Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property

Definition and meaning

A Transmutation or Postnuptial Agreement is a legal document used by married couples to convert community property into separate property. Community property refers to assets acquired during the marriage, which are jointly owned by both partners. This agreement clarifies the conversion of specific assets, ensuring they are owned individually by one spouse after the agreement is executed.

How to complete a form

To effectively complete a Transmutation or Postnuptial Agreement, follow these steps:

- Gather necessary information: Collect details such as names, addresses, and any property information that needs to be converted.

- Fill out the form: Clearly write the name of each spouse, the date of the agreement, and the specific assets being converted.

- Sign the agreement: Both parties must sign the document to validate the transmutation.

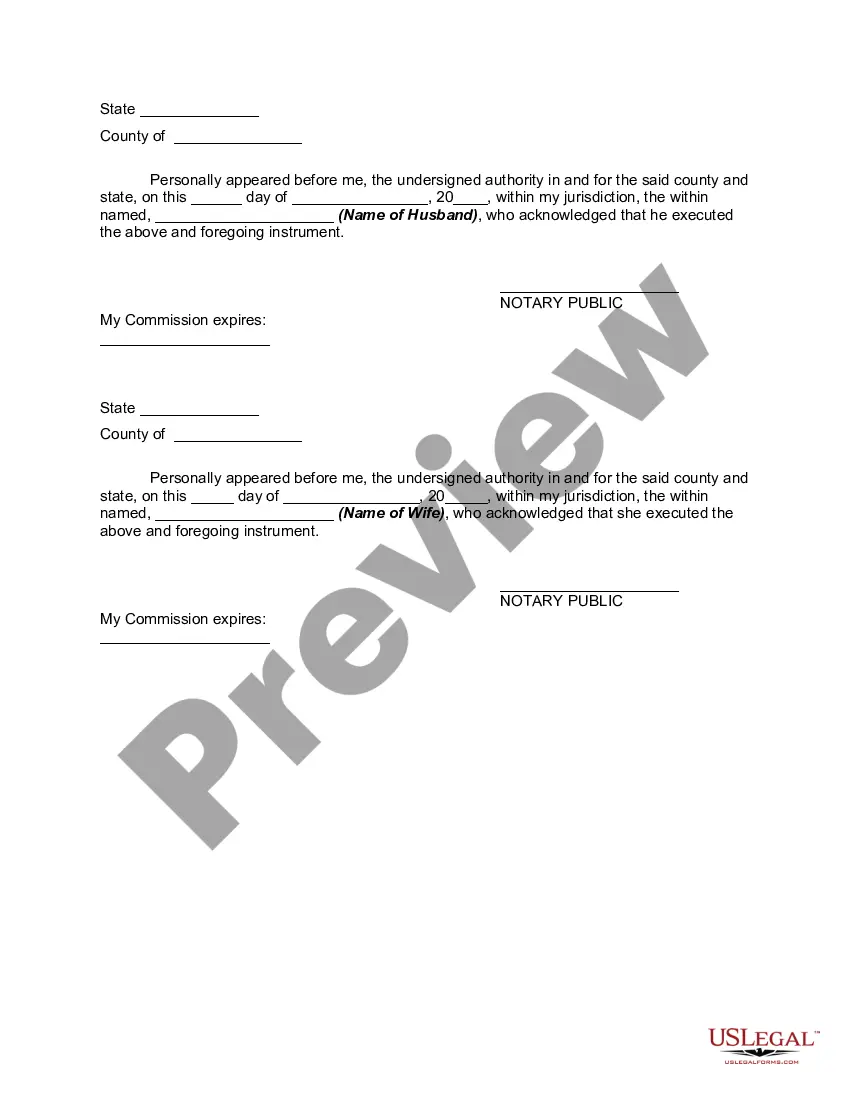

- Obtain notarization: A notary public must witness the signatures to ensure the document meets legal requirements.

Who should use this form

This form is suitable for married couples who wish to change the ownership status of their community property to protect their assets individually. It is particularly relevant for couples considering divorce, those wishing to clarify their financial arrangements, or partners wanting to allocate ownership rights of specific assets acquired during the marriage.

