Foreclosure With Lien

Description

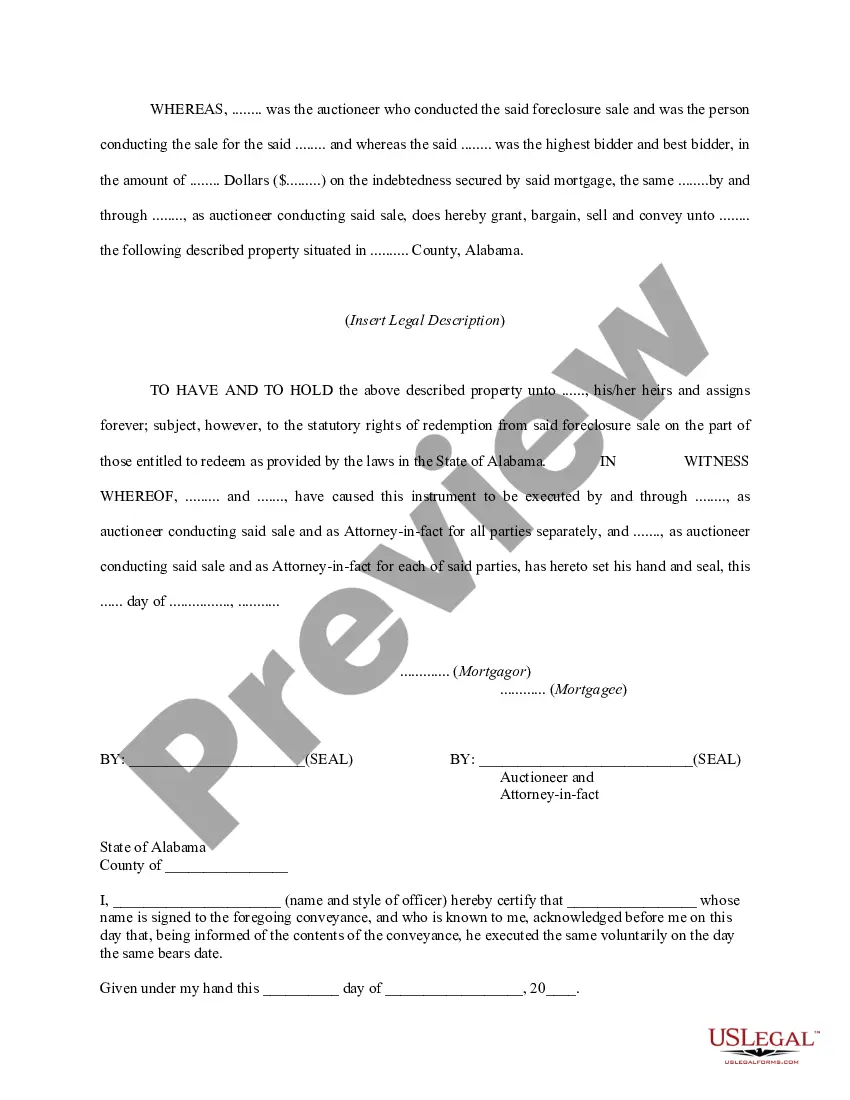

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

- Log into your US Legal Forms account to access your saved documents, ensuring your subscription is current.

- If you're new to the service, begin by reviewing the Preview and description of the form related to foreclosure with lien to ensure it meets your needs and legal requirements.

- Utilize the Search feature to find alternative templates if necessary, ensuring the documents align with your jurisdiction.

- Select the appropriate form for purchase by clicking the Buy Now button, then choose your preferred subscription plan.

- Complete the transaction by providing credit card information or opting for PayPal for seamless payment.

- Once your payment is processed, download the form and save it to your device. You can access it anytime in the My Forms section of your profile.

In conclusion, utilizing US Legal Forms simplifies the often complex process of handling foreclosure with lien documentation. Their extensive collection and premium support ensure you have the right forms at your fingertips.

Start leveraging US Legal Forms today to streamline your legal needs!

Form popularity

FAQ

A lien is not the same as foreclosure, though they are related concepts in property law. A lien is a legal claim against property, while foreclosure is the process of taking possession of a property when the owner fails to meet mortgage obligations. Understanding the difference between foreclosure with lien issues can help property owners make informed decisions.

Responding to a foreclosure lien involves submitting a formal answer to the lien claim, outlining your observations and defenses. It's crucial to provide accurate information and any relevant evidence to support your position. Utilizing tools from US Legal Forms can simplify this process and ensure you meet all necessary legal requirements.

