On Duty Meals

Description

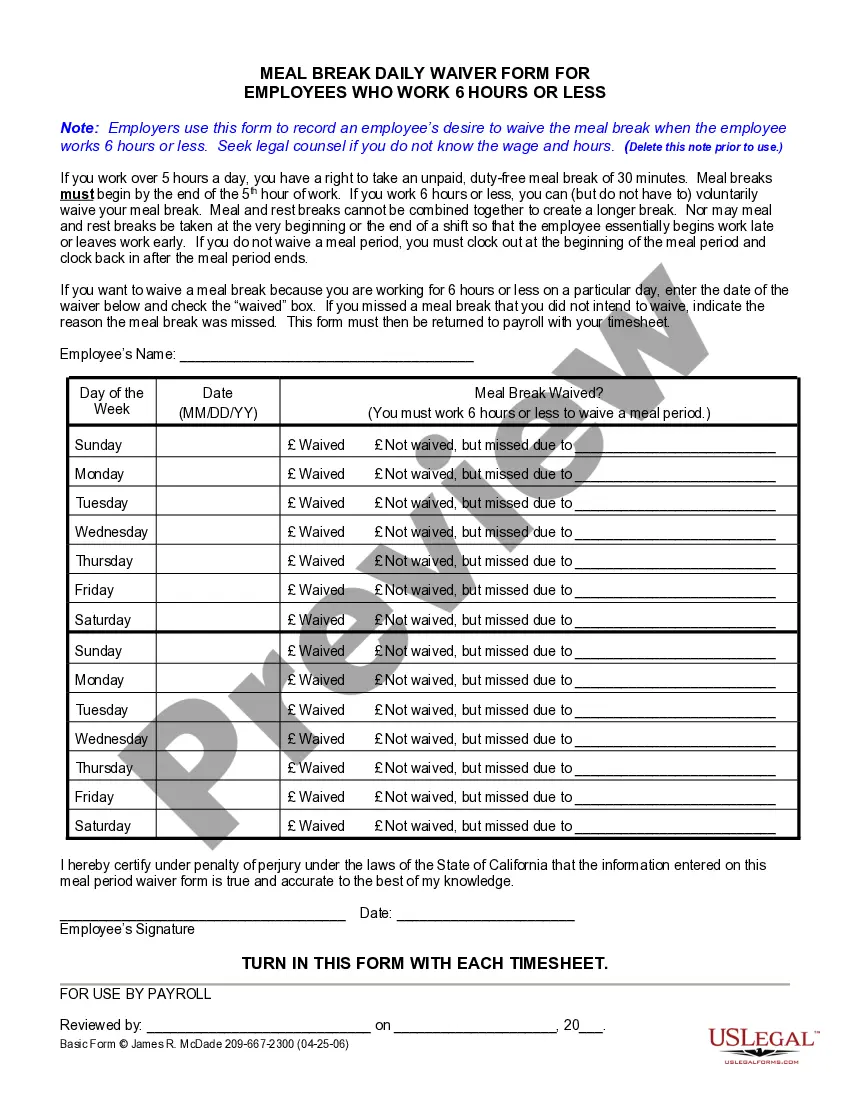

How to fill out California On Duty Meal Period Agreement?

- Visit the US Legal Forms website and select 'Login' if you already have an account, or sign up for a new account if this is your first visit.

- Search for the specific legal form related to on duty meals. Use the Preview mode to review the form's description and ensure it fits your needs.

- If the version you want isn't available, utilize the Search tab to find alternatives that align with your local jurisdiction's requirements.

- Once you've found the correct document, click on the 'Buy Now' button and choose a subscription plan that suits your needs.

- Enter your payment details via credit card or PayPal to finalize your purchase.

- After payment, download your chosen template directly to your device for further completion and easy future access through the 'My Forms' section.

By following these steps, you can easily navigate through US Legal Forms' extensive library, designed to empower users like you to produce legally sound documents without hassle.

Don't let legal documentation overwhelm you. Start using US Legal Forms today to streamline your process and ensure your on duty meals documentation is handled accurately.

