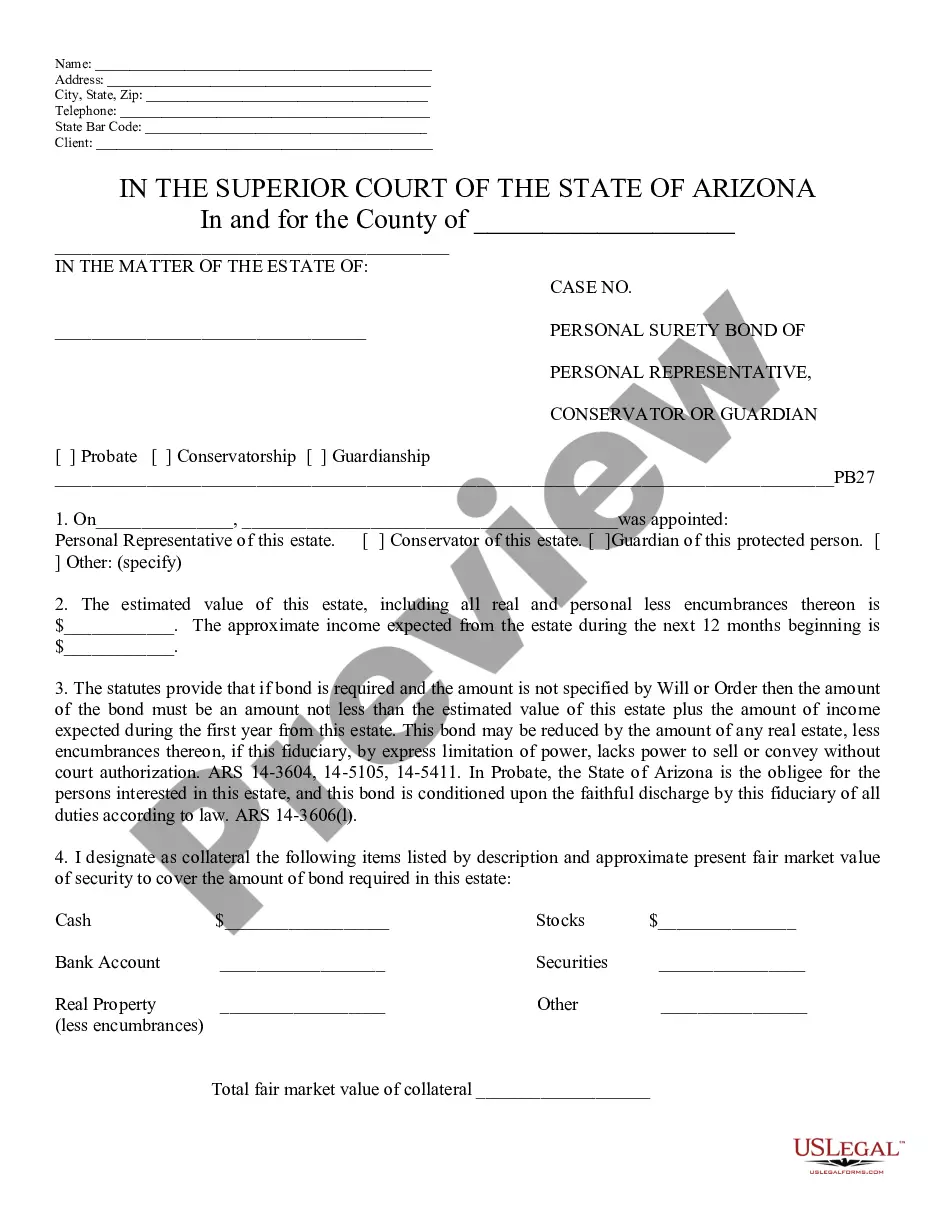

Personal Bond With Surety Format

Description

How to fill out Arizona Personal Surety Bond Of Personal Representative?

- If you have used US Legal Forms before, log in to your account and download the required form template by clicking the Download button. Ensure your subscription is active; if it's not, renew it as specified in your plan.

- For first-time users, start by examining the Preview mode and form descriptions to ensure you've selected a template that aligns with your specific requirements.

- If you find discrepancies, use the Search tab to locate the appropriate template. Once verified, proceed to the next step.

- Click on the Buy Now button to purchase the document and select your preferred subscription plan. Registration is necessary to access the full range of resources.

- Complete your purchase by entering your payment details, using either a credit card or PayPal.

- Finally, download your completed form. You can access it later in the My Forms section of your profile.

US Legal Forms not only provides an extensive library of over 85,000 legal templates but also ensures a smooth process with guidance from legal experts. This guarantees that your documents are both accurate and legally binding.

Start your journey towards creating legally sound documents today by visiting US Legal Forms and exploring the benefits for yourself!

