Probate Code 4401 Withdrawal

Description

How to fill out California Uniform Statutory Power Of Attorney - Property - Finances - Section 4401?

Whether for business purposes or for individual matters, everyone has to deal with legal situations at some point in their life. Completing legal documents demands careful attention, beginning from choosing the proper form template. For example, if you select a wrong version of a Probate Code 4401 Withdrawal, it will be rejected once you submit it. It is therefore crucial to have a trustworthy source of legal documents like US Legal Forms.

If you have to obtain a Probate Code 4401 Withdrawal template, follow these simple steps:

- Find the template you need using the search field or catalog navigation.

- Examine the form’s description to make sure it matches your case, state, and region.

- Click on the form’s preview to examine it.

- If it is the wrong document, get back to the search function to locate the Probate Code 4401 Withdrawal sample you need.

- Get the file if it meets your needs.

- If you have a US Legal Forms profile, simply click Log in to gain access to previously saved documents in My Forms.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the profile registration form.

- Pick your transaction method: use a bank card or PayPal account.

- Choose the file format you want and download the Probate Code 4401 Withdrawal.

- When it is saved, you can fill out the form with the help of editing software or print it and finish it manually.

With a large US Legal Forms catalog at hand, you never have to spend time looking for the right template across the internet. Utilize the library’s straightforward navigation to get the right form for any occasion.

Form popularity

FAQ

A petition for final distribution of probate is a legal document that asks the court to distribute the remaining assets of an estate to the beneficiaries or heirs. It is usually filed by the executor or administrator of the estate after all debts, taxes, and other matters have been resolved.

A petition for final distribution of probate is a legal document that asks the court to distribute the remaining assets of an estate to the beneficiaries or heirs. It is usually filed by the executor or administrator of the estate after all debts, taxes, and other matters have been resolved.