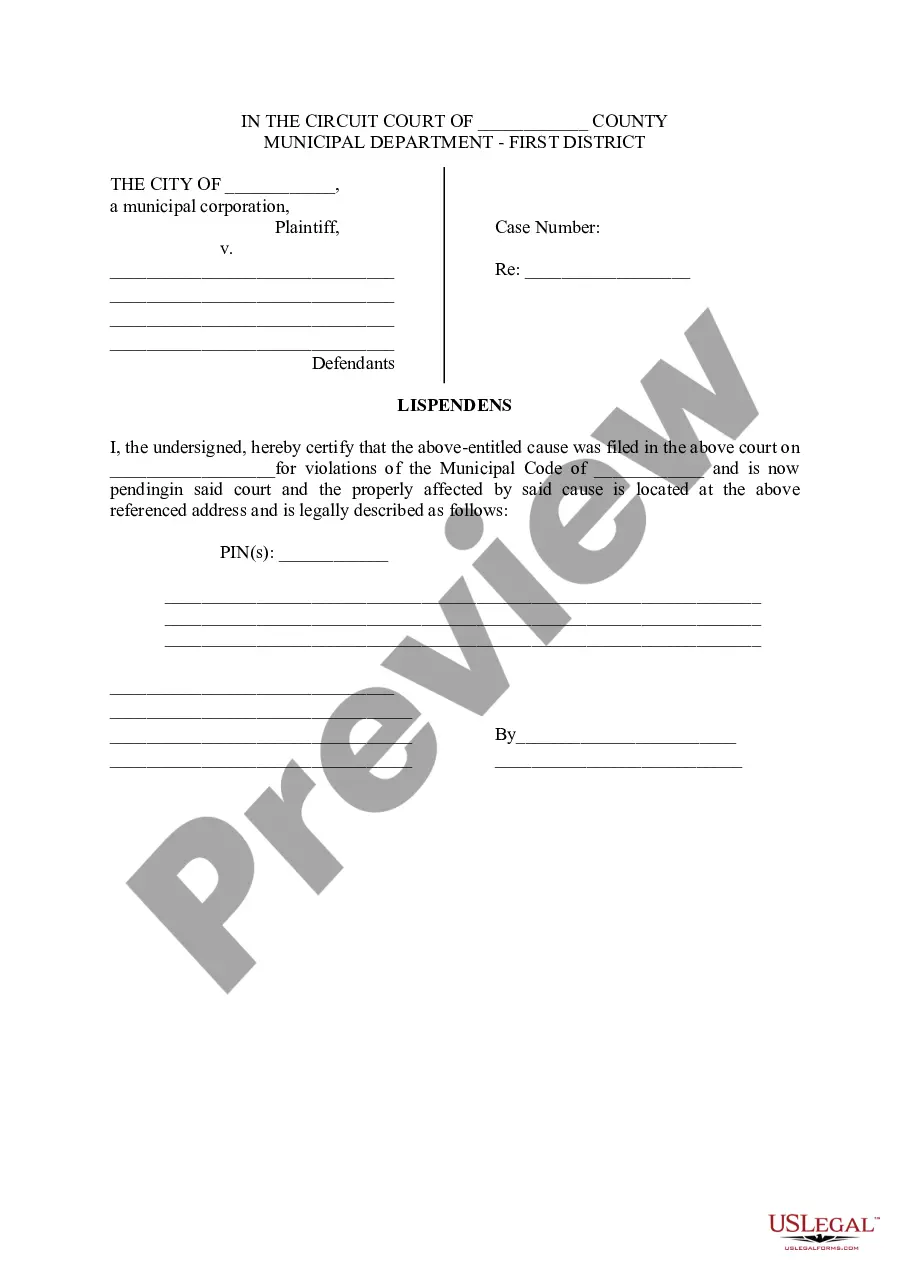

To file a lien foreclosure action, you generally need to prepare a complaint outlining the details of the lien and the reasons for foreclosure. This complaint is then filed in the appropriate court, alongside necessary documentation. Resources from US Legal Forms can assist you in ensuring that your filing is complete and compliant with legal standards.

Responding to a foreclosure lien requires careful evaluation of the lien's legitimacy. Your response may involve filing a legal document with the court to contest the lien or negotiating terms with the lienholder. Understanding your rights in these situations is crucial, and resources like US Legal Forms can provide guidance on crafting a proper response.

Typically, homeowners suffer the most in a foreclosure, often facing financial and emotional distress. Additionally, lenders can incur losses from unpaid mortgages, something that can lead to broader economic implications. Understanding how foreclosures with liens work can help homeowners mitigate these effects.

Filing an Answer to a foreclosure involves preparing a legal document that responds to the claims made against you. This document must generally include your defenses and counterclaims regarding the foreclosure with lien. It’s important to file within the specified timeframe to preserve your rights. US Legal Forms offers resources to guide you through this preparation.

To respond to a lien, you should first review the document carefully. Determine the validity of the lien and check for any discrepancies. You might need to file a dispute or negotiate directly with the lienholder to resolve the issue. Using platforms like US Legal Forms can help you navigate this process effectively.

To foreclose on a lien means that the lender or creditor can take possession of the property in order to satisfy unpaid debts. This process occurs when the homeowner fails to meet financial obligations, leading to potential foreclosure with lien situations. Understanding this can help you navigate the legal landscape effectively. Utilizing US Legal Forms can assist you in acquiring accurate legal forms and resources related to foreclosures and liens.

Generally, a property tax lien is considered the lien with the highest priority. This is because tax authorities have the right to collect overdue taxes ahead of other creditors during foreclosure with lien situations. Recognizing this priority can help property owners make informed decisions about their financial responsibilities. Familiarizing yourself with these complexities can aid in more effective property management.

In Quizlet and other learning contexts, the highest priority of a lien usually comes from statutory provisions, such as property tax liens. These liens often supersede other debt claims and take precedence during foreclosure with lien situations. Understanding these principles can empower you when managing properties. Always be aware of how such regulations impact your financial decisions.