Rate Commercial Real Estate With No Down Payment

Description

How to fill out California Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Whether for corporate purposes or for personal matters, everyone must deal with legal situations at some stage in their life.

Filling out legal documents requires meticulous attention, starting with choosing the correct form template.

With a vast US Legal Forms catalog available, you never need to waste time searching for the right template online. Utilize the library’s user-friendly navigation to find the correct form for any scenario.

- For instance, if you choose an incorrect version of a Rate Commercial Real Estate With No Down Payment, it will be rejected upon submission.

- Thus, it is vital to obtain a reliable source of legal documents such as US Legal Forms.

- If you need to acquire a Rate Commercial Real Estate With No Down Payment template, follow these simple steps.

- Obtain the template you require by utilizing the search bar or catalog navigation.

- Review the form’s details to ensure it corresponds with your circumstances, state, and area.

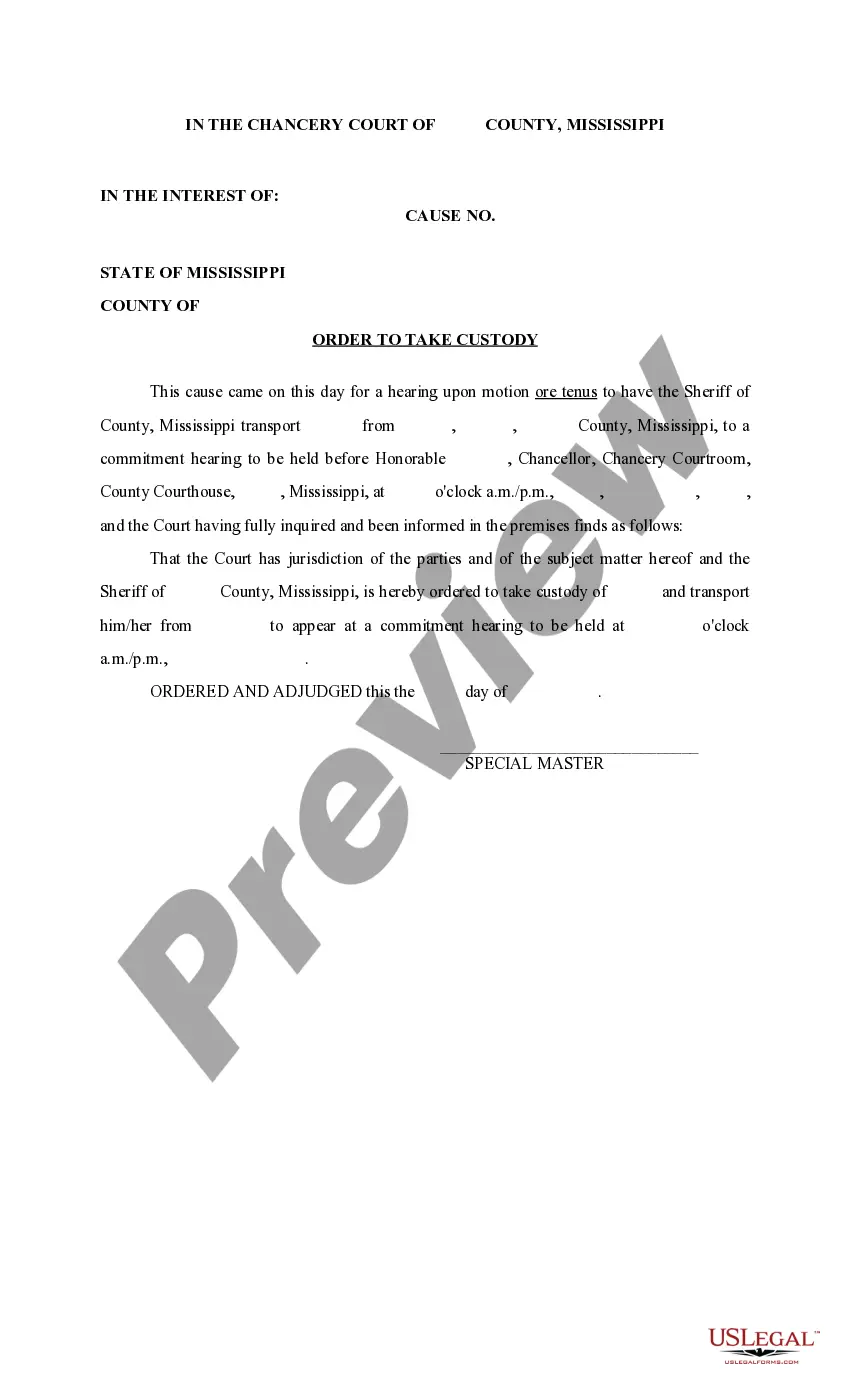

- Click on the form’s preview to view it.

- If it is the wrong document, return to the search feature to find the Rate Commercial Real Estate With No Down Payment template you need.

- Download the file if it satisfies your requirements.

- If you already have a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you may acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your payment option: use a credit card or PayPal account.

- Choose the document format you desire and download the Rate Commercial Real Estate With No Down Payment.

- Once saved, you can complete the form using editing software or print it and finish it manually.

Form popularity

FAQ

If you are thinking about how to invest in real estate with little money, then Real Estate mutual funds are the answer. These are quite similar to conventional mutual funds with a majority of investment in real estate stocks, REITs, as well as direct purchase of residential, commercial, and industrial units.

The down payment for a commercial loan can come from a variety of sources ? cash on hand or savings, funds from your 401K or a home equity line of credit. At least half of the down payment has to come directly from the owners of the business.

Mortgage lenders typically require you to have a debt-to-income ratio (DTI) that's lower than 43%. Taking out a personal loan for a down payment will increase your DTI ratio to the point where you could no longer be eligible with some lenders. Loan options are limited.

The average down payment on a commercial loan is between 10% and 30% of the equity of the property. Typically, the down payment is around 25%. How much of a down payment you need for a commercial property loan will depend on the type of loan you are approved for and the type of building you want to buy.

Here are some examples of no-money-down real estate deals: Borrow the money. ... Assume the existing mortgage. ... Lease with option to buy. ... Seller financing. ... Negotiate the down payment. ... Swap personal property. ... Exchange your skills. ... Take on a partner.