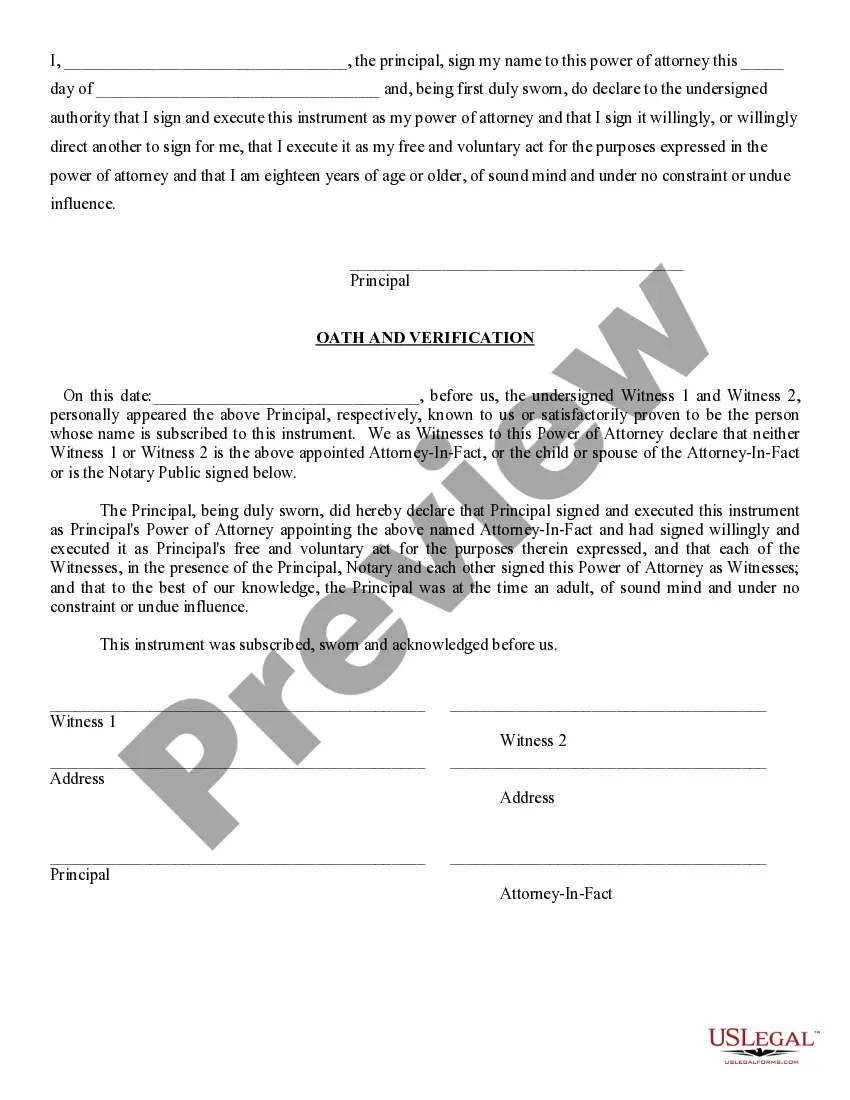

This form is a durable power of attorney. The form provides that the agent of the principal is only authorized to use the principal's funds for the best interest of the principal. If the agent fails to comply with principal's instructions, the agent then may be liable for criminal charges or civil liability.

The Power of Attorney form with the IRS is a legal document that authorizes an individual or organization to act on another person's behalf in tax-related matters. It grants a specific individual or entity the authority to represent the taxpayer before the Internal Revenue Service (IRS). This form is crucial in situations where a taxpayer is unable to handle their tax affairs personally or desires to delegate such responsibilities to someone else. The Power of Attorney form with the IRS allows the designated representative to receive confidential tax information, correspond with the IRS, and make decisions regarding the taxpayer's tax matters. This representative can assist with various tax-related actions such as filing tax returns, negotiating settlements, responding to IRS inquiries, and attending meetings with the IRS on behalf of the taxpayer. There are several types of Power of Attorney forms with the IRS, each serving different purposes: 1. Form 2848: Power of Attorney and Declaration of Representative — This is the most common and widely used form. It authorizes an individual, such as a family member, attorney, or accountant, to represent the taxpayer before the IRS in a broad range of tax matters. 2. Form 8821: Tax Information Authorization — Unlike Form 2848, this form grants limited authority and is primarily used to allow representative access to specific tax information or records. It does not provide the representative with the power to negotiate or make decisions on the taxpayer's behalf. 3. Form 4506-T: Request for Transcript of Tax Return — Although not a traditional Power of Attorney form, it authorizes someone, such as a tax professional, to request the taxpayer's tax return transcripts or other tax-related documents from the IRS. This form is frequently used when applying for loans, mortgages, or resolving tax controversies. It's important to note that completing any Power of Attorney form with the IRS requires careful consideration and understanding of its implications. The designated representative should be trustworthy and well-versed in tax laws and procedures to effectively assist the taxpayer. Having a Power of Attorney form with the IRS is particularly valuable in situations where individuals or businesses face complex tax issues, lack the necessary expertise, or are physically unable to manage their tax affairs. By designating a qualified representative, taxpayers can ensure their tax matters are handled promptly, accurately, and in compliance with IRS regulations.