Form For Lien Release

Description

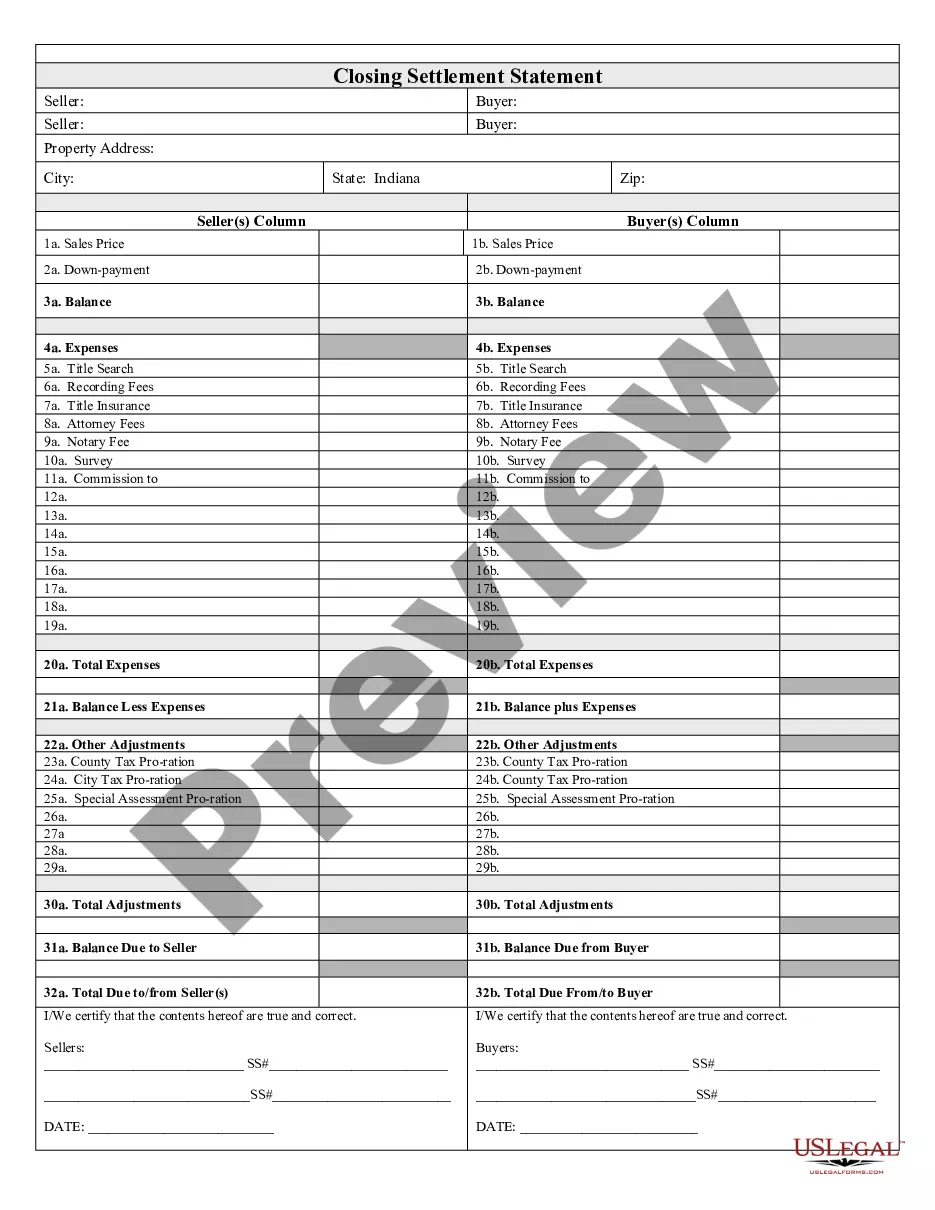

How to fill out Release Of Judgment Lien - Abstract Of Judgment?

It’s widely known that you cannot transform into a legal expert instantly, nor can you quickly learn to draft the Form For Lien Release without possessing a unique set of skills.

Creating legal documents is a lengthy endeavor that necessitates specific training and expertise. Thus, why not entrust the creation of the Form For Lien Release to the experts.

With US Legal Forms, which boasts one of the most comprehensive legal document collections, you can find everything from judicial papers to in-office communication templates. We understand the significance of compliance and adherence to federal and local regulations.

Create a complimentary account and select a subscription plan to purchase the template.

Click Buy now. After completing the transaction, you can download the Form For Lien Release, fill it out, print it, and send or deliver it to the appropriate recipients or organizations.

- That’s why all templates on our website are tailored for your location and are current.

- Begin by visiting our site to obtain the form you require in just a few minutes.

- Utilize the search bar located at the top of the page to find the necessary document.

- If available, preview it and review the accompanying description to ascertain if the Form For Lien Release meets your needs.

