Ar Deed Beneficiary Withholding

Description

How to fill out Arkansas Transfer On Death Deed Or TOD - Beneficiary Deed For One Individual To Two Individuals?

Getting a go-to place to access the most recent and appropriate legal samples is half the struggle of dealing with bureaucracy. Choosing the right legal papers needs precision and attention to detail, which is the reason it is very important to take samples of Ar Deed Beneficiary Withholding only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and see all the details about the document’s use and relevance for your situation and in your state or region.

Consider the following steps to complete your Ar Deed Beneficiary Withholding:

- Use the library navigation or search field to find your sample.

- View the form’s information to see if it matches the requirements of your state and area.

- View the form preview, if there is one, to ensure the template is the one you are searching for.

- Resume the search and find the proper template if the Ar Deed Beneficiary Withholding does not fit your needs.

- When you are positive about the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Pick the pricing plan that fits your needs.

- Go on to the registration to complete your purchase.

- Finalize your purchase by choosing a payment method (bank card or PayPal).

- Pick the document format for downloading Ar Deed Beneficiary Withholding.

- When you have the form on your device, you can change it using the editor or print it and finish it manually.

Eliminate the inconvenience that comes with your legal documentation. Explore the extensive US Legal Forms library to find legal samples, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

If your beneficiary dies before you, the property is not part of his or her estate. Incapacity not addressed. This type of transfer does not address or protect against your incapacity or disability. The property cannot be sold to pay for your care.

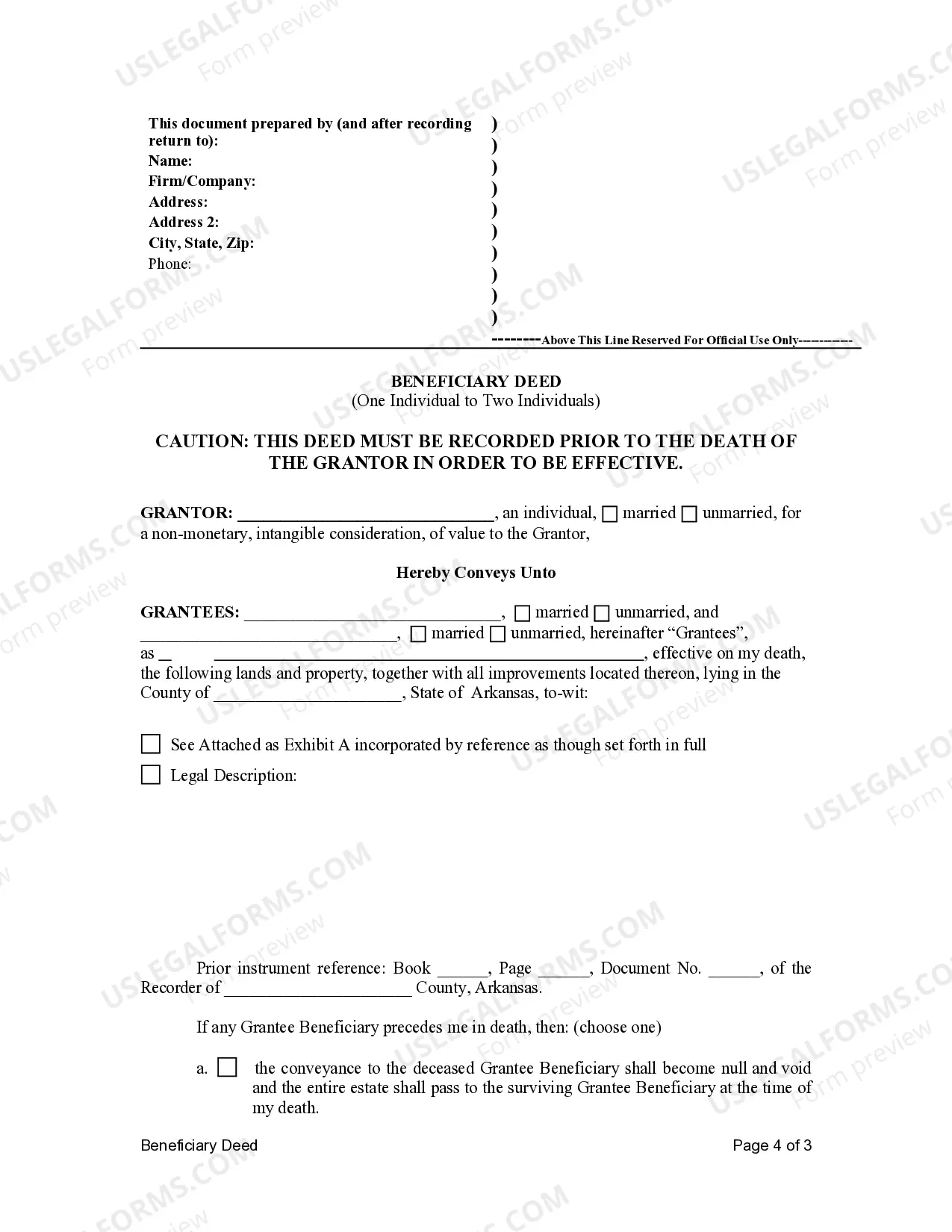

Arkansas Beneficiary (Transfer-on-Death) Deed (Ark. Code Ann. section 18-12-608.) You must sign the deed and get your signature notarized, and then record (file) the deed with the county recorder's office before your death.

To get title to the property after your death, the beneficiary must take a few administrative steps. The beneficiary can call the county clerk, circuit clerk, or recorder's office for details, but the process will likely require recording a certified copy of the death certificate. No probate is necessary.

In most cases, an Arkansas Beneficiary Deed costs $300 to prepare, and $15 for the first page and $5 for each additional page in recording costs. For a typical warranty deed, the total cost is $320 (a $300 lawyer fee and $20 in recording fees). Your deed will be prepared and recorded by a licensed Arkansas attorney.