Starting An Llc In Arkansas With H

Description

How to fill out Arkansas Limited Liability Company LLC Formation Package?

It’s clear that you cannot become a legal expert instantly, nor can you learn how to swiftly draft Starting An Llc In Arkansas With H without having a specialized education.

Assembling legal paperwork is a labor-intensive task that necessitates specific knowledge and abilities. So why not entrust the generation of the Starting An Llc In Arkansas With H to the experts.

With US Legal Forms, one of the most extensive collections of legal templates available, you can locate anything from court documents to templates for internal communication.

If you require a different template, begin your search again.

Create a free account and select a subscription plan to buy the template.

- We recognize the significance of compliance with federal and state laws and regulations.

- That’s why all forms on our website are location-specific and current.

- To begin, access our platform and acquire the document you need in just minutes.

- Find the form you need by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and review the supplementary description to confirm whether Starting An Llc In Arkansas With H is what you’re after.

Form popularity

FAQ

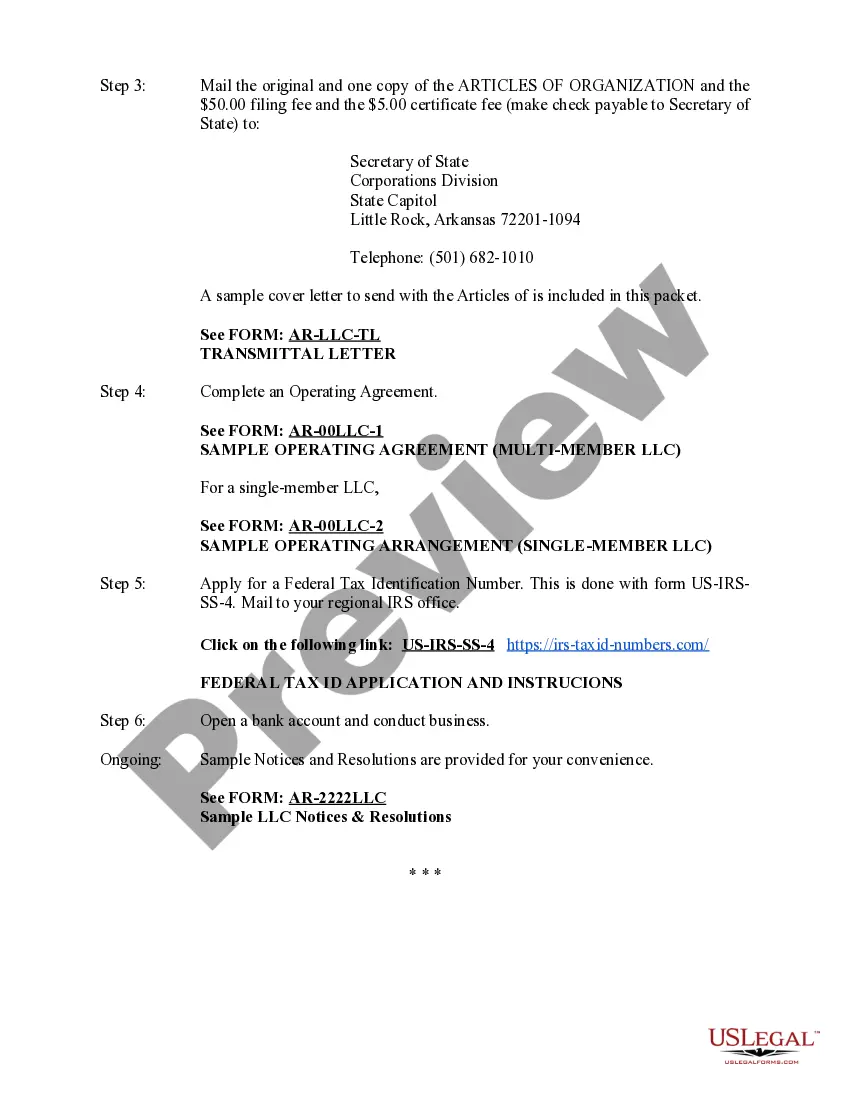

Arkansas LLC Cost. Arkansas charges a $45 state fee to form an LLC ($50 by mail). You'll also need to pay $150 every year to file a franchise tax report, and you may have to pay for additional services for your LLC?such as filing a DBA or hiring a professional registered agent.

