Estate Form Information With One Another

Description

How to fill out California Estate Planning Questionnaire And Worksheets?

Handling legal paperwork and processes can be a lengthy addition to your routine.

Estate Form Information With One Another and similar documents frequently require you to locate them and comprehend the optimal way to fill them out correctly.

Thus, whether you are managing financial, legal, or personal issues, having a comprehensive and convenient online directory of documents at your disposal will greatly assist you.

US Legal Forms is the premier online resource for legal templates, providing over 85,000 state-specific forms and a range of tools to help you finalize your documents swiftly.

Is it your first experience using US Legal Forms? Register and create a free account in just a few moments to gain entry to the form directory and Estate Form Information With One Another. Then, follow the steps outlined below to fill out your form: Ensure you have located the correct form by utilizing the Review option and examining the form description. Select Buy Now when ready, and choose the subscription plan that fits your needs. Click Download then fill out, sign, and print the document. US Legal Forms has twenty-five years of experience assisting users with their legal paperwork. Find the form you need today and streamline any procedure effortlessly.

- Browse the array of relevant paperwork available to you with just one click.

- US Legal Forms offers you state- and county-specific forms ready for download at any time.

- Protect your document handling processes with a high-quality service that enables you to prepare any form in a matter of minutes without additional or hidden fees.

- Simply Log In to your account, locate Estate Form Information With One Another, and download it directly from the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

Common mistakes when filing Form 706 include incorrect valuations of assets, omitting necessary information, and failing to meet deadlines. These errors can lead to delays and complications in the estate tax process. To avoid these pitfalls, it is crucial to gather accurate estate form information with one another and ensure thoroughness when completing your forms. Utilizing US Legal Forms can provide the guidance you need to file Form 706 correctly.

A life estate based on someone else's life is commonly referred to as a 'pur autre vie' estate. This type of arrangement allows the life tenant to use the property during the lifetime of another person, rather than their own. Understanding this concept is essential for proper estate planning and management. For detailed estate form information with one another, US Legal Forms offers valuable resources to assist you.

