Alabama Deed Trust With Future Advance Clause

Description

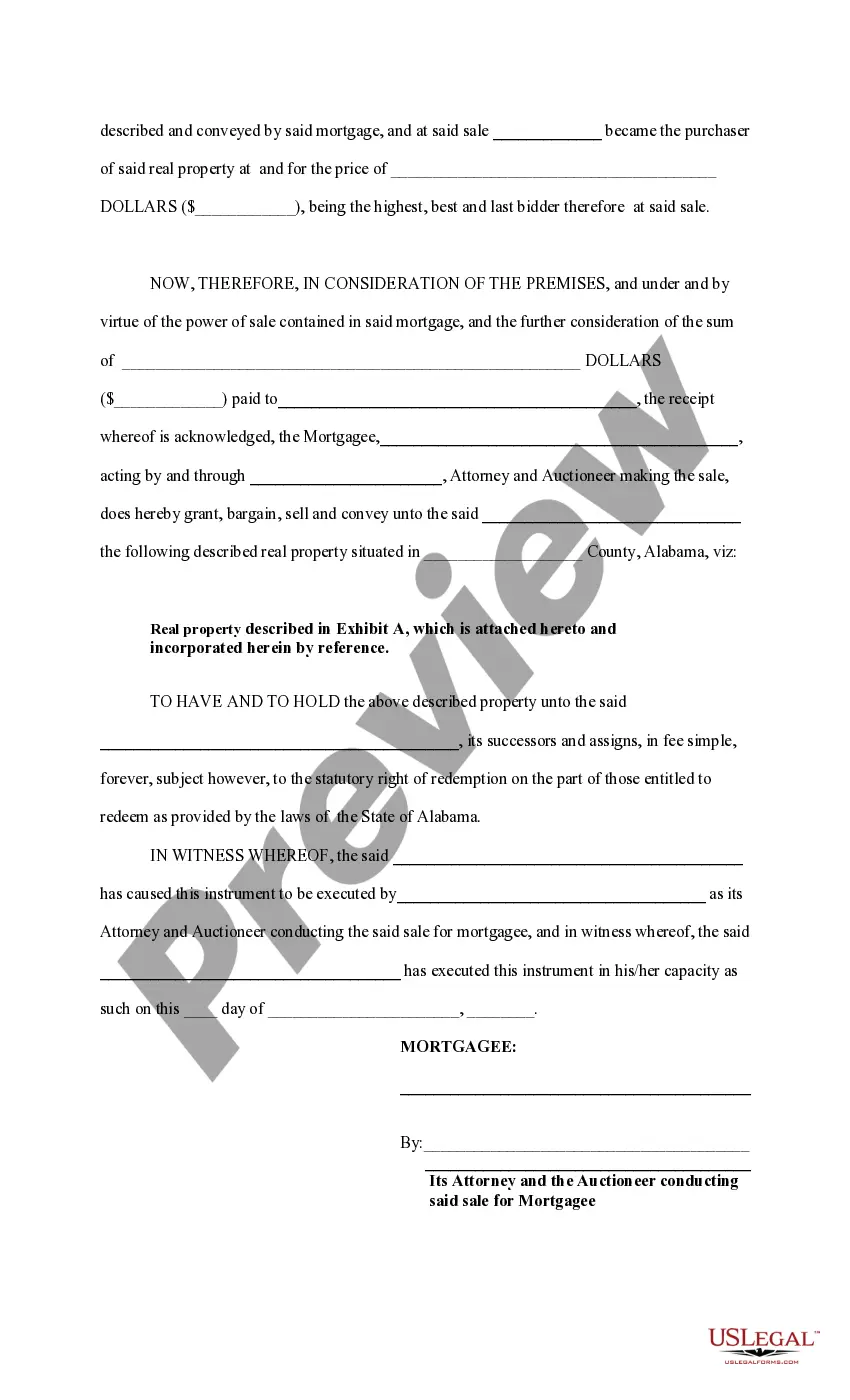

How to fill out Alabama Mortgage Foreclosure Deed?

