Life Estate Deed Explained

Description

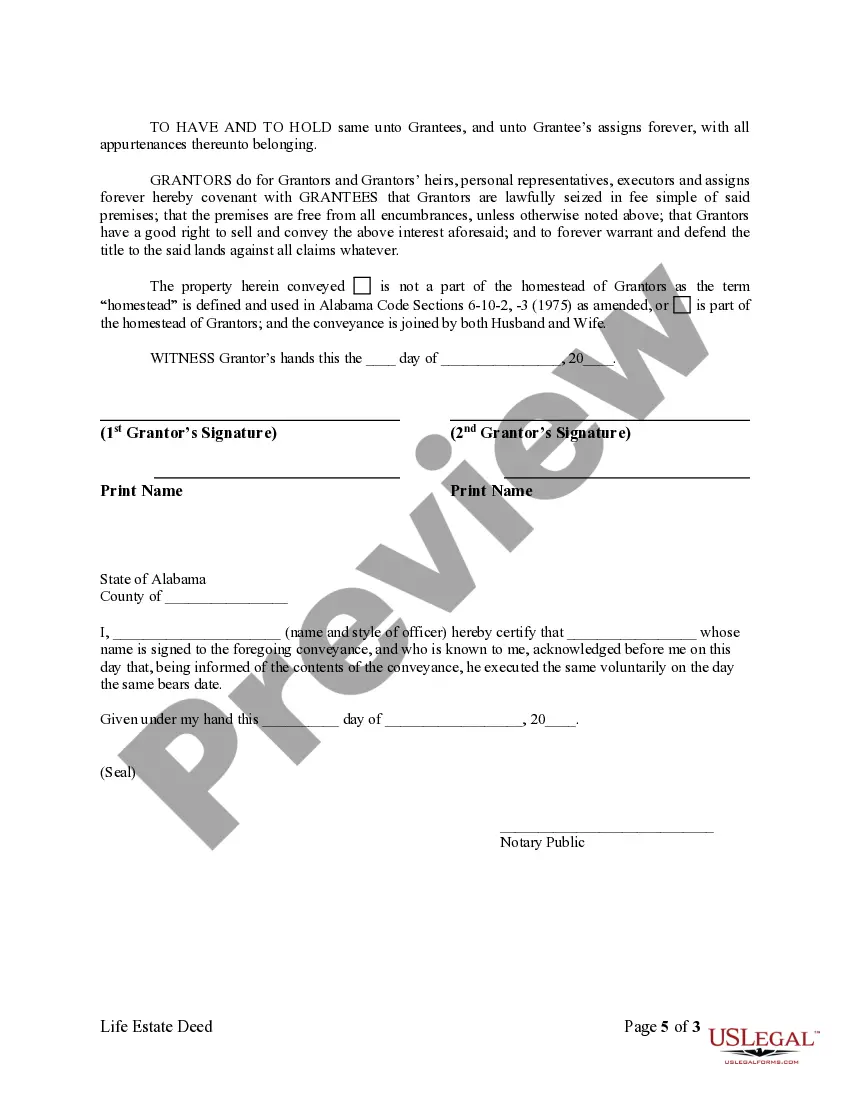

How to fill out Alabama Warranty Deed For Retention Of Life Estate (Husband And Wife To Husband And Wife)?

- If you're a returning user, log in to your account to download the life estate deed template you need. Ensure your subscription is current; if not, renew it as per your payment plan.

- If this is your first visit, start by exploring the Preview mode alongside the form description. Confirm that you've selected the correct deed that aligns with your requirements and complies with local laws.

- Search for additional templates if necessary. Should you encounter any inconsistencies, utilize the Search feature to find the appropriate form.

- Purchase your selected document by clicking the Buy Now button. Choose your preferred subscription plan and register for an account for full access.

- Complete your transaction by entering your credit card information or PayPal details to finalize your subscription.

- Finally, download the life estate deed template to your device. Access it anytime under the My Forms section of your profile.

In conclusion, US Legal Forms provides a simple and effective way to manage your legal documentation needs with a vast resource library. With tools to help you ensure accuracy and compliance, you're backed by a supportive network of legal experts.

Start your journey in estate planning today with US Legal Forms!

Form popularity

FAQ

While a life estate deed explained can provide benefits, it also presents drawbacks. One significant disadvantage is that the life tenant cannot easily sell or modify the property without the consent of the remainderman. Additionally, the life tenant remains responsible for property taxes and upkeep during their lifetime. This arrangement may lead to potential conflicts among family members over property rights and management.

Selling a home with a life estate deed explained is possible, but it comes with limitations. The life tenant has the right to live in the property during their lifetime, which can complicate the sale. However, if both the life tenant and future interest holder consent, they may be able to sell the property with appropriate legal steps. Otherwise, the life tenant typically maintains their rights until their death.

In most cases, a will cannot override a life estate deed explained. The deed establishes a clear transfer of property rights that takes effect upon the life tenant's death. Therefore, any provisions in a will regarding that property generally do not apply. It's essential to review the deed and consult an expert to understand your specific situation.

