Garnished Credit Wages For Student Loans

Description

How to fill out USLegal Guide On How To Stop Garnishment?

Legal documentation administration can be irritating, even for experienced professionals.

If you are looking for a Garnished Credit Wages For Student Loans and lack the time to search for the correct and current version, the process can be taxing.

Access a valuable resource library of articles, guides, and materials pertinent to your situation and needs.

Conserve time and effort searching for the forms you require, and utilize US Legal Forms' sophisticated search and Review tool to find and download Garnished Credit Wages For Student Loans.

Take advantage of the US Legal Forms online catalog, backed by 25 years of experience and trustworthiness. Transform your routine document management into a seamless and user-friendly process today.

- If you hold a membership, Log Into your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to see the documents you have previously stored and manage your folders as needed.

- If this is your first experience with US Legal Forms, create an account and gain unlimited access to all the benefits of the library.

- Here are the steps to follow after obtaining the desired form.

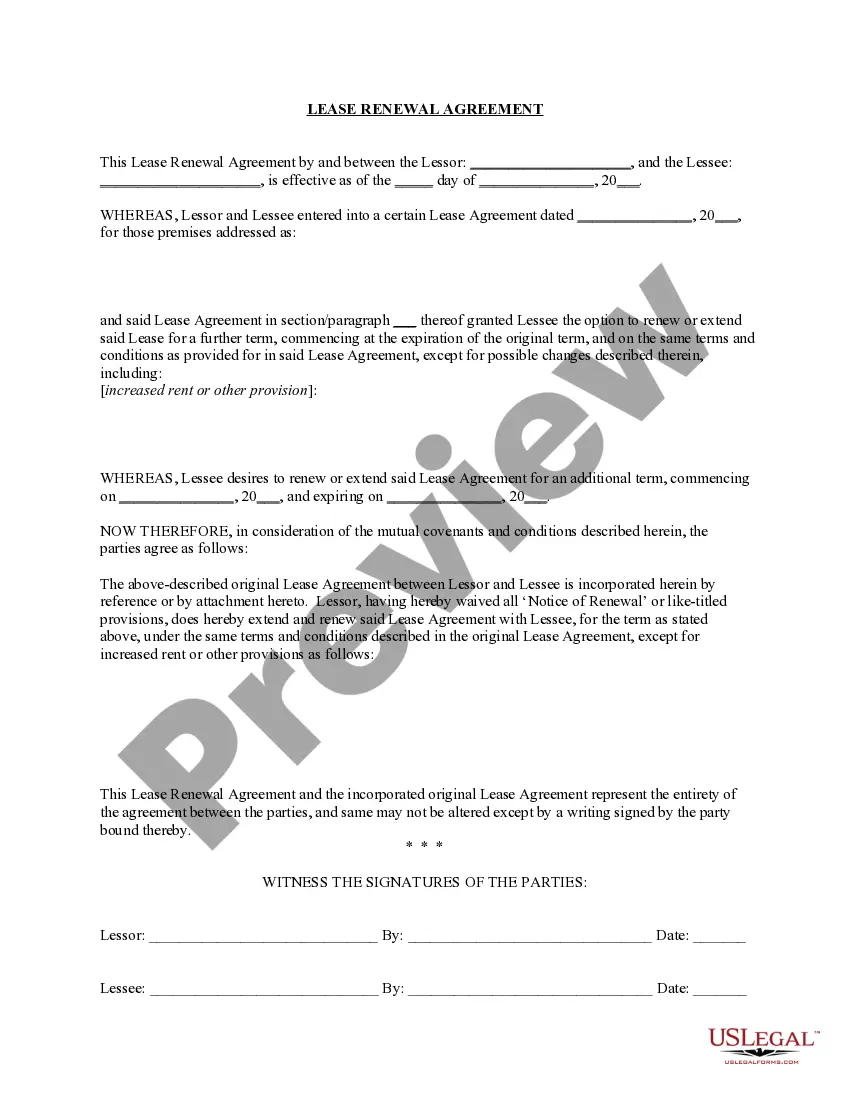

- Verify it is the correct form by previewing it and reviewing its details.

- Confirm that the template is valid in your state or county.

- Click Buy Now when you're prepared.

- Choose a subscription plan.

- Select your preferred format, then Download, complete, sign, print, and send your documents.

- Access state- or county-specific legal and business documents.

- US Legal Forms meets any requirements you may have, from personal to commercial paperwork, all in one location.

- Leverage advanced tools to manage and handle your Garnished Credit Wages For Student Loans.

Form popularity

FAQ

You can potentially have your student loans forgiven through specific federal programs or income-driven repayment plans. It’s vital to meet the eligibility requirements and follow the necessary steps to apply for forgiveness. If you’re facing garnished credit wages for student loans, taking proactive measures to seek forgiveness can greatly improve your situation. US Legal Forms can provide valuable resources to assist you in this process.

To effectively stop wage garnishment, consider negotiating with your lender to establish a repayment plan that works for you. You can also explore options like consolidating your student loans or applying for an income-driven repayment plan. If you are facing financial hardship, filing for bankruptcy can halt wage garnishments temporarily. Additionally, US Legal Forms provides resources that can help you navigate the complexities of garnished credit wages for student loans, ensuring you have the information you need to regain control of your finances.

Administrative Wage Garnishments Temporarily Paused The payment pause is ending at the end of August 2023, but the Department of Education has stated that collections on loans that are eligible for the new Fresh Start program will continue to be paused during the Fresh Start period.

You have the following options to avoid garnishment of 15% of your disposable pay: Pay the balance in full, or negotiate a settlement in full, of all the debts included in the garnishment.

Student loan wage garnishment works like this: Default on your federal student loans and the government can take up to 15% of your paychecks. For someone who normally takes home $2,000 each month, that amounts to $300 garnished.

Your loan holder can order your employer to withhold up to 15 percent of your disposable pay to collect your defaulted debt without taking you to court. This withholding (?garnishment?) continues until your defaulted loan is paid in full or the default status is resolved.

Collections (offset and garnishment) on most defaulted loans will not resume until at least September 2024 due to the Fresh Start program. Eligible borrowers can use the Fresh Start initiative to easily get their loans out of default.