- If you require a different template, simply restart your search.

Form popularity

FAQ

A release of lien occurs when a borrower fulfills their obligation, often by paying off the debt secured by the lien. Events such as completing a mortgage payment or settling a tax obligation can trigger this release. To formalize the process, you will need to fill out a Form for lien release. This document not only helps clear any encumbrances on your property but also serves as proof that you have met your obligations.

The process for releasing a lien is commonly referred to as lien release or lien discharge. During this process, the lien holder formally acknowledges that the debt has been settled, and necessary documentation is filed with relevant authorities. Utilizing a user-friendly platform like USLegalForms can simplify acquiring the correct form for lien release, ensuring that all requirements are met efficiently.

To add or remove a lien on your vehicle title, visit your local county tax office. The title fee is $28 or $33, depending on your county, and must be paid at time of application. Please contact your local county tax office for the exact cost.

To remove a lien recorded on a paper title, you will need: the vehicle title. a release of lien letter and/or other notifications from the lienholder(s) currently named on the vehicle title. a completed Application for Texas Title and/or Registration (Form 130-U)

Protect Yourself With a Release of Lien (Lien Waiver) Fortunately, it's a simple process. A Lien Waiver is similar to a receipt. It basically states that you've paid the subcontractor what is owed, they accept the payment in full, and they waive the right to put a lien on your property.

Release details: Provide a statement confirming that the borrower has fully repaid the debt and that the lienholder is relinquishing their legal claim on the property or asset. Include the date when the borrower paid off the debt.

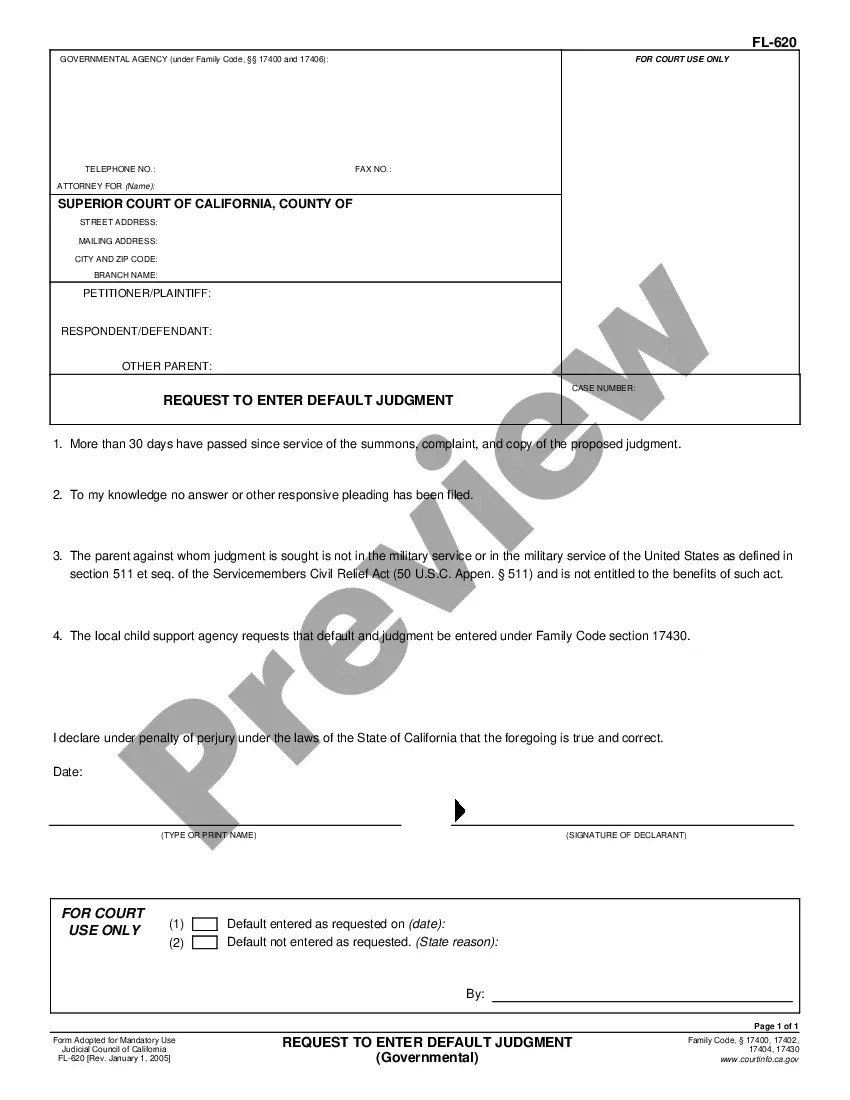

The property owner will need to have the judgment lien removed so the title can be cleared and the property sold. A knowledgeable California debt settlement attorney can have the lien taken off, possibly without payment to the creditor or debt collector.