Well-constructed official documentation is among the essential assurances for preventing problems and legal disputes, but obtaining it without the assistance of a lawyer may require time.

Whether you need to swiftly locate a current Alabama Deed Trust With Future Advance Clause or any other documents for work, family, or business purposes, US Legal Forms is consistently here to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the selected document. Additionally, you can revisit the Alabama Deed Trust With Future Advance Clause at any time, as all documents previously obtained on the platform are accessible within the My documents section of your profile. Save both time and money on preparing official paperwork. Experience US Legal Forms today!

- Ensure that the document is appropriate for your situation and location by verifying the description and preview.

- Search for another example (if necessary) using the Search bar in the header of the page.

- Click Buy Now once you find the relevant template.

- Choose the pricing option, Log In to your account or create a new one.

- Select the payment method you prefer for purchasing the subscription plan (using a credit card or PayPal).

- Choose PDF or DOCX file format for your Alabama Deed Trust With Future Advance Clause.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

The best type of deed depends on your specific needs and circumstances. However, an Alabama deed trust with future advance clause often provides flexibility by allowing additional borrowing on the same property without needing a new deed. This feature can be beneficial for families or investors looking for convenience and security in their financing options. Consulting with a legal expert can further guide you in selecting the most suitable deed.

Yes, Alabama does recognize and use deeds of trust as a valid method of securing loans. Within the context of an Alabama deed trust with future advance clause, these documents enable efficient financing arrangements between lenders and borrowers. If you're seeking a clear and compliant way to create a deed of trust, US Legal Forms can provide the resources and templates necessary to get started.

A future advance clause is a provision within a security agreement that gives a lender the right to provide additional funds in the future, securing those funds against the same collateral. This is essential in an Alabama deed trust with future advance clause, as it maintains a clear framework for ongoing financial support between borrowing transactions. By including this clause, you create a more flexible borrowing environment.

A future advance endorsement is a statement that accompanies a deed of trust, allowing future advances to be secured under the same deed of trust. When it comes to an Alabama deed trust with future advance clause, this endorsement ensures that any additional loans are covered by the existing security agreement. This streamlining helps both lenders and borrowers manage financing more effectively.

Tennessee operates primarily as a deed of trust state, similar to Alabama. Borrowers there use deeds of trust to secure loans, which can make for a more streamlined foreclosure process if needed. If you are considering options like an Alabama deed trust with future advance clauses, understanding Tennessee's similar laws might provide helpful insights. Each state has its unique procedures that can affect your financing options.

The choice between a deed of trust and a mortgage often depends on individual circumstances. A deed of trust allows for a quicker and more streamlined foreclosure process. In the context of Alabama, a deed trust with a future advance clause can provide flexible financing options for borrowers. Understanding the nuances of each option can help you make an informed decision.

A future conditional often refers to a scenario where an action is dependent upon another occurrence in the future. For example, in the context of the Alabama deed trust with a future advance clause, a homeowner might agree to borrow more funds when the property appreciates. Such conditions can provide flexibility and assurance, allowing homeowners to act on investment opportunities as they arise. It highlights the importance of strategic financial planning.

The future advance clause in a deed of trust allows a lender to provide additional funds to the borrower in the future without creating a new trust deed. This flexibility is particularly beneficial in Alabama, where the deed trust with a future advance clause can streamline the borrowing process for homeowners. By including this clause, borrowers can secure ongoing financing, promoting easier financial management. This is a crucial detail for anyone considering property financing options.

A future consideration in law often involves a commitment to provide something of value at a later date. For instance, in the context of the Alabama deed trust with future advance clause, a lender may agree to offer additional funds to a borrower in the future. This arrangement allows the borrower to access funds when needed without needing to renegotiate terms each time. Understanding these concepts can help you navigate the complexities of property financing.