Compromise And Release Form With Open Medical

Description

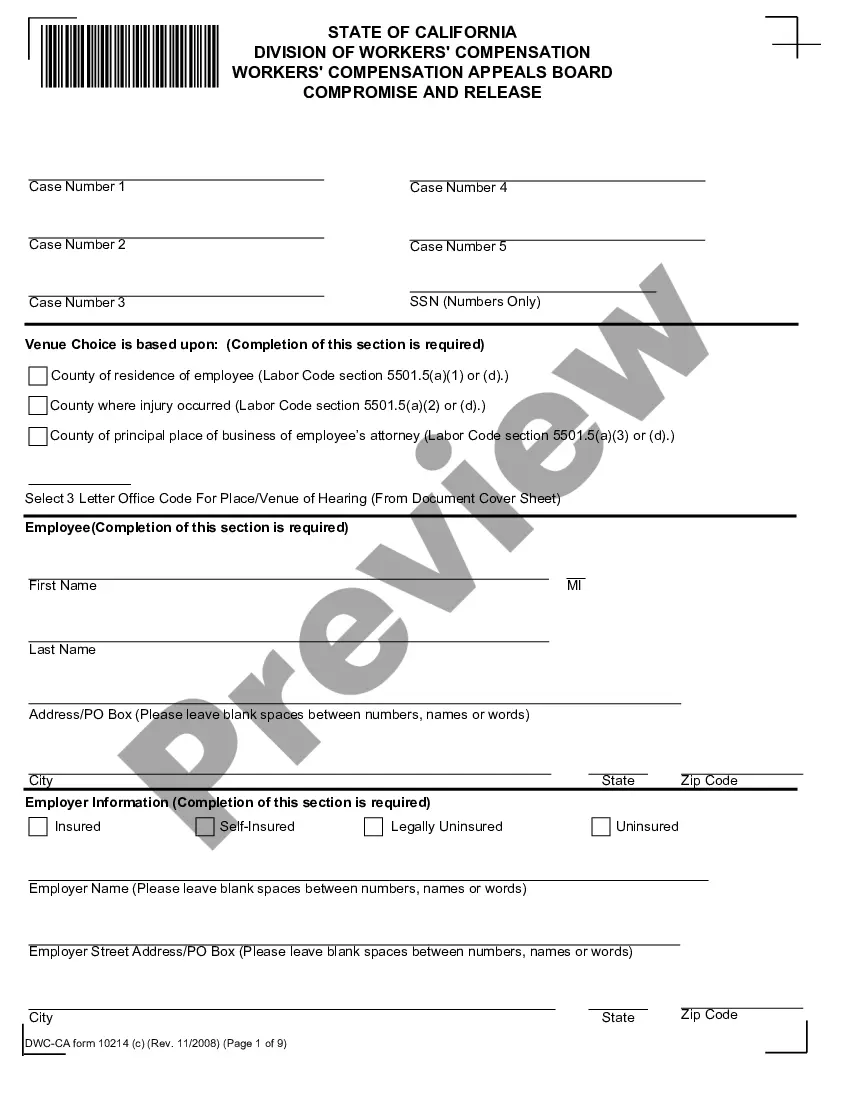

How to fill out California Third Party Compromise And Release For Workers' Compensation?

Administrative procedures require exactness and correctness.

Unless you handle completing documents like the Compromise And Release Form With Open Medical on a daily basis, it may lead to some misunderstandings.

Selecting the appropriate sample from the outset will ensure that your document submission proceeds smoothly and avert any hassles of re-submitting a file or starting the same task from scratch.

Obtaining the correct and updated templates for your documents is just a matter of minutes with an account at US Legal Forms. Eliminate the concerns of bureaucracy and simplify your paperwork tasks.

- Obtain the template through the search bar.

- Confirm that the Compromise And Release Form With Open Medical you've found is applicable to your state or county.

- Open the preview or review the description that includes the specifics on the application of the sample.

- If the outcome aligns with your search, click the Buy Now button.

- Choose the suitable option from the available pricing plans.

