Revocation Living Trust For Property

Description

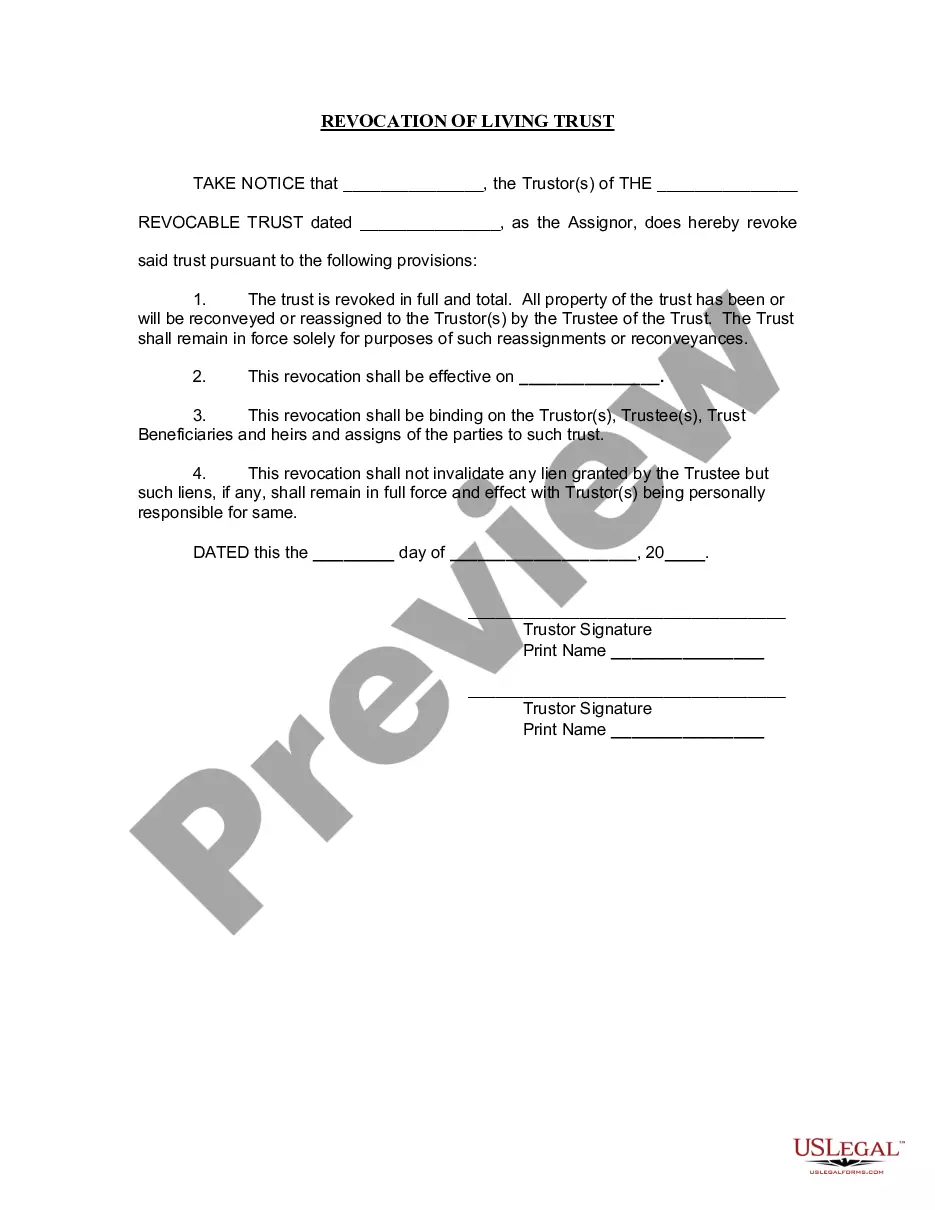

How to fill out Alabama Revocation Of Living Trust?

- If you have an existing account, log in and download the necessary form template. Ensure your subscription is active.

- For first-time users, start by reviewing the form description and preview mode. Confirm that it aligns with your local jurisdiction's requirements.

- If you need a different template, utilize the Search feature to find the one that fits your criteria. Once you find a suitable option, proceed to the next step.

- Purchase the document by clicking the Buy Now button. Choose a subscription plan that suits your needs and set up an account to access the library.

- Complete your payment using credit card details or your PayPal account to finalize your subscription.

- Download the form onto your device, ensuring you can easily access it again in the My Forms section of your profile.

In conclusion, US Legal Forms provides a valuable service that empowers individuals and attorneys to efficiently manage their legal documents. With a vast library and expert support, preparing your revocation living trust for property is easier than ever.

Start today by visiting US Legal Forms to simplify your legal needs!

Form popularity

FAQ

Yes, you can amend a revocation living trust for property at any time while you are alive and competent. This flexibility allows you to make changes to beneficiaries, assets, and terms as your circumstances evolve. You simply create an amendment document that specifies the changes and attach it to your original trust. Utilizing online platforms like US Legal Forms can make this process simpler and more efficient.

While a revocation living trust for property provides many benefits, it also has some disadvantages. One key drawback is that it does not provide asset protection from creditors, as you still have control over the assets. Additionally, setting up a revocable trust can involve initial costs and requires time to fund it correctly. Understanding these aspects can help you make an informed decision.

You should review your revocation living trust for property at least every few years or after significant life changes. These life changes can include marriage, divorce, the birth of a child, or a change in your financial situation. Regular updates ensure that your trust reflects your current intentions and offers the protection you need. By staying on top of these updates, you maintain the effectiveness of your trust.

