Sample Letter To Uscis For Rfe

Description

How to fill out Alabama Notice Of Name Correction Of Defendant?

Discovering a reliable source to obtain the latest and most pertinent legal forms is a significant part of navigating red tape.

Selecting the appropriate legal paperwork requires precision and careful consideration, which is why sourcing your Sample Letter To Uscis For Rfe exclusively from trustworthy outlets, such as US Legal Forms, is crucial.

Once you have the form saved on your device, you can edit it using the editor or print it out and fill it manually. Eliminate the complications associated with your legal documents. Explore the extensive US Legal Forms catalog to find legal templates, verify their applicability to your situation, and download them right away.

- Utilize the library navigation or search option to find your sample.

- Review the form’s details to confirm it meets the specifications of your state and locality.

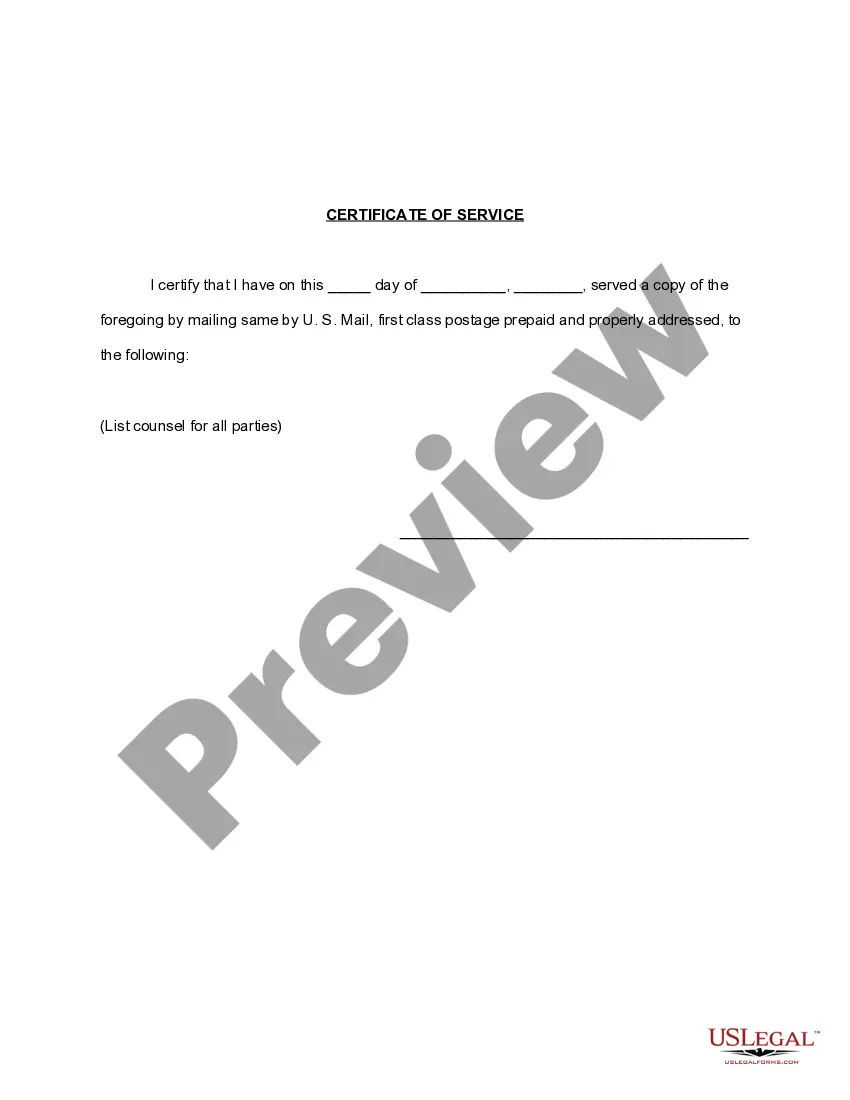

- Inspect the form preview, if available, to ensure it aligns with your interests.

- Return to the search to locate an alternative document if the Sample Letter To Uscis For Rfe does not fulfill your needs.

- If you are certain regarding the document’s suitability, download it.

- As a registered user, click Log in to verify your identity and access your chosen templates in My documents.

- If you haven’t created an account yet, click Buy now to purchase the template.

- Choose the payment plan that fits your needs.

- Proceed to register to finalize your acquisition.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading the Sample Letter To Uscis For Rfe.

Form popularity

FAQ

You will be required to obtain a new EIN if any of the following statements are true. A corporation receives a new charter from the secretary of state. You are a subsidiary of a corporation using the parent's EIN or you become a subsidiary of a corporation. You change to a partnership or a sole proprietorship.

Having an EIN can be helpful when applying for business loans, opening business bank accounts and for other business tasks. Obtaining an EIN is free of charge and can be done online, by mail, fax or via telephone. If an EIN is lost or misplaced, it is not possible to look it up online.

Identify the information that has changed (LLC name, removal or addition of owners, address/location of the LLC). All other changes should be mailed to the IRS based on the state the entity's principal business, office or agency is located. The IRS will send a letter confirming receipt of your updated information.

You may be able to find information about a company, including its EIN, by searching various state and federal government websites. The secretary of state's website (in the state where the business is located) may be a good place to start.

Your tax ID number is a unique 9-digit code the IRS uses to track your company. This code is permanent. After assigned, The IRS does not require Tax ID renewal except in special circumstances. You must file income taxes for your company every year using the assigned EIN.

If the EIN was recently assigned and filing liability has yet to be determined, send Business Name Change requests to the IRS address where you file your return. In some situations a name change may require a new Employer Identification Number (EIN) or a final return.

A change of address with the IRS must be submitted on paper, but it doesn't take long. You can print and fill out Form 8822 from the IRS website.

To revive or reinstate your Idaho LLC, you'll need to submit the following to the Idaho Secretary of State: a completed Idaho Reinstatement Form. any missing annual reports. a $25 filing fee.