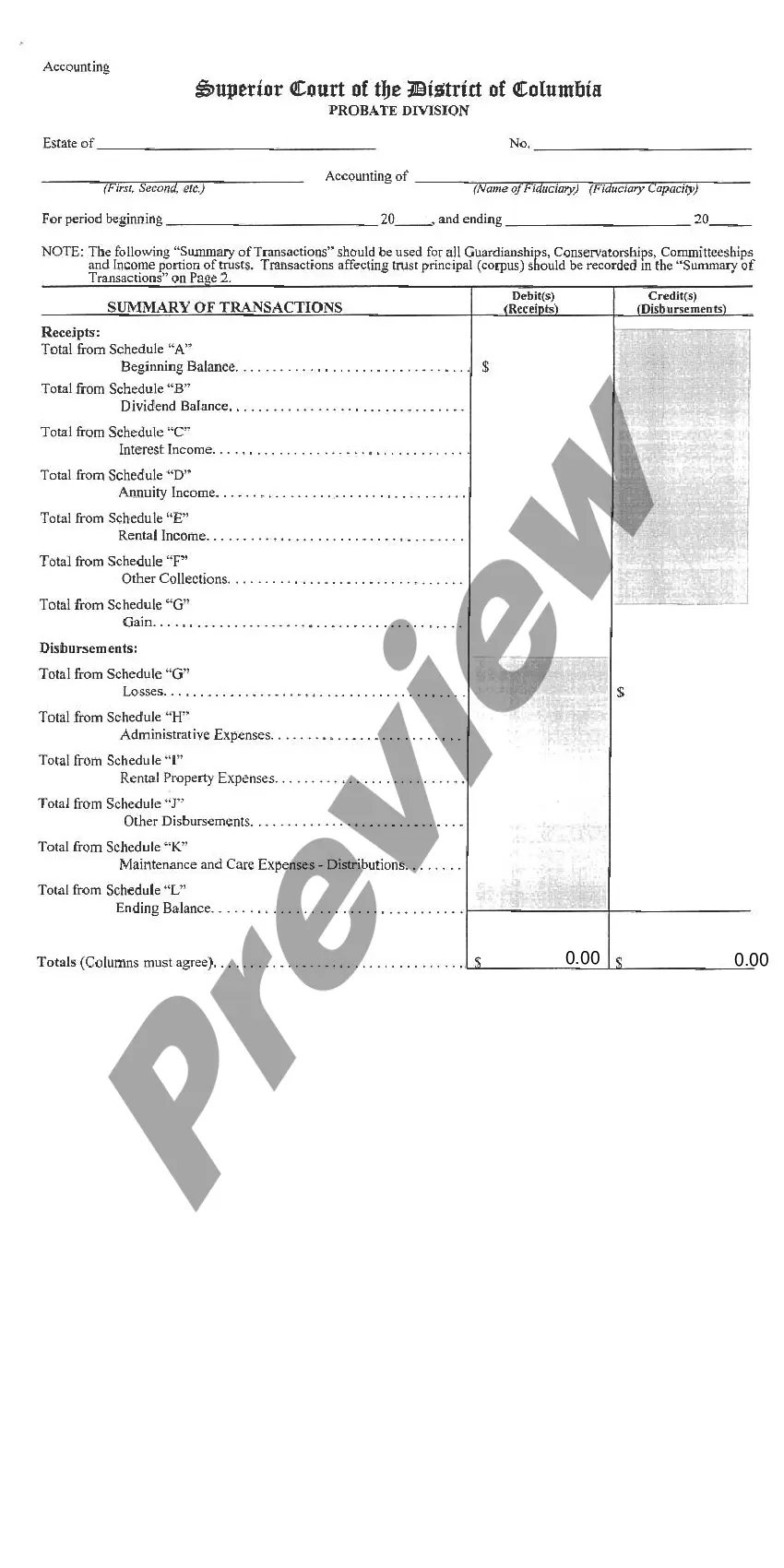

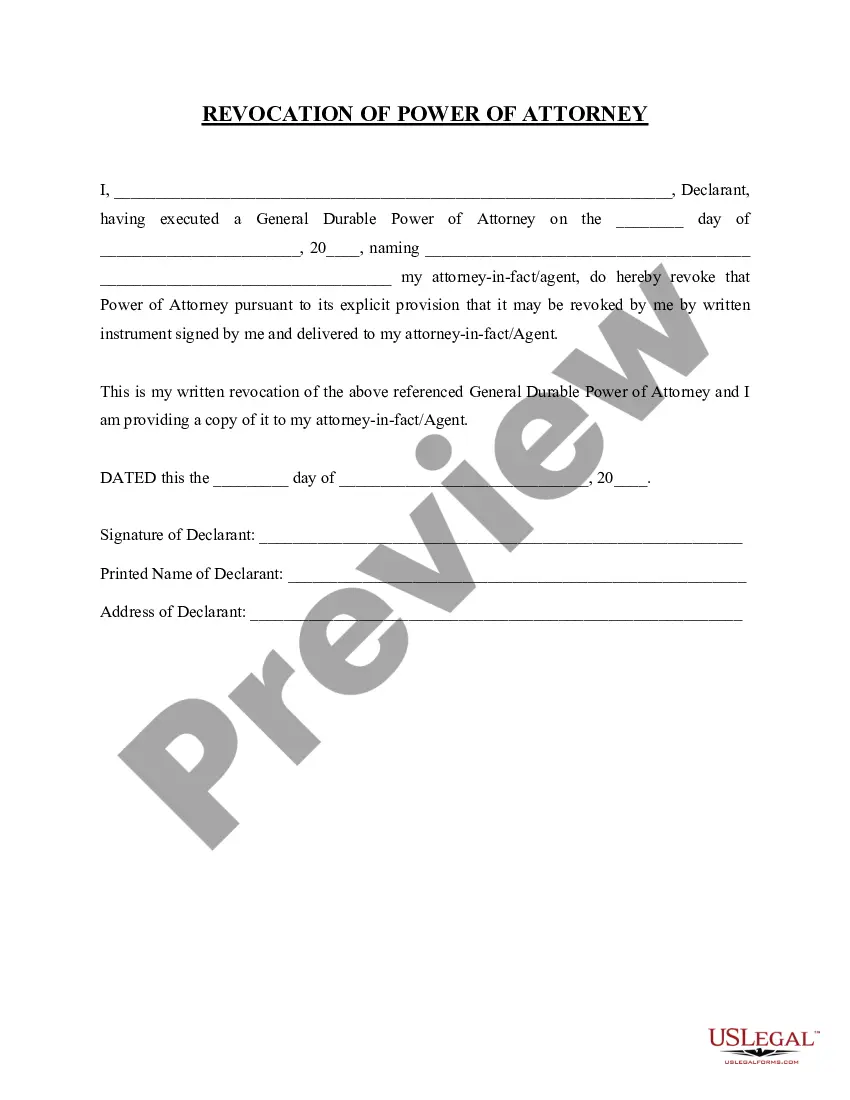

Alabama Power Of Attorney Form Withholding

Description

How to fill out Alabama Revocation Of General Durable Power Of Attorney?

Navigating through the administrative complexity of official documents and templates can be challenging, particularly when one does not engage in that professionally.

Even locating the correct template for an Alabama Power Of Attorney Form Withholding will be labor-intensive, as it must be accurate and precise to the last digit.

However, you will need to invest significantly less time obtaining a suitable template from a reliable resource.

Obtain the correct document in just a few straightforward steps: Enter the title of the document into the search bar. Identify the appropriate Alabama Power Of Attorney Form Withholding in the results. Review the description of the example or view its preview. If the template meets your requirements, click Buy Now. Choose your subscription plan. Provide your email and create a password to set up an account at US Legal Forms. Select a credit card or PayPal as your payment method. Download the template file to your device in your preferred format. US Legal Forms will save you time and effort in determining if the document you found online is appropriate for your requirements. Establish an account and gain unlimited access to all the templates you need.

- US Legal Forms is a service that streamlines the process of locating the appropriate documents online.

- US Legal Forms is the one-stop destination for recent examples of documents, guidance on their usage, and downloading these examples for completion.

- It comprises a repository with over 85,000 documents applicable in various domains.

