Amend J

Description

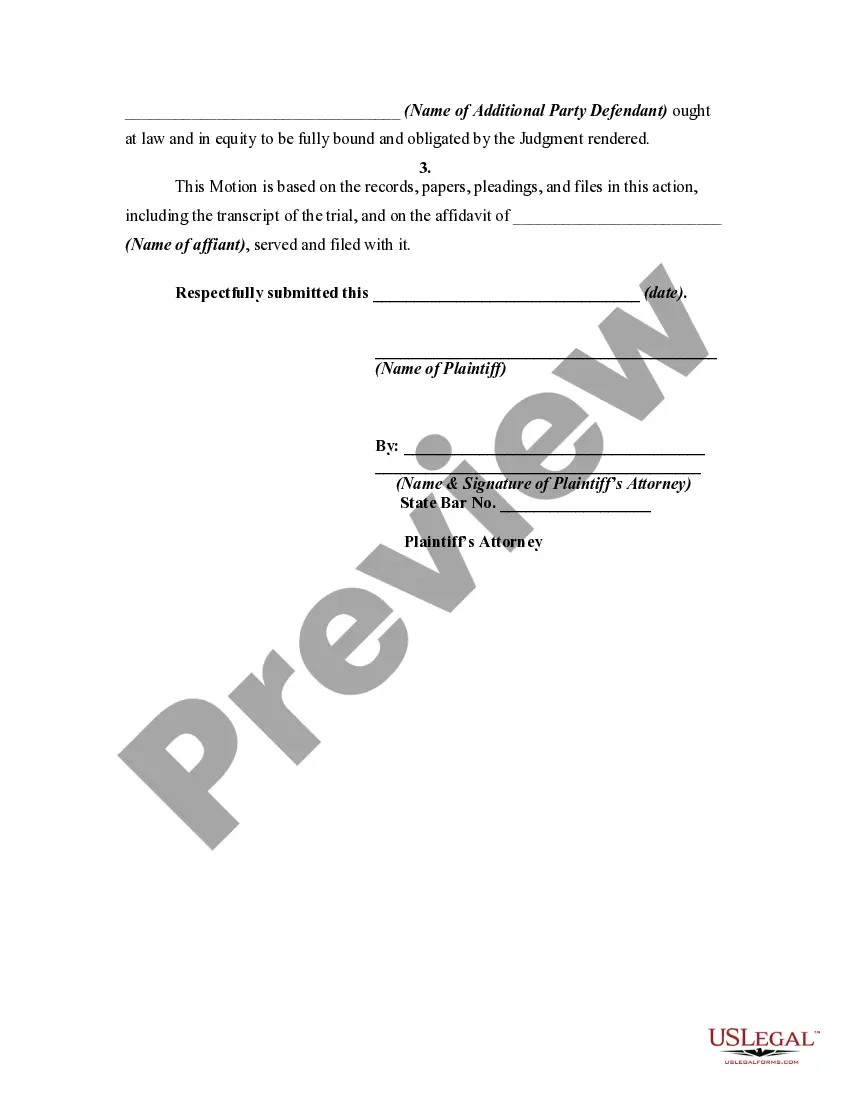

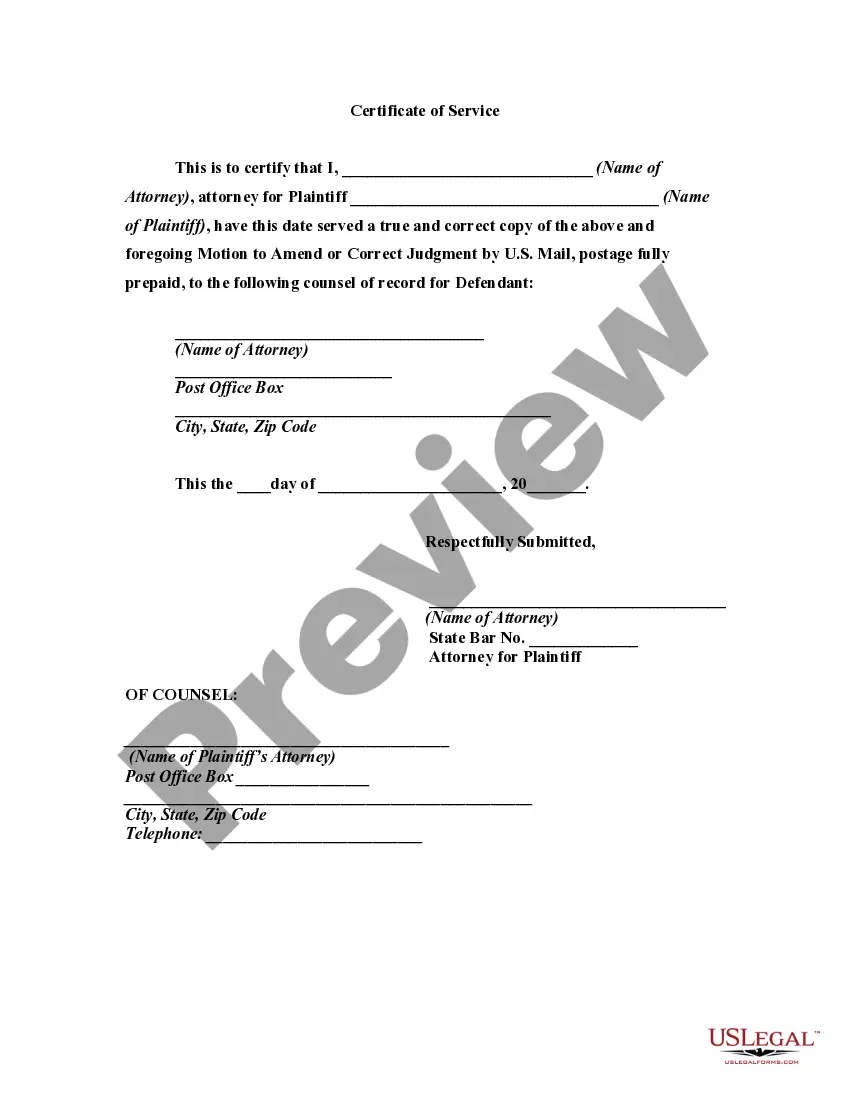

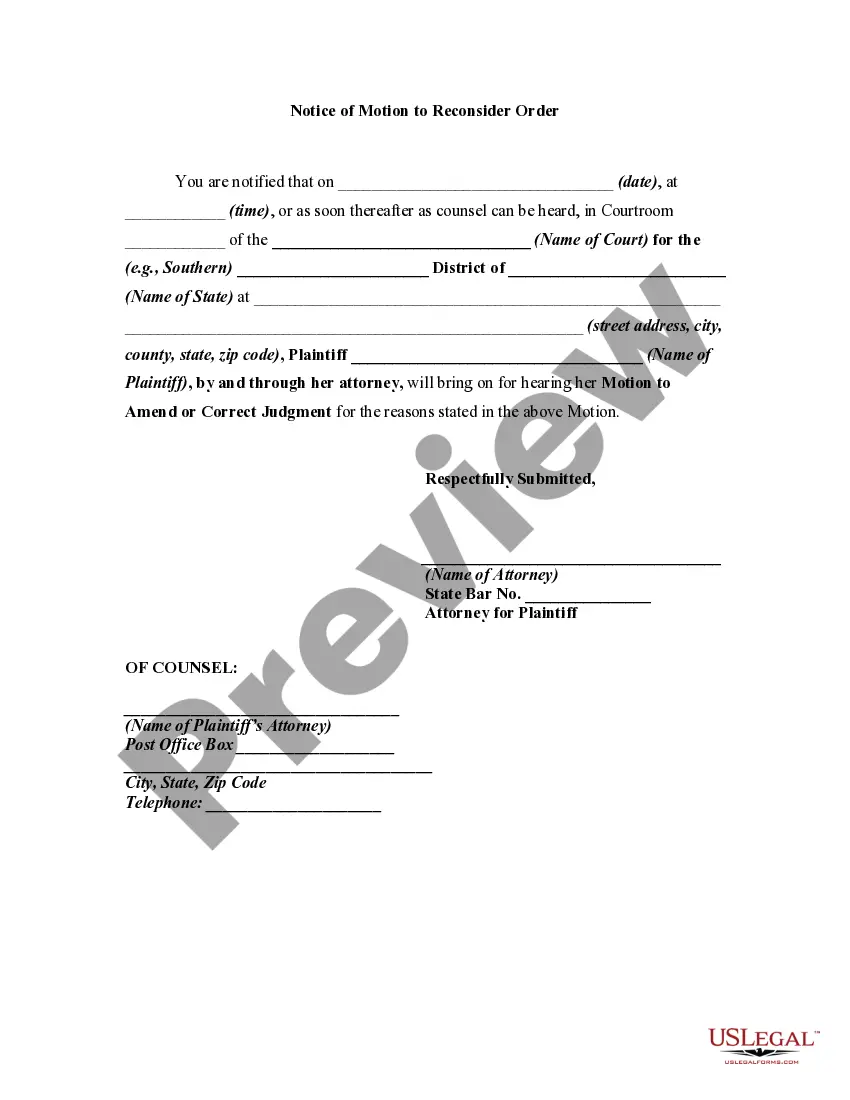

How to fill out Motion To Amend Or Correct Judgment To Include Additional Party Defendant As Real Party In Interest?

- Start by checking if you already have an account. If so, log in and confirm your subscription is active before proceeding.

- If you’re new to the service, browse the Preview mode to check the description of the form. Ensure it's the right document for your needs.

- Should you need another template, utilize the Search tab to find the appropriate form that matches your requirements.

- Once you have the right form, click the ‘Buy Now’ button and select your preferred subscription plan. Creating an account is essential to access the extensive library.

- Complete the payment process by entering your credit card information or opting for PayPal.

- Finally, download your form and save it on your device. You can access it anytime from the My Forms section of your profile.

Following these steps ensures you can easily amend j and have the necessary legal paperwork at your fingertips.

Don't hesitate—get started now with US Legal Forms and experience the convenience of having over 85,000 legal documents easily accessible!

Form popularity

FAQ

To amend your return and remove dependents, start by filling out the 1040X form, and be sure to reference the changes on the dependent section. Clearly explain why you need to remove these dependents in the appropriate area, as this provides context for the IRS. It is essential to ensure that all other information on the return is accurate, as this will provide a complete picture. Platforms like uslegalforms can help guide you through this process effectively.