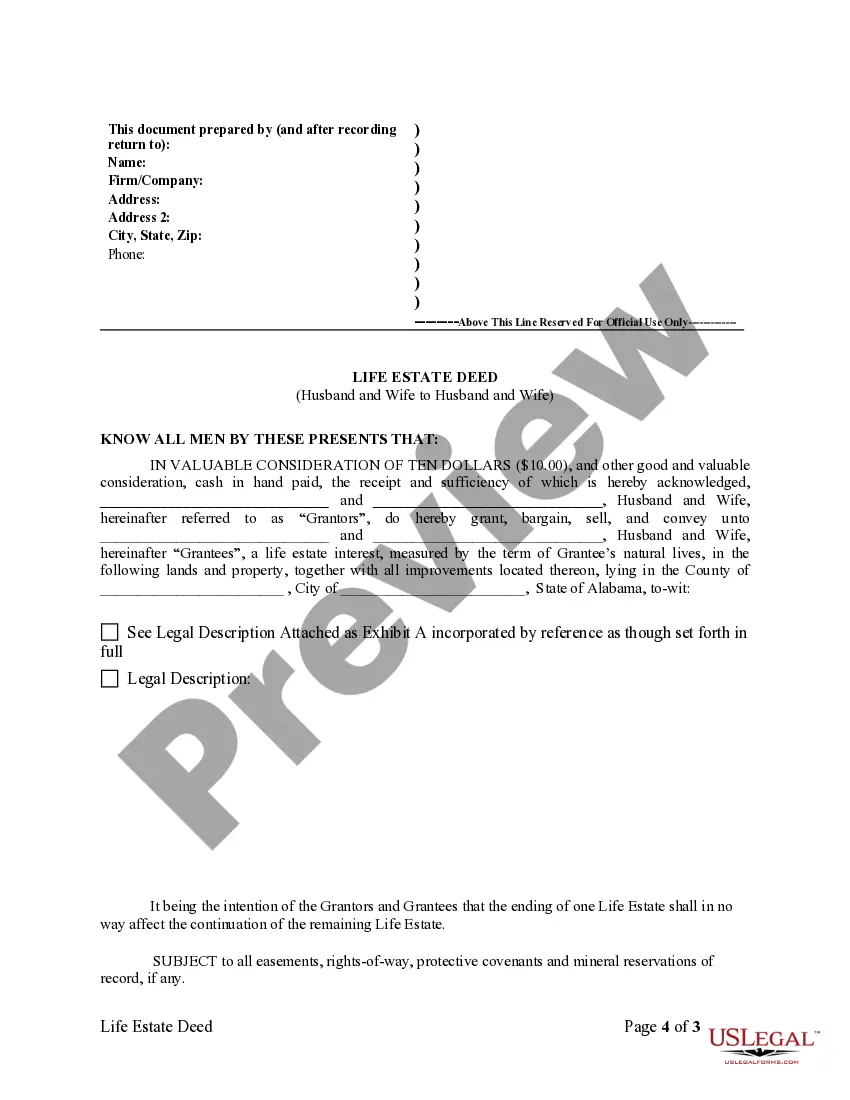

A life estate deed explained is a legal document that grants someone the right to live in or use a property for their lifetime. After that person's death, ownership automatically transfers to another individual or entity. This arrangement allows property owners to maintain control while ensuring their assets pass to chosen heirs. It simplifies the transfer process and may help avoid probate.

Getting around a life estate can be complex, but understanding the rules helps. Typically, the owner of a life estate does not have full control over the property until the life estate ends. In some cases, you might need to negotiate with the remainderman, who benefits once the life estate is over. For those looking for a clear explanation and guidance, our platform, US Legal Forms, offers resources that clearly explain life estate deeds and provide legal forms to navigate these situations effectively.

Selling a house with a life estate deed can be complex, as the life tenant cannot unilaterally sell the property. Both the life tenant and remainderman must agree to the transaction. Therefore, having the life estate deed explained thoroughly is crucial for anyone considering this option, and platforms like uslegalforms can offer valuable guidance.

Some negatives of a life estate include the potential tax implications for the remainderman and restrictions on the life tenant’s ability to sell the property. Additionally, if the life tenant incurs debts, creditors may target the property, affecting the remainderman's interest. Understanding the life estate deed explained can help individuals anticipate these challenges and make more informed decisions.

A significant advantage of a life estate deed is that it allows individuals to retain the use and enjoyment of their property during their lifetime while providing for a seamless transfer to heirs. This deed can minimize tax implications and help bypass probate, saving time and costs. Grasping the concept of life estate deed explained offers clarity on these benefits for effective estate planning.

One main disadvantage of a life estate is the limited control over the property. The life tenant cannot sell or modify the property without the consent of the remainderman. This lack of flexibility can lead to complications, especially if family dynamics change. Therefore, it’s essential to weigh the life estate deed explained carefully before proceeding.

People often create life estates to ensure that their property passes to a chosen beneficiary after their death. This arrangement can simplify the transfer of property and avoid the complex probate process. Understanding life estate deed explained helps individuals secure their estate preservation plans and provide for their loved ones.