Signing A Lease With A Guarantor

Description

How to fill out California Guaranty Attachment To Lease For Guarantor Or Cosigner?

Finding a dependable location to obtain the latest and pertinent legal templates is a significant part of navigating bureaucracy.

Identifying the suitable legal documents requires precision and careful consideration, which is why it's crucial to take samples of Signing A Lease With A Guarantor exclusively from trustworthy sources, such as US Legal Forms.

Eliminate the stress associated with your legal documents. Browse the extensive US Legal Forms library to discover legal templates, assess their applicability to your situation, and download them immediately.

- Utilize the library navigation or search function to find your template.

- Review the form’s details to ensure it meets the requirements of your state and county.

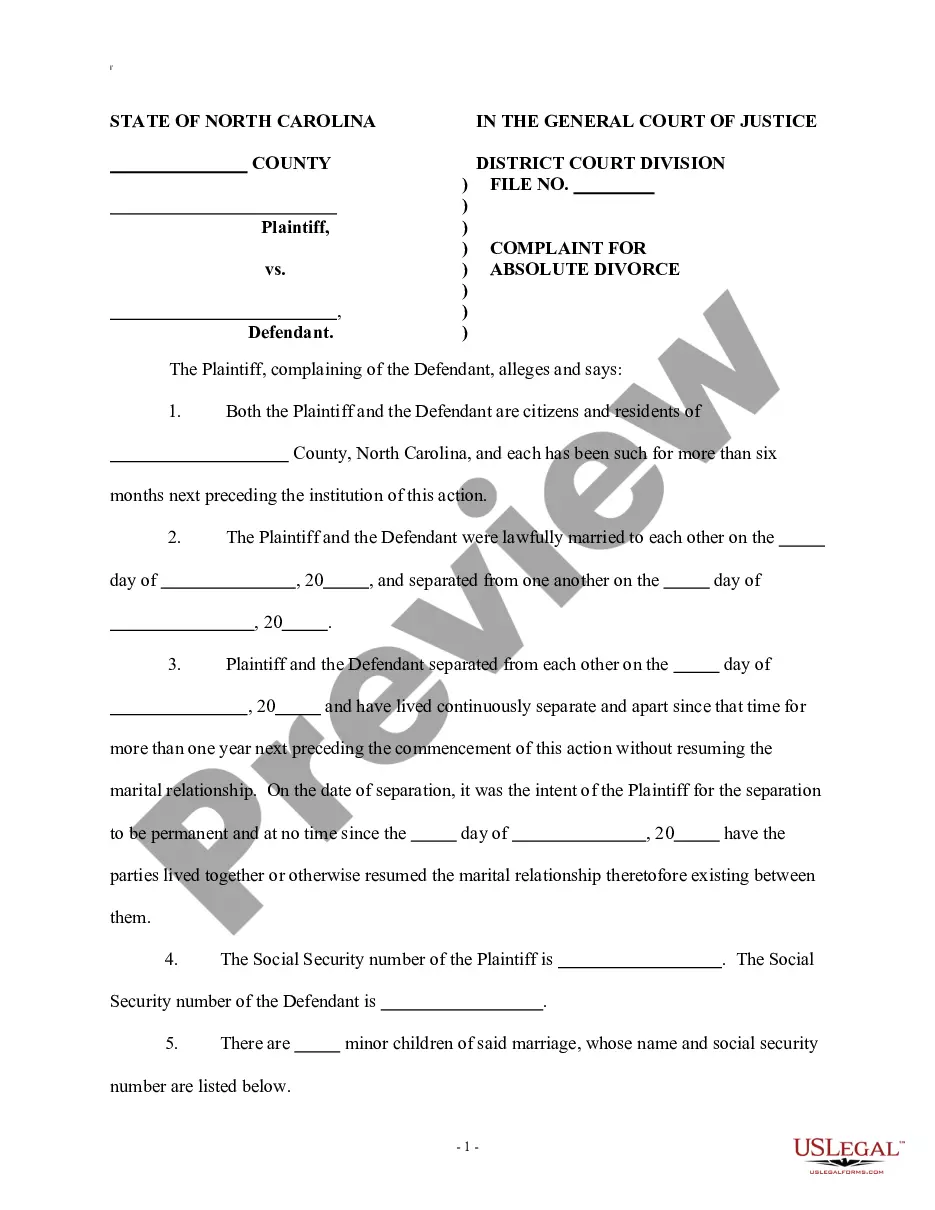

- Check the form preview, if available, to confirm that the form meets your needs.