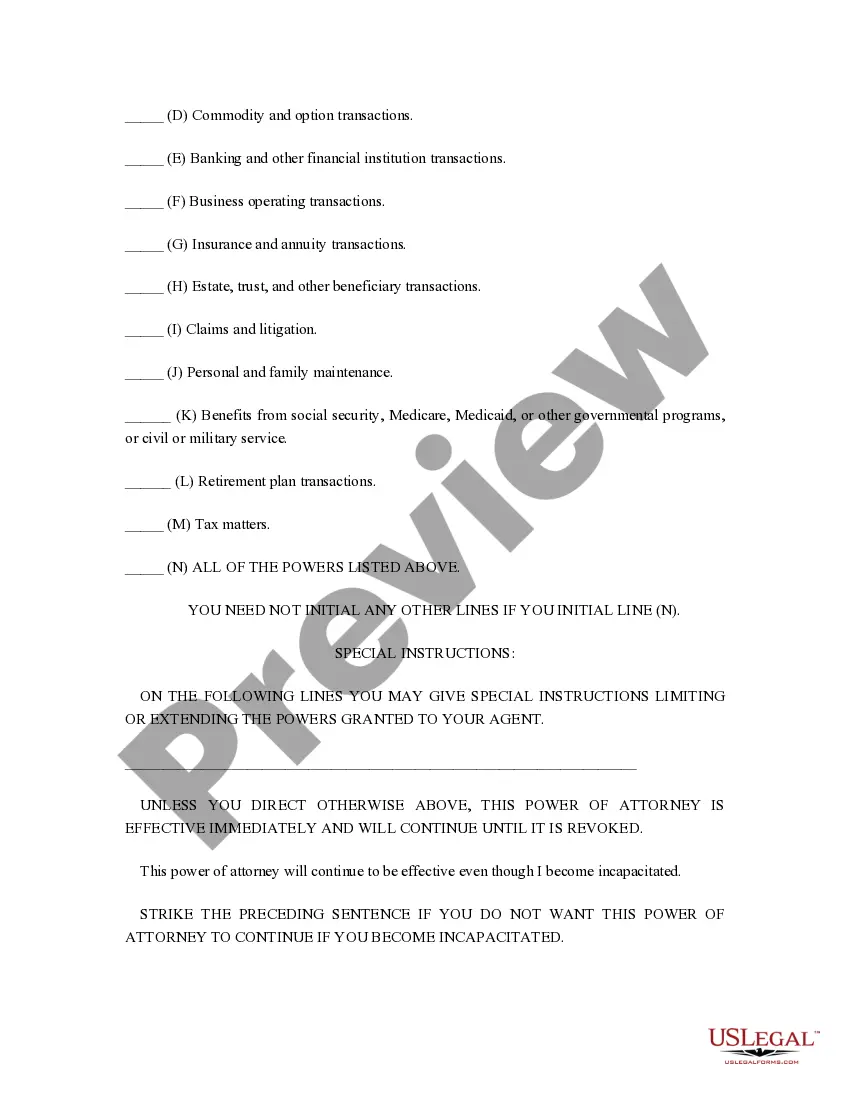

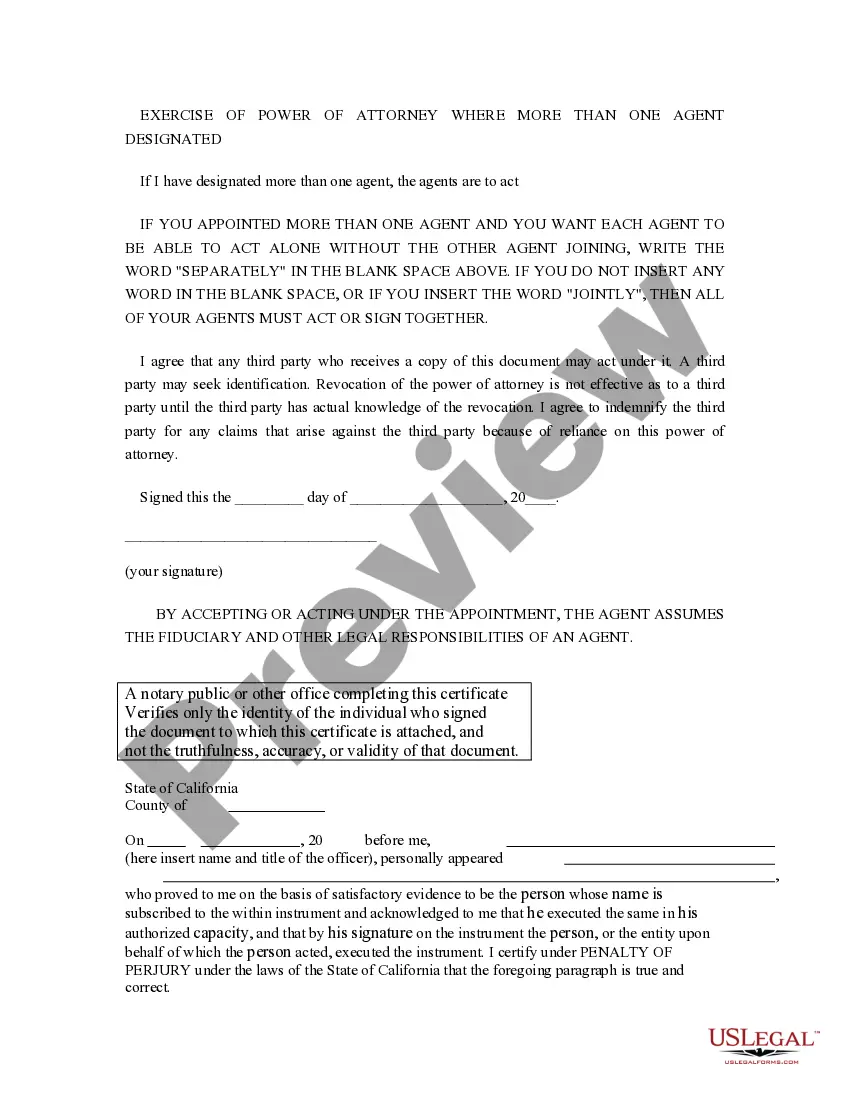

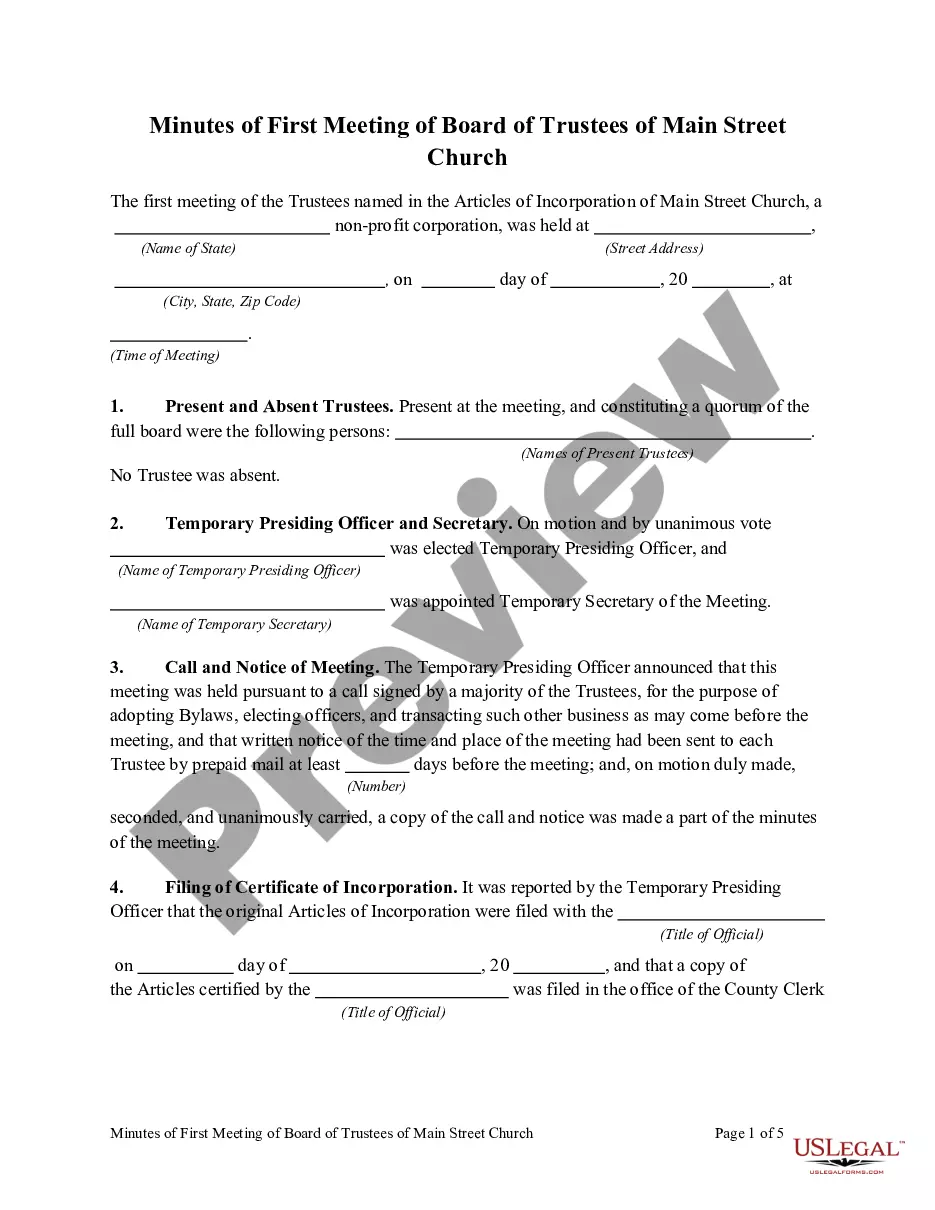

Power of Attorney Uniform Statutory Form ? California Probate Code §4401 ? RPI Form 447. This form is used by an agent or escrow officer when an owner or buyer appoints a person who is to act on their behalf as their attorney-in-fact, to grant specific powers to the person authorized to act as their attorney-in-fact.

A notice of motion and motion to be relieved as counsel under Code of Civil Procedure section 284(2) must be directed to the client and must be made on the Notice of Motion and Motion to Be Relieved as Counsel-Civil (form MC-051).

In other words, heirs receive their inheritance at the end of the probate proceeding. Generally, this is at least 10-18 months after the probate petition is initially filed with the court. Once the judge has issued the order for distribution, estate heirs can expect to receive an inheritance check within a few weeks.