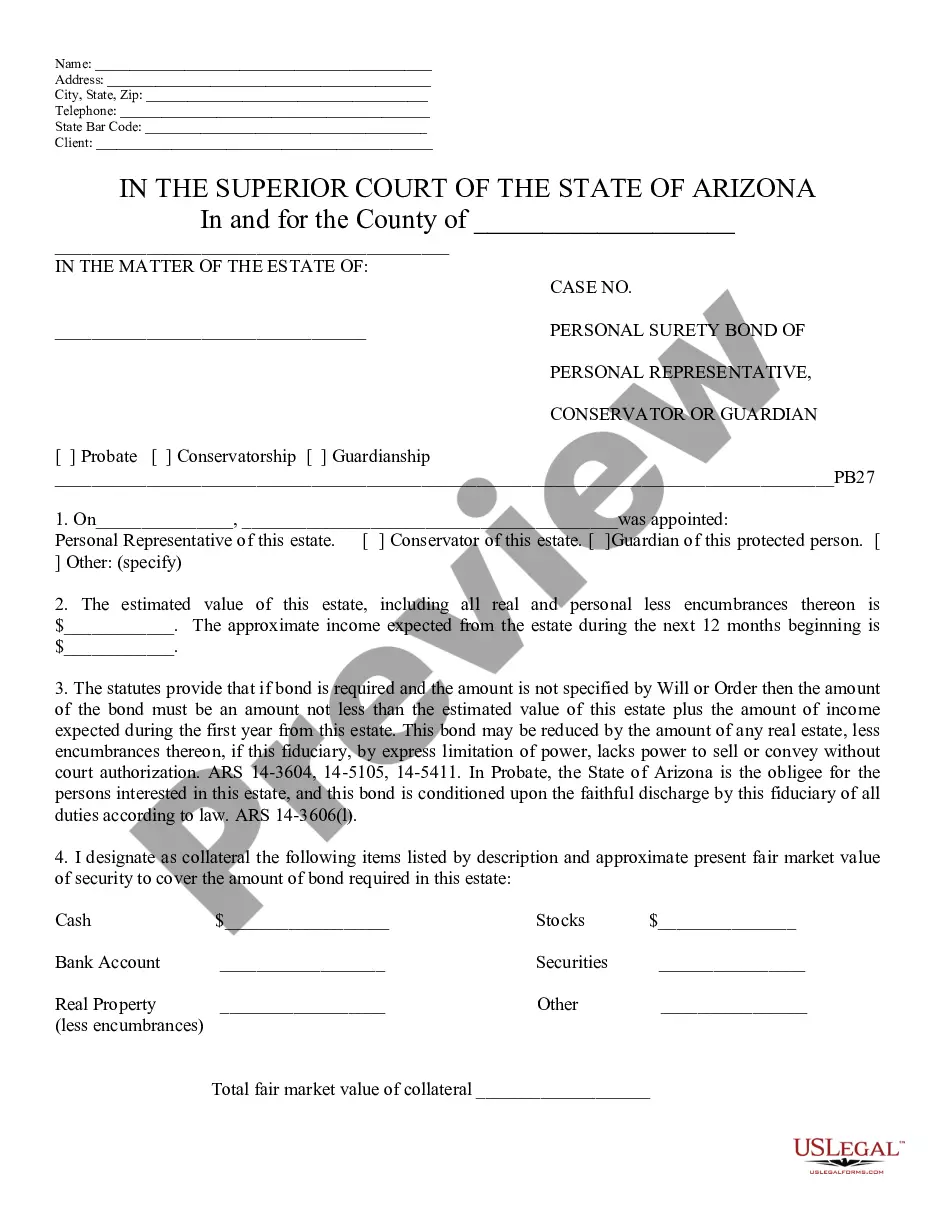

Personal Bond With Surety

Description

How to fill out Arizona Personal Surety Bond Of Personal Representative?