Form popularity

FAQ

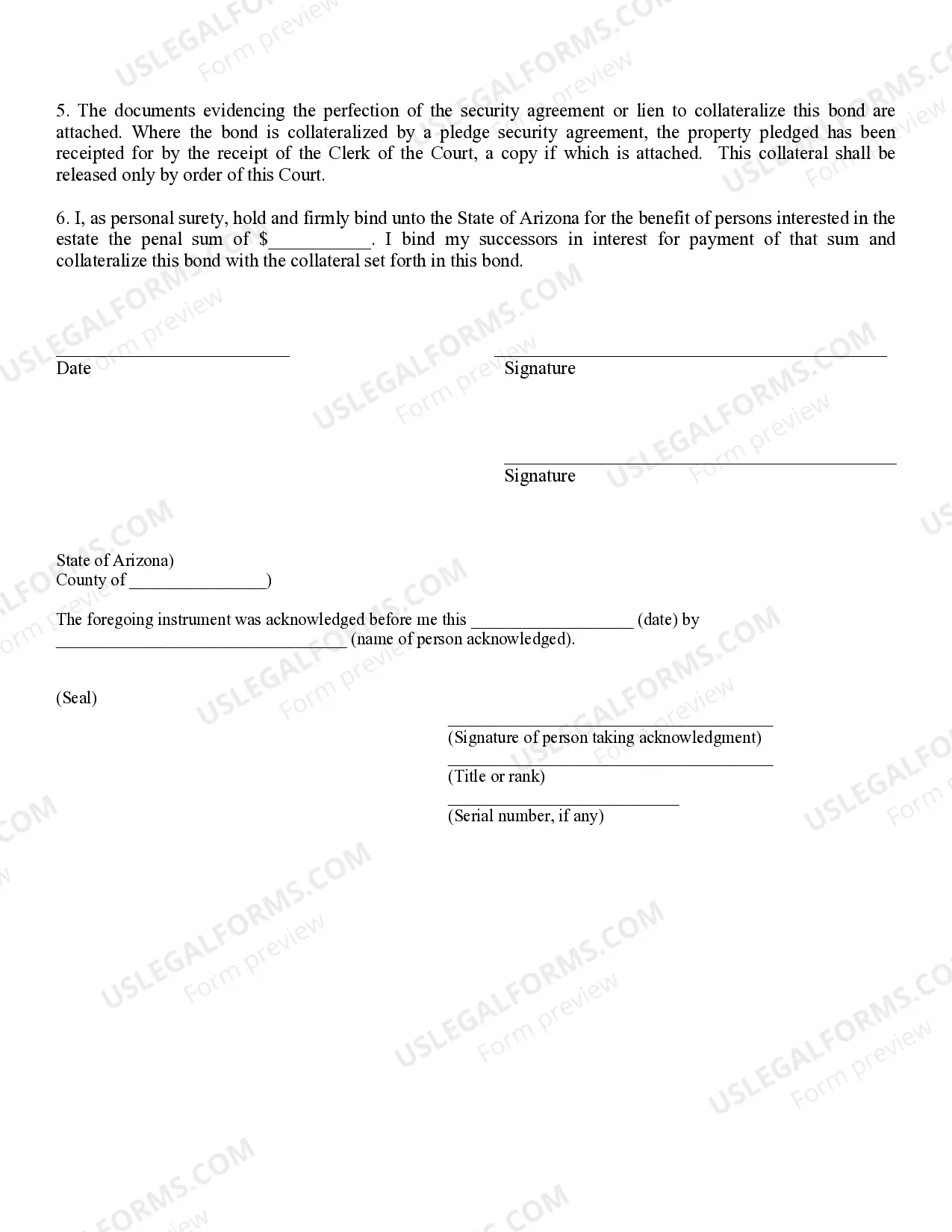

Setting up a surety bond involves a few straightforward steps. First, select a reputable bonding company that offers personal bonds with surety format. Next, fill out the application and provide any required documentation, such as personal identification and financial statements. Once approved, review the terms carefully, and you can finalize the bond, ensuring you are fully aware of your responsibilities.

To get a surety bond, start by researching reliable providers who specialize in personal bonds with surety format. Compare rates, services, and customer reviews to find the best fit for your situation. You can gather all necessary documents and information before contacting your chosen provider, which will expedite the application process. Additionally, consider using a platform like US Legal Forms, as it can guide you through the paperwork effortlessly.

The primary purpose of a surety bond is to provide a financial guarantee that a party will fulfill their obligations. If the obligated party fails to meet their responsibilities, the surety is liable for any resulting losses. By implementing the personal bond with surety format, you can ensure that your legal documents are structured effectively, offering peace of mind and security in various situations.

A bond with personal surety is a type of surety bond where an individual acts as the guarantor for another’s obligations. This form of bond is often used in court situations, ensuring that the principal adheres to specific commitments. The personal bond with surety format provides the necessary legal framework to protect the interests of all parties.

