Power Attorney Revoke With Irs

Description

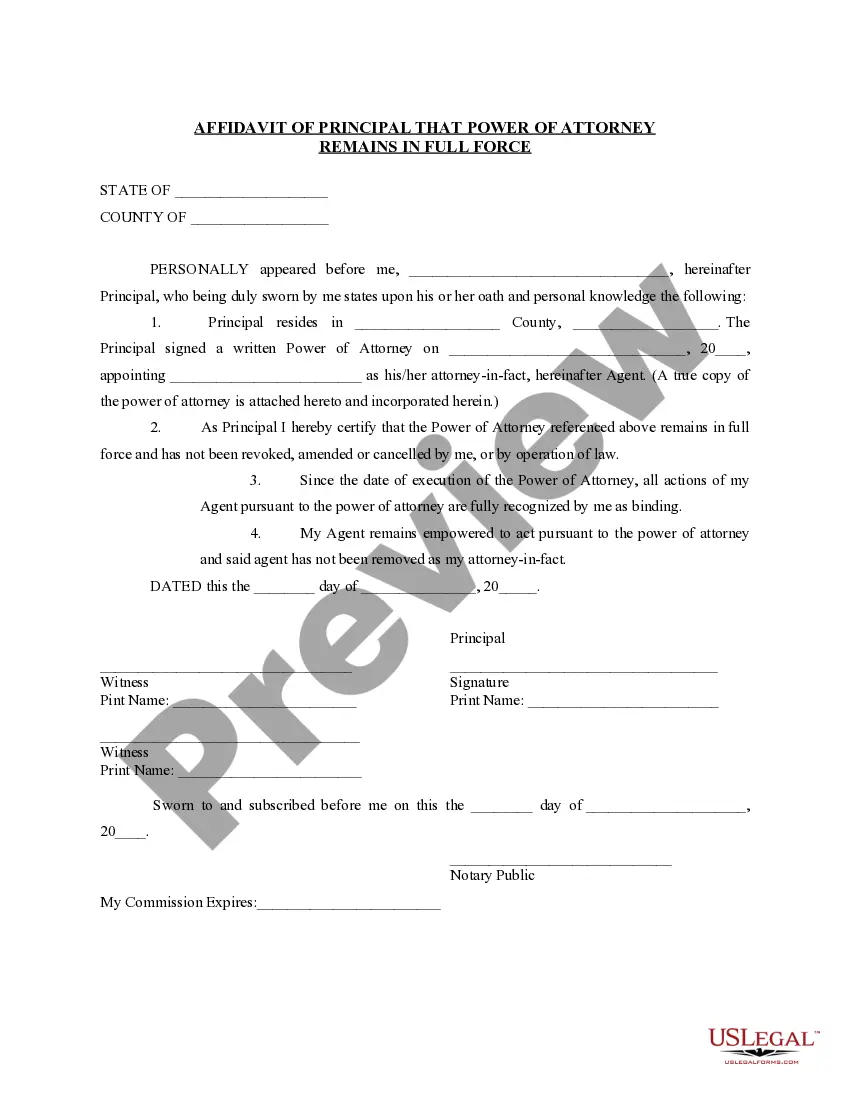

How to fill out Affidavit Of Principal That Power Of Attorney Not Revoked And In Full Force?

Obtaining legal document examples that adhere to federal and state regulations is crucial, and the web provides numerous choices to select from.

However, what’s the use of spending time searching for the properly drafted Power Attorney Revoke With Irs example online when the US Legal Forms online library already has such documents compiled in one location.

US Legal Forms is the largest digital legal repository with over 85,000 editable templates created by lawyers for any business and personal situation.

