Alabama Estate Executor With A Trust

Description

Form popularity

FAQ

Selecting an executor of a trust involves considering various factors, such as trustworthiness, organizational skills, and financial knowledge. It is wise to choose someone who understands your wishes and maintains open communication with beneficiaries. Furthermore, appointing an Alabama estate executor with a trust can provide peace of mind, knowing they have the expertise to effectively manage the distribution of your assets according to your wishes.

Trust laws in Alabama require that a written document clearly outlines the terms and conditions of the trust. The trust must also designate a trustee to manage the assets on behalf of the beneficiaries. Furthermore, Alabama recognizes different types of trusts, including revocable and irrevocable trusts, each serving unique purposes. Consulting an Alabama estate executor with a trust can clarify these rules to tailor a plan that fits your needs.

To avoid probate in Alabama, consider setting up a trust, which allows assets to transfer directly to your beneficiaries. Additionally, naming beneficiaries on accounts and establishing joint ownership can also help bypass probate. Implementing these strategies early in life can reduce the burden on your loved ones. An Alabama estate executor with a trust can guide you through effective methods to minimize or eliminate probate.

In Alabama, several types of assets are exempt from probate, including life insurance policies with named beneficiaries, jointly owned property, and retirement accounts. This means these assets can pass directly to the recipients without going through probate court. Understanding these exemptions can benefit your estate planning strategies. Working with an Alabama estate executor with a trust can help you identify and maximize these exemptions.

A trust cannot serve as an executor itself, but it can designate a trustee to handle the distribution of assets according to the trust’s terms. When an Alabama estate involves a trust, it benefits from the expertise of the appointed trustee. This can streamline the estate administration process and provide clarity among beneficiaries. An experienced Alabama estate executor with a trust can help ensure the trust's provisions are honored.

Yes, a trust effectively avoids probate in Alabama. When you place your assets in a trust, they are not subject to probate court, allowing for a quicker distribution to your beneficiaries. This feature often results in lower costs and less time spent managing the estate. Utilizing an Alabama estate executor with a trust can make this process more efficient and seamless.

Changing the executor of a trust in Alabama involves reviewing the trust documents to ensure proper procedures are followed. Typically, the current executor must agree to relinquish their position, and a new executor should be formally appointed. It is important to update the trust documentation to reflect this change for clarity. US Legal Forms can assist you with the necessary forms to ensure a straightforward transition.

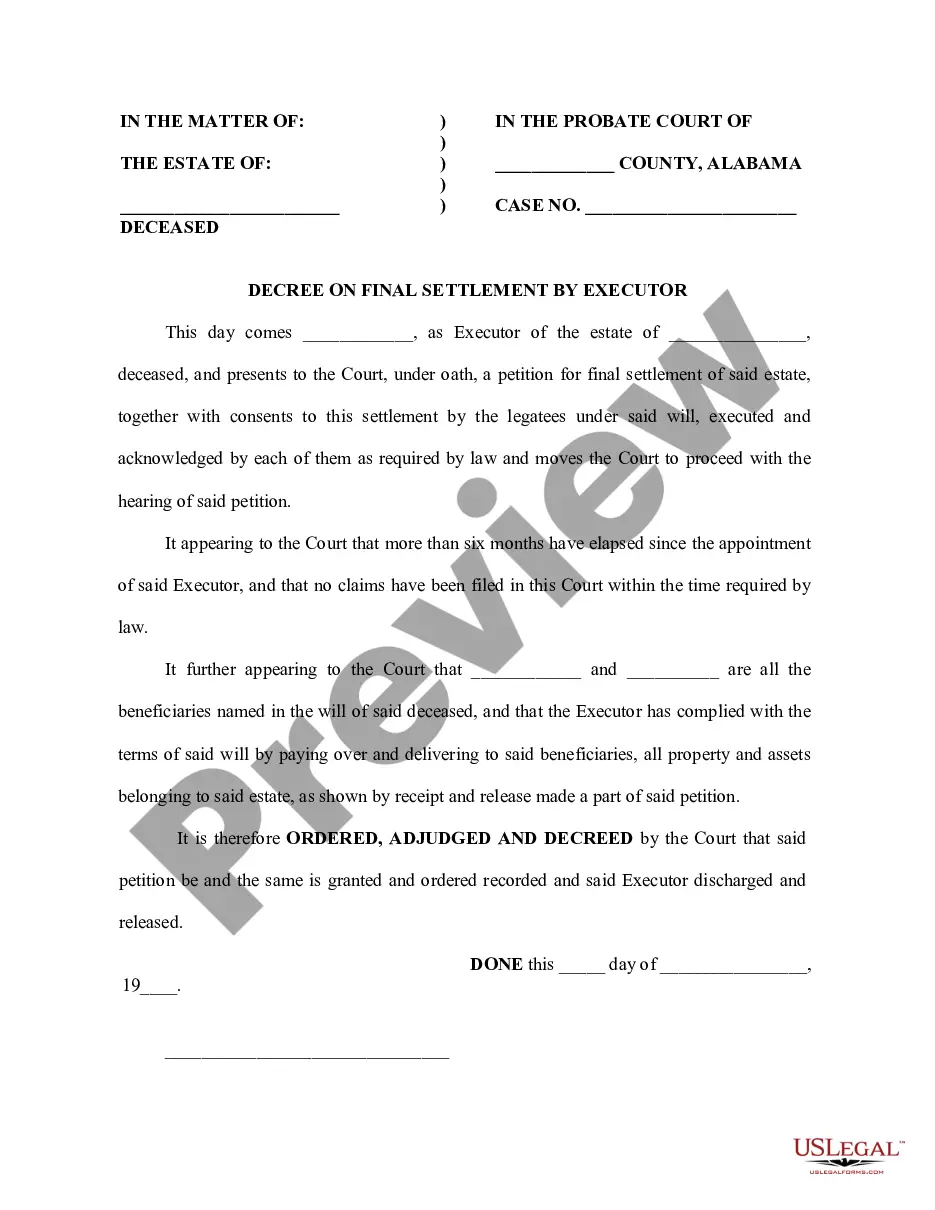

To file as an Alabama estate executor with a trust, start by gathering the necessary documents, including the will and death certificate. Next, submit these documents to the probate court in the county where the deceased lived. The court will then verify the will and appoint you as the executor, allowing you to manage the estate. For a smoother process, consider using US Legal Forms to access the required forms and guidelines.

Even if you have a trust, having an Alabama estate executor with a trust can still be beneficial. Trusts typically transfer your assets outside of probate, but an executor may still be necessary if you have assets not included in the trust. This person ensures that all facets of your estate are addressed and managed according to your wishes. Exploring resources on USLegalForms can help clarify the roles and offer guidance for your specific situation.

An Alabama estate executor with a trust holds significant responsibilities and powers. This role includes managing the trust's assets, making distributions to beneficiaries, and ensuring all financial obligations are met. The executor must act in the best interests of the trust and its beneficiaries, following the trust document's instructions. You can rely on platforms like USLegalForms to guide you through the specific duties involved.