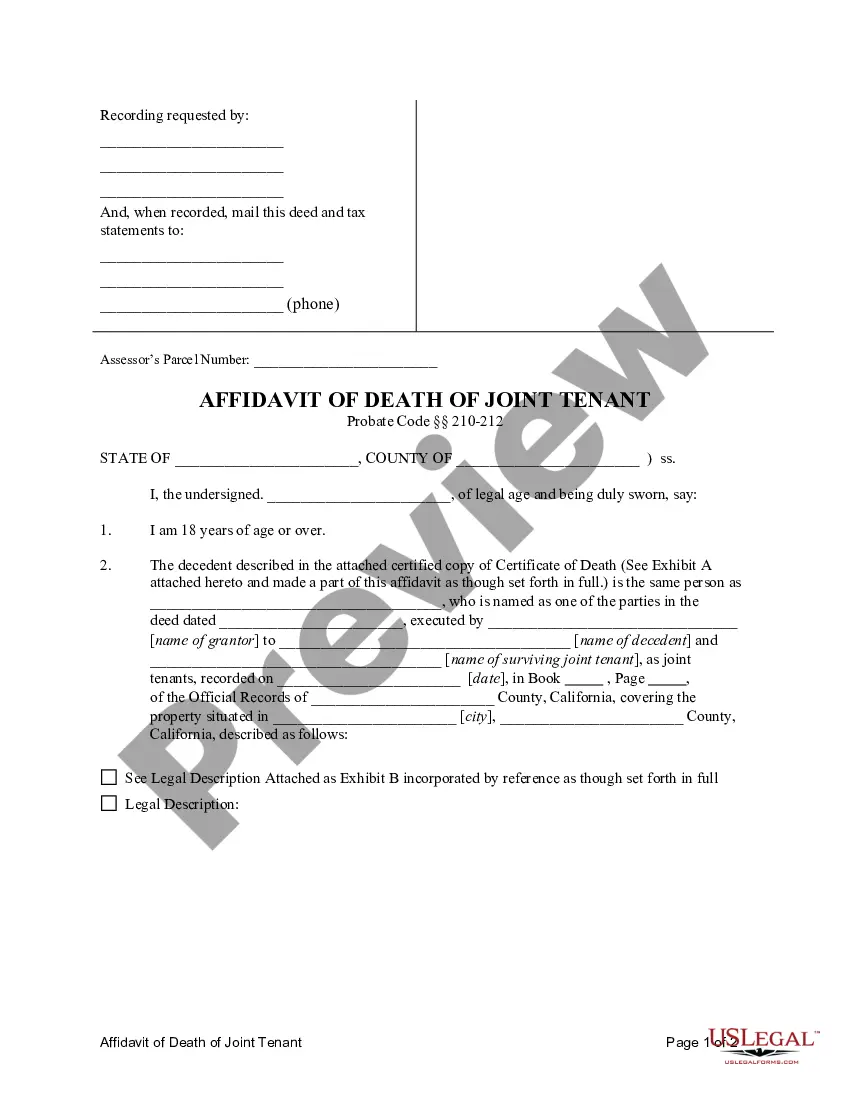

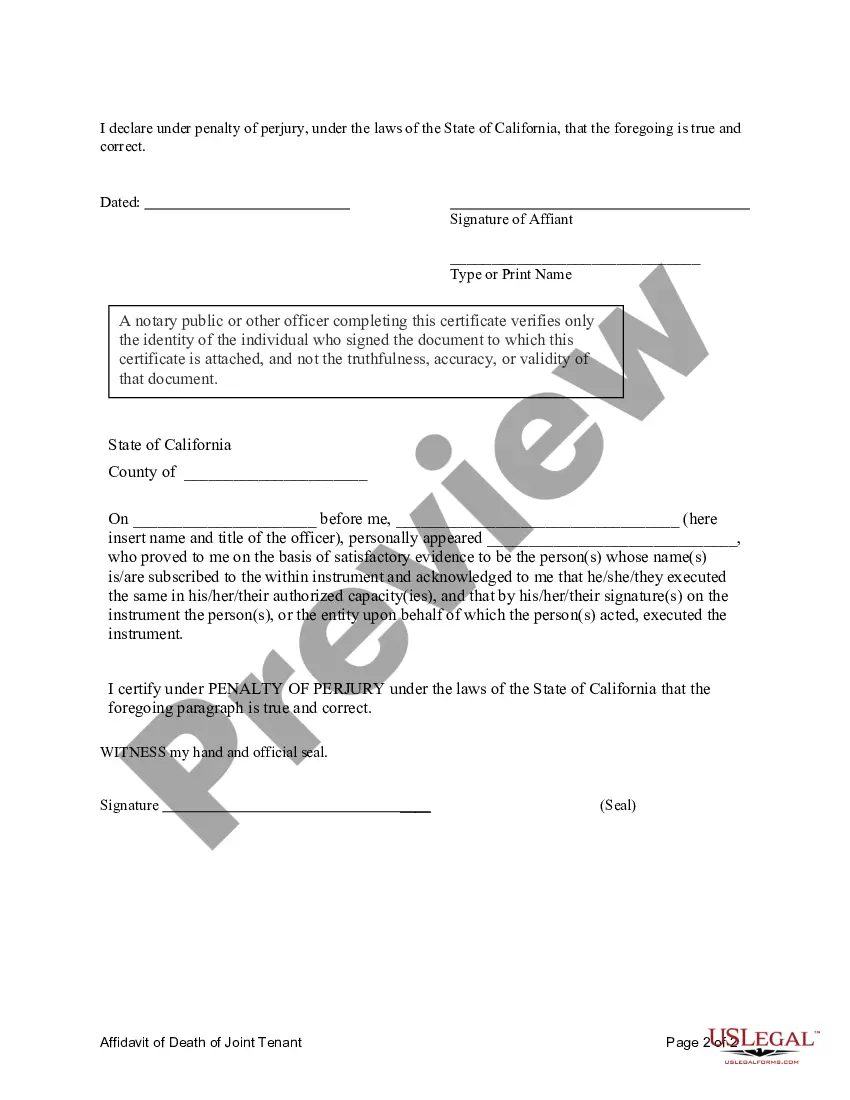

Affidavit Of Death Of Joint Tenant California Withholding

Description

How to fill out California Affidavit Of Death Of Joint Tenant?

Managing legal documents can be daunting, even for the most experienced individuals.

If you need an Affidavit Of Death Of Joint Tenant California Withholding but lack the time to search for the right and updated version, the process can become overwhelming.

Gain access to a valuable resource library of articles, guides, and materials pertinent to your case and requirements.

Save time and energy searching for the forms needed, and take advantage of US Legal Forms’ sophisticated search and Preview feature to locate your Affidavit Of Death Of Joint Tenant California Withholding efficiently.

Make sure the template is accepted in your state or county before proceeding. Choose Buy Now when ready, select a subscription plan, find the format you need, and then Download, complete, eSign, print, and send your document.

- If you hold a membership, Log In to your US Legal Forms account, find the form, and acquire it.

- Check your My documents tab to review the documents you've previously saved and manage your folders.

- If you’re new to US Legal Forms, create a free account and enjoy unlimited access to all of the platform’s advantages.

- Here are the steps to take after locating the necessary form.

- Ensure it is the correct form by reviewing it and examining its details.

- Discover state- or county-specific legal and business forms.

- US Legal Forms caters to any needs you may have, ranging from personal to business documents, all in one place.

- Utilize advanced tools to complete and manage your Affidavit Of Death Of Joint Tenant California Withholding.