Form popularity

FAQ

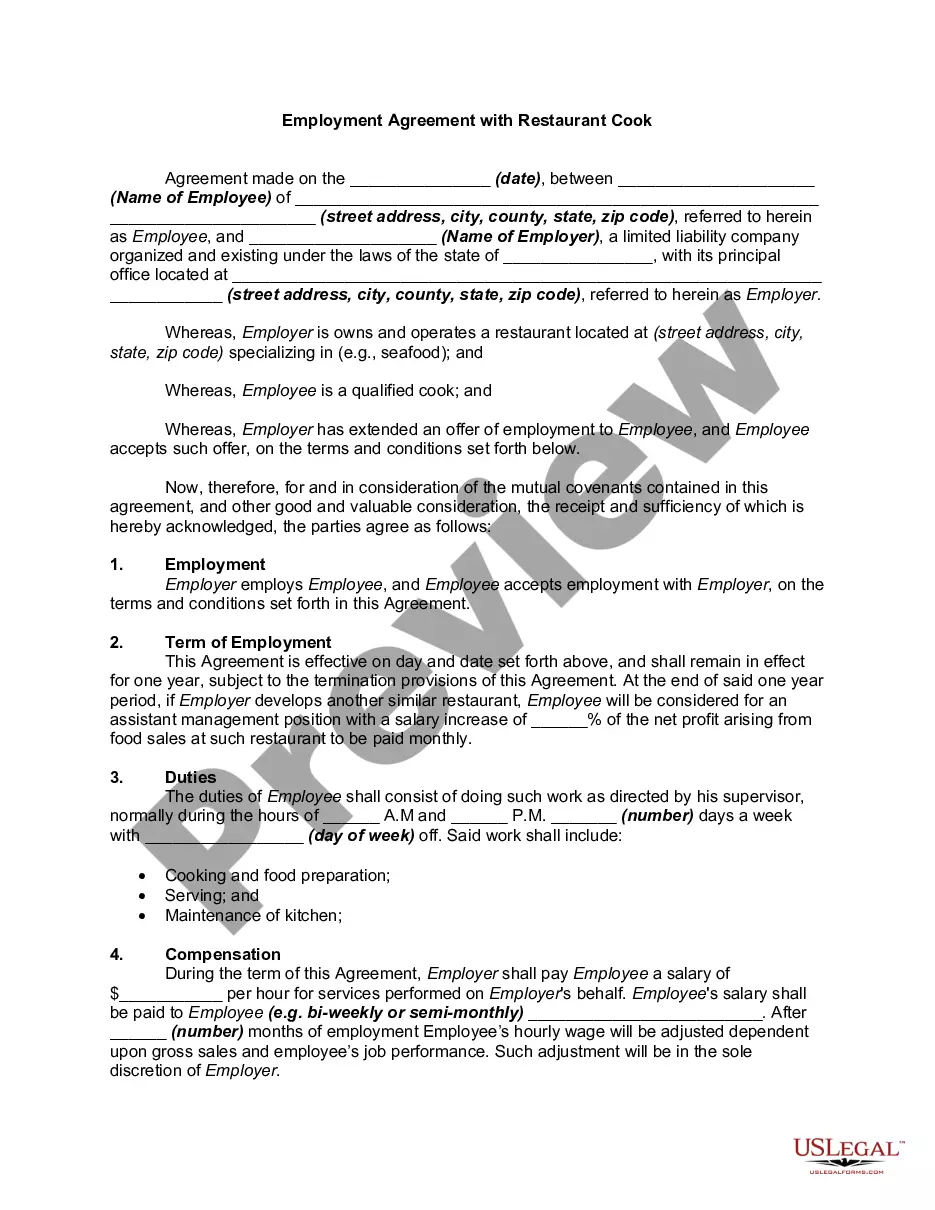

When accounting for staff meals, you should categorize them as on duty meals if they support business operations. Document details, such as the purpose of the meal and attendees, to substantiate your deductions. Following IRS guidelines, you may qualify for deductions on these meals, thus reducing your overall tax liability. Platforms like USLegalForms can streamline this process and ensure compliance with tax regulations.

To qualify for the 80% meal deduction, the meals must be provided for the convenience of the employer or as part of a business meeting. On duty meals that support work-related activities can meet this criterion. It's crucial to maintain good documentation and follow IRS guidelines to claim these deductions properly. Taking advantage of resources like USLegalForms can help you understand these qualifications better.

For on duty meals, the IRS generally requires you to keep receipts, especially if the meals exceed $75. This applies to business meals, ensuring you can verify your deductions if needed. While detailed records are essential, keeping organized receipts can simplify tax filing. Consider using organizational tools from USLegalForms to assist with this.

The dot 80% limit refers to the maximum deduction for meals provided under specific circumstances, typically in business operations. According to IRS rules, businesses can claim an 80% deduction on meals that meet certain qualifications. Understanding these limits can help you maximize your deductions when claiming on duty meals. Always review IRS regulations to ensure compliance.

To calculate per diem for meals, you can use the standard meal allowance provided by the IRS. This amount varies based on location and is updated periodically. You multiply the daily rate by the number of travel days to get the total meal deduction. Utilizing platforms like USLegalForms can help you track and manage your meal expenses effectively.

