Life Estate Deed California With Remainder

Description

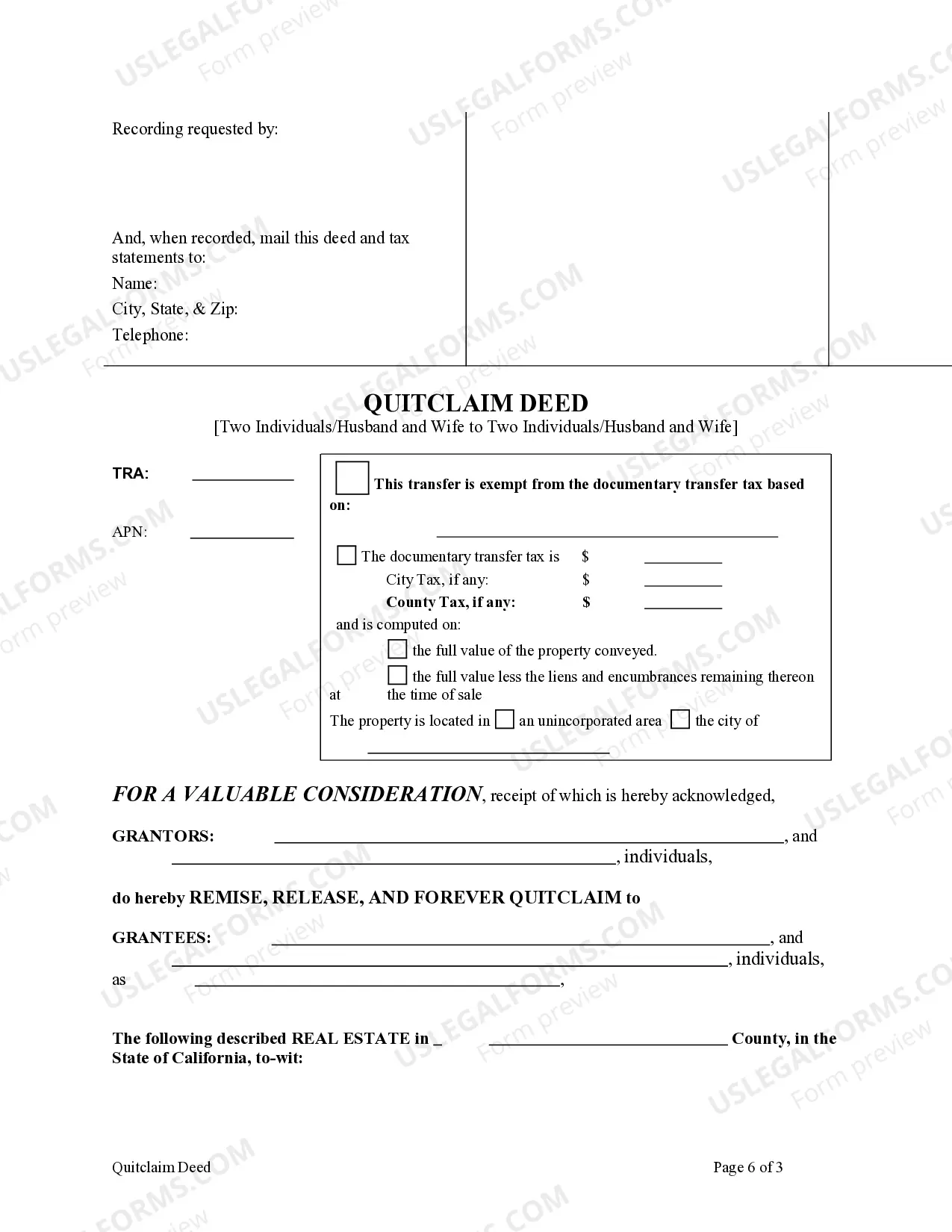

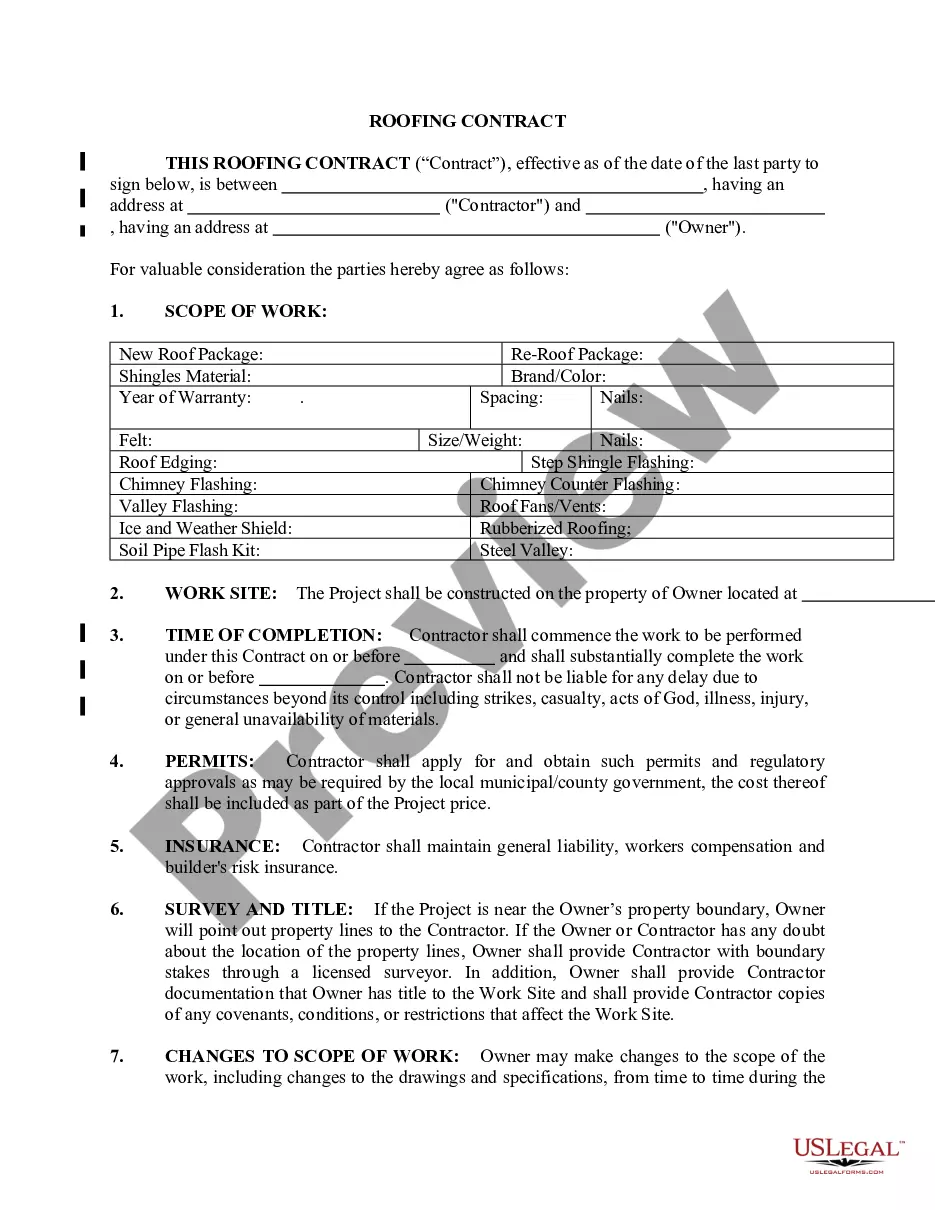

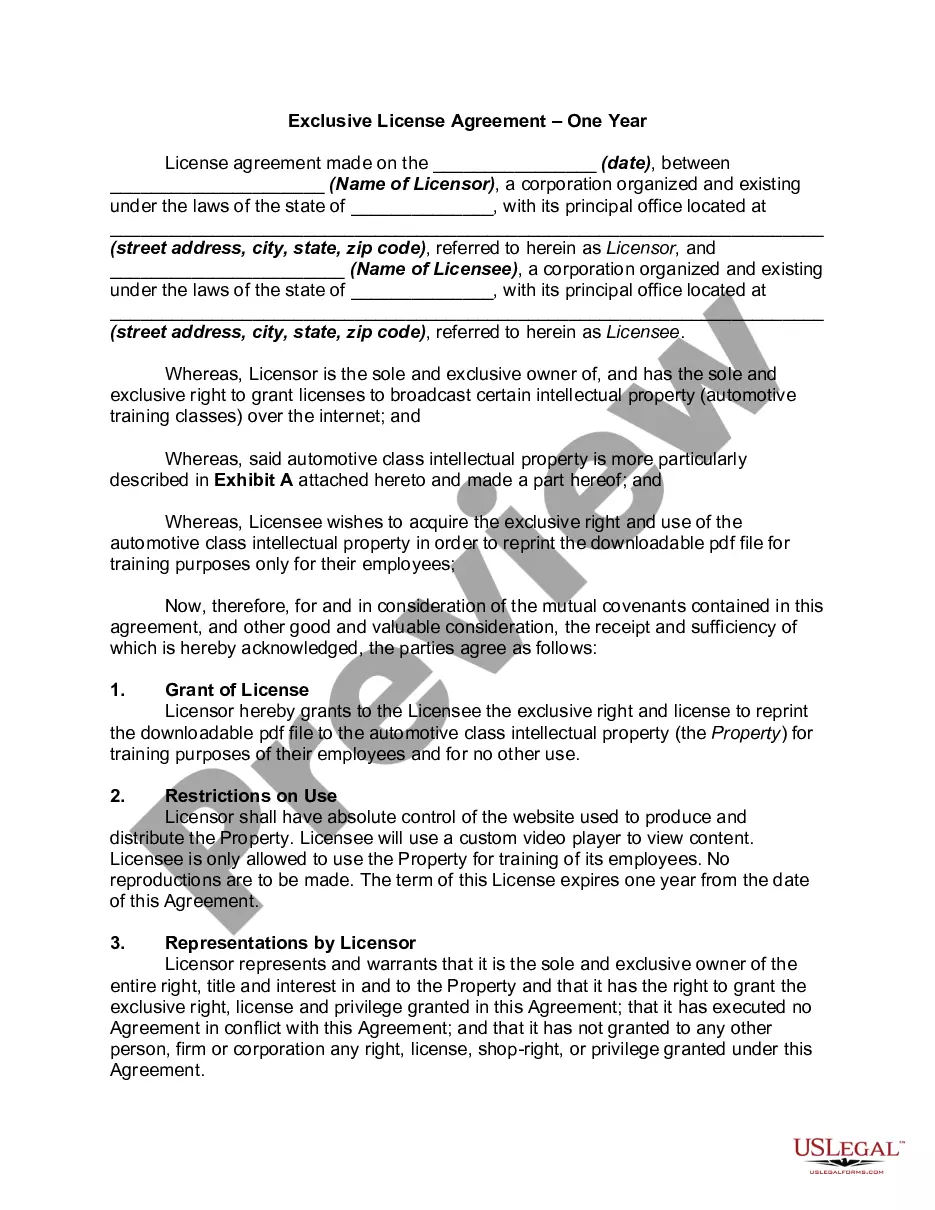

How to fill out California Enhanced Life Estate Or Lady Bird Quitclaim Deed From Two Individuals, Or Husband And Wife, To Two Individuals, Or Husband And Wife?

There’s no longer a necessity to squander time searching for legal documents to satisfy your local state mandates.

US Legal Forms has compiled all of them in a single location and enhanced their accessibility.

Our platform offers over 85k templates for various business and personal legal situations organized by state and usage area.

Utilize the Search field above to find another template if the current one isn’t suitable.

- All forms are expertly crafted and verified for legitimacy, so you can trust in receiving an up-to-date Life Estate Deed California With Remainder.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also access all obtained documents whenever necessary by visiting the My documents tab in your profile.

- If this is your first interaction with our service, the procedure will involve a few additional steps to finalize.

- Here’s how new users can acquire the Life Estate Deed California With Remainder from our repository.

- Carefully review the page content to confirm it includes the sample you require.

- To assist, make use of the form description and preview options if available.

