Enh Life Est

Description

How to fill out California Enhanced Life Estate Or Lady Bird Grant Deed From Two Individuals, Or Husband And Wife, To Two Individuals, Or Husband And Wife?

- If you're a returning user, log in to your account and check your subscription status to ensure it's valid. Click the Download button to retrieve your preferred form.

- For new users, start by exploring the Preview mode and reviewing the form descriptions. This ensures that you select the correct document that aligns with local jurisdiction.

- If necessary, utilize the Search tab to find an alternative template. Confirm that it meets all your specific needs before proceeding.

- Purchase the document by selecting the Buy Now button and picking a suitable subscription plan. You must register an account to access the comprehensive library.

- Complete your payment through credit card or PayPal, then navigate to your profile to download the form. Access it anytime via the My Forms section.

With US Legal Forms, you can be assured of a high-quality experience backed by a robust library and expert assistance to guide you through form completion.

Start your journey toward legal efficiency today by visiting US Legal Forms!

Form popularity

FAQ

Filling out a life insurance claim form involves several important steps. First, obtain the correct form from your insurance provider or download it from their website. Carefully enter the beneficiary information, policy number, and relevant personal details. Include any additional documentation as required by the insurer. For a smooth experience, consider leveraging US Legal Forms, which can assist you with the necessary forms and ensure you meet all requirements efficiently. This way, you can navigate the process confidently.

To fill out a life insurance claim, you must start by contacting your insurer to request the claim form. Gather all required documentation, such as the death certificate and policy details, to streamline the process. Once you have the form, fill it out completely, ensuring that all information is accurate and legible. After completing the form, submit it along with the necessary documents to your insurer for review. Using a platform like US Legal Forms can simplify this process, providing you with the right templates and guidance.

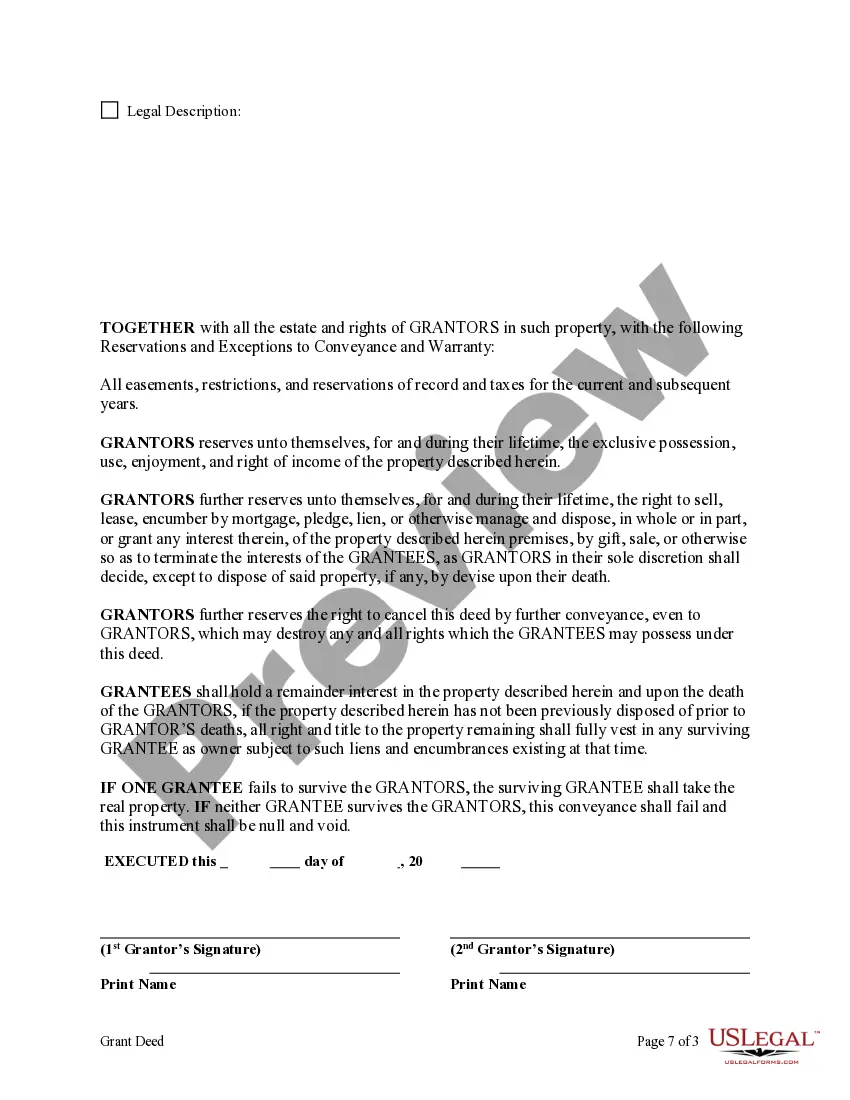

While a life estate can offer benefits, there are potential downsides to consider. One major concern is that the life tenant cannot sell the property without the consent of the remainder beneficiaries. Additionally, any increase in property tax liability or maintenance costs falls on the life tenant. Understanding these implications is vital, and tools like US Legal Forms can provide clarity on how to structure a life estate to best meet your needs.