- If you are a returning user, log in to your account and verify your active subscription. Click the Download button to get your form.

- For first-time users, start by previewing the form options available. This ensures you select a document that fits your jurisdiction and specific needs.

- Should you find the initial form unsuitable, utilize the Search tab to explore other templates until you find the right one.

- Once you select the appropriate form, click on the Buy Now button and pick a subscription plan that works for you. A user account registration will be necessary.

- Make your payment by entering your credit card information or using your PayPal account to finalize the subscription.

- After your purchase, download the form to your device. You can also access this document anytime from the My Forms section of your profile.

By leveraging the robust form collection and expert assistance available at US Legal Forms, you ensure your documents are legally sound and tailored to your needs. This extensive library provides users with a seamless experience.

Start your journey to establishing a personal bond with surety today. Sign up and explore our vast collection of legal forms!

Form popularity

FAQ

Being bonded under a surety bond means that a surety company guarantees the fulfillment of a specific obligation by the bonded individual. If the bonded person fails to meet their commitments, the surety will compensate the affected party. This process helps ensure that all contractual duties are executed properly, giving peace of mind to those involved. A personal bond with surety can be particularly useful in navigating complex legal environments.

Personal surety refers to an individual who guarantees the obligations of another, often in the context of legal and financial arrangements. When a person relies on a personal bond with surety, they enlist someone who willingly takes responsibility for ensuring that obligations are met. This arrangement can offer peace of mind for both the obligor and the obligee, as it provides an added layer of security. A personal surety shows commitment and responsibility.

A person may need to be bonded for various reasons, such as fulfilling legal requirements or securing a contract. In many cases, a personal bond with surety provides assurance to a third party that the bonded individual will meet their obligations. This type of bond protects the interests of all parties involved, ensuring compliance with laws or contractual terms. Ultimately, securing a bond can enhance credibility and trust.

A bond with personal surety involves a person vouching for another's obligation, acting as a guarantee of performance or compliance. This type of personal bond with surety typically requires the surety to have a close relationship with the bonded individual, often involving family or friends. The surety assumes financial responsibility if the bonded party fails to meet their obligations. It's a crucial tool for establishing trust and ensuring accountability in various situations.

Obtaining a surety bond, such as a personal bond with surety, is generally straightforward if you meet specific eligibility criteria. People often find that the requirements focus on creditworthiness and the ability to meet bond conditions rather than unattainable standards. However, it can vary depending on the bond's nature and the surety company. With the correct guidance and resources, you can successfully navigate this process and secure the bond you need.

You typically do not need a bondsman for a surety bond, but having one can be beneficial depending on your circumstances. A personal bond with surety can be obtained directly from a bonding company. However, if your situation is complex, a bondsman can guide you through the intricate details. This assistance can lead to a smoother application process and greater confidence in your obligations.

A personal surety bond is a form of guarantee provided by an individual acting as a surety. This bond ensures that an obligation will be fulfilled, often related to legal issues or securing contracts. When using a personal bond with surety, it is crucial to understand the responsibilities and potential financial implications for the surety. Choosing the right support, like USLegalForms, can simplify the process.

While you might consider creating your own surety bond, it is generally advisable to work with a qualified bonding agency. A personal bond with surety requires specific legal language and adherence to state regulations. By partnering with a professional, you can ensure that your bond is valid and fully compliant with the law, reducing risks down the road.

The best way to secure a personal bond with surety is to choose a reputable bonding company. Start by researching their services and reading reviews from past clients. Once you've selected a company, you will typically need to submit an application that includes your financial information and the specifics of your situation. This process ensures you get the best rates and terms for your bond.

To fill out a surety bond form, start by gathering the necessary information about the principal, the obligee, and the bond amount. Most forms will require details such as names, addresses, and social security numbers. After completing the form, review it carefully for accuracy before submitting it through platforms like uslegalforms, which simplifies the process and ensures all requirements are met correctly. Following these steps will help ensure a smooth bonding experience.