Amendment Living Trust With Pour-over Will

Description

Form popularity

FAQ

Setting up a trust involves several potential pitfalls. Many people overlook the need for careful drafting and ongoing management, which can result in compliance issues later. Furthermore, failing to update an amendment living trust with pour-over will as family circumstances change can lead to confusion and legal challenges. Engaging with uslegalforms can simplify this process and help ensure everything is in order.

One downside of a family trust is that it may restrict access to assets until certain conditions are met, which can frustrate beneficiaries. Additionally, if not properly structured, an amendment living trust with pour-over will might lead to unintended tax implications. To avoid these pitfalls, it’s vital to seek guidance from a knowledgeable resource like uslegalforms, which can help lay out the best strategy for your family.

Deciding whether to place assets in a trust depends on your parents' specific financial situation and goals. A trust can help avoid probate and provide clearer asset distribution after their passing. However, it’s important to consult with a legal expert who can help them navigate the complexities of an amendment living trust with pour-over will.

While trust funds offer many advantages, there are also some downsides to consider. One issue is the potential for high setup and maintenance fees, which can reduce the overall value of the assets. Additionally, the complexity of an amendment living trust with pour-over will can lead to misunderstandings or conflicts among family members if not clearly communicated.

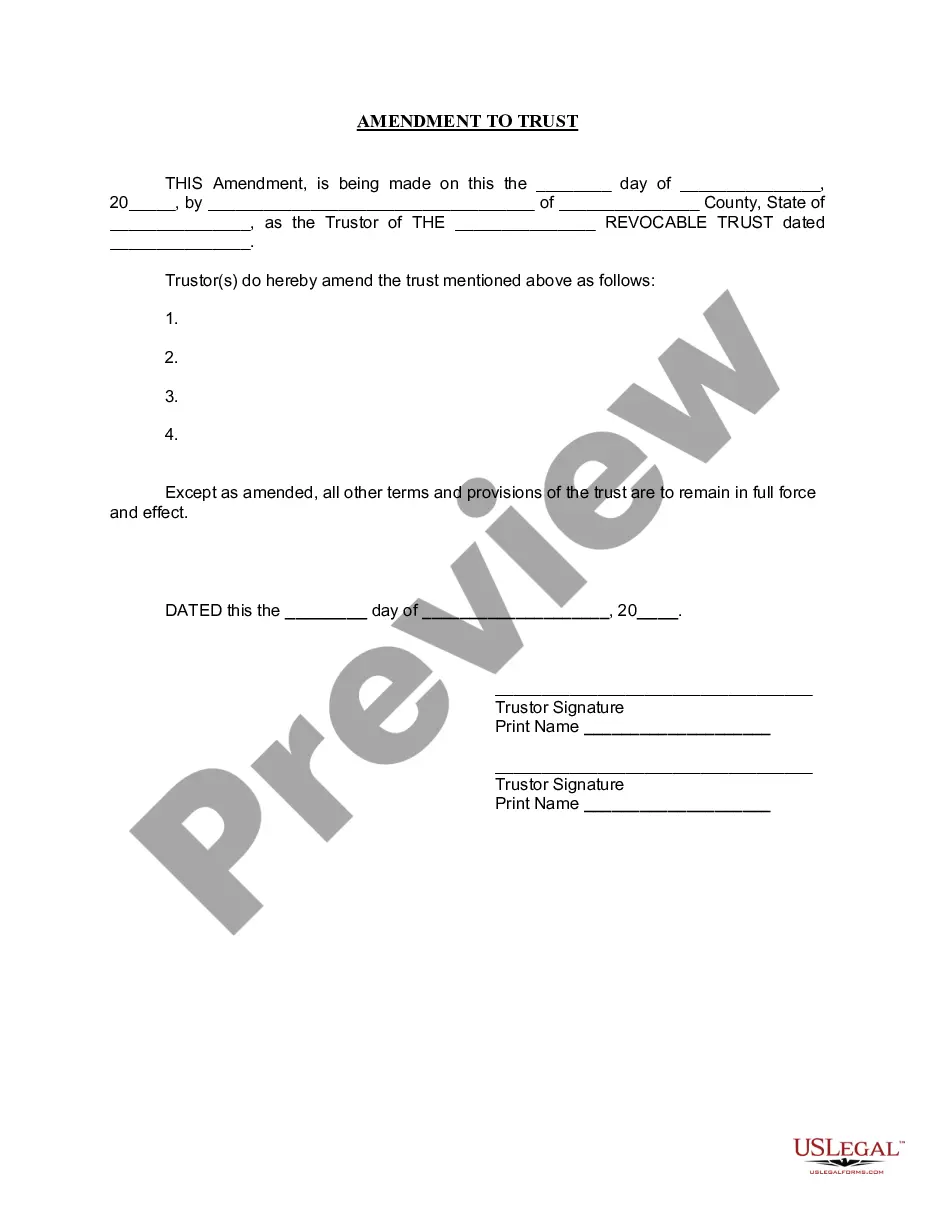

Yes, you can amend your trust by yourself, especially if you are familiar with the document’s language. However, it’s wise to follow specific legal guidelines to ensure the amendment is valid in your state. Consider consulting a professional or utilizing resources from US Legal Forms to assist you in drafting your amendment accurately and effectively. This approach minimizes the risk of errors that could affect your estate plan.

One of the biggest mistakes parents make when setting up a trust fund is failing to properly fund the trust. Without transferring assets into the trust, it cannot achieve its intended purpose. Additionally, neglecting to keep the trust updated can lead to complications for beneficiaries. Using tools from US Legal Forms helps ensure that your living trust with a pour-over will is fully funded and reflects your wishes.

A living trust generally takes precedence over a will regarding assets placed in the trust. This means that assets in the trust do not go through probate and are distributed according to the trust terms. However, a will can address assets not included in the trust, including directives that should be considered. Understanding this dynamic is essential for effective estate planning, especially with a pour-over will.

Handwritten changes to a trust, known as a holographic amendment, can be valid if they reflect your intentions. However, these changes may need to be signed by you and could require witnesses or notarization, depending on state laws. To avoid any potential disputes or issues, it is advisable to draft formal amendments instead. US Legal Forms provides templates to help you create amendments properly.

Generally, an amendment to a trust does not need to be filed with the court, but it should be kept with the original trust document. While not legally required, having the amendment on record can reduce confusion for your heirs and ensure clarity about your intentions regarding the trust. Keeping good documentation helps maintain the integrity of your estate plan, especially when it involves a living trust with a pour-over will.

over will acts as a safety net for your estate. It ensures that any assets not already included in your living trust are transferred to it upon your passing. This mechanism helps simplify the distribution of your estate by directing assets to your trust for management. Understanding this relationship between a pourover will and a living trust is crucial for efficient estate planning.