To file a 1040X amended tax return, ensure you have all relevant documents handy, like your original return and any supporting documents. Complete the form meticulously, making sure to provide accurate adjustments. After completing the form, mail it directly to the IRS at the address specified in the instructions. For added ease, consider utilizing uslegalforms to assist with the filing process.

Amending a tax return does not automatically trigger an audit, but it can increase your chances. The IRS pays close attention to inconsistencies and significant changes in returns. However, if the information you provide is accurate and well-documented, you can mitigate potential issues. Always make sure your amendments are well-supported to ease concerns.

Filling out an amended 1040X return involves three main sections: personal information, the changes you're making, and your explanation of changes. Begin by entering your original amounts alongside the new corrected figures. After that, provide a detailed description of each change in the designated section, which is crucial for clarity. Using an intuitive platform like uslegalforms can further simplify this process.

A common reason for filing a 1040X is to correct errors on your original tax return, such as misreported income or overlooked deductions. Sometimes taxpayers discover new information that can reduce their tax liability, prompting them to amend. Understanding these reasons can help you ensure your tax return is accurate and up-to-date. Utilizing services from uslegalforms can also help streamline your amendments.

To fill out a 1040X form for stimulus payments, accurately indicate the amount you received in the pertinent section. Include any adjustments to your income or credits that might affect your eligibility for additional payments. Additionally, ensure that you clearly state your reason for amendment in the explanation section. You can simplify this process by using platforms like uslegalforms, which can guide you through the paperwork.

When explaining changes in your Form 1040X, be clear and concise. Outline the type of amendments you're making, such as income adjustments or deductions. You should also specify the reason for these changes, which helps the IRS understand your situation better. Providing a thorough explanation can expedite the review process.

To file an amended tax return electronically, you must use specific tax software that supports the Form 1040X. Start by opening your previous return and making the necessary adjustments. After completing the amendments, follow your software's instructions to submit electronically. It’s essential to ensure all changes are accurate to avoid any complications.

To use 'amend,' start by identifying the document or law you wish to alter. Then, clarify the specific changes you want to propose, ensuring they align with legal guidelines. Platforms like uslegalforms can provide templates and guidance to assist you in drafting and submitting necessary amendments effectively.

An example of an amend could be when a landlord decides to amend a lease agreement to include new terms for pet ownership. This change illustrates how amending agreements can resolve specific concerns or adapt to changing circumstances. Such amendments help parties to align on expectations legally.