To write a surety bond, you'll need to draft a document that outlines the terms and conditions of the bond. This involves detailing the obligations of all parties involved, including the principal, surety, and obligee. Utilizing the personal bond with surety format can ensure clarity and compliance with legal requirements, making the process more straightforward.

A personal surety bond is a legal agreement where an individual takes responsibility for another person’s obligations. This bond assures the court or relevant authority that the individual will uphold their responsibilities. Using the personal bond with surety format, you can facilitate smoother processes in legal situations, such as court appearances or probation.

The two common types of surety bonds are contract bonds and license and permit bonds. Contract bonds usually secure project completion, while license and permit bonds ensure compliance with local laws. Understanding these bond categories can help you choose the right Personal bond with surety format for your situation. This knowledge empowers you to make informed decisions in fulfilling your bonding requirements.

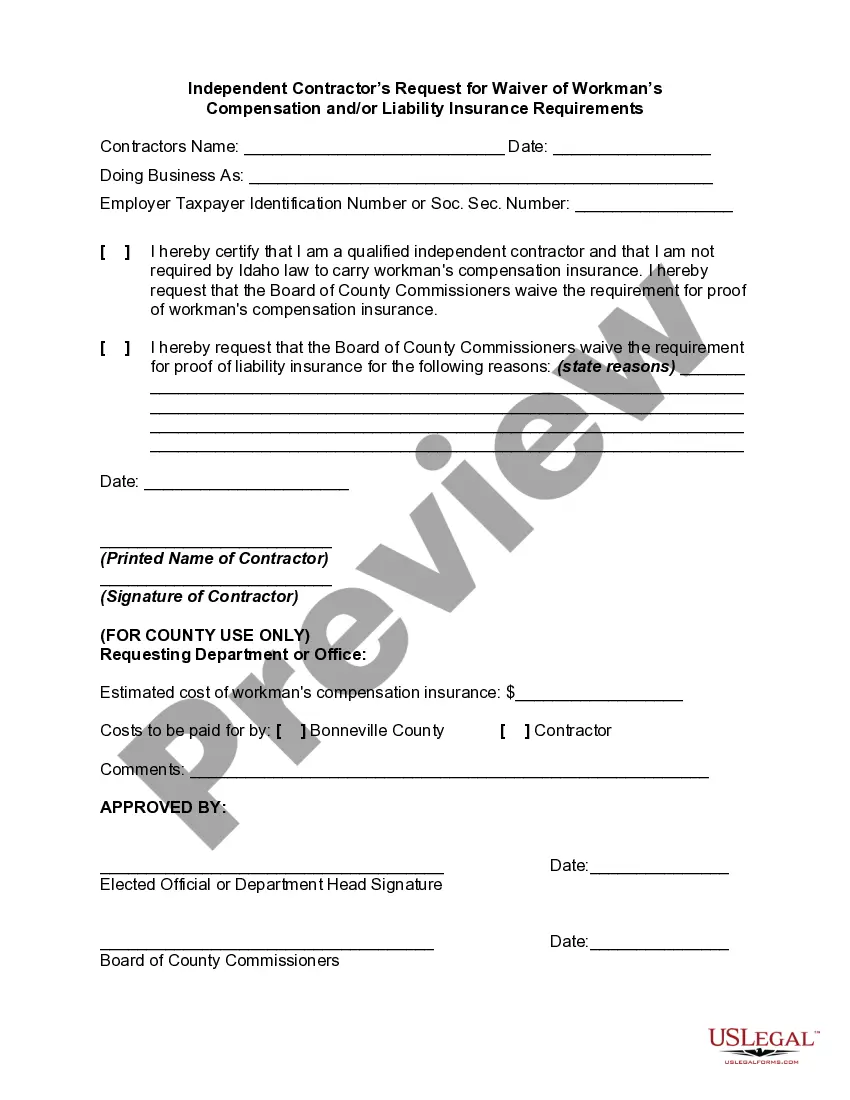

To fill an indemnity bond with surety, you must gather all necessary details about the indemnitor, indemnitee, and surety bondsman. Clearly outline the obligations and the conditions under which the indemnity applies. Using a reliable Personal bond with surety format can simplify this process, as it provides a structured outline for your information. This structured approach makes it easier to understand your rights and responsibilities.

A simple example of a surety bond is a construction bond, which guarantees that a contractor will complete a project as agreed. This bond serves to protect the project owner and outlines the responsibilities of the parties involved. In many cases, you can find a Personal bond with surety format that suits your specific industry needs. This flexibility ensures that you can quickly access the protection you need.

Filling out a surety bond form requires you to provide specific information about the parties involved, including the principal, obligee, and surety. Start by clearly identifying the purpose of the bond and any amounts involved. Ensure to follow the formats provided in the templates, like the Personal bond with surety format, for accuracy. Taking care with detail here helps expedite your bonding process.