Ca Form Wills Withholding

Description

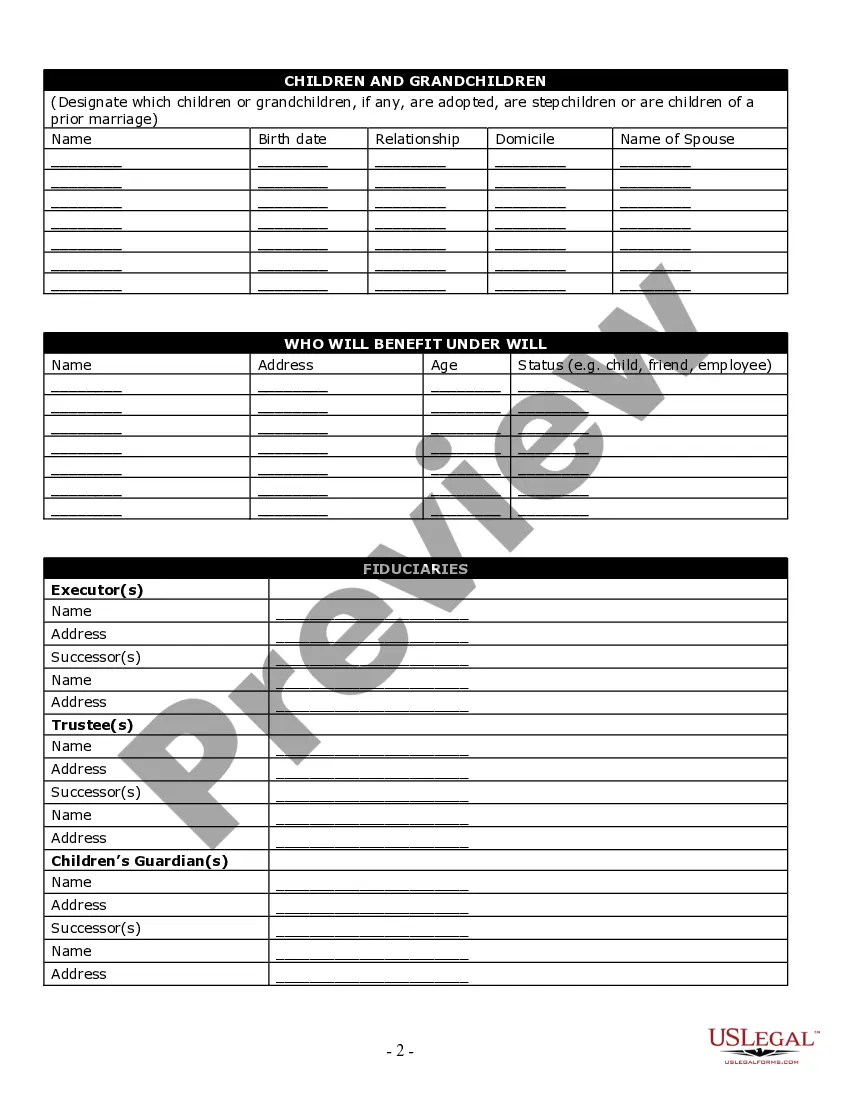

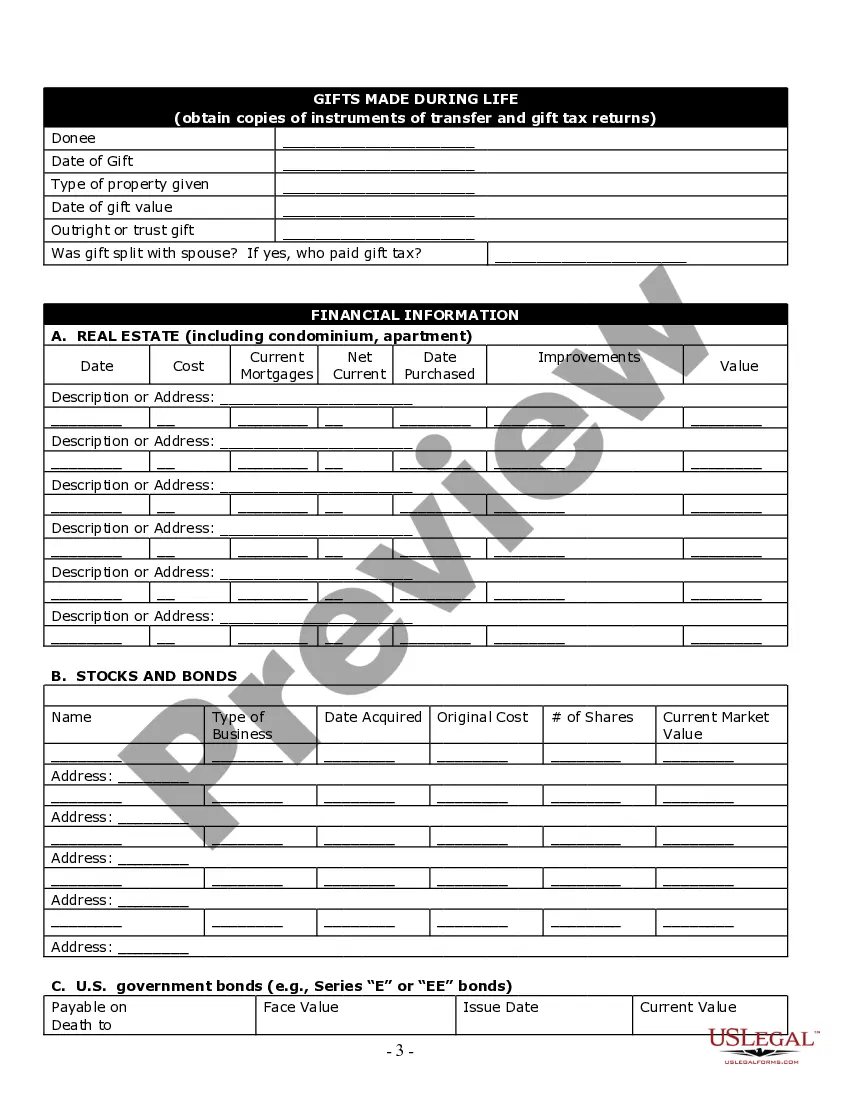

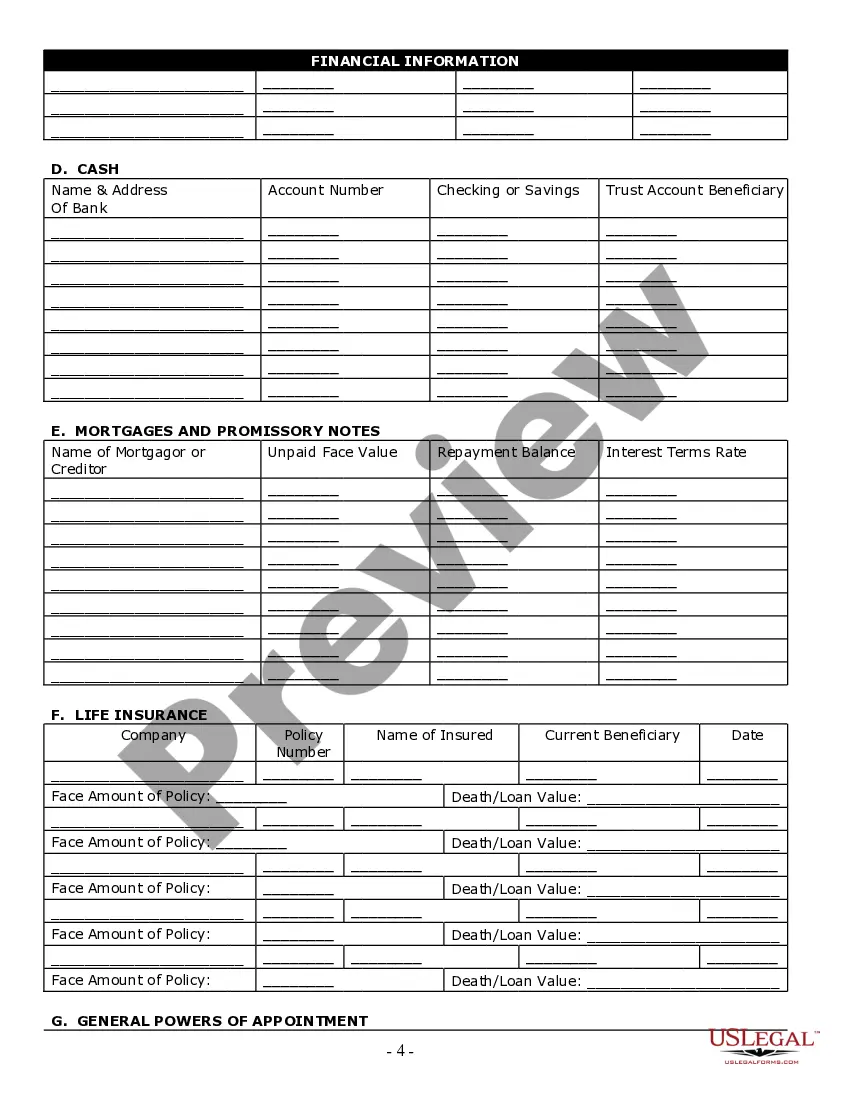

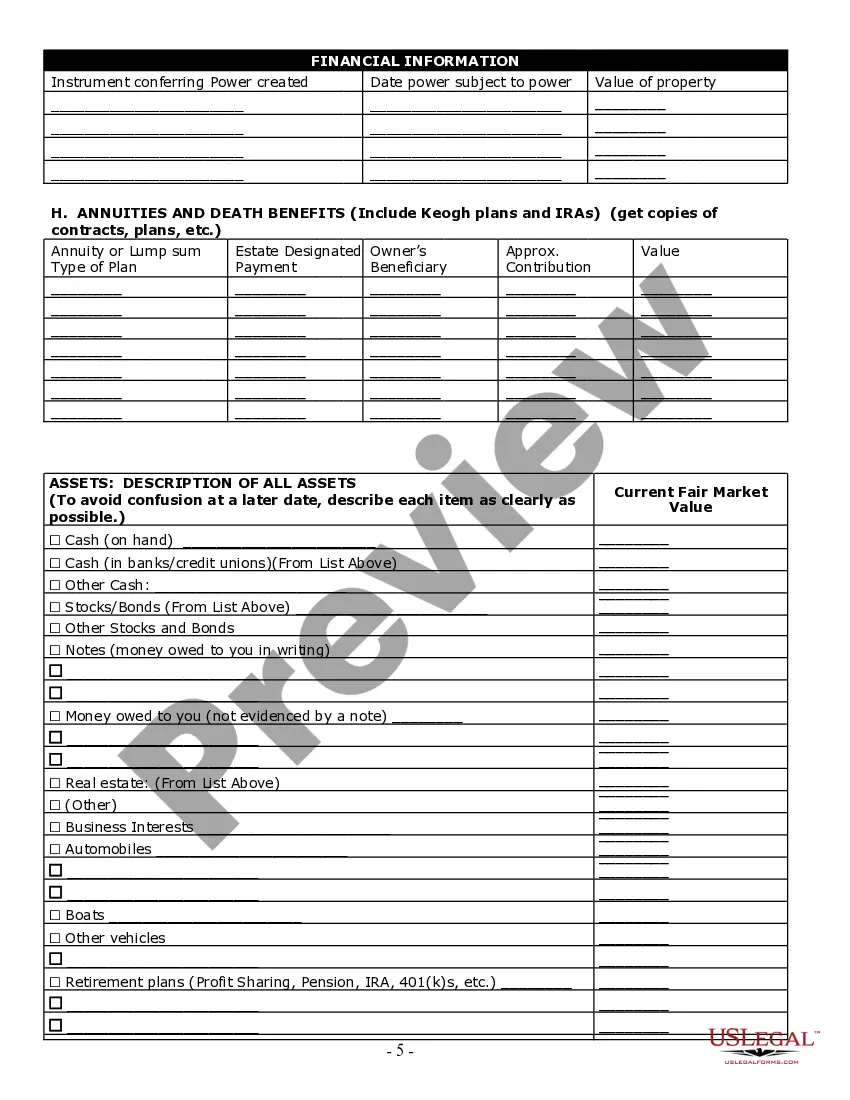

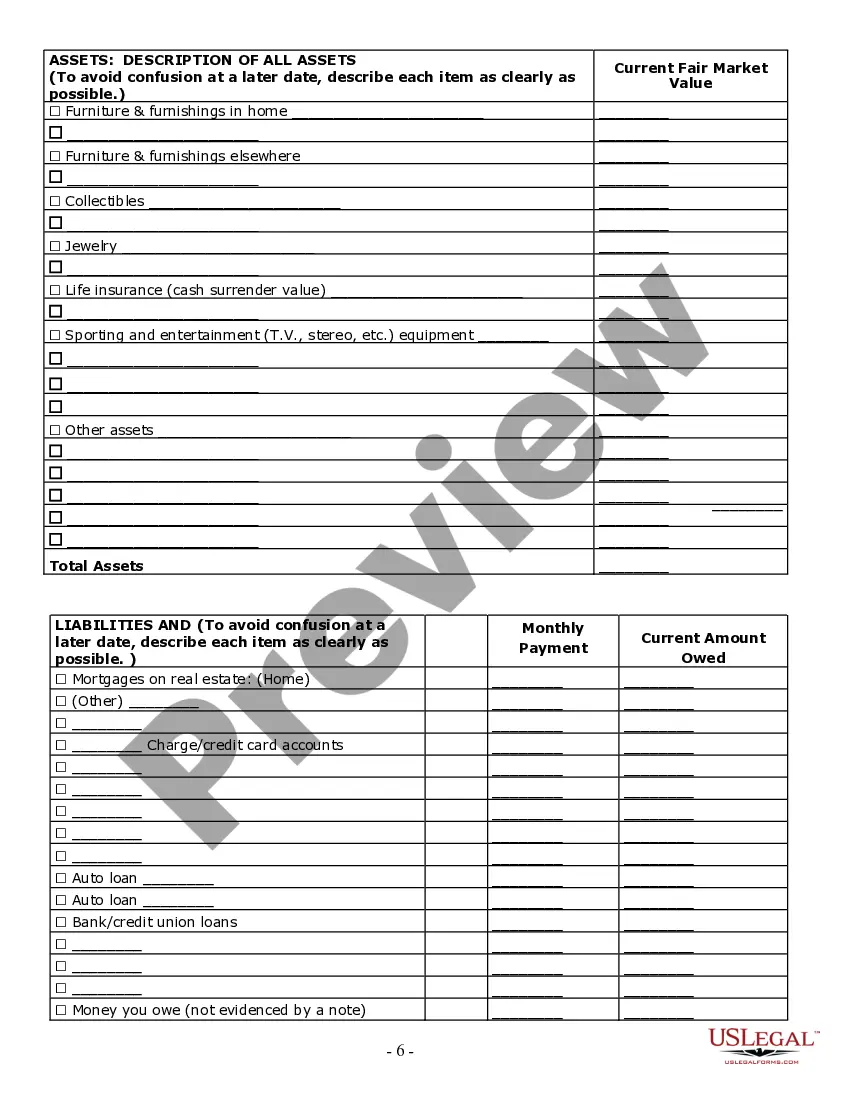

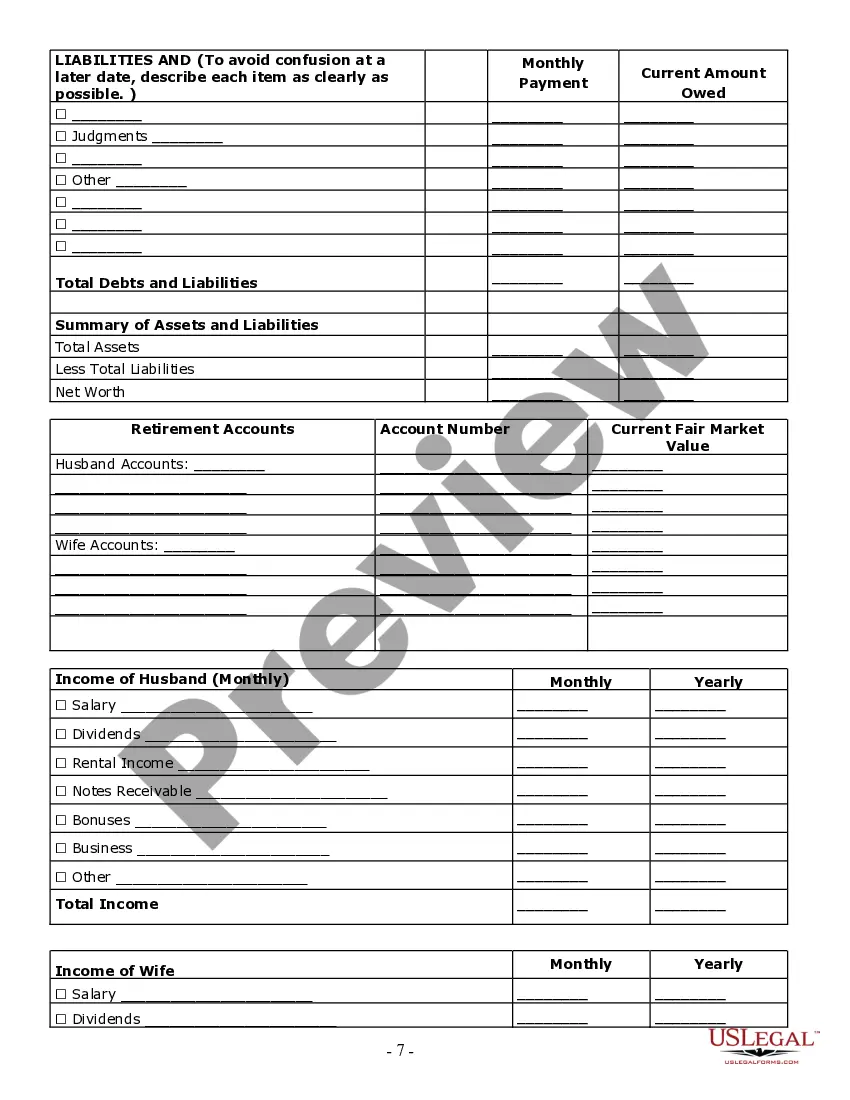

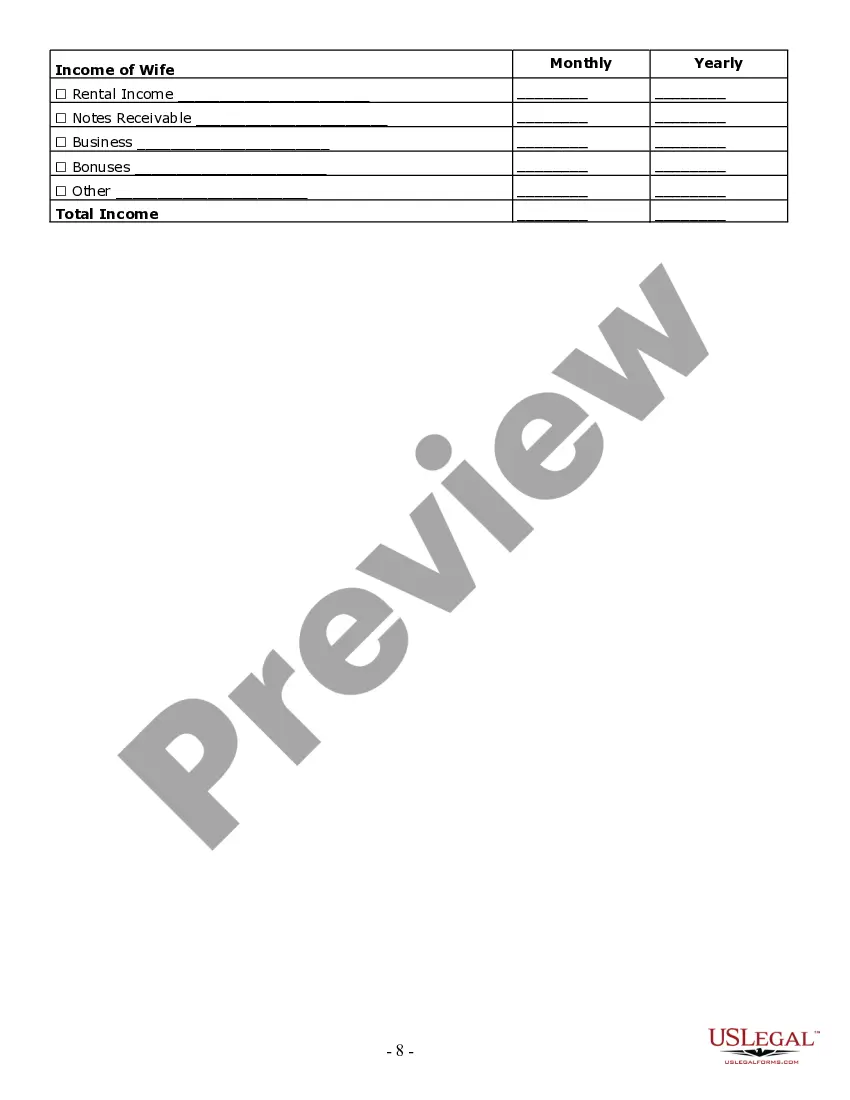

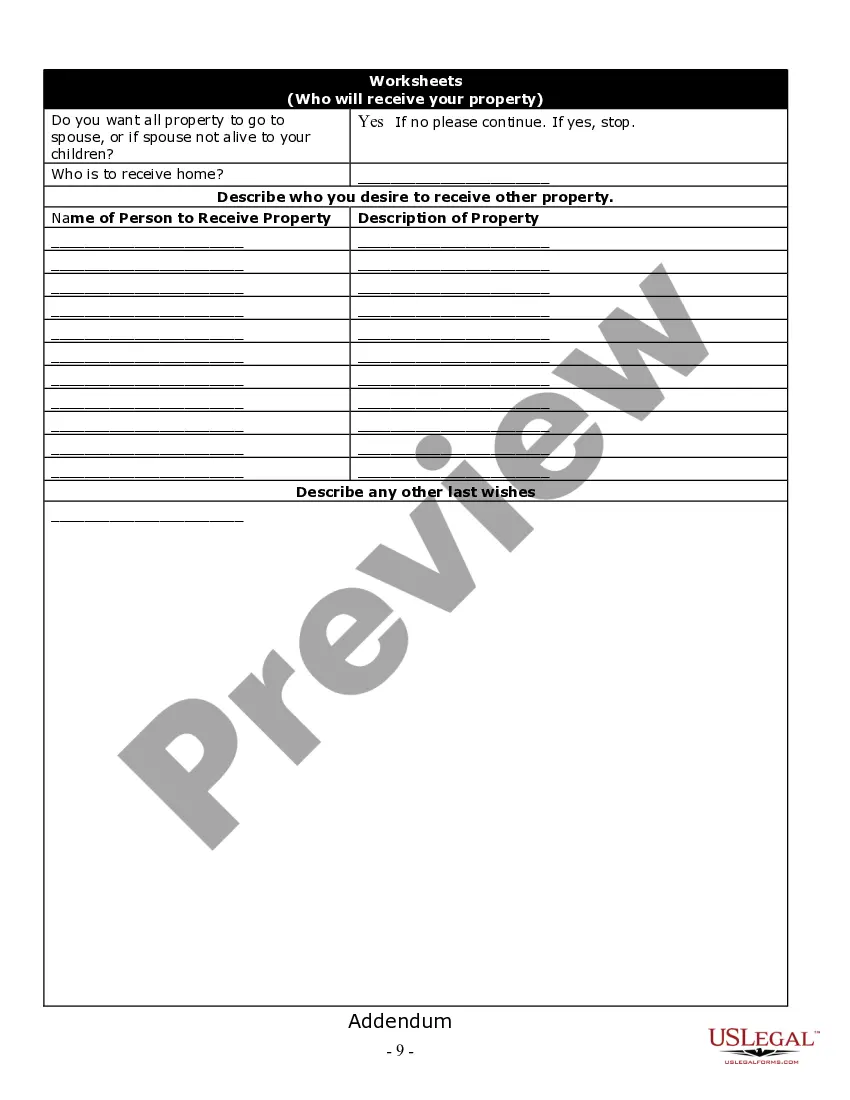

How to fill out California Estate Planning Questionnaire And Worksheets?

