Indiana Closing Statement

Understanding this form

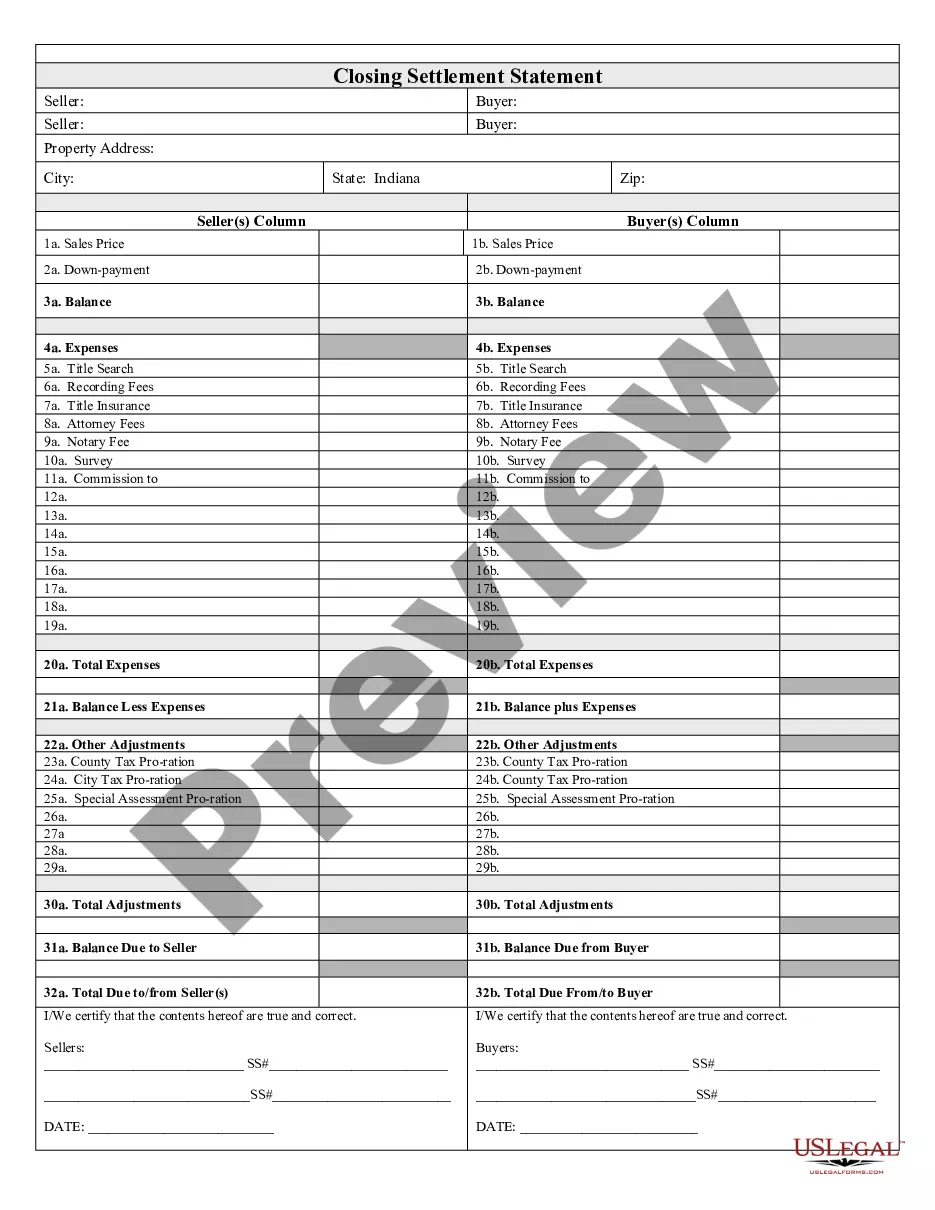

The Closing Statement is a crucial document in a real estate transaction, particularly in cases of cash sales or owner financing. It summarizes the financial aspects of the transaction and outlines the expenses related to the sale. This settlement statement is signed and verified by both the seller and the buyer, ensuring clarity and accountability for all parties involved.

Key parts of this document

- Balance: Displays the final financial balance after accounting for all costs.

- Expenses: Itemizes various expenses related to the transaction, such as title search, recording fees, and attorney fees.

- Adjustments: Accounts for tax prorations and any specific financial adjustments necessary for the sale.

- Certification: Requires signatures from both the seller and buyer to validate the statement's accuracy.

- Total due: Clearly outlines the total amount owed by either party at closing.

Situations where this form applies

This Closing Statement should be used whenever a real estate transaction occurs, particularly when dealing with cash sales or owner financing. It is essential for finalizing the sale, ensuring that all parties are aware of the financial distribution and obligations. Use this form to document and verify the transaction details before closing.

Who needs this form

- Homebuyers involved in cash purchases or owner-financed transactions.

- Home sellers who are closing a deal and need to outline financial terms clearly.

- Real estate agents facilitating the closing of property sales.

- Attorneys representing buyers or sellers in real estate transactions.

Instructions for completing this form

- Identify the parties involved: Include the names of both the buyer and the seller.

- Specify the property: Clearly outline the property being bought or sold.

- List all expenses: Include all relevant costs, from title search to attorney fees.

- Calculate adjustments: Include any prorated taxes or adjustments relevant to the transaction.

- Sign and date: Ensure both parties sign and date the form to validate it.

Notarization guidance

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all relevant expenses, leading to an incomplete financial overview.

- Not updating the balance after adjustments, causing confusion for both parties.

- Omitting signatures from either party, which can invalidate the document.

Why use this form online

- Convenience: Easily download and complete the form at your convenience.

- Editability: Customize the document to fit your specific transaction needs.

- Reliability: Access forms drafted by licensed attorneys to ensure accuracy and compliance.

Looking for another form?

Form popularity

FAQ

Small Estate Threshold The Indiana small estate procedures are available when the gross probate estate, less liens and encumbrances, does not exceed $50,000. The estate calculation includes all property owned by the decedent, including real estate.

Fill in the name of the Indiana county at the top of the small estate affidavit. It should be the county where the decedent resided when he died or a county where he owned real estate. Enter your full name in at the top of the affidavit, after "I." Write your postal and residence addresses on the provided lines.

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

Once all assets have been distributed, you must provide the court with the full details of the estate transactions so that the estate can be formally closed. This is accomplished by providing a final accounting of the actions you have taken, and filing a petition to settle the estate.

If real estate was transferred, an affidavit should be filed with the county recorder's office in the county where the real estate is situated and also filed with the closing statement. Ind. Code Ann. § A§ 29-1-8-3 and following.

A small estate affidavit is a sworn written statement that authorizes someone to claim a decedent's assets outside of the formal probate process.

Probate and its alternatives in Indiana. Conducting a probate in Indiana commonly takes six months to a year, depending on the situation. It can take longer if there is a court fight over the will (which is rare) or unusual assets or debts that complicate matters.

In Indiana, a small estate is an estate that has a value of $50,000 or less after liens, encumbrances, and reasonable funeral expenses are subtracted. All joint assets and beneficiary designations are not included in the $50,000 estate amount. Beneficiary designations include life insurance and joint assets.