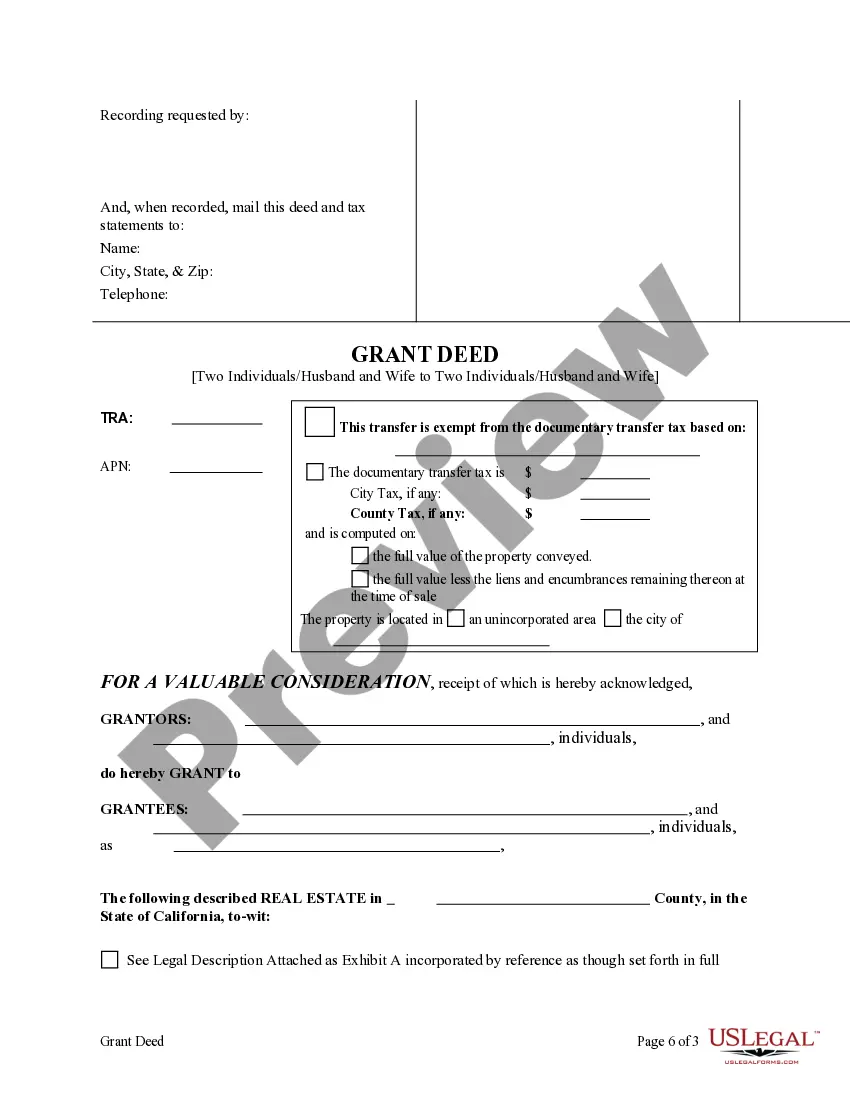

The key difference between a life estate deed and an enhanced life estate deed lies in control and flexibility. A life estate deed restricts the owner’s ability to sell or mortgage the property without the consent of the remainder beneficiaries. In contrast, with an enhanced life estate deed, the owner retains full rights to manage, sell, or mortgage the property during their lifetime. This added flexibility can be crucial, and resources from US Legal Forms make it easier to understand these distinctions.

An enhanced life estate deed allows an individual, such as a parent, to transfer property to their children while retaining the right to live in it until death. For instance, a mother may transfer her home to her daughter using this deed, ensuring that she can continue to reside there without interference. This arrangement can simplify the transfer process and avoid probate complications. To create such a deed, you can find suitable templates on US Legal Forms.

In a life estate arrangement, the life tenant—who holds the life estate—typically pays property taxes. This ensures that the property remains in good standing while the life tenant is alive. Beneficiaries, who will receive the property after the life tenant's death, do not bear this responsibility during the life tenant's lifetime. Understanding these details can be vital, and platforms like US Legal Forms offer resources to clarify property obligations.

The enhanced life estate deed (enh life est) is often considered one of the best solutions for avoiding probate. This type of deed allows the property owner to retain control of the property during their lifetime while transferring the property to beneficiaries upon death. By doing so, it bypasses the lengthy and sometimes complicated probate process. If you're interested in setting up this deed, US Legal Forms provides user-friendly templates and guidance.

Many states in the U.S. recognize enhanced life estate deeds, commonly known as 'Lady Bird Deeds.' States like Florida, Texas, and Michigan have implemented these laws. It's important to verify the specific regulations in your state, as some have unique requirements. Resources such as US Legal Forms can help you navigate these state-specific laws effectively.

A life estate and a trust serve different purposes in estate planning. A life estate provides rights to use property during one's lifetime, while a trust holds assets on behalf of another person or beneficiaries and can control how and when those assets are distributed. Each option has unique benefits and can complement each other in your estate strategy. Consider using the Enh life est and trust combination for effective estate management.

Having a life estate means that you possess the rights to live in, use, and benefit from a property for the duration of your life. However, once you pass away, the property automatically transfers to a designated remainderman or your heirs. This arrangement offers certain tax benefits and simplifies the process of transferring property upon death. Using Enh life est wisely can enhance your estate planning.