Arizona Wage Laws

Description

How to fill out Arizona Order To Stop Wage Assign.?

Regardless of whether for corporate objectives or personal matters, everyone must confront legal situations at some stage in their existence.

Filling out legal documents requires meticulous focus, starting from choosing the right template.

With an extensive US Legal Forms catalog available, you do not have to waste time searching for the suitable template online. Utilize the library’s user-friendly navigation to find the correct form for any situation.

- For example, selecting an incorrect version of the Arizona Wage Laws will result in rejection upon submission.

- Thus, it is essential to have a reliable source of legal documents such as US Legal Forms.

- If you wish to acquire an Arizona Wage Laws template, follow these straightforward steps.

- Retrieve the sample you require using the search bar or catalog navigation.

- Review the form’s description to confirm it aligns with your case, state, and county.

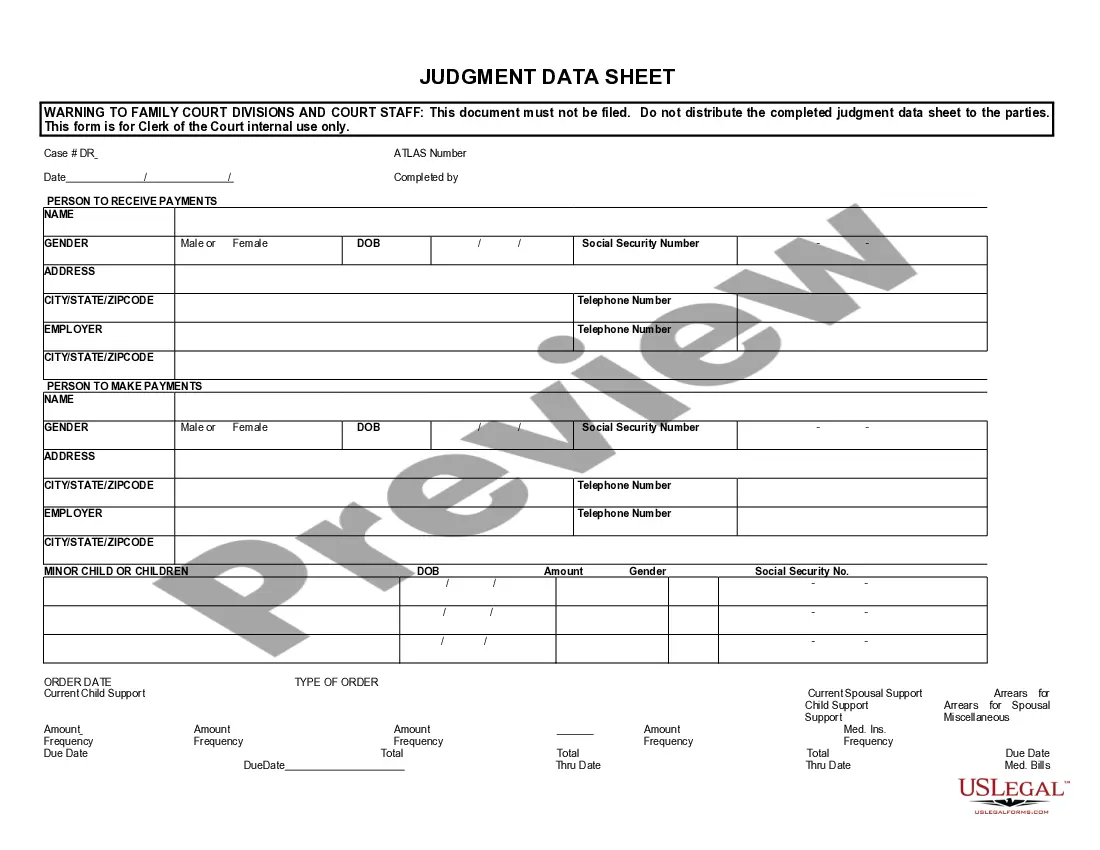

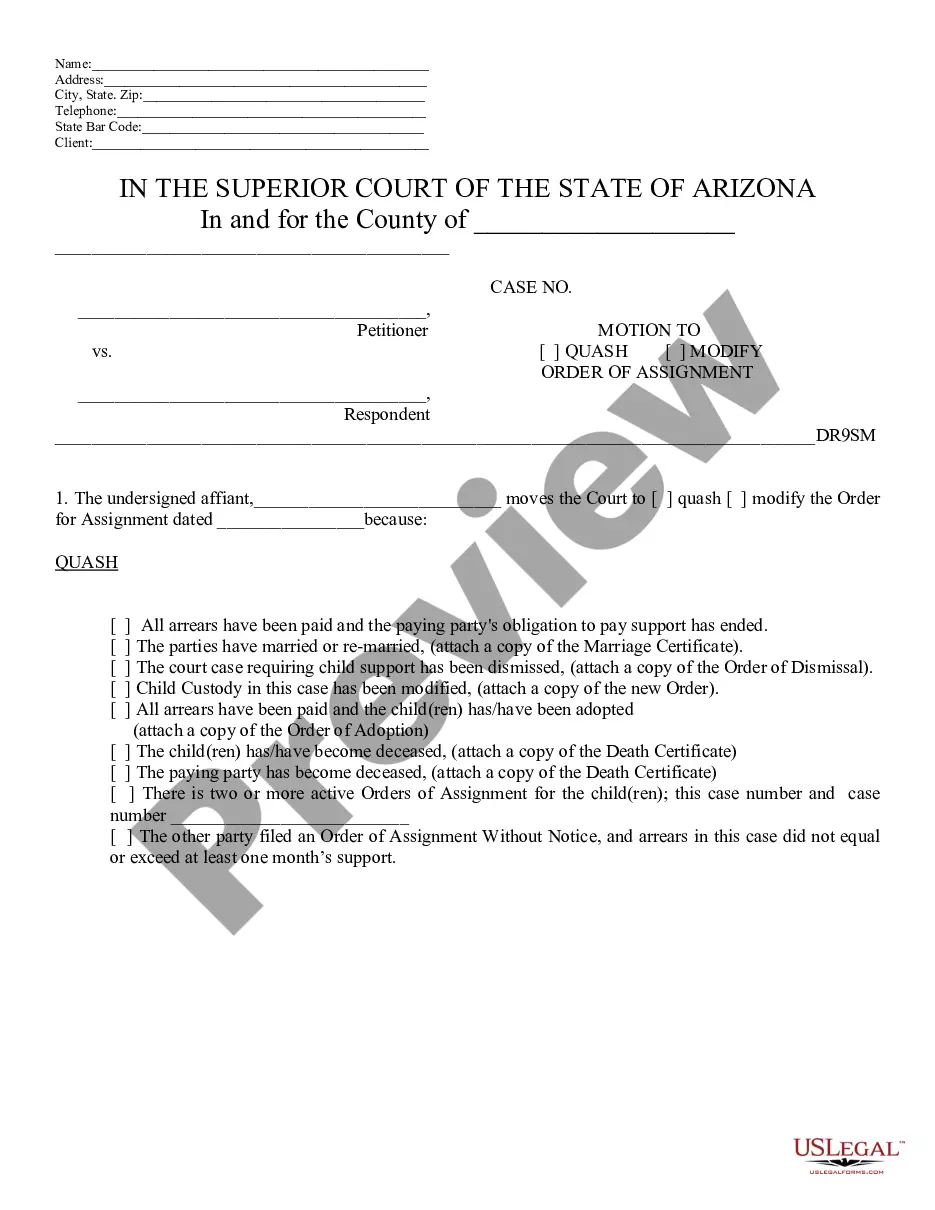

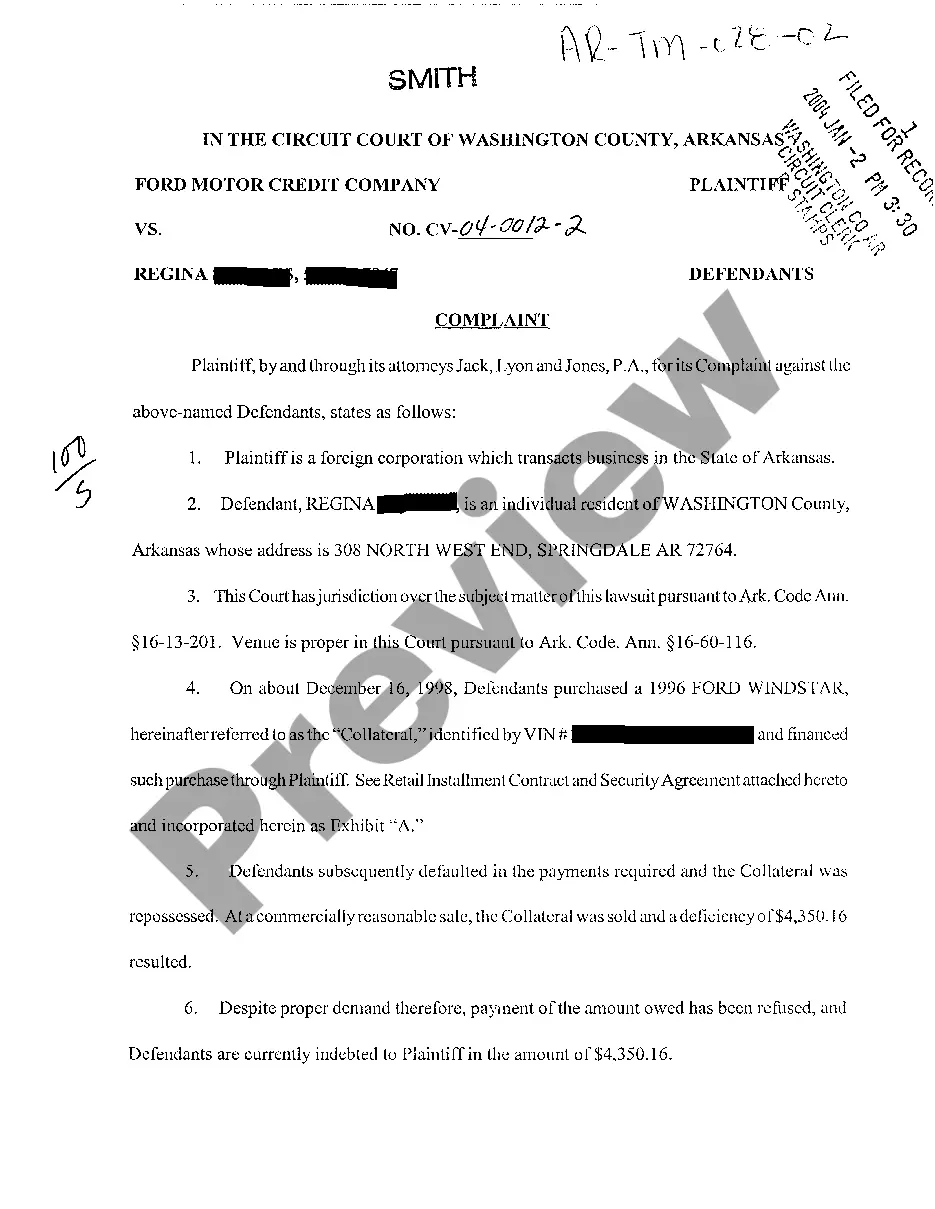

- Click on the form’s preview to inspect it.

