Guarantor On Lease Requirements

Description

How to fill out California Guaranty Attachment To Lease For Guarantor Or Cosigner?

Creating legal documents from the beginning can frequently be intimidating.

Certain situations may require extensive research and significant expenses.

If you're looking for a simpler and more budget-friendly method of preparing Guarantor On Lease Requirements or any other documents without unnecessary complications, US Legal Forms is readily available.

Our online collection of over 85,000 current legal documents covers nearly every area of your financial, legal, and personal matters.

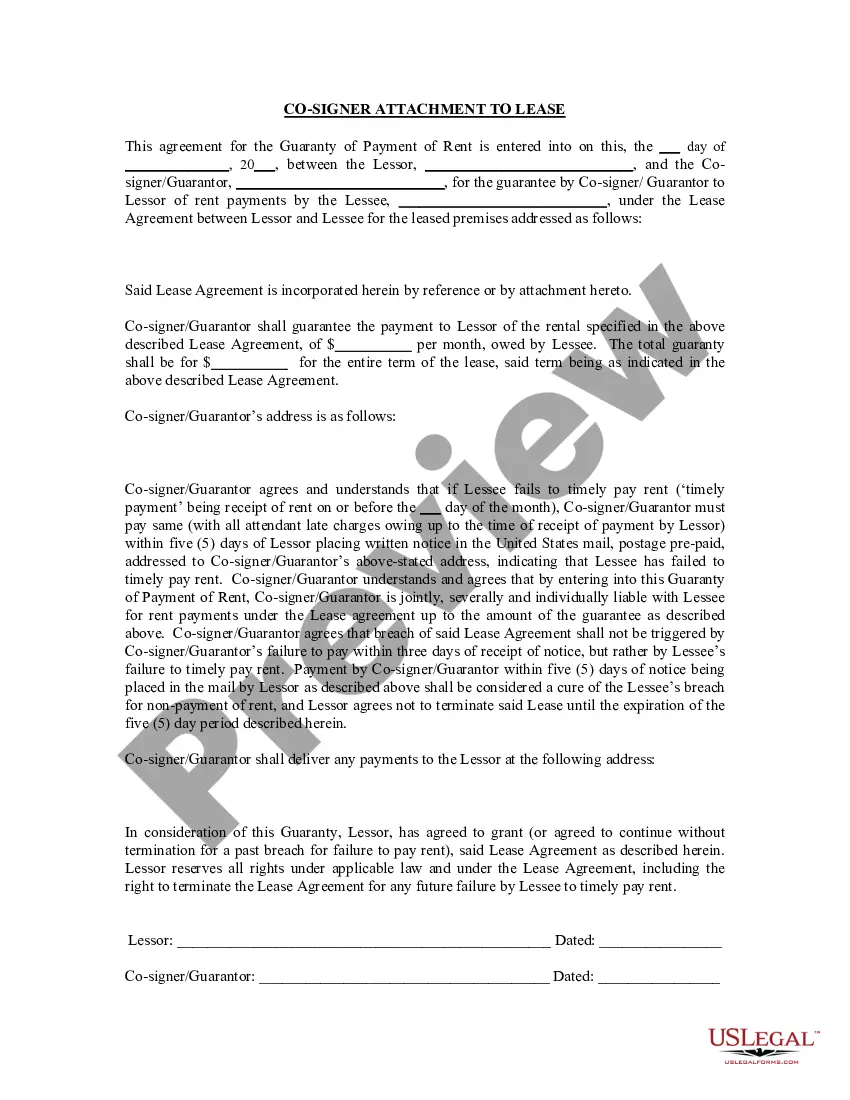

However, before proceeding to download the Guarantor On Lease Requirements, adhere to these tips: Review the document preview and descriptions to confirm you have the correct form. Ensure that the template you select aligns with the laws and regulations of your state and county. Choose the most suitable subscription plan to obtain the Guarantor On Lease Requirements. Download the form, then complete, verify, and print it out. US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and simplify the process of document execution!

- With just a few clicks, you can swiftly find state- and county-compliant templates meticulously assembled by our legal experts.

- Utilize our platform whenever you need dependable services through which you can easily identify and download the Guarantor On Lease Requirements.

- If you're not new to our site and have already created an account, simply Log In to your account, find the template, and download it or re-download it whenever you wish in the My documents section.

- Not registered yet? No worries. It only takes a few minutes to set up and explore the library.

Form popularity

FAQ

A guarantor on a lease provides a safety net for landlords by agreeing to be responsible for the rent if the tenant cannot fulfill their financial commitments. This arrangement allows tenants, especially young renters or those with limited credit history, to secure housing they might otherwise be denied. By understanding the guarantor on lease requirements, potential guarantors can better prepare themselves to support tenants, ensuring both parties can enjoy a smoother renting experience.

