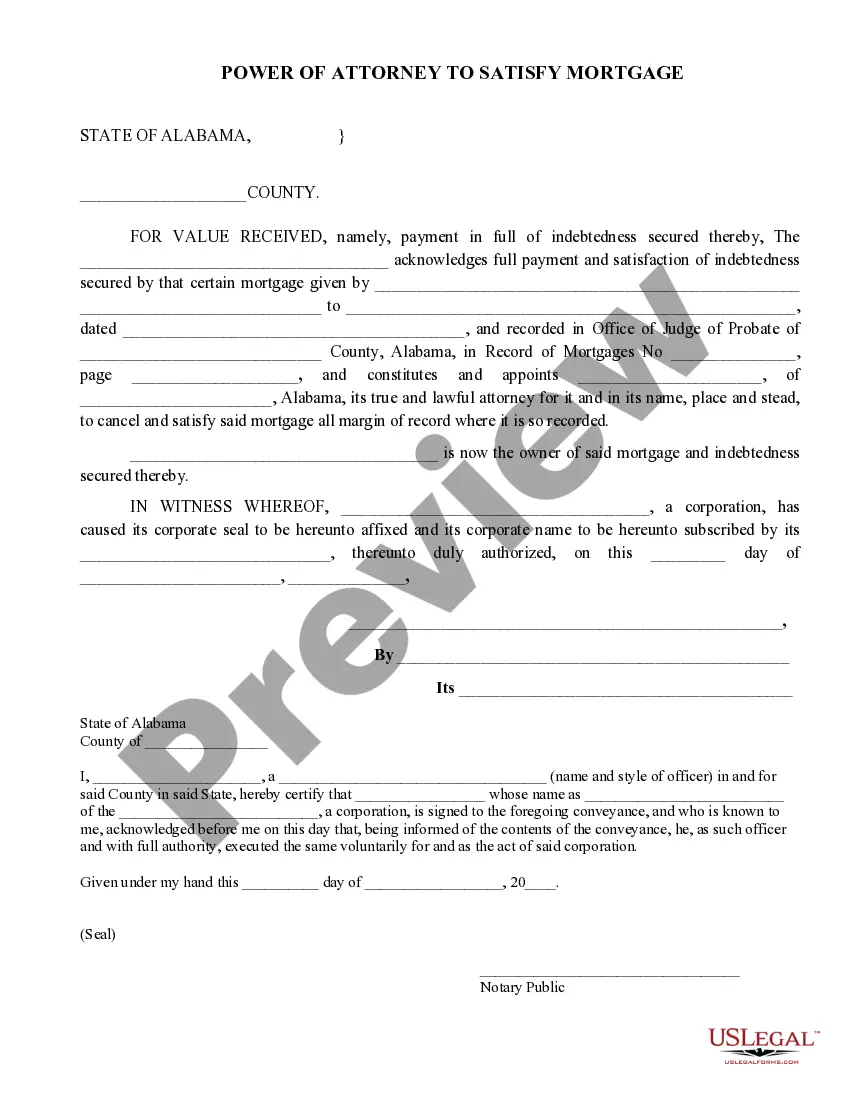

This is a sample of a Power of Attorney to Satisfy Mortgage used to acknowledge that a mortgage obligation has been satisfied and to appoint another to act on behalf of the note holder to cancel and satisfy the mortgage.

Power Of Attorney For A Mortgage Alabama Form 2019

Description

How to fill out Alabama Power Of Attorney To Satisfy Mortgage?

When you need to submit the Power Of Attorney For A Mortgage Alabama Form 2019 that adheres to your local state's rules, there can be numerous choices available.

There's no requirement to review every form to ensure it fulfills all the legal requirements if you are a US Legal Forms member.

It is a trustworthy service that can assist you in obtaining a reusable and current template on any topic.

Utilize the Preview mode and examine the form description if available.

- US Legal Forms is the most extensive online directory with a compilation of over 85k ready-to-use documents for business and personal legal events.

- All templates are verified to comply with the laws of each state.

- As a result, when downloading the Power Of Attorney For A Mortgage Alabama Form 2019 from our site, you can be assured that you possess a legitimate and current document.

- Acquiring the necessary sample from our platform is quite straightforward.

- If you already have an account, simply Log In to the system, ensure your subscription is active, and save the chosen file.

- Later, you can access the My documents section in your profile and retrieve the Power Of Attorney For A Mortgage Alabama Form 2019 at any time.

- If it's your initial experience with our library, please follow the instructions below.

- Browse the suggested page and verify it for alignment with your criteria.

Form popularity

FAQ

Notarization Requirement While Alabama does not technically require you to get your POA notarized, notarization is very strongly recommended. Under Alabama law, when you sign your POA in the presence of a notary public, you signature is presumed to be genuinemeaning your POA is more ironclad.

There are different types of power of attorney and you can set up more than one.Ordinary power of attorney.Lasting power of attorney (LPA)Enduring power of attorney (EPA)

How To Get an Alabama Financial Power of Attorney FormChoose an agent. Your agent must be over age 18 and willing and able to act in your best interests.Assign duties to your agent. Your agent's duties depend entirely on you.Hire a notary public.Distribute copies.Revoking a Financial Power of Attorney.

One must mention the following details on the Power of Attorney format PDF:The name of the principal.The name of the agent.Signature.Details and legal authorities provided to the agent.Other details depending on the Power of Attorney format for authorized signatories.

A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care. A limited power of attorney restricts the agent's power to particular assets.