Arizona Specific Form Application Format

Description

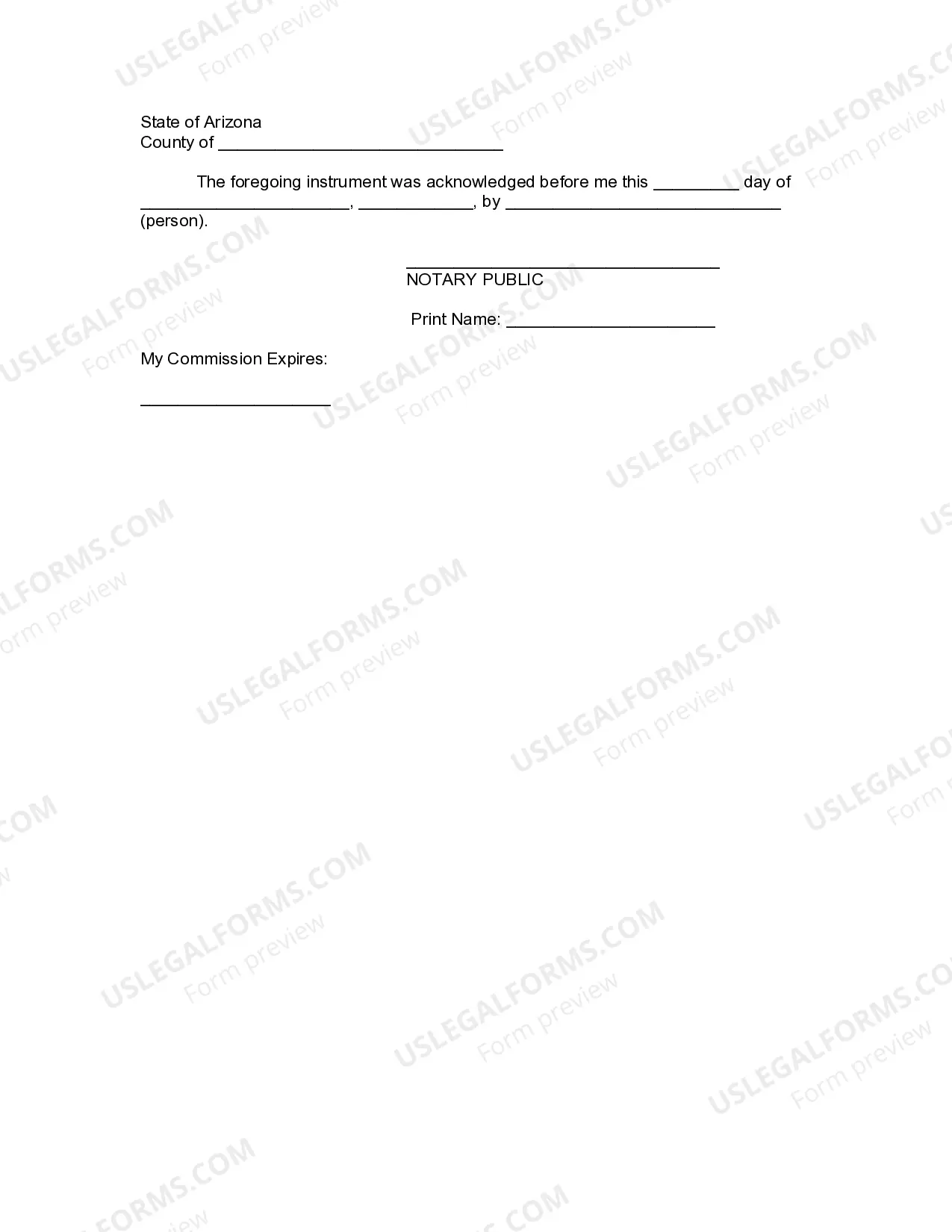

How to fill out Arizona Revocation Of Living Trust?

Whether for business purposes or for personal matters, everyone has to manage legal situations sooner or later in their life. Completing legal papers demands careful attention, beginning from selecting the proper form template. For example, if you select a wrong edition of the Arizona Specific Form Application Format, it will be rejected once you submit it. It is therefore important to have a trustworthy source of legal files like US Legal Forms.

If you need to obtain a Arizona Specific Form Application Format template, stick to these simple steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Look through the form’s description to make sure it matches your case, state, and region.

- Click on the form’s preview to view it.

- If it is the incorrect form, go back to the search function to locate the Arizona Specific Form Application Format sample you need.

- Get the template if it meets your requirements.

- If you already have a US Legal Forms account, just click Log in to gain access to previously saved templates in My Forms.

- In the event you don’t have an account yet, you can obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Finish the account registration form.

- Pick your transaction method: use a bank card or PayPal account.

- Choose the document format you want and download the Arizona Specific Form Application Format.

- When it is downloaded, you can fill out the form by using editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you do not have to spend time searching for the right template across the web. Utilize the library’s straightforward navigation to get the right form for any situation.

Form popularity

FAQ

The Arizona Form A-4, Employee's Arizona Withholding Percentage Election, must be completed so that you know how much state income tax to withhold from your new employee's wages.

Yes, the employer should then select 2.0% as the default rate. This means by March 2023 the paychecks would have the default rate chosen for them.

Form 140 - Resident Personal Income Tax Form -- Fillable. Individual. 140.

The Arizona Department of Revenue (ADOR) updated the Employee's Arizona Withholding Election form, Form A-4, to reflect Arizona's seven lower individual income tax rates. The new Form A-4 also retained both the zero withholding rate option and line for additional Arizona withholding.

The new default Arizona withholding rate is 2.0%.