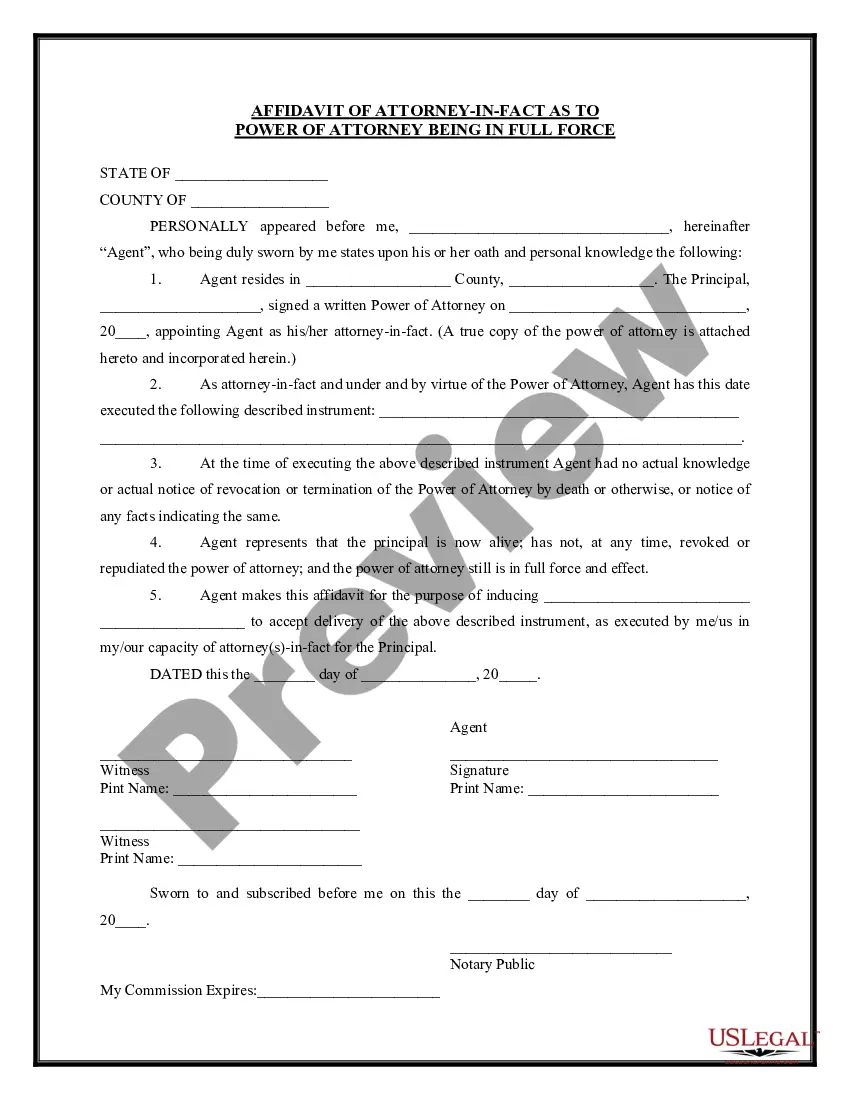

Review the template using the Preview feature or through the textual description to ensure it suits your needs.

- They are simple to navigate with all documents categorized by state and intended use.

- Our experts keep abreast of legal changes, ensuring your documents are current and compliant when obtaining a Power Attorney Revoke With Irs from our site.

- Acquiring a Power Attorney Revoke With Irs is fast and straightforward for both existing and new users.

- If you have an account with an active subscription, sign in and download the document sample you need in the desired format.

- If you are a newcomer to our site, follow the steps below.

Form popularity

FAQ

Form 8821 authorizes the IRS to disclose your confidential tax information to the person you appoint. This form is provided for your convenience and its use is voluntary. The information is used by the IRS to determine what confidential tax information your appointee can inspect and/or receive.

Form 2848, Power of Attorney and Declaration of RepresentativePDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information AuthorizationPDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.

To revoke an authorization, the taxpayer must write ?REVOKE? across the top of the Form 2848 or 8821 and sign and date ing to the form's instructions. To withdraw as a representative on a Form 2848, write ?WITHDRAW? across the top of the first page of the form and sign and write the date below this annotation.

Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.

Learn How to Fill the Form 2848 Power of Attorney and ... - YouTube YouTube Start of suggested clip End of suggested clip And allows space for additions or deletions from the standard to allow the taxpayer to define theMoreAnd allows space for additions or deletions from the standard to allow the taxpayer to define the scope of the power of attorney. If the standard form is acceptable. Leave box 5 blank.