Form popularity

FAQ

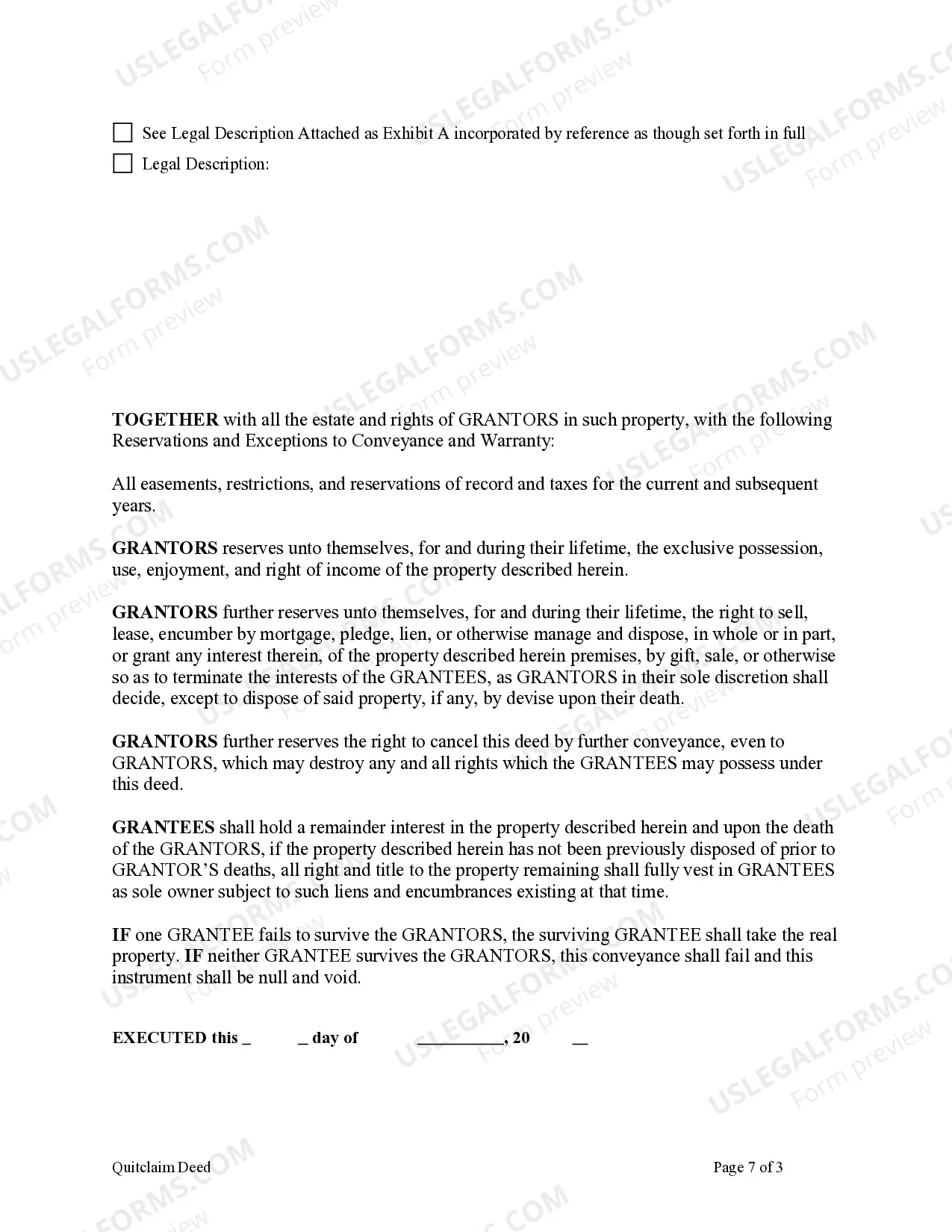

'In remainder' means that a person is entitled to receive ownership of a property at a future date, usually upon the termination of a life estate. In the context of a life estate deed in California with remainder, this term denotes that the individual holds a future interest in the property that will come into effect following the life tenant's passing. This arrangement is crucial for ensuring a smooth transition of property ownership in estate planning.

The remainder of an estate refers to the portion of a person's assets designated to pass to others when certain conditions, such as a life estate ending, are fulfilled. This is often specified in estate planning documents, ensuring that the designated remainder beneficiaries receive their intended share. Understanding the remainder of an estate can aid in better planning for future needs and family dynamics.

The remainder of the property is the portion that is set to pass to another person or party once a life estate ends. In a life estate deed in California with remainder, the remainder interest is the right to own the property after the life tenant's death. This concept is essential for estate planning, as it helps clarify future ownership and can avoid disputes among heirs.

Transferring a deed after death in California usually involves filing the appropriate documents with the county recorder's office. If the property was held in a life estate deed with remainder, the transfer occurs automatically upon the death of the life tenant. It is advisable to engage professionals to ensure the correct execution of the transfer process, which can be streamlined through platforms like USLegalForms.

Yes, California allows the creation of life estate deeds. These deeds grant a person the right to use and occupy the property during their lifetime, after which ownership automatically transfers to the specified remainder beneficiary. Utilizing a life estate deed in California with remainder can be an effective estate planning tool to avoid probate and ensure a smooth transfer of property.

To remove someone from a life estate in California, you typically need a mutual agreement among the parties involved and potentially a legal instrument like a deed of revocation. If both parties consent, you can modify or terminate the life estate using the correct forms. Consulting a legal professional or using a service like USLegalForms can simplify this process and provide necessary documentation.

A property remainder refers to the future interest in a property that will pass to someone after a life estate ends. In the context of a life estate deed in California with remainder, it signifies that a designated person will receive full ownership of the property after the life tenant's rights expire. This arrangement can help ensure that the property remains within a family or is passed on according to the owner's wishes.

Yes, a life estate should be recorded in California to ensure clarity and enforceability. Recording the life estate deed establishes official ownership and protects the interests of both the life tenant and remainderman. It is advisable to work with legal professionals or use platforms like US Legal Forms to navigate the recording process efficiently.

In California, the life tenant owns the property during their lifetime, enjoying rights to use, occupy, and benefit from it. Meanwhile, the remainderman retains an interest in the property that becomes effective upon the death of the life tenant. The arrangement defined in the life estate deed in California with remainder creates a clear understanding of ownership and future rights.

To transfer a property deed from a deceased relative in California, you will first need to determine whether the property is part of the probate process. If the property was held in a trust or had a life estate deed with remainder, the transfer may be more straightforward. Utilizing a platform like US Legal Forms can guide you through the necessary steps and provide the required documents for a smooth transfer.