Form popularity

FAQ

The sole proprietorship business can be started easily by just one person. There is minimum compliance that is required to be adhered to get it incorporated. This form of business is economical as it is relatively less expensive to start than a company or LLP.

Sole proprietors file personal income tax returns using Form 1040 and report their business income on Schedule C. Individuals must determine their taxable income by subtracting expenses from total income.

Because in India a sole proprietor does not have to pay taxes as a different entity. Therefore, just like any other individual? they also have to file for an Income Tax Return. Learn more about File ITR For Proprietorship Firm. On further reading, you will Realise why ITR isn't simply important because it is mandatory.

The choice of the appropriate ITR form primarily depends on your sources of income. If you are a salaried individual, you can file returns using ITR Form 1. However, if you have both salaried income and capital gains from investments, you should use ITR Form 2.

Sole proprietor is required to have a tax audit carried out if the sales, turnover or gross receipts of business exceed Rs. 1 crore in the financial year. However, he may be required to get their accounts audited in certain other circumstances.

ITR-3 form is used to file income tax for proprietorships run by a Hindu Undivided Family (HUF) or any other proprietor.

In the case of a sole proprietorship, you declare your profit and loss on Schedule C of Form 1040. But, to file Schedule C, you'll have to qualify first. The conditions to qualify are: Your goal is to engage in business activity for income and profit.

More In Forms and Instructions Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor.