Payment Bond In Construction

Description

How to fill out Arkansas Performance And Payment Bond?

Bureaucracy demands exactness and correctness.

If you do not handle the completion of documents like Payment Bond In Construction daily, it may lead to some misinterpretations.

Choosing the right template from the beginning will guarantee that your document submission will proceed smoothly and avert any issues of re-submitting a document or repeating the same task from the beginning.

If you are not a registered user, finding the necessary template will require a few extra steps.

- Acquire the right template for your documentation from US Legal Forms.

- US Legal Forms is the largest online forms repository offering over 85 thousand templates across various sectors.

- You can access the latest and most pertinent version of the Payment Bond In Construction by simply exploring it on the site.

- Locate, save, and store templates in your profile or verify with the description to confirm you have the accurate one available.

- With a US Legal Forms account, you can obtain, keep in one area, and peruse the templates you've stored for easy access.

- When on the website, click the Log In button to authenticate.

- Next, visit the My documents page, where your form history is maintained.

- Review the descriptions of the forms and save the ones you need at any moment.

Form popularity

FAQ

A good construction bond rate for a payment bond in construction typically ranges from 0.5% to 3% of the total bond amount. This rate depends on various factors, including your credit score, project size, and type of work. It's essential to shop around and compare rates from different sureties to get the best deal. Using the resources available on US Legal Forms can help you understand the market and secure a favorable rate.

Obtaining a payment bond in construction starts with selecting a reputable bonding company. You will need to provide necessary documentation, such as financial statements and project details. Once your information is assessed, the surety will determine your eligibility and bond amount. Through US Legal Forms, you can easily access the forms needed to expedite the process of securing a payment bond.

A bond payout occurs when a surety company pays subcontractors for unpaid services through a payment bond in construction. For example, if a contractor defaults on payments, the bond ensures that subcontractors receive their outstanding balance from the surety provider. This system protects suppliers and laborers, fostering a more reliable construction environment.

A bond payment is a financial assurance provided to ensure that all involved parties in a construction project receive compensation for their services. It acts as a safety net for subcontractors and suppliers, promising payment even if the primary contractor faces financial issues. This arrangement fosters a sense of security and promotes collaboration among all project stakeholders.

In the construction industry, the four main types of bonds are bid bonds, performance bonds, payment bonds, and warranty bonds. Each type serves a different purpose, with the payment bond specifically ensuring that subcontractors and suppliers are compensated for their work. Understanding these bonds can help participants manage risks and navigate complex construction contracts effectively.

