Arizona Trust Filing Requirements

Description

How to fill out Arizona Amendment To Living Trust?

Finding a go-to place to take the most current and appropriate legal samples is half the struggle of handling bureaucracy. Discovering the right legal files demands accuracy and attention to detail, which explains why it is important to take samples of Arizona Trust Filing Requirements only from reputable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and view all the details concerning the document’s use and relevance for your circumstances and in your state or region.

Consider the following steps to complete your Arizona Trust Filing Requirements:

- Utilize the library navigation or search field to find your template.

- Open the form’s description to ascertain if it matches the requirements of your state and region.

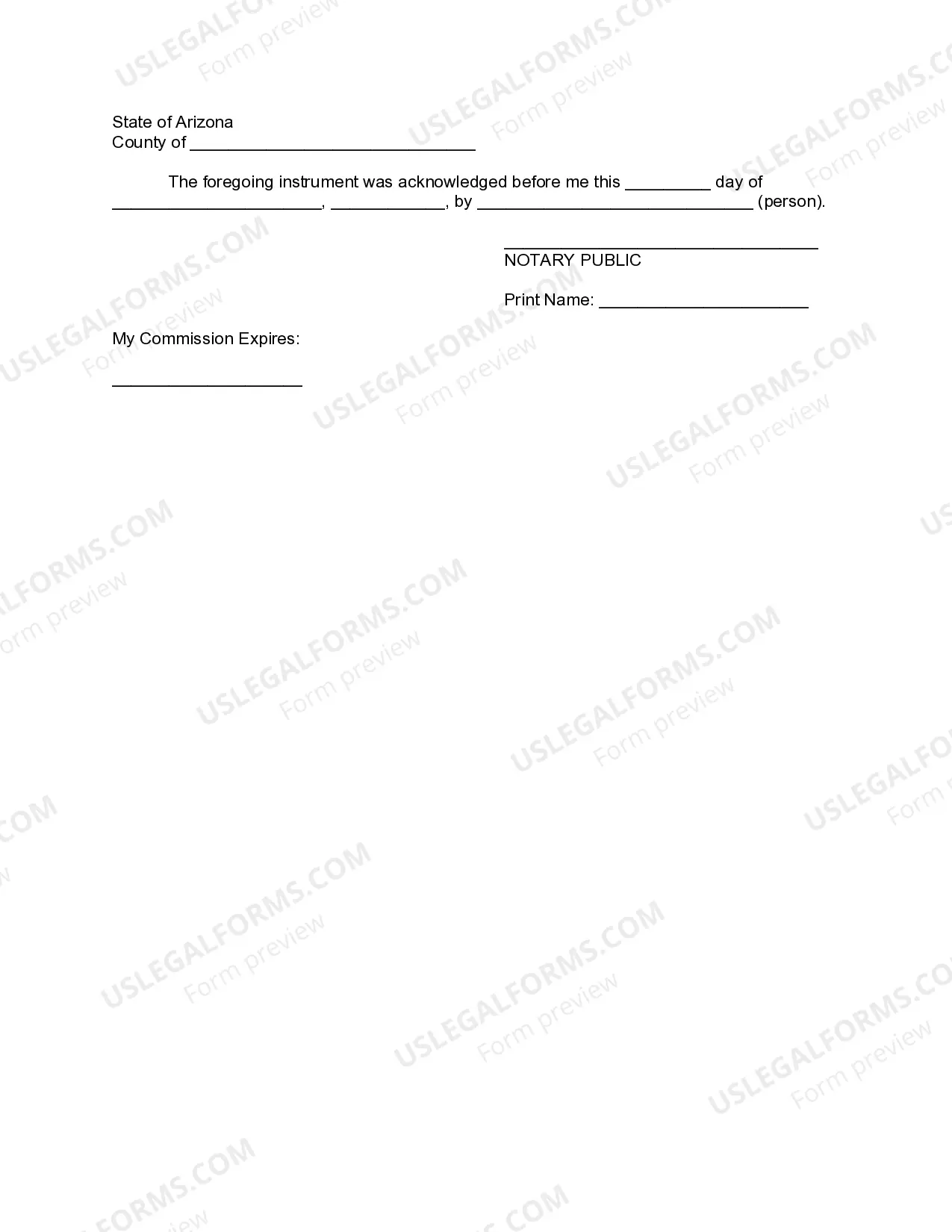

- Open the form preview, if there is one, to ensure the template is definitely the one you are interested in.

- Resume the search and look for the appropriate template if the Arizona Trust Filing Requirements does not fit your requirements.

- When you are positive about the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to get the form.

- Select the pricing plan that suits your needs.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by selecting a payment method (bank card or PayPal).

- Select the document format for downloading Arizona Trust Filing Requirements.

- Once you have the form on your gadget, you can alter it using the editor or print it and complete it manually.

Remove the inconvenience that accompanies your legal documentation. Explore the extensive US Legal Forms collection where you can find legal samples, check their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

Tax Laws for Trusts When you put assets into a trust, be aware that your beneficiaries will be required to pay taxes on distributions from income. Unlike income distributions, distributions from the trust principal are not taxed.

Q: Do trusts have a requirement to file federal income tax returns? A: Trusts must file a Form 1041, U.S. Income Tax Return for Estates and Trusts, for each taxable year where the trust has $600 in income or the trust has a non-resident alien as a beneficiary.

The fiduciary, or fiduciaries, must file a return for an estate or trust if: 1. The estate or trust has any Arizona taxable income for the tax year. 2.

A trust with more than $600 in income during a tax year is required to file a federal income tax return. The trustee files out a Form 1041 reporting the trust's income.

You must file Form 1041 for a domestic trust that has: Any taxable income for the tax year. Gross income of $600 or more (regardless of taxable income) A beneficiary who is a non-resident alien.