- If it is not the correct form, revert to the search feature to locate the Arizona Wage Laws template you need.

- Download the file if it meets your specifications.

- If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- Should you not have an account yet, you can acquire the form by clicking Buy now.

- Choose the suitable pricing plan.

- Fill out the account registration form.

- Select your payment method: utilize a credit card or PayPal account.

- Choose the document format you prefer and download the Arizona Wage Laws.

- Once downloaded, you can complete the form using editing software or print it out and finish it by hand.

Form popularity

FAQ

As of now, Arizona's minimum wage is set to gradually increase, but it is not at $20. The current state minimum wage is lower, and it is important to stay updated on changes to Arizona wage laws. You can check reliable sources to ensure you are informed about any wage adjustments.

Arizona wage laws do not specify a maximum number of hours you can work in a day. However, employers must provide appropriate breaks and follow labor regulations to ensure worker safety. If you have concerns about your work hours, consider consulting resources like US Legal Forms.

Payment of Wages for Salaried Employees in Arizona Most employers in Arizona have an obligation to pay salaried employees at least bi-monthly with no more than 16 days between payments. Additionally, these payments should follow a consistent schedule.

Arizona does not have any wage and hour laws governing overtime requirement. However, the Fair Labor Standards Act always applies and requires that non-exempt employees be paid 1.5 times their regular rate of pay for all hours worked over 40 in a workweek.

In Arizona, employers are required to pay a terminated employee their final paycheck within 7 working days or by the next payday, whichever is sooner (ARS 23-353).

In ance with Proposition 206, known as the Fair Wages and Healthy Families Act, Arizona's minimum wage in 2023 increased to $13.85. The updated 2023 Arizona minimum wage took effect on January 1, 2023 and will remain so through December 31, 2023.

The completed Unpaid Wage Claim Form may be submitted (1) Electronically by completing the Sign and Submit Form below; (2) by e-mail to Laborinv@azica.gov; (3) by Fax to (602)-542-8097; or (4) by U.S. Mail to Labor Department, P.O. Box 19070, Phoenix, AZ 85005-9070.