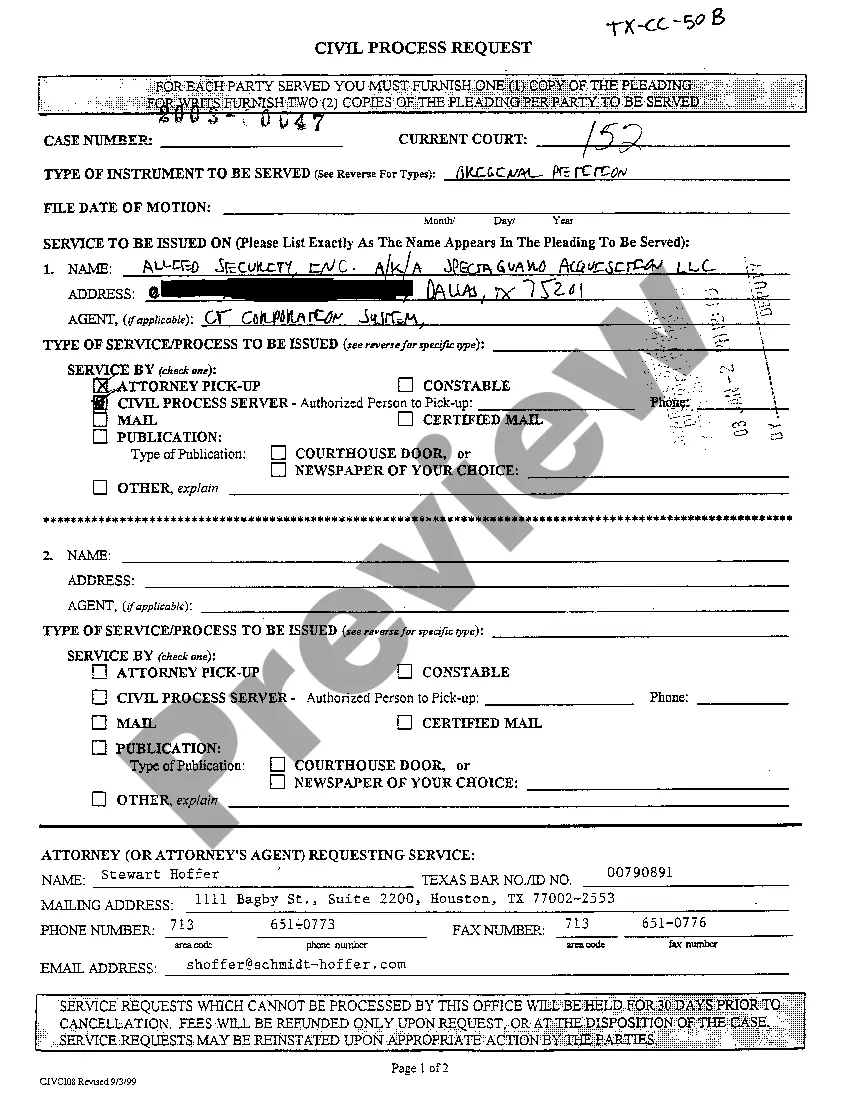

Filling out a performance bond involves detailing the nature of the work, project specifications, and the obligations of the contractor. You should also include the payment bond in construction to ensure all aspects are covered. Make sure to follow the guidance provided on the performance bond template, as clarity is essential. Platforms like US Legal Forms streamline this process by offering user-friendly templates and comprehensive instructions.

The worth of a $100 bond after 30 years depends primarily on the interest rate it accrues over time. Generally, if you hold a payment bond in construction that pays interest, its value could increase significantly. However, you should consult financial figures or use online calculators for precise estimates. For more details on bonds and their value, consider checking resources provided by platforms such as US Legal Forms.

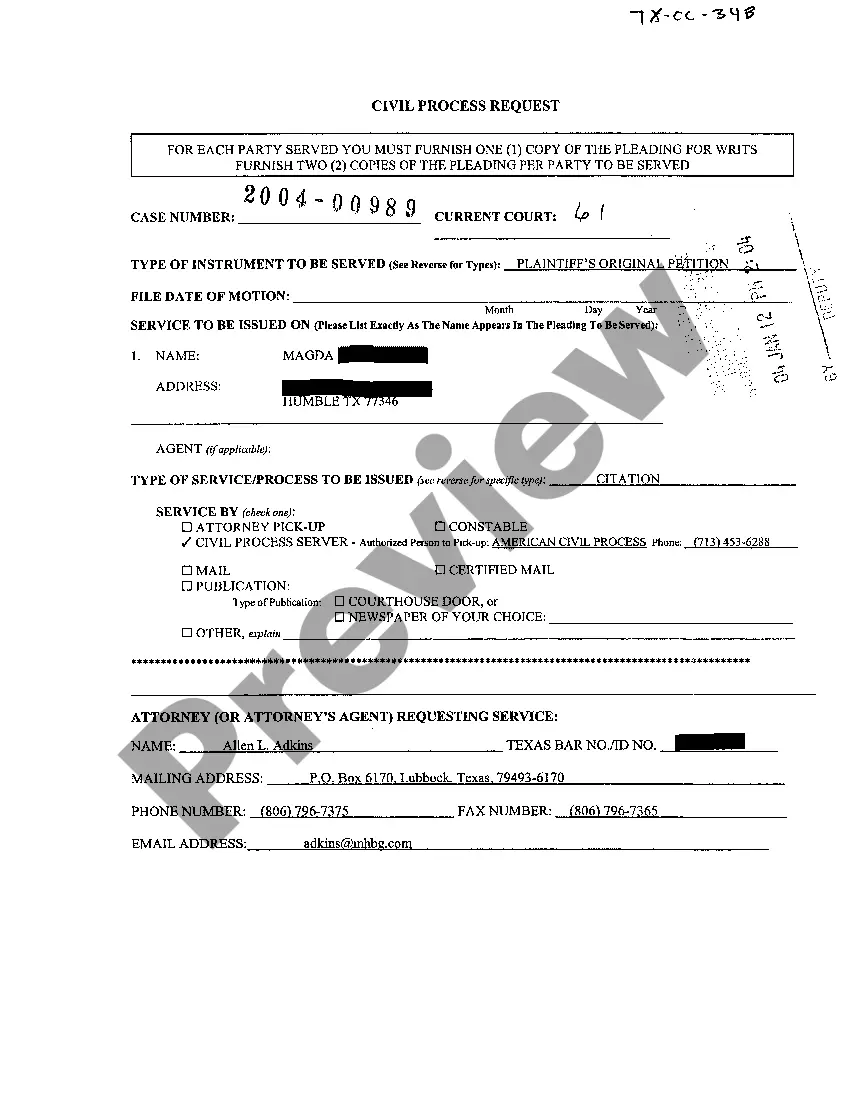

Filling out a bond form requires you to provide your personal information, dates, and the specifics related to the payment bond in construction. Start with the bond type and clearly identify the parties involved. Following the instructions outlined on the form is essential. If you're uncertain, US Legal Forms offers resources and templates that can assist you in completing the bond form accurately.

To fill out a bond order, you first need to gather the necessary details, including the bond's name, amount, and relevant parties involved. Make sure to include the project information where the payment bond in construction applies. Accurate information is crucial to avoid delays. You can utilize platforms like US Legal Forms for assistance, as they provide templates and guidance to simplify the process.

A construction bond claim follows a clear process to protect unpaid parties. First, the affected subcontractor or supplier files a claim with the surety company that issued the payment bond in construction. They must present evidence of non-payment along with any contractual agreements. After assessment, the surety company may fulfill the claim and later hold the contractor responsible for repaying the bond amount.