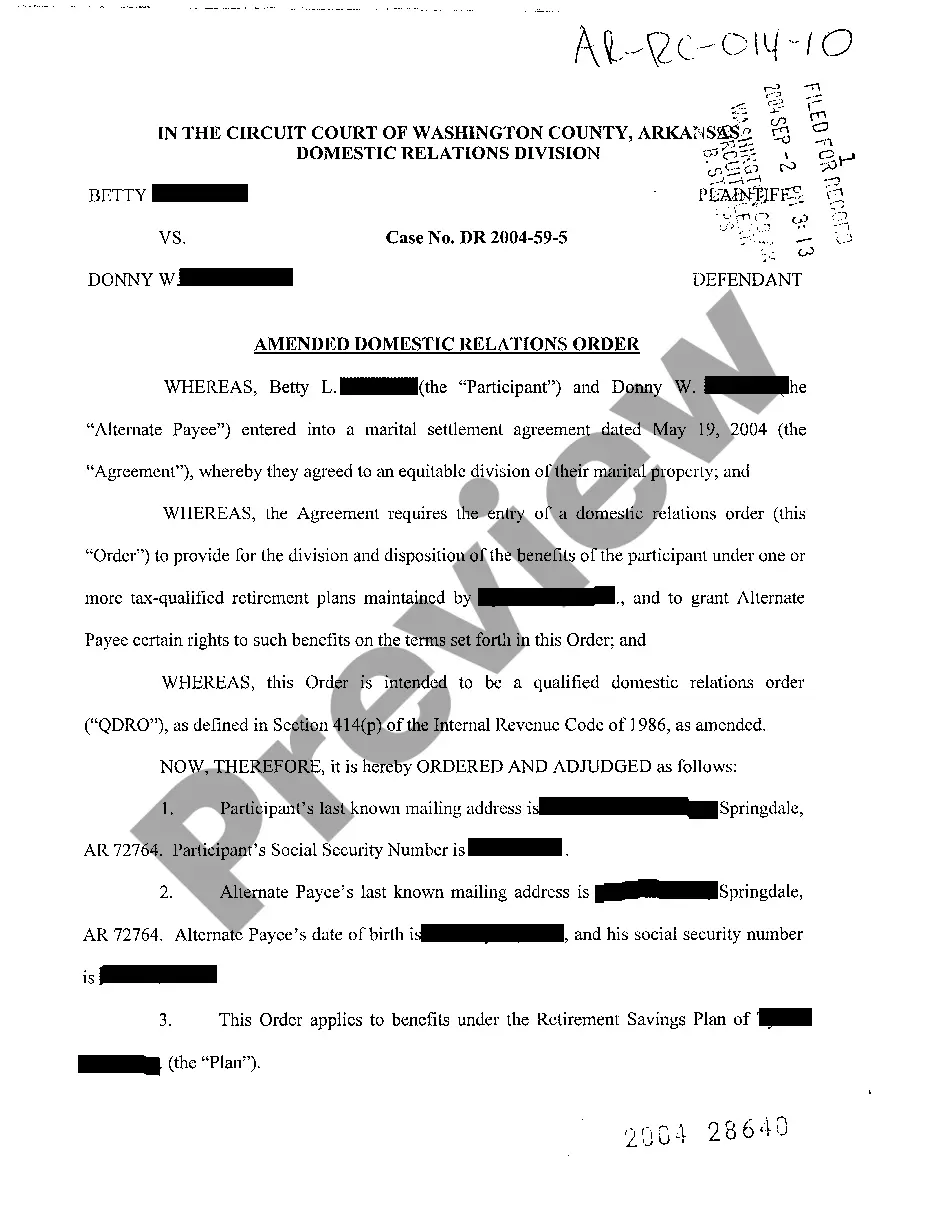

Legal use and context

The Transmutation or Postnuptial Agreement is legally recognized in many jurisdictions as a valid method for couples to change the character of their property. It provides legal clarity in matters of property division in the event of separation or divorce. Couples should ensure they understand their state’s laws concerning property rights before executing this agreement to avoid any future disputes.

Common mistakes to avoid when using this form

When completing the Transmutation or Postnuptial Agreement, consider the following common pitfalls:

- Failing to specify all assets: Ensure that the agreement lists all relevant property being converted.

- Inadequate signatures: Both parties must sign the form for it to be valid.

- Not obtaining notarization: Without a notary public's witness, the agreement may not hold legal weight.

What to expect during notarization or witnessing

During the notarization process:

- Both parties will need to present valid identification to the notary public.

- The notary may ask questions to ensure both parties understand the agreement.

- Once signed, the notary will add their seal and signature to verify the document's authenticity.

Form popularity

FAQ

Make an informal agreement. make a financial agreement. (link is external) get a consent order from the court.

When you get divorced, community property is generally divided equally between the spouses, while each spouse gets to keep his or her separate property. Equitable distribution: In all other states, assets and earnings accumulated during marriages are divided equitably (fairly) but not necessarily equally.

California is a community property state, not an equitable distribution state. This means that any assets or property gained during the course of a marriage belong equally to both spouses and, therefore, the property must be equally divided between the two spouse by the court in a divorce.

At divorce, community property is generally divided equally between the spouses, while each spouse keeps his or her separate property. Equitable distribution. In all other states, assets and earnings accumulated during marriage are divided equitably (fairly), but not necessarily equally.

Equitable distribution, also known as equitable division or division of property, takes into account a variety of factors when dividing assets and debts, including how long the parties were married, their needs, and the financial contribution each party made during the marriage.

Can my wife/husband take my house in a divorce/dissolution? Whether or not you contributed equally to the purchase of your house or not, or one or both of your names are on the deeds, you are both entitled to stay in your home until you make an agreement between yourselves or the court comes to a decision.

Separate property can become marital property if it is mixed with marital property. For example, if one of the spouses uses money they had before the marriage to buy a house for the couple, that money might become marital property.

Transmutation means to change form, and in the context of California, Orange County divorce cases, transmutation means that property has changed form or character in one of the following ways: Property changed from community property to separate property. Property changed from separate property to community property;

The key to proving separate property is documentation and showing a paper trail to trace your separate property. Tracing is the method used when your original separate property has changed form, been exchanged, or sold during your marriage, resulting in you owning different property at the time of divorce.