- If the Signing A Lease With A Guarantor does not fulfill your criteria, return to the search and look for the appropriate template.

- Once you are certain about the form’s relevance, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not possess an account yet, click Buy now to acquire the template.

- Select the pricing plan that meets your preferences.

- Proceed with registration to complete your purchase.

- Finalize your transaction by choosing a payment method (credit card or PayPal).

- Choose the file format for downloading Signing A Lease With A Guarantor.

- After obtaining the form on your device, you can modify it using the editor or print it and complete it manually.

Form popularity

FAQ

When signing a lease with a guarantor, the guarantor agrees to take responsibility for the lease terms if the primary tenant cannot fulfill them. This means, should the tenant miss a payment or violate lease conditions, the guarantor can be held liable. A guarantor typically provides additional security for landlords, making it easier for tenants who might have less established credit histories. Using platforms like US Legal Forms can streamline the process, offering clear agreements that define the roles and responsibilities of all parties involved.

To effectively add a guarantor to a lease agreement, begin by documenting the guarantor's name and address in the agreement. It's essential to specify what the guarantor guarantees, like rent payments or damages. Both the tenant and the guarantor should read over the agreement carefully, ensuring they understand the terms before signing. This careful approach strengthens the lease, especially when signing a lease with a guarantor.

Adding a guarantor to a tenancy agreement involves including their details directly within the document. You'll want to clearly state their responsibilities and obligations for the lease, ensuring everything is transparent. Often, landlords will require a background check or financial verification from the guarantor. This step helps protect both parties while signing a lease with a guarantor.

To add a guarantor when signing a lease with a guarantor, you will typically need to include their information on the lease document. Make sure to provide their full name, contact information, and relevant financial details. It is also helpful to have the guarantor review the entire lease to understand the obligations they are taking on. Lastly, both you and the guarantor should sign the lease, solidifying their commitment.

Filling out a guarantor form requires accurate information to ensure the lease process runs smoothly. Start by providing your details as the tenant, followed by your guarantor's information, such as their name, address, and financial background. It's essential to understand the obligations involved in signing a lease with a guarantor, so discuss this with your guarantor beforehand. If you need assistance, uslegalforms offers customizable forms that can guide you through the process.

To put a guarantor on a lease, first, discuss the arrangement with your landlord. Ensure both you and your guarantor understand the responsibilities involved in signing a lease with a guarantor. Next, gather the necessary information, such as the guarantor's financial details and identification. Finally, fill out the lease agreement and include the guarantor's information in the specified section.

To successfully find a guarantor on a lease, start by discussing your situation with potential candidates in your network. If you encounter challenges, consider leveraging professional services specifically tailored to match tenants with suitable guarantors. Always remember to clarify the responsibilities and implications of their role before finalizing any agreement.

Yes, signing a lease with a guarantor generally makes the renting process smoother. A guarantor can reassure landlords about your ability to meet rent payments, thus increasing your chances of approval. Moreover, having a guarantor often opens up opportunities to qualify for better rental agreements that you might not secure alone.

You can obtain a guarantor for renting by engaging with friends, family, or colleagues who have the financial means and are willing to help. Another option is to use online services that specialize in connecting renters with qualified guarantors. Make sure to communicate your rental needs clearly to encourage someone to take on this role.

Typically, a guarantor should have a credit score of at least 650 to effectively assist in signing a lease with a guarantor. Landlords look for a solid credit history to ensure the guarantor can fulfill their financial obligations. However, requirements may vary by landlord, so always check with them for their specific criteria.