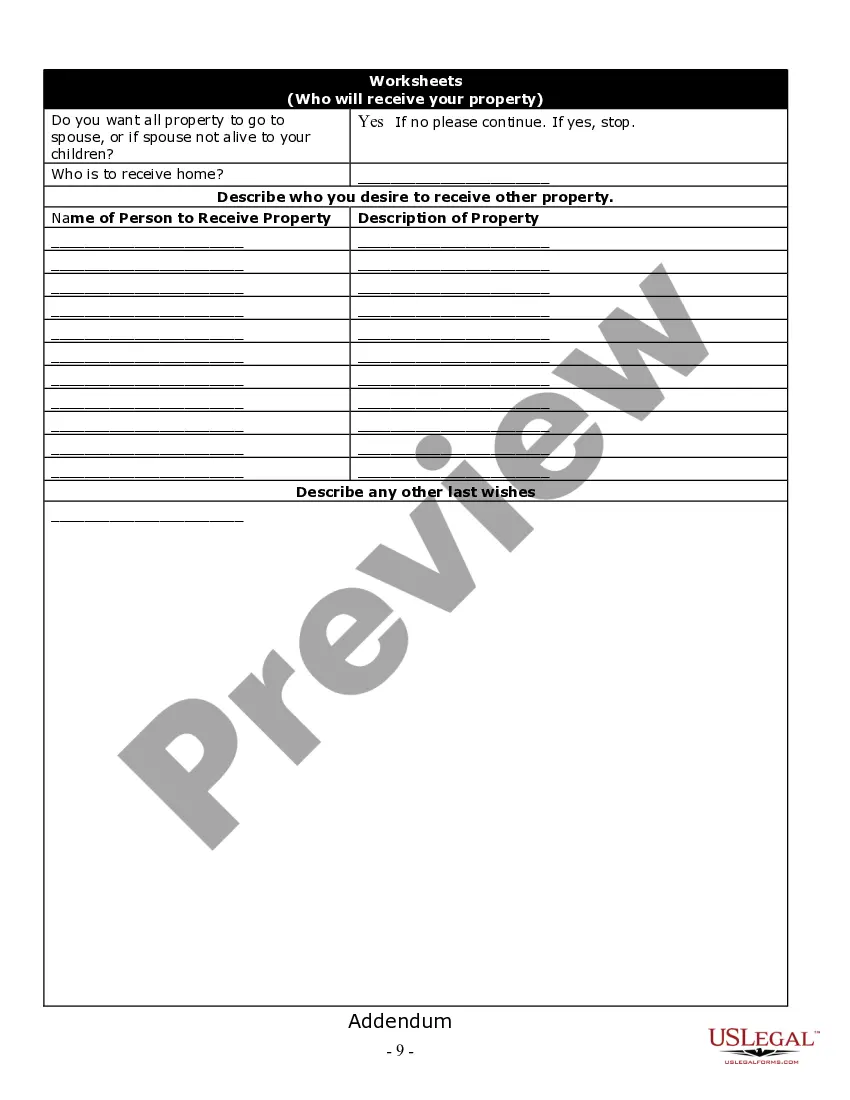

Ownership transfers from a deceased estate through a legal process called probate. During probate, the court validates the deceased's will and appoints an executor to handle the estate's distribution. This process ensures that assets are distributed according to the deceased's wishes, as outlined in the will. For comprehensive estate form information with one another, consider using US Legal Forms to simplify your document preparation.

Yes, clothing is considered an asset in an estate and should be included in the inventory. While it may not hold significant monetary value, it is part of the deceased's personal property. For thorough estate form information with one another, refer to US Legal Forms, which provides templates to help you accurately assess and document all assets, including clothing.

To set up an estate for someone who passed away, you first need to validate the will through probate court. After that, you will gather all relevant estate form information with one another, including asset documentation and beneficiary notifications. Using resources from US Legal Forms can help you create necessary legal documents and comply with state laws effectively.

