Break Employee California Withholding 2023

Description

How to fill out California Meal Break Daily Waiver For 6 Hour Employees?

It's clear that you cannot become a legal expert immediately, nor can you comprehend how to swiftly prepare the Break Employee California Withholding 2023 without a specialized skill set.

Drafting legal documents is a lengthy task that demands particular education and expertise. So why not entrust the creation of the Break Employee California Withholding 2023 to the professionals.

With US Legal Forms, one of the most comprehensive legal document collections, you can find anything from court forms to templates for in-house communication.

You can regain access to your documents from the My documents tab at any time.

If you're a current client, you can simply Log In and locate and download the template from that same tab.

- Locate the form you require using the search bar located at the top of the page.

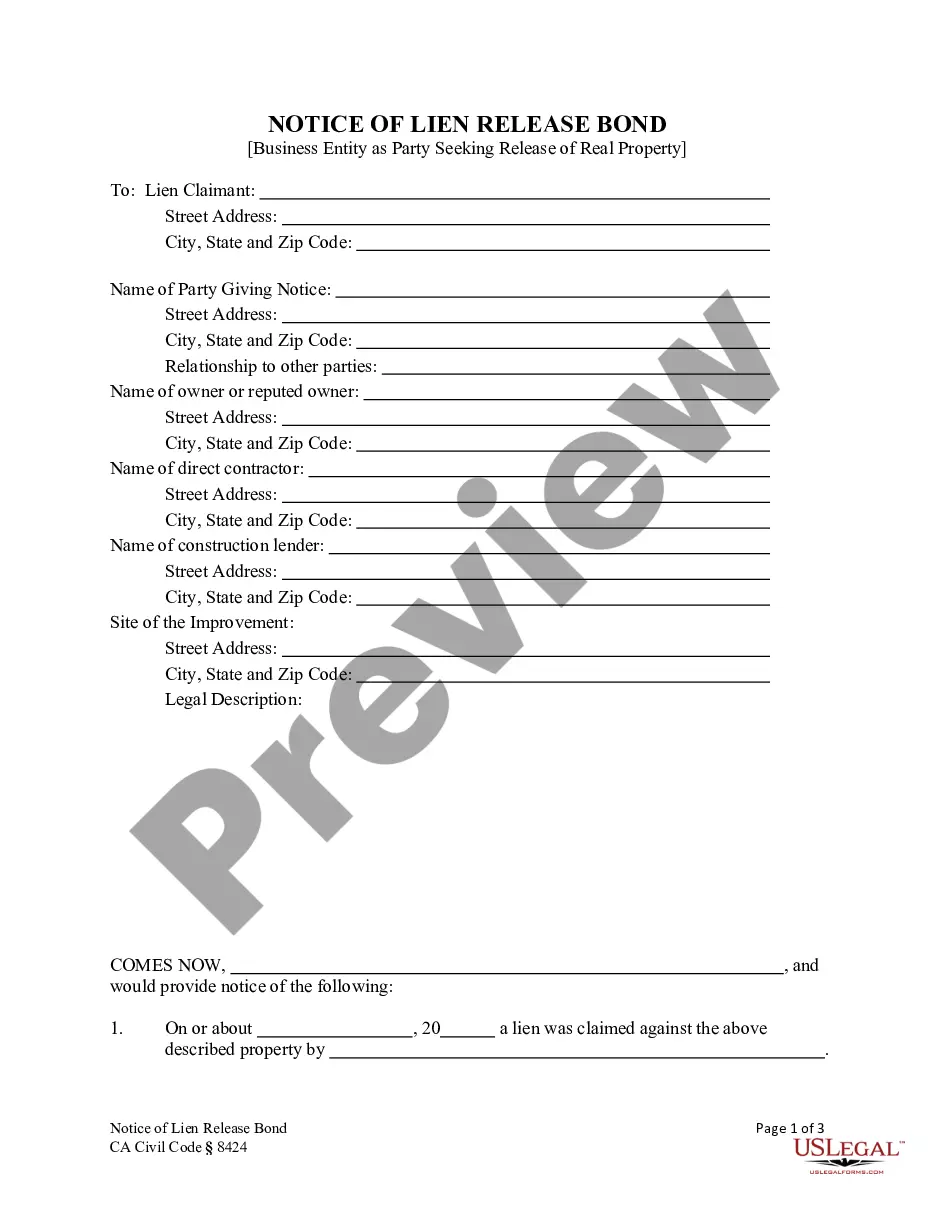

- Preview it (if this option is available) and review the accompanying description to ascertain if Break Employee California Withholding 2023 is what you're looking for.

- If you need a different template, restart your search.

- Create a free account and choose a subscription plan to purchase the form.

- Select Buy now. After completing the transaction, you can obtain the Break Employee California Withholding 2023, complete it, print it, and send or mail it to the intended recipients or organizations.

Form popularity

FAQ

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

You may claim exemption from withholding for 2023 if you meet both of the following conditions: you had no federal income tax liability in 2022 and you expect to have no federal income tax liability in 2023.

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax.

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).