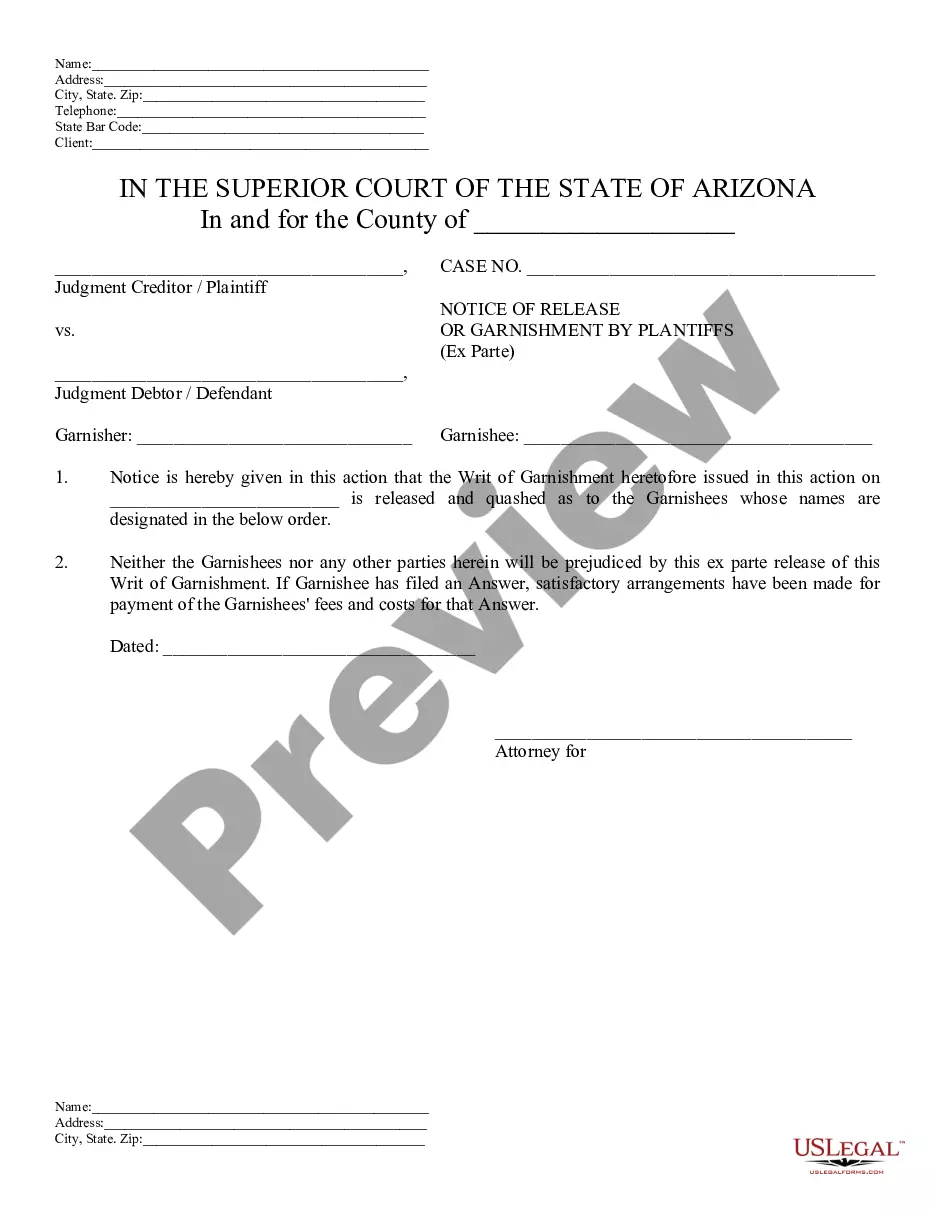

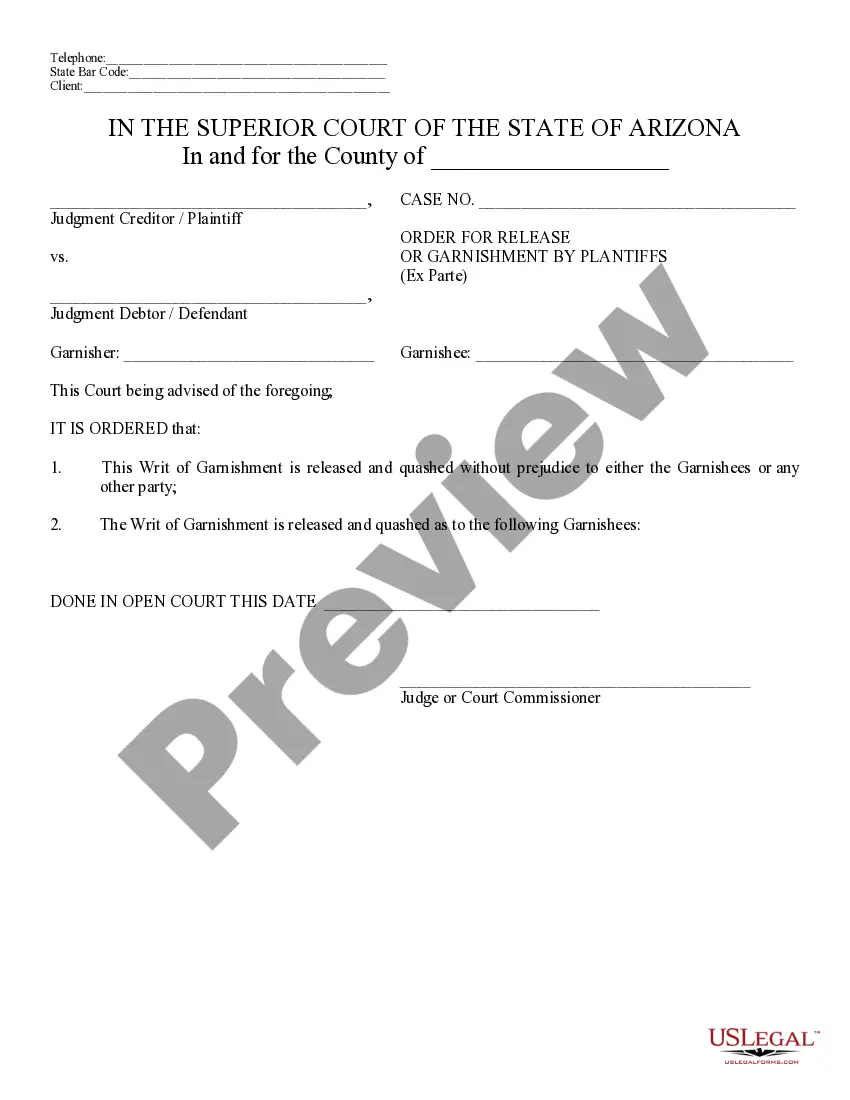

Arizona Garnishment Withdrawal

Description

How to fill out Arizona Notice Of Release Of Garnishment And Order?

The Arizona Garnishment Withdrawal you see on this page is a reusable formal template drafted by professional lawyers in line with federal and state regulations. For more than 25 years, US Legal Forms has provided people, organizations, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, most straightforward and most reliable way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Obtaining this Arizona Garnishment Withdrawal will take you just a few simple steps:

- Look for the document you need and check it. Look through the file you searched and preview it or check the form description to ensure it suits your requirements. If it does not, utilize the search option to get the right one. Click Buy Now once you have found the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Choose the format you want for your Arizona Garnishment Withdrawal (PDF, DOCX, RTF) and download the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your papers one more time. Make use of the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

You may object to the garnishment or file a claim of exemption by requesting a hearing with this court, if you believe any of the following is true: 1. The judgment creditor does not have a valid provisional remedy order or support order or judgment against you or that the debt or judgment has been paid in full. 2.

Release of Garnishment forms are most commonly used to stop the garnishment because the amount owed is paid in full however, they can also be used if the person being garnished has switched employment. If an amount is still outstanding the garnishment can be reinstated.

Before Proposition 209, creditors could garnish up to 25% of a debtor's non-exempt disposable earnings. Now, the law has reduced this maximum limit to 10% of an individual's disposable income or 60 times the highest applicable minimum wage (whichever is less).

You must file a Garnishee's Answer with the Court Clerk within 10 business days after you receive the Writ of Garnishment and Summons. Within 10 business days after you receive the paperwork listed above, fill out a Garnishee's Answer (Earnings)(FORM 6) and file it with the Court Clerk.