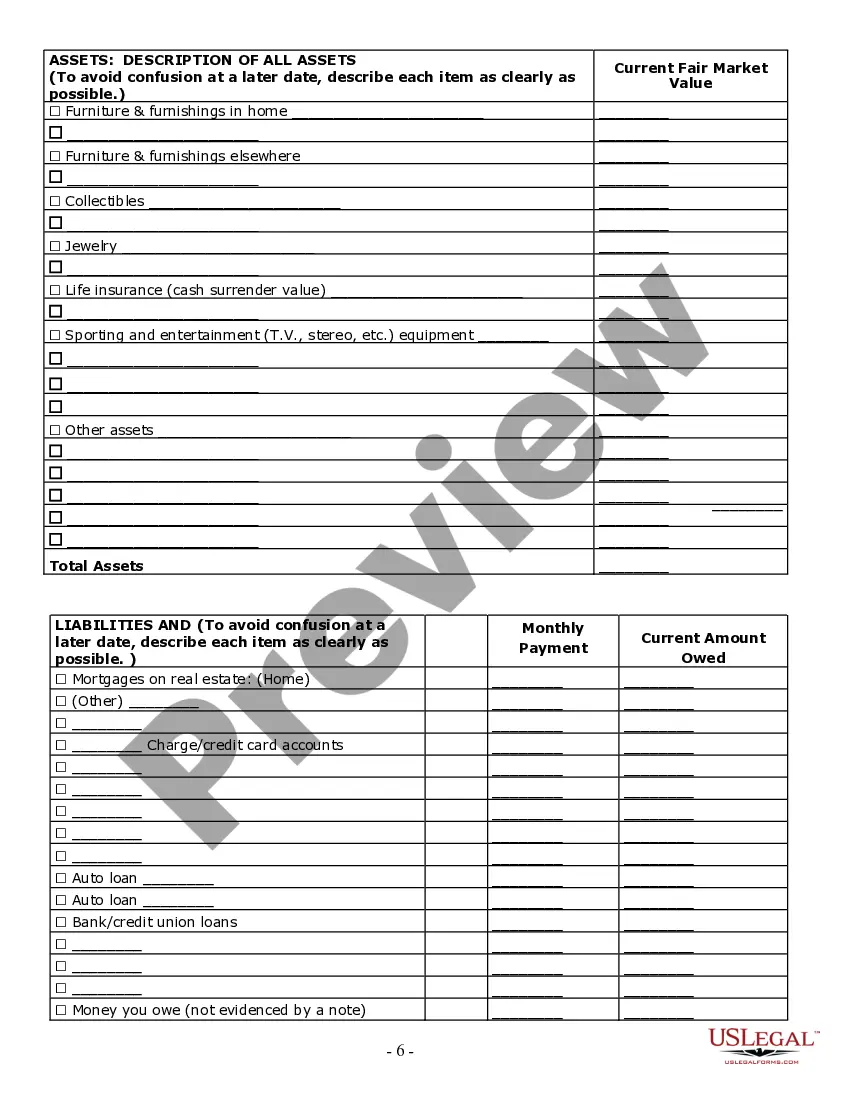

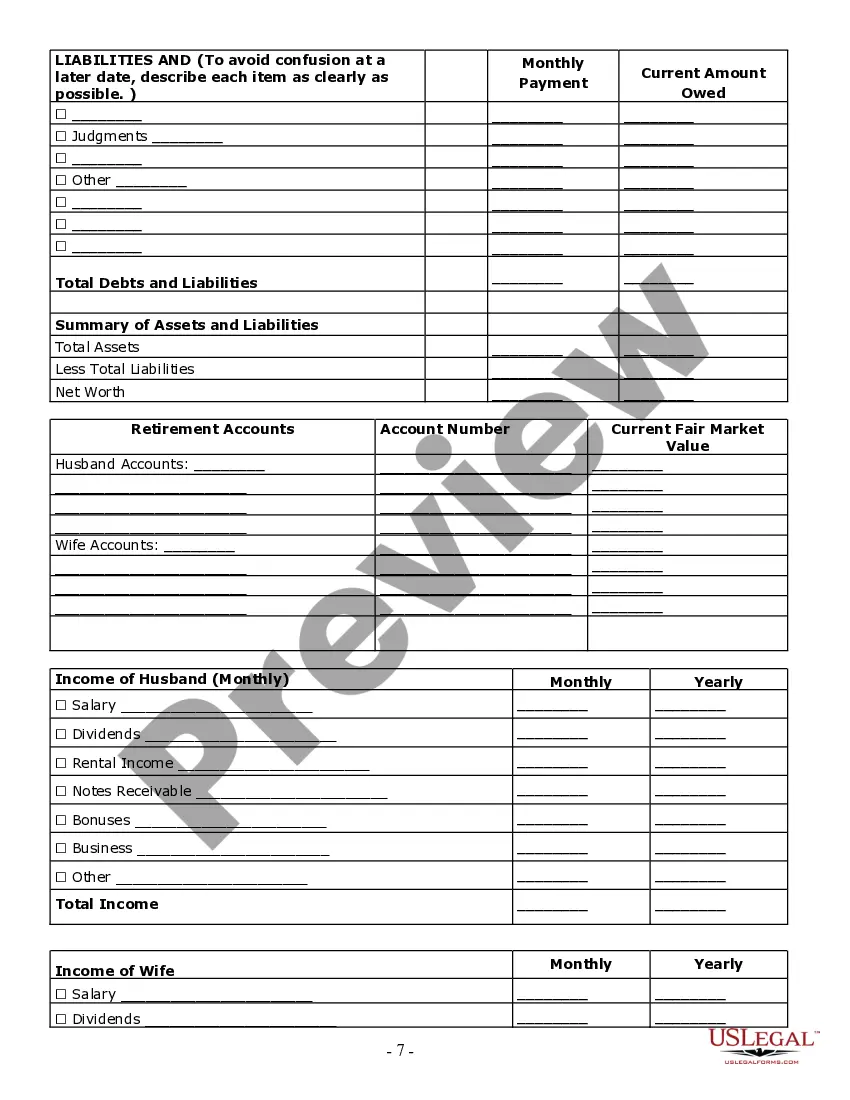

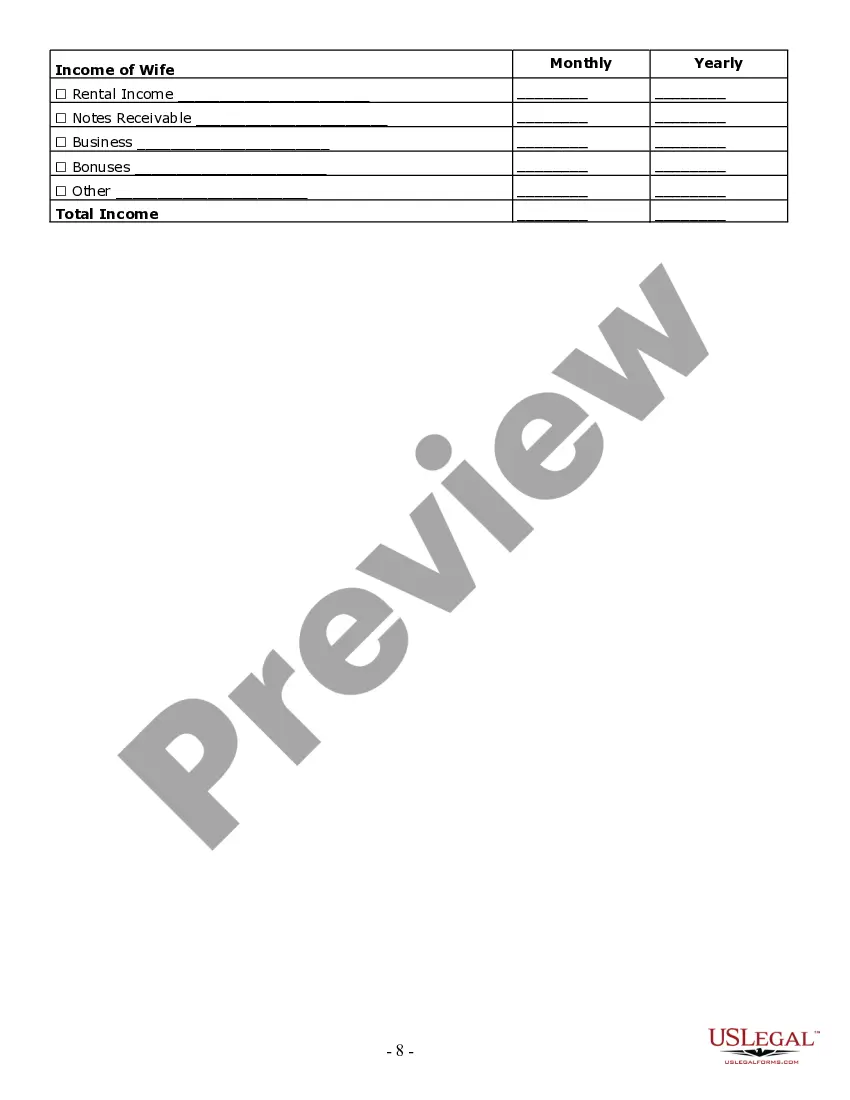

Taking inventory in a deceased estate requires you to list all assets and liabilities of the estate. You should gather documentation such as bank statements, property deeds, and personal property lists. By using estate form information with one another available on US Legal Forms, you can streamline this process and ensure you include everything necessary for the probate court.

To settle an estate in Colorado, you need to file the will with the probate court and start the probate process. This process involves notifying beneficiaries, paying debts, and distributing assets according to the will or state law. You can find detailed estate form information with one another through platforms like US Legal Forms, which offer resources to help you navigate the legal requirements smoothly.