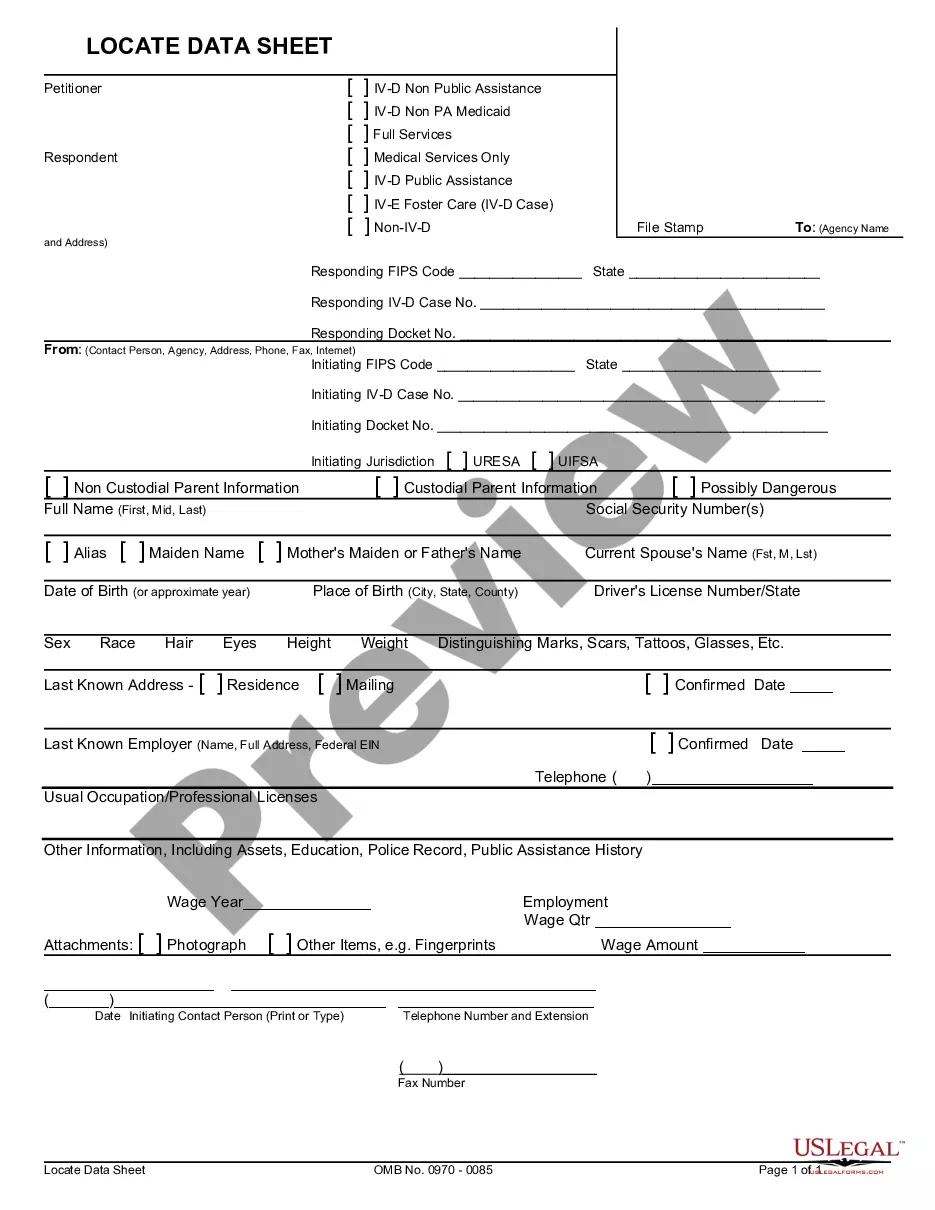

To meet the guarantor on lease requirements, a guarantor typically needs to provide proof of income, maintain a good credit history, and demonstrate financial stability. Landlords usually look for individuals who have a solid employment record and sufficient income to cover the rent. Additionally, some landlords may request personal information, such as social security numbers and references, to further assess the guarantor's ability to fulfill their obligations.

For a guarantor, essential information includes their full name, contact information, income details, and employment status. This information helps landlords verify the financial situation of the guarantor. Make sure to provide accurate data to meet the guarantor on lease requirements effectively. Using resources from platforms like US Legal Forms can assist you in gathering and presenting this information.

A guarantor typically has to fill out an application form that details their personal and financial information. This information helps landlords evaluate the guarantor's ability to fulfill lease obligations. Additionally, they might need to sign a lease agreement that outlines their responsibilities. Completing these forms is essential to conform to the guarantor on lease requirements.

Typically, you need a few key documents for a guarantor, including identification, proof of income, and references. These documents confirm the guarantor's financial stability and ability to cover the rent if necessary. Landlords might also require credit reports as part of the guarantor on lease requirements. Collecting this paperwork in advance will smooth the process.

To fill out a guarantor form, you should gather your financial information and details about your relationship with the tenant. Complete each section of the form clearly, ensuring you provide accurate and truthful information. Double-check for any required signatures or dates before submitting. Following these guidelines helps in fulfilling the guarantor on lease requirements efficiently.

Yes, a guarantor typically needs to fill out an application. This process helps landlords verify if the guarantor meets the necessary financial criteria. The information collected usually includes income details and credit history. Completing this application is an essential step in meeting the guarantor on lease requirements.

Getting a guarantor on a lease often involves demonstrating your financial stability to potential guarantors. Clearly outline your income and financial situation when discussing the guarantor on lease requirements. If personal connections are not an option, numerous platforms, like uslegalforms, offer helpful resources for finding a professional guarantor. This approach can streamline the process and provide peace of mind for both you and your landlord.

To get a guarantor for a lease, start by reaching out to friends or family who may be willing to help. Discuss your situation openly, and explain the guarantor on lease requirements. You can also consider professional guarantor services, which can connect you with individuals willing to serve as guarantors. Ensure that you have all your financial documents and rental history ready to present.

To find a guarantor for renting, start by discussing your need with family members or trusted friends who may qualify. Ensure they understand the responsibilities involved in being a guarantor. You may also want to use platforms like US Legal Forms, which can simplify the process and help both you and your guarantor navigate the legal requirements effectively.