California Gift Deed With Consideration

Description

How to fill out California Gift Deed For Individual To Individual?

Using legal templates that meet the federal and state laws is a matter of necessity, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the appropriate California Gift Deed With Consideration sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the biggest online legal library with over 85,000 fillable templates drafted by attorneys for any professional and life case. They are simple to browse with all documents grouped by state and purpose of use. Our experts keep up with legislative changes, so you can always be confident your form is up to date and compliant when getting a California Gift Deed With Consideration from our website.

Getting a California Gift Deed With Consideration is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the right format. If you are new to our website, follow the steps below:

- Take a look at the template utilizing the Preview feature or through the text description to make certain it meets your requirements.

- Look for another sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the suitable form and opt for a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your California Gift Deed With Consideration and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete previously obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

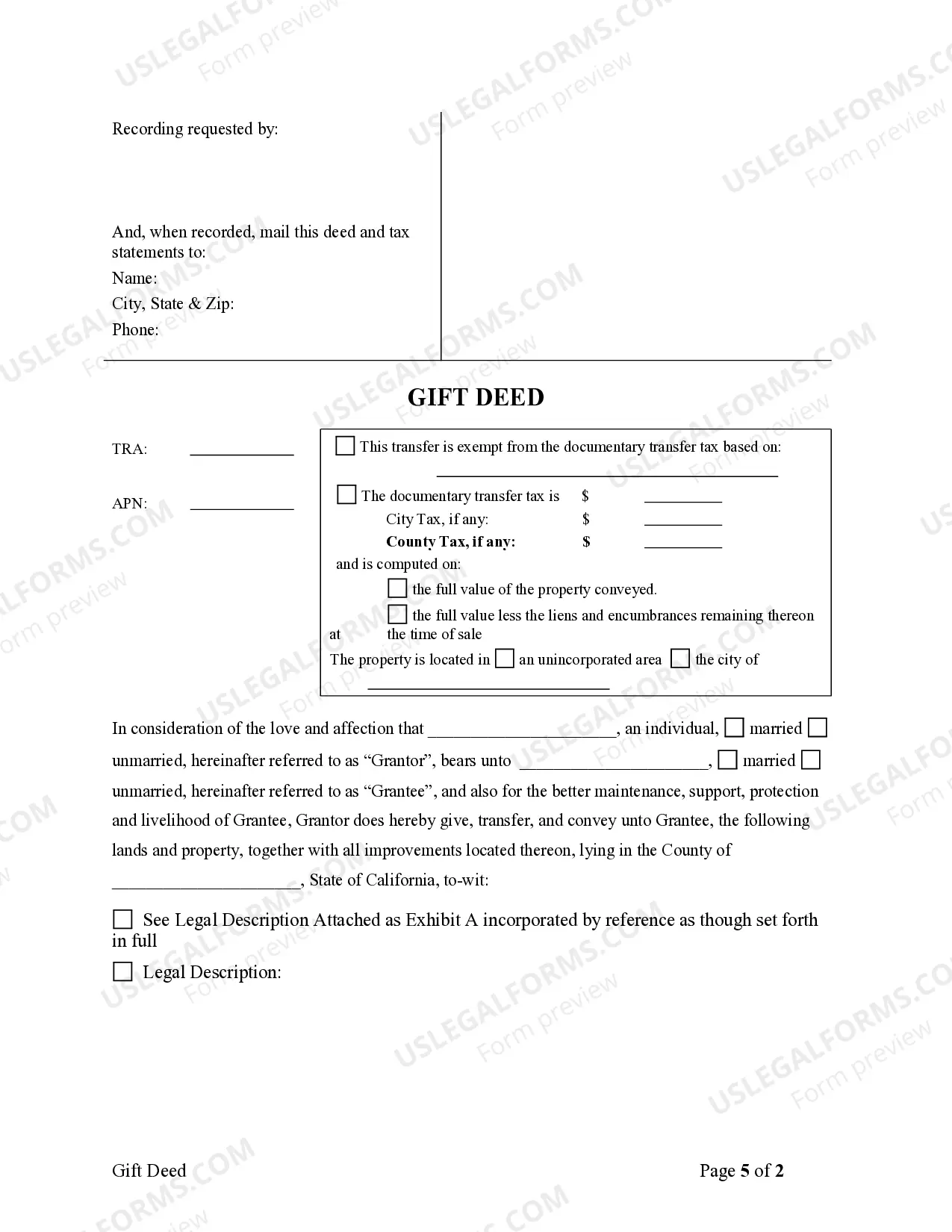

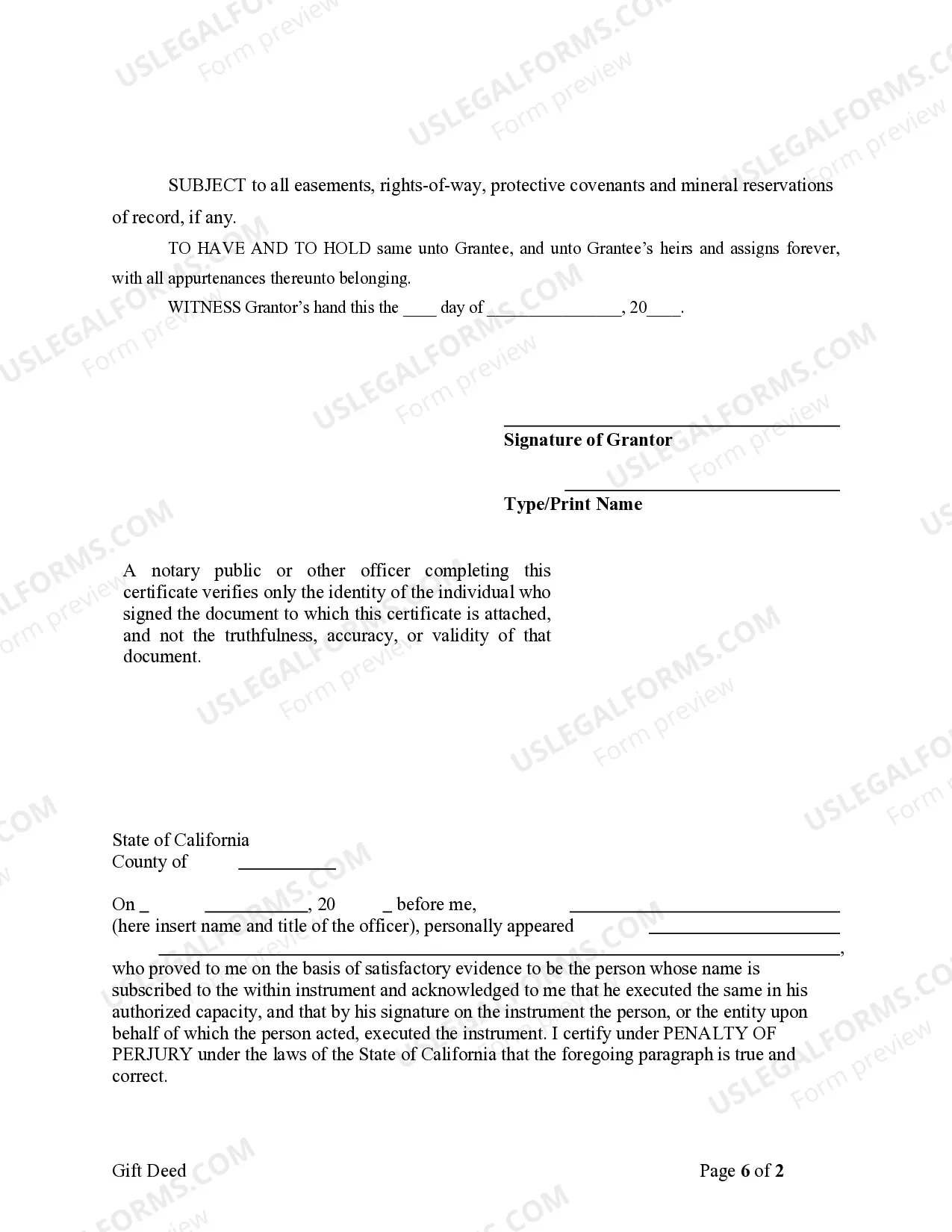

From here, the process looks like this: Choose the most appropriate deed. Prepare the deed. Complete the deed with accurate information about the property and the person being added. Sign the deed in the presence of a notary public. File the deed with the county recorder's office. Update the property records.

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

It is a voluntary transfer of ownership from one individual to another without exchanging money or consideration. The transfer of ownership is immediate and irrevocable, and once the gift deed is executed, the donor cannot revoke or cancel the gift.

Taxes On Title Transfer In California State Documentary Transfer Tax: This is a state-level tax for California that applies to transfers of real property. It is set at $1.10 or $1,000 of the property's sale price and is usually paid by the seller.

How to Correct a Deed Re-recording of the original document. With corrections made in the body of the original document. A cover sheet detailing the changes. Must be re-signed and re-acknowledged. Correction Deed. A new deed reflecting the corrections/changes. Must meet all recording requirements of a deed.