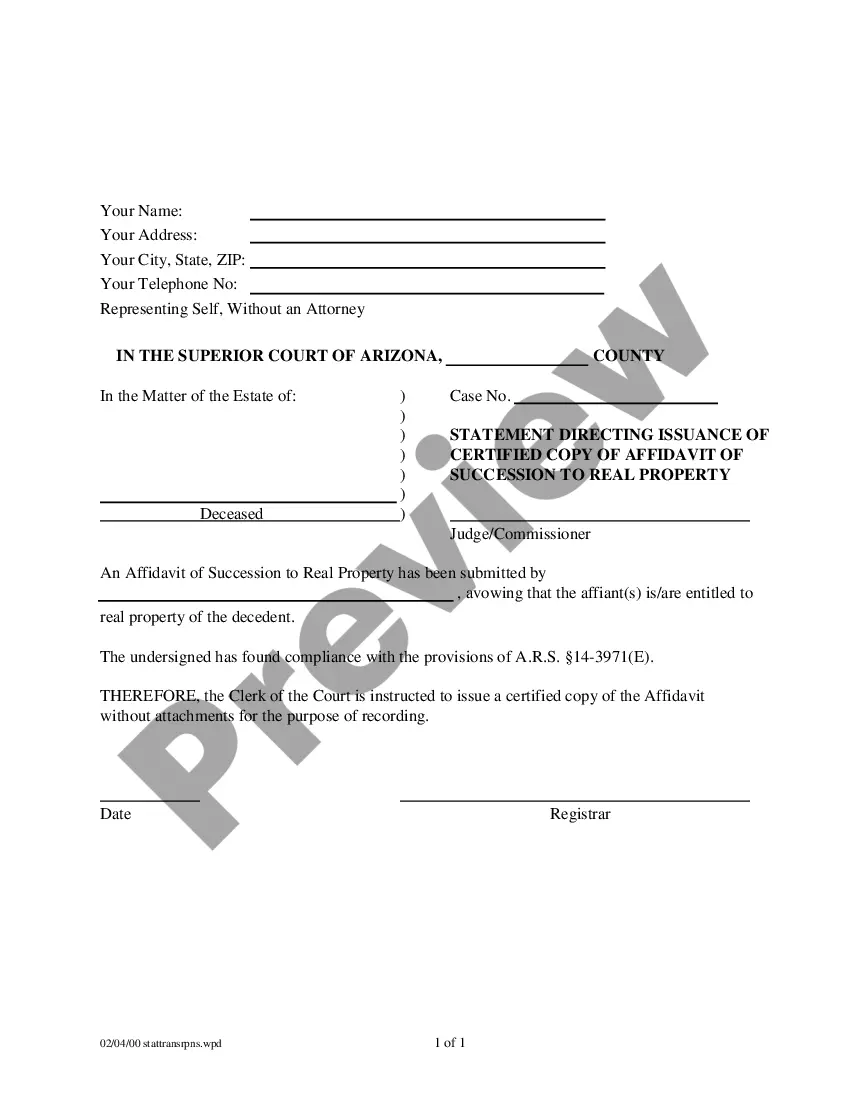

Affidavit For Transfer Of Real Property

Description

How to fill out Arizona Statement Directing Issuance Of Certified Copy Of Affidavit Of Succession To Real Property?

There's no longer any justification to squander time searching for legal documents to fulfill your local state obligations.

US Legal Forms has gathered all of them in one location and made their access easier.

Our platform offers over 85k templates for various business and personal legal needs, organized by state and area of use.

Employ the search bar above to look for another template if the previous one was unsuitable.

- All forms are appropriately drafted and validated for accuracy, ensuring peace of mind when obtaining an up-to-date Affidavit For Transfer Of Real Property.

- If you are familiar with our platform and already possess an account, ensure your subscription is active prior to retrieving any templates.

- Log In to your account, select the document, and click Download.

- You can also return to any saved documentation at any time by accessing the My documents tab in your profile.

- If you've never utilized our platform before, the process will require additional steps.

- Here's how new users can find the Affidavit For Transfer Of Real Property in our catalog.

- Carefully read the page content to confirm it contains the sample you need.

- Utilize the form description and preview options if available.

Form popularity

FAQ

In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including

How to Transfer Michigan Real EstateFind the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

If the heirs are only looking to transfer the real estate, with no personal possessions, Form DE-310 must be completed and filed. Signing Requirements Must be notarized (Prob. Code § 13104(e)).

An affidavit or declaration signed under penalty of perjury at least 40 days after the death can be used to collect the assets for the beneficiaries or heirs of the estate. No documents are required to be filed with the Superior Court if the small estates law (California Probate Code Sections 13100 to 13116) is used.

A California small estate affidavit, or Petition to Determine Succession to Real Property, is used by the rightful heirs to an estate of a person who died (the decedent). The total net value of the estate cannot be more than $184,500 for it to qualify under this process and bypass probate.