The IRS allows deductions for 50% of meal expenses that are directly related to business activities. Meals qualify if they are necessary for conducting business, such as entertaining clients or traveling for work. However, if meals fall under the category of providing on duty meals for employees in specific situations, you might be able to deduct 100%. Always consult the latest IRS guidelines to confirm.

On duty meals that are provided for the convenience of your employer are fully deductible. This includes meals served during meetings or conferences where business is the primary focus. Make sure to keep detailed records that demonstrate the business purpose of these meals. This will help ensure your deductions are valid.

To obtain Meals on Wheels, an individual typically needs to contact their local Meals on Wheels program. After an assessment to determine eligibility, the program will schedule meal deliveries based on your needs. This service is vital for providing nutritious meals, ensuring that those who are homebound receive on duty meals to maintain a healthy diet.

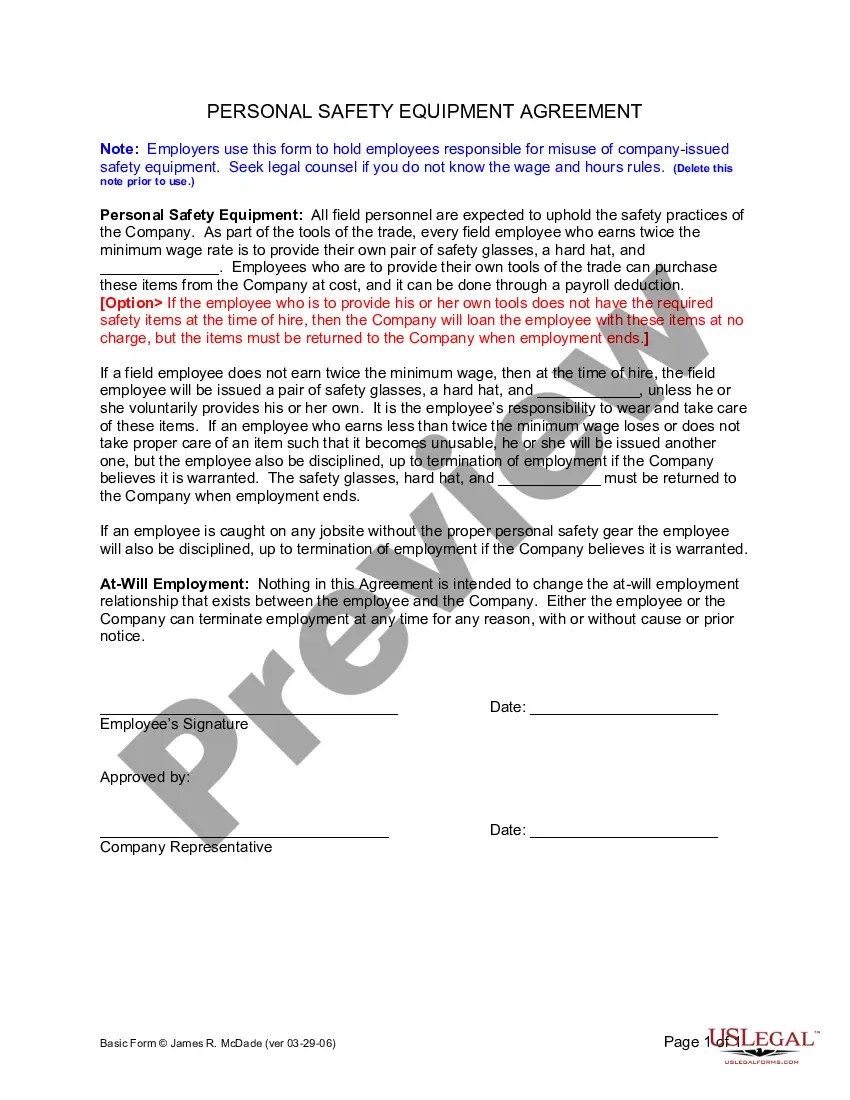

A duty meal refers to meals provided to employees who are required to work during their scheduled meal time. These meals serve to support the well-being of staff, ensuring they can focus on their tasks without worrying about food. On duty meals often come with specific guidelines, tailored to comply with company policies and regulations.

In Florida, there is no state law requiring a 30-minute lunch break for employees. However, many employers offer this benefit to promote worker well-being and productivity. It's crucial for businesses to establish clear meal policies, especially when it comes to on duty meals. If you need guidance on compliance and employee rights, the US Legal Forms platform provides valuable resources and documentation.