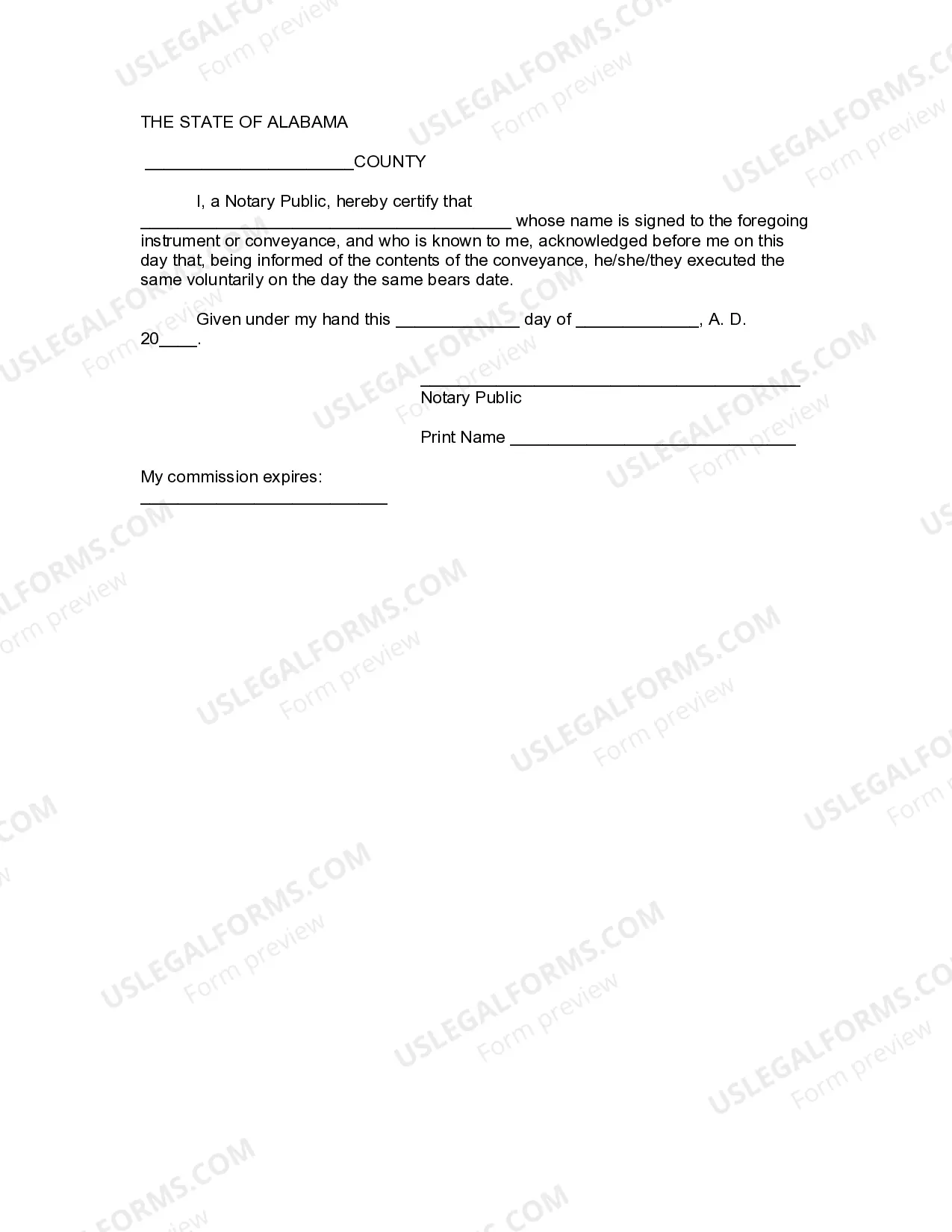

Revoking a revocable trust is a straightforward process, typically involving a written document that states your intent to revoke. This document should be signed and dated, making it clear that you wish to dissolve the trust and distribute its assets as you see fit. Knowing how to manage your estate efficiently is vital, and resources like USLegalForms can guide you in correctly executing your revocation living trust for property.

A revocable trust becomes irrevocable when the grantor passes away or formally decides to change its status. At that point, the trust's terms become fixed, and no further amendments can be made. Understanding this transition is key to effective estate planning, especially regarding your revocation living trust for property. Utilizing services such as USLegalForms can provide valuable insights and documents to facilitate this process.

Generally, a nursing home cannot take your revocable trust for property. However, assets within the trust may be considered when determining eligibility for Medicaid or other assistance programs. It's crucial to understand how these programs view trusts, as they might influence your financial planning. To navigate these complexities, consider consulting with a legal expert or using platforms like USLegalForms to obtain resources tailored to your situation.

Certain assets may not be ideal for inclusion in a revocable trust, such as retirement accounts and life insurance policies. These assets have their own designation processes that may bypass probate. Therefore, balancing your overall estate plan is key when considering a revocation living trust for property.

While there are advantages, disadvantages exist as well. Revocable trusts may offer limited protection against creditors, and you can lose some control over your home. Therefore, careful consideration of a revocation living trust for property is essential to ensure it aligns with your financial goals.

A trust can be terminated through revocation by the creator, by reaching the trust's purpose, or by the death of the trust's beneficiaries. Understanding these methods is crucial for proper estate planning. By learning about the revocation living trust for property, you can effectively manage your assets.

A revocation of living trust involves formally canceling an existing trust agreement, thereby nullifying its legal effects. This process can occur if the trust creator decides to change their estate plan. It is vital to consider how a revocation living trust for property impacts your assets and future plans.