Legal documentation management can be daunting, even for the most adept professionals.

When you require a Ca Form Wills Withholding and lack the time to search for the accurate and current version, the tasks may become taxing.

US Legal Forms addresses all your requirements, from personal to business documents, all in one place.

Leverage advanced tools to complete and oversee your Ca Form Wills Withholding.

Here are the steps to follow after you download the necessary form: Validate that it is the correct form by previewing and reviewing its details. Ensure the template is acceptable in your state or county. Select Buy Now when you are prepared. Choose a monthly subscription option. Locate the desired format, and Download, complete, sign, print, and submit your documents. Enjoy the US Legal Forms online catalog, backed by 25 years of expertise and trustworthiness. Improve your daily document management in a seamless and user-friendly manner today.

- Access a resource library of articles, guides, and tools pertinent to your circumstances and requirements.

- Save time and energy in locating the forms you need, and utilize US Legal Forms’ advanced search and Review feature to find Ca Form Wills Withholding and obtain it.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to view the documents you have previously downloaded and manage your files as needed.

- If this is your first experience with US Legal Forms, create a free account for unlimited access to all the library's benefits.

- A comprehensive online form directory can be a significant advantage for anyone looking to handle these matters proficiently.

- US Legal Forms is a leader in online legal documents, offering over 85,000 state-specific legal forms available at any time.

- With US Legal Forms, you can access tailored legal and business forms based on your state or county needs.

Form popularity

FAQ

» The standard withholding is 3.3% of the purchase price of the property, in ance with California Revenue and Taxation Code Section 18662. Form 593-C will be provided with your escrow instructions. The seller should carefully fill out the form to see if any exemptions apply.

For the State, the law is written such that all real property being sold requires the payment of tax at the close of escrow in an amount equal to 3.33% of the Sales Price. An Alternative Calculated Amount can also be used.

The withholding is 3 1/3% (. 0333) of the down payment during escrow. Buyers/Transferees are required to withhold on the principal portion of all payments made following the close of the real estate transaction unless an approval letter for the elect-out method is received.

How to Avoid Probate in California Creating a Living Trust. Setting up a Joint Ownership. Payable-on-Death Designations for Bank Accounts. Transfer-on-Death Registration for Securities. Transfer-on-Death Deeds for Real Estate. Transfer-on-Death Registration for Vehicles.