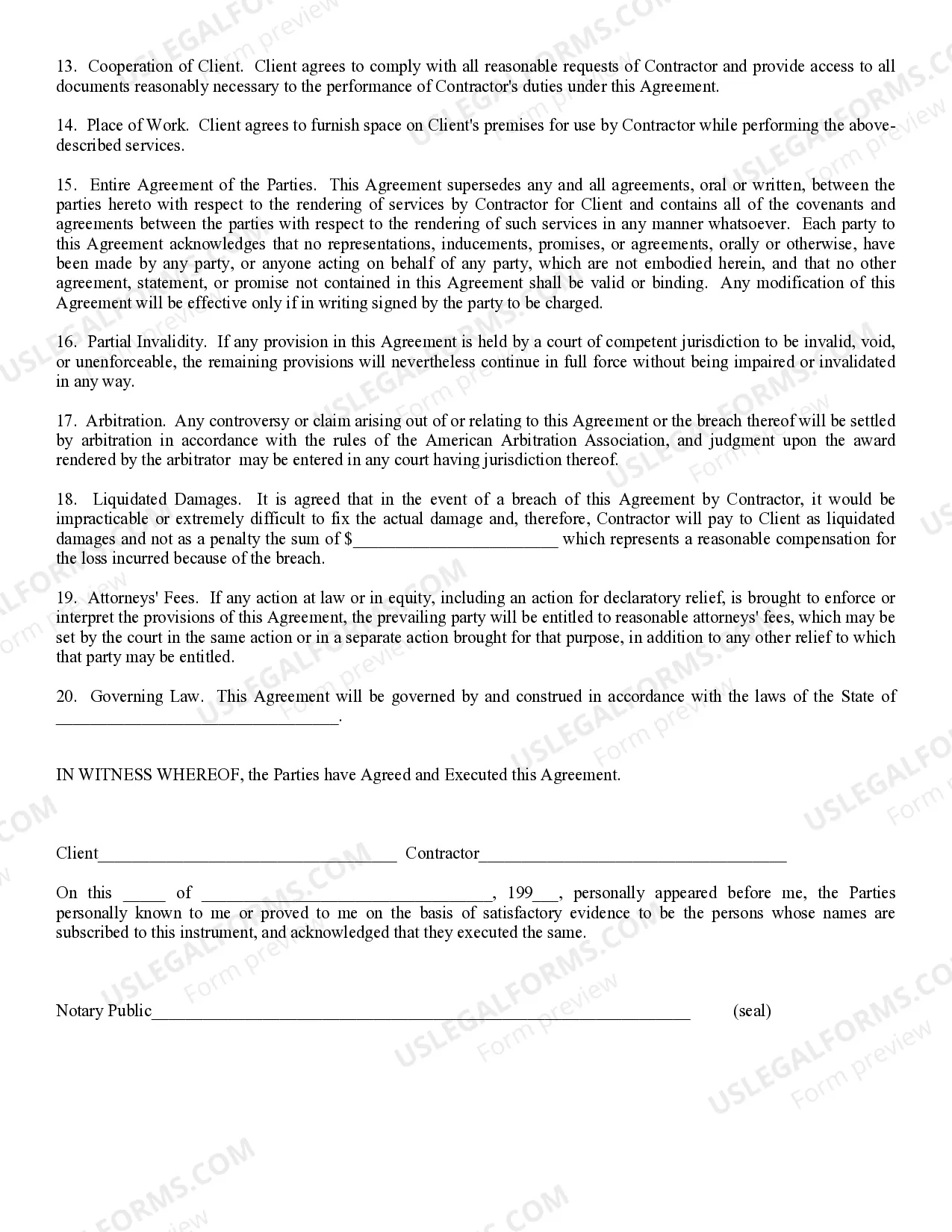

Independent Contractor: This is a contract to be used by an independent contractor. The independent contractor uses this type of contract before beginning a job with either a sub-contractor and/or Owner of a parcel of land. This form is available in both Word and Rich Text formats.

Independent Contractor Agreement Arizona For Accountant And Bookkeeper

Description

How to fill out Arizona Self-Employed Independent Contractor Agreement?

When you are required to submit an Independent Contractor Agreement Arizona for Accountants and Bookkeepers in accordance with your local state's laws and regulations, there may be several options to choose from.

You don't have to scrutinize every document to confirm it meets all the legal requirements if you are a US Legal Forms subscriber.

It is a trustworthy service that can assist you in obtaining a reusable and current template on any subject.

US Legal Forms makes obtaining properly crafted legal documents easy. Moreover, Premium users can take advantage of robust integrated options for online document editing and signing. Give it a try today!

- US Legal Forms is the most extensive online directory with a repository of over 85k ready-to-use documents for both business and personal legal matters.

- All templates are verified to comply with each state's laws.

- Therefore, when downloading the Independent Contractor Agreement Arizona for Accountants and Bookkeepers from our site, you can be assured that you have a valid and up-to-date document.

- Acquiring the necessary sample from our platform is extremely simple.

- If you already possess an account, just Log In to the system, ensure your subscription is active, and save your selected file.

- In the future, you can access the My documents tab in your profile and maintain access to the Independent Contractor Agreement Arizona for Accountants and Bookkeepers at any time.

- If this is your first time using our library, please follow the instructions below.

- Navigate through the recommended page and verify it aligns with your needs.

Form popularity

FAQ

Yes, the company should send you a 1099. Its easy to forget to include yourself when you're doing the books! All you need to do is print out a blank form 1099 (from IRS.gov), fill it out, check the "Corrected" box, and mail to the IRS.....and keep your copy of course!

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.