- Access your account or register a new one.

- Complete the transaction using a credit card or PayPal payment method.

- Download the form in your preferred format.

Form popularity

FAQ

1.4 Is the compromise and release settlement taxable? Workers' compensation benefits are not taxable. This includes payments an injured worker receives in a Compromise and Release workers' compensation settlement.

Once you sign a compromise and release, your employer is released from all future liability. If the injury leads to a death in this case, your loved ones will not be able to collect benefits as a result of this release as well. Legally binding once a judge approves it.

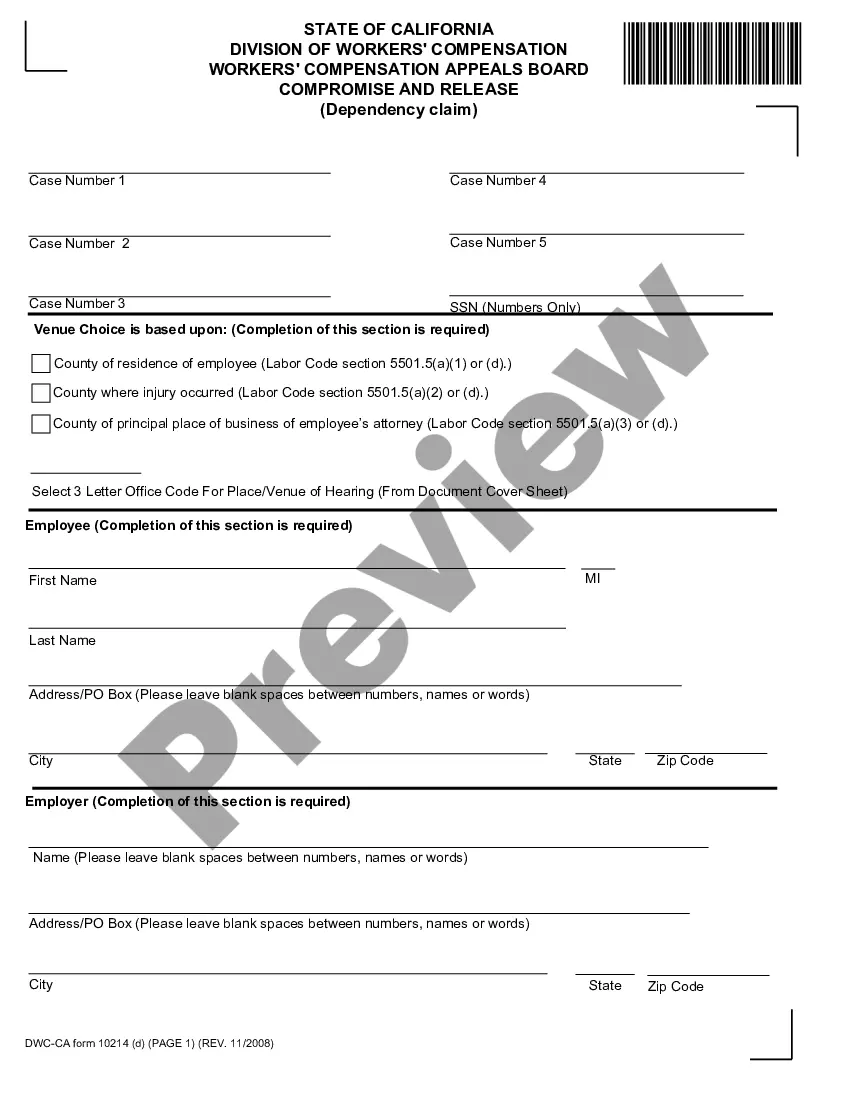

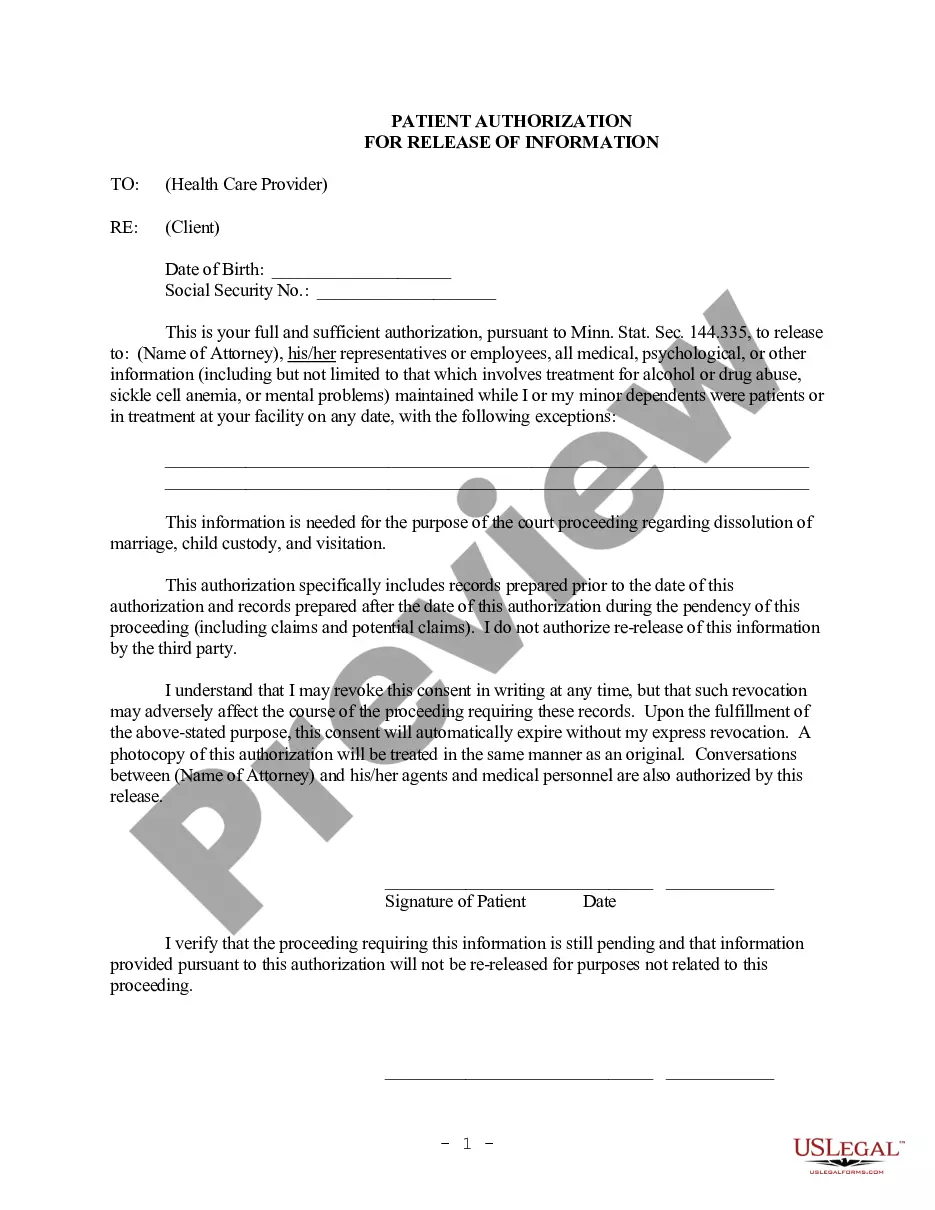

In addition, if the applicant (employee) has been injured by a third party, both the workers' compensation claim and the third party claim may be settled by means of what is called a "Third Party Compromise and Release." The filing of a Compromise and Release may be deemed the filing of an application.

A Compromise and Release Agreement is a settlement which usually permanently closes all aspects of a workers' compensation claim except for vocational rehabilitation benefits, including any provision for future medical care. The Compromise and Release is paid in one lump sum to you.

In California, the parties have a right to negotiate a Compromise and Release to resolve their claim. These settlements are often effective for both parties. In fact, most workers' compensation claims are now settled through C&Rs. It is important to note that these agreements must be approved by a judge.