- When searching for an Alabama Power Of Attorney Form Withholding, you need not question its authenticity, as all documents are verified.

- Creating an account at US Legal Forms will guarantee that you have all the necessary examples at your fingertips.

- You can store them in your history or add them to the My documents catalog.

- You can retrieve your saved documents from any device by simply clicking Log In on the library site.

- If you do not yet have an account, you can always search for the document you require.

Form popularity

FAQ

2020 Form OR-40. Oregon Individual Income Tax Return for Full-year Residents.

Alabama Withholding Tax Account NumberIf you are a new business, register online with the AL Department of Revenue.If you already have an AL Withholding Tax Account Number, you can find this on correspondence from the AL Department of Revenue or by contacting the agency at 334-242-1584.

Form 40A is Alabama's Individual Resident Income Tax Return (short version) and it applies to full year residents only. Please keep in mind that if you file Form 40A close to the deadline, there might be a delay of 90 days until you receive the refund.

How To Get an Alabama Financial Power of Attorney FormChoose an agent. Your agent must be over age 18 and willing and able to act in your best interests.Assign duties to your agent. Your agent's duties depend entirely on you.Hire a notary public.Distribute copies.Revoking a Financial Power of Attorney.

You must complete your U.S. income tax return first, before you can prepare the Alabama tax return. The UA Tax Office usually hosts several tax seminars with the Alabama Department of Revenue to assist nonresident aliens with filing the Alabama tax return.