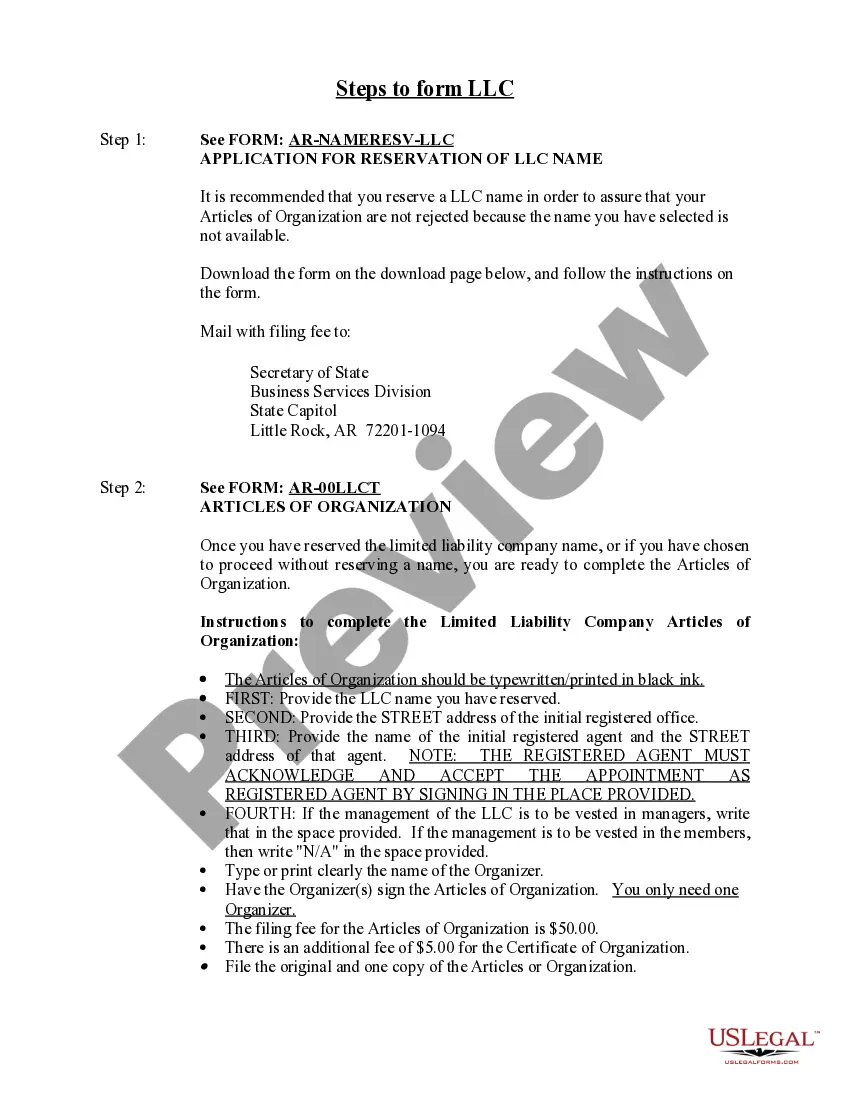

Starting an LLC in Arkansas will include the following steps: #1: Choose a Name for Your Arkansas LLC. #2: Hire a Registered Agent in Arkansas. #3: Request a Federal Employer Identification Number (EIN) #4: File Your Certificate of Organization. #5: Create an Operating Agreement. #6: Fulfill Your Ongoing Obligations.

The LLC itself does not pay federal taxes. Instead the revenue from the business is passed through to the LLC's owners, who then report it as income on their personal taxes. The owners of the Arkansas LLC will have their income taxed at the 15.3% federal self-employment tax rate.

Arkansas Naming Requirements Your name must include the phrase "limited liability company," "limited company," or the abbreviation "L.L.C.", "LLC", "L.C." or "LC" in uppercase or lowercase letters.

Starting an LLC in Arkansas will include the following steps: #1: Choose a Name for Your Arkansas LLC. #2: Hire a Registered Agent in Arkansas. #3: Request a Federal Employer Identification Number (EIN) #4: File Your Certificate of Organization. #5: Create an Operating Agreement. #6: Fulfill Your Ongoing Obligations.