details or using your PayPal account.

- Download the finalized form to your device for easy access. You can find your document within the 'My Forms' section of your profile at any time.

US Legal Forms offers an extensive library, featuring over 85,000 legal forms, empowering you to execute necessary documents efficiently. With a cost-effective collection that surpasses competitors, it provides users with access to premium support from legal experts for form accuracy.

In conclusion, filing a judgment lien with the Secretary of State is straightforward with US Legal Forms. Leverage their robust resources to ensure your legal documents are correctly prepared. Start your journey today and secure your financial interests!

Form popularity

FAQ

A lien is a legal right or interest that a lender has in your property, typically as security for a debt. A judgment, on the other hand, is a court's decision that concludes a lawsuit, which may result in a monetary award. When you file a judgment lien with secretary of state, you transform a judgment into a secured interest in the debtor's property. This distinction is crucial for anyone dealing with debt recovery.

To fill out a lien affidavit, you need to gather necessary information, including the names of the parties involved and details of the debt owed. Ensure you accurately describe the property affected and any pertinent dates. Many find it beneficial to download a template from a reliable platform, like US Legal Forms, which provides guidance on how to file a judgment lien with the secretary of state correctly. Following the necessary steps helps ensure your lien is enforceable.

Examples of judgment liens include those placed on real estate, bank accounts, and personal property. When a creditor successfully sues you for non-payment, they may file a judgment lien with the secretary of state to collect what you owe. These liens can complicate property sales or refinancing efforts. Knowing the implications of judgment liens can help you make informed decisions.

To find out if you have a judgment or lien against you, start by checking public records at your local courthouse or online databases. Many states allow you to search for judgment liens filed with the secretary of state. Additionally, reviewing your credit report can reveal any legal judgments that impact your credit. Staying informed about your financial standing is essential.

The most common liens include mortgage liens, tax liens, and judgment liens. A judgment lien occurs when a court ruling grants a creditor a legal claim against your property. You can file a judgment lien with the secretary of state to formally secure your interest in the property. Understanding various types of liens helps you navigate financial obligations effectively.

A secretary of state lien refers to a lien that is officially recorded with the secretary of state’s office to secure a debt. This filing provides public notice that a creditor has a legal claim against a debtor's property. When you file a judgment lien with the secretary of state, it serves to protect your rights as a creditor.

A judgment is a court's final decision against a debtor, while a lien is a legal claim against that debtor's property. When you file a judgment lien with the secretary of state, you are enforcing the judgment by creating a claim on the debtor's assets. Therefore, they are related but distinct legal concepts.

Typically, the first mortgage lien takes priority, followed by other secured debts, like judgment liens. However, different jurisdictions may have specific rules that affect the priority of liens. Always consult legal resources or professional platforms like USLegalForms when you file a judgment lien with the secretary of state.

When you file a judgment lien with the secretary of state, it does not automatically take first position. The priority of a judgment lien depends on when it is recorded in relation to other liens. Thus, it's crucial to understand the timing and order of filings to establish priority.

Selling property with a UCC lien can be complicated. Generally, the lien must be cleared or satisfied before the sale can proceed. If you're uncertain how to file judgment lien with secretary of state, using tools available on USLegalForms can help clarify your options and streamline the process.