Deed Tod Beneficiary Without A Trust

Description

How to fill out Arkansas Transfer On Death Deed Or TOD - Beneficiary Deed For One Individual To Two Individuals?

Acquiring a reliable source to obtain the latest and pertinent legal templates is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents necessitates accuracy and careful attention, which is why it is essential to obtain samples of Deed Tod Beneficiary Without A Trust solely from trustworthy providers, such as US Legal Forms. An incorrect template can squander your time and delay your current situation.

Eliminate the inconvenience associated with your legal documentation. Explore the extensive US Legal Forms library where you can discover legal templates, verify their relevance to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to find your template.

- Examine the form’s description to determine if it aligns with the requirements of your state and county.

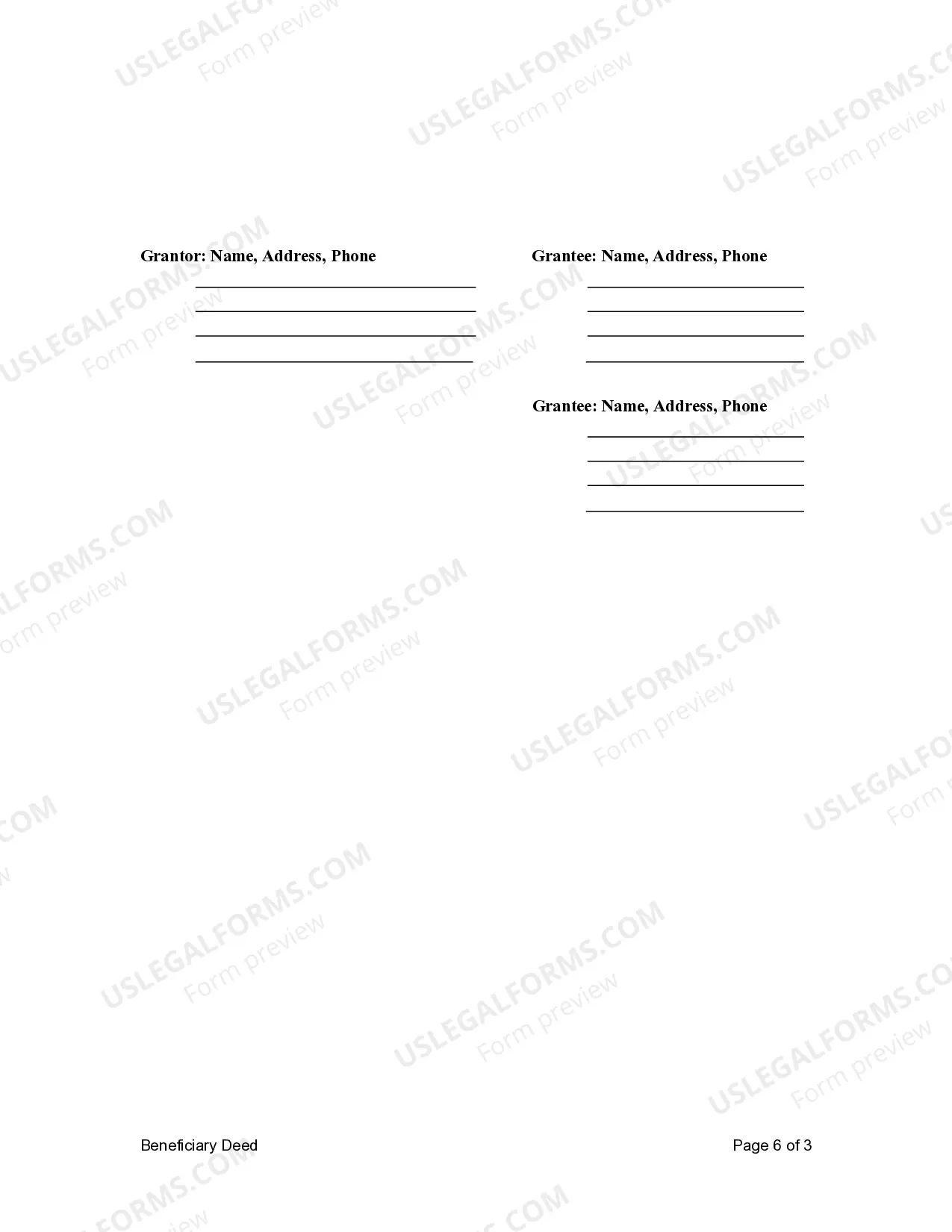

- Check the form preview, if available, to confirm that the template is what you need.

- Return to the search to locate the correct document if the Deed Tod Beneficiary Without A Trust does not fulfill your needs.

- Once you are confident about the form’s relevance, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Choose the pricing plan that meets your requirements.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Deed Tod Beneficiary Without A Trust.

- After obtaining the form on your device, you may edit it with the editor or print it and complete it manually.

Form popularity

FAQ

The most important benefit of a TOD account is simplicity. Estate planning can help minimize the legal mess left after you die. Without it, the probate system can take over the distribution of your assets. It can also name an executor of your estate and pay off your remaining debts with your assets.

While both TOD accounts and revocable trusts can both protect assets from going through probate upon the creator's death, a revocable trust can do much more. The only major benefit of a TOD account is that it can bypass probate.

Invalidation and Probate The transfer on the death deed is rendered ineffective if the designated recipient passes away before the property owner. This could cause the property to enter probate without adequate planning or execution, negating the goal of using a transfer on the death deed to avoid probate.

You can make both using WillMaker, but there are important differences. A transfer on death deed (sometimes also called a beneficiary deed) has a much more limited focus than a living trust.

The way it differs from a TOD deed is that a living trust can be used for any type of asset, not just real estate. So if you have stocks, savings accounts, valuable belongings, or other assets that you want to